Answered step by step

Verified Expert Solution

Question

1 Approved Answer

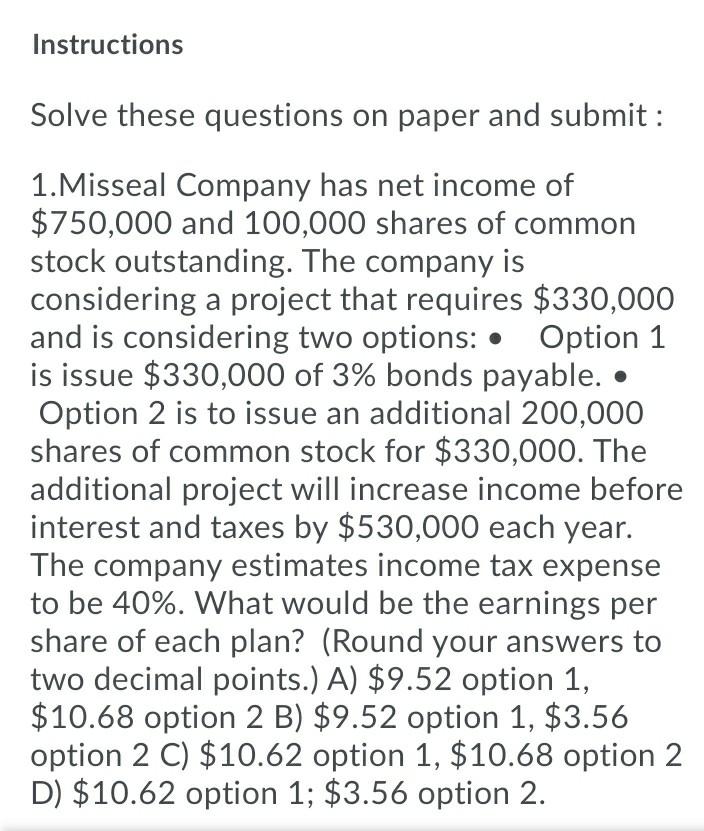

Instructions Solve these questions on paper and submit : 1. Misseal Company has net income of $750,000 and 100,000 shares of common stock outstanding. The

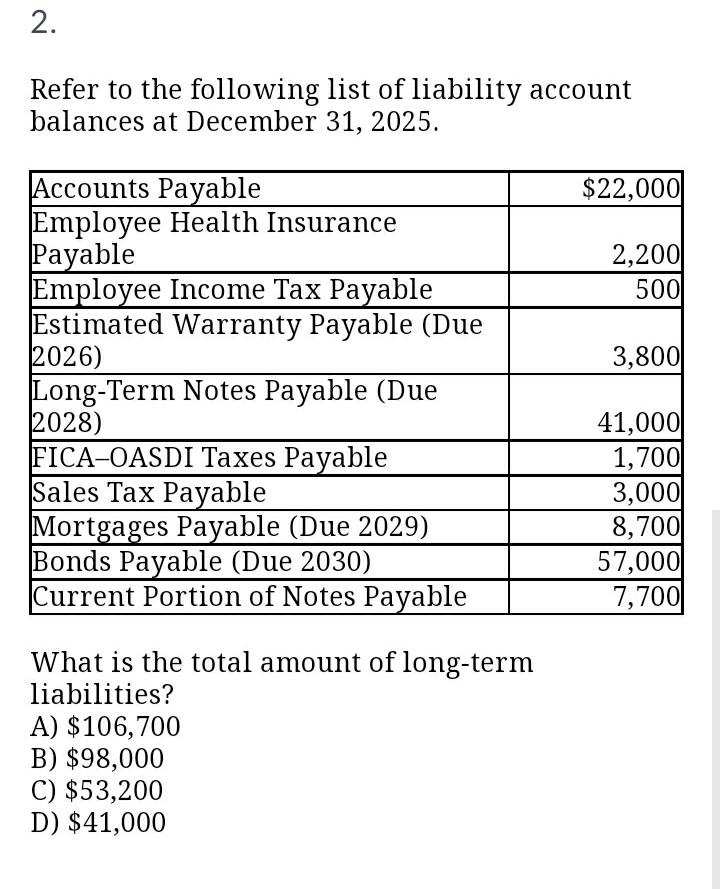

Instructions Solve these questions on paper and submit : 1. Misseal Company has net income of $750,000 and 100,000 shares of common stock outstanding. The company is considering a project that requires $330,000 and is considering two options: Option 1 is issue $330,000 of 3% bonds payable. Option 2 is to issue an additional 200,000 shares of common stock for $330,000. The additional project will increase income before interest and taxes by $530,000 each year. The company estimates income tax expense to be 40%. What would be the earnings per share of each plan? (Round your answers to two decimal points.) A) $9.52 option 1, $10.68 option 2 B) $9.52 option 1, $3.56 option 2 C) $10.62 option 1, $10.68 option 2 D) $10.62 option 1; $3.56 option 2. 2. Refer to the following list of liability account balances at December 31, 2025. $22,000 2,200 5001 3,800 Accounts Payable Employee Health Insurance Payable Employee Income Tax Payable Estimated Warranty Payable (Due 2026) Long-Term Notes Payable (Due 2028) FICA-OASDI Taxes Payable Sales Tax Payable Mortgages Payable (Due 2029) Bonds Payable (Due 2030) Current Portion of Notes Payable 41,000 1,700 3,000 8,700 57,000 7,700 What is the total amount of long-term liabilities? A $ 106,700 B) $98,000 C) $53,200 D) $41,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started