Answered step by step

Verified Expert Solution

Question

1 Approved Answer

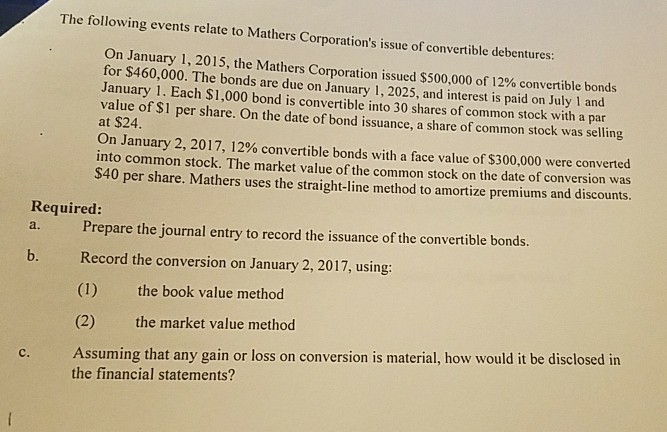

The following events relate to Mathers Corporation's issue of convertible debentures: On January 1, 201 5, the Mathers Corporation issued $500,000 of 12% convertible bonds

The following events relate to Mathers Corporation's issue of convertible debentures: On January 1, 201 5, the Mathers Corporation issued $500,000 of 12% convertible bonds for $460,000. The bonds are due on January 1, 2025, and interest is paid on July 1 and January value of $1 per share. On the date of bond issuance, a share of common stock was selling at $24 On January 2, 2017, 12% convertible bonds with a face value of $300,000 were converted into common stock. The market value of the common stock on the date of conversion was S40 per share. Mathers uses the straight-line method to amortize premiums and discounts. 1. Each $1,000 bond is convertible into 30 shares of common stock with a par Required: a. Prepare the journal entry to record the issuance of the convertible bonds. b. Record the conversion on January 2, 2017, using: (1) the book value method (2) the market value method Assuming that any gain or loss on conversion is material, how would it be disclosed in C. the financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started