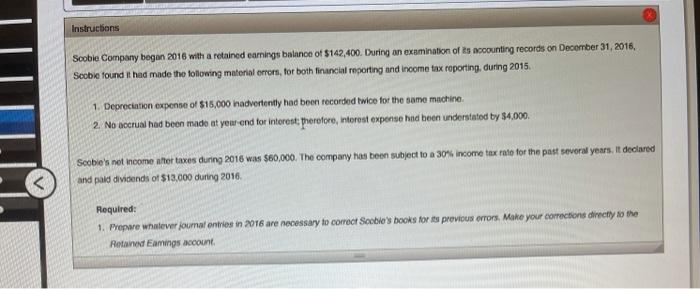

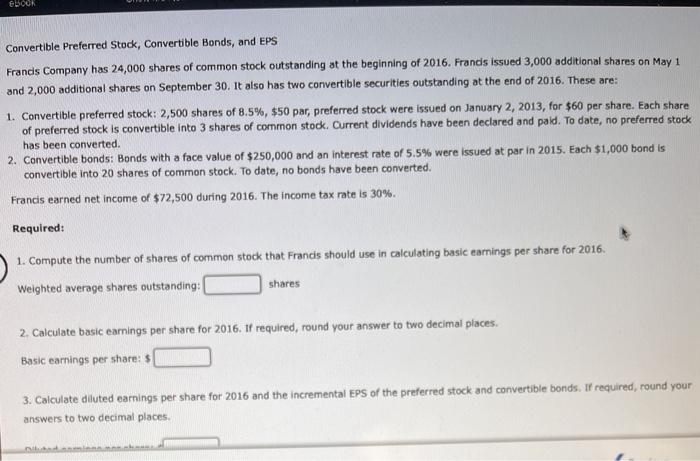

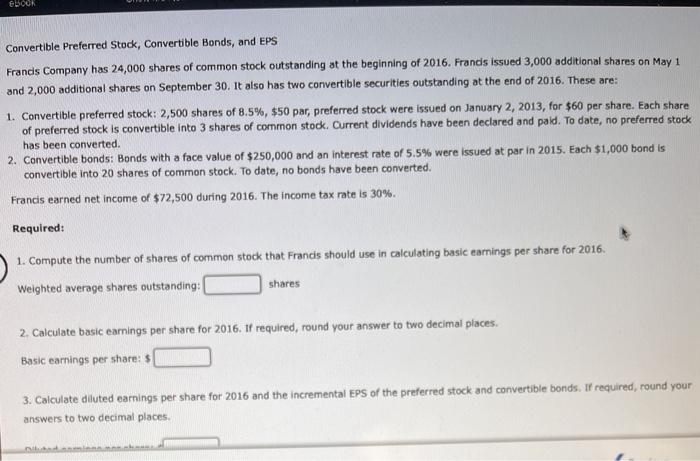

Instructions Scoblo Company began 2016 with a retained earnings balance of $142,400. During an examination of its accounting records on December 31, 2016, Scobie found it had made the following material errors, for both financial reporting and income tax roporting, during 2015 1. Depreciation expense of $15,000 nadvertently had been recorded twice for the same machine 2. No accrual had been made at your end for interest: pherefore, interest expense had been understated by 84,000 Scobie's not income after taxes during 2016 was $80,000. The company has been subject to a 30% income tax rate for the past several years. It declared and paid dividends of $13,000 during 2016 Required: 1. Pepwre whatever journal entries in 2016 are necessary to correct Scobie's books for its previous errors. Make your corrections directly to the Retained Eamings account EBOOK Convertible Preferred Stock, Convertible Bonds, and EPS Francis Company has 24,000 shares of common stock outstanding at the beginning of 2016. Frands issued 3,000 additional shares on May 1 and 2,000 additional shares on September 30. It also has two convertible securities outstanding at the end of 2016. These are: 1. Convertible preferred stock: 2,500 shares of 8.5%, $50 par, preferred stock were issued on January 2, 2013, for $60 per share. Each share of preferred stock is convertible into 3 shares of common stock. Current dividends have been declared and paid. To date, no preferred stock has been converted, 2. Convertible bonds: Bonds with a face value of $250,000 and an interest rate of 5.5% were issued at par in 2015. Each $1,000 bond is convertible into 20 shares of common stock. To date, no bonds have been converted, Francis earned net income of $72,500 during 2016. The income tax rate is 30%. Required: 1. Compute the number of shares of common stock that Francis should use in calculating basic earnings per share for 2016. Weighted average shares outstanding: shares 2. Calculate basic earnings per share for 2016. If required, round your answer to two decimal places. Basic earnings per share: $ 3. Calculate diluted earnings per share for 2016 and the incremental EPS of the preferred stock and convertible bonds. If required, round your answers to two decimal places. Instructions Scoblo Company began 2016 with a retained earnings balance of $142,400. During an examination of its accounting records on December 31, 2016, Scobie found it had made the following material errors, for both financial reporting and income tax roporting, during 2015 1. Depreciation expense of $15,000 nadvertently had been recorded twice for the same machine 2. No accrual had been made at your end for interest: pherefore, interest expense had been understated by 84,000 Scobie's not income after taxes during 2016 was $80,000. The company has been subject to a 30% income tax rate for the past several years. It declared and paid dividends of $13,000 during 2016 Required: 1. Pepwre whatever journal entries in 2016 are necessary to correct Scobie's books for its previous errors. Make your corrections directly to the Retained Eamings account EBOOK Convertible Preferred Stock, Convertible Bonds, and EPS Francis Company has 24,000 shares of common stock outstanding at the beginning of 2016. Frands issued 3,000 additional shares on May 1 and 2,000 additional shares on September 30. It also has two convertible securities outstanding at the end of 2016. These are: 1. Convertible preferred stock: 2,500 shares of 8.5%, $50 par, preferred stock were issued on January 2, 2013, for $60 per share. Each share of preferred stock is convertible into 3 shares of common stock. Current dividends have been declared and paid. To date, no preferred stock has been converted, 2. Convertible bonds: Bonds with a face value of $250,000 and an interest rate of 5.5% were issued at par in 2015. Each $1,000 bond is convertible into 20 shares of common stock. To date, no bonds have been converted, Francis earned net income of $72,500 during 2016. The income tax rate is 30%. Required: 1. Compute the number of shares of common stock that Francis should use in calculating basic earnings per share for 2016. Weighted average shares outstanding: shares 2. Calculate basic earnings per share for 2016. If required, round your answer to two decimal places. Basic earnings per share: $ 3. Calculate diluted earnings per share for 2016 and the incremental EPS of the preferred stock and convertible bonds. If required, round your answers to two decimal places