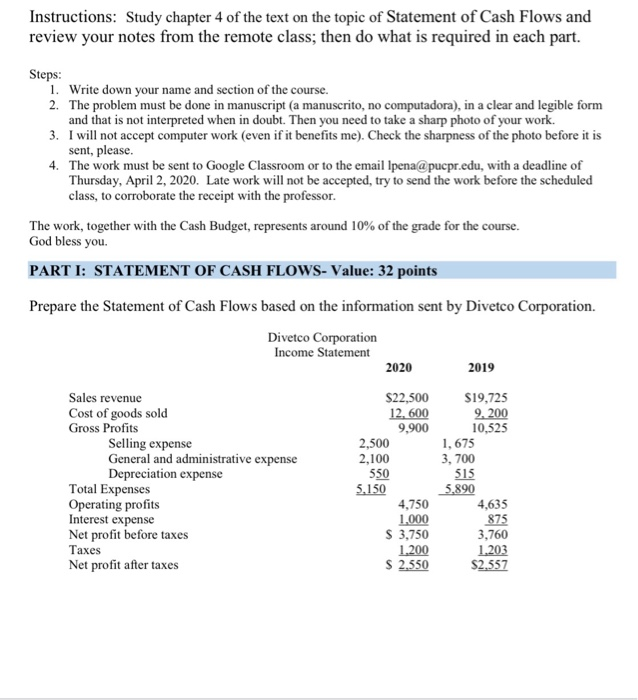

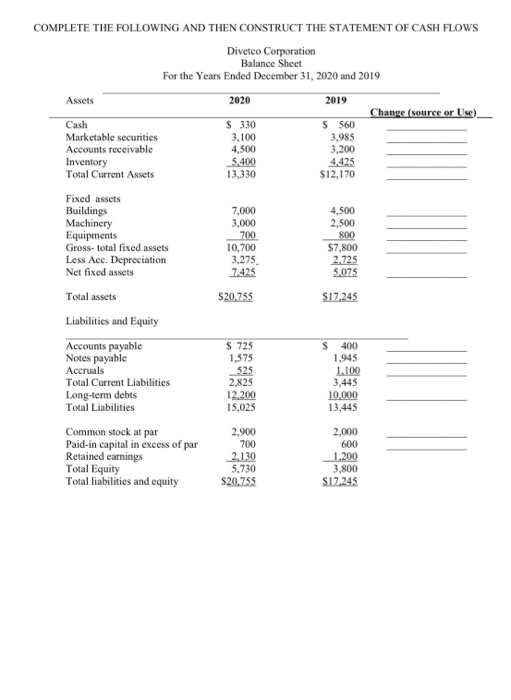

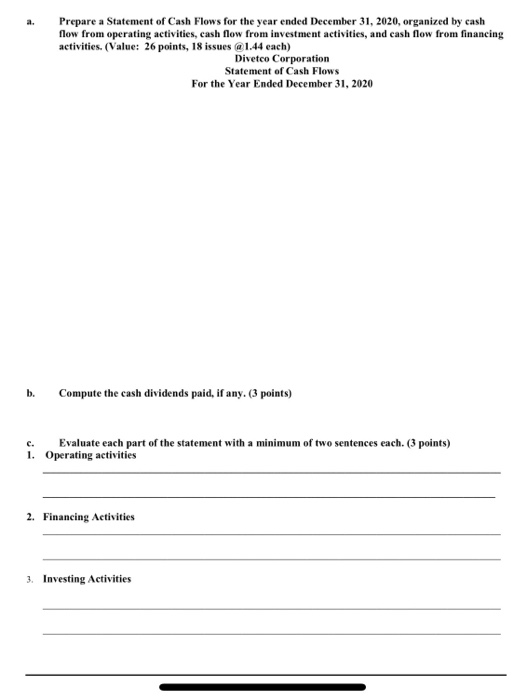

Instructions: Study chapter 4 of the text on the topic of Statement of Cash Flows and review your notes from the remote class; then do what is required in each part. Steps: 1. Write down your name and section of the course. 2. The problem must be done in manuscript (a manuscrito, no computadora), in a clear and legible form and that is not interpreted when in doubt. Then you need to take a sharp photo of your work. 3. I will not accept computer work (even if it benefits me). Check the sharpness of the photo before it is sent, please. 4. The work must be sent to Google Classroom or to the email lpena@pucpr.edu, with a deadline of Thursday, April 2, 2020. Late work will not be accepted, try to send the work before the scheduled class, to corroborate the receipt with the professor The work, together with the Cash Budget, represents around 10% of the grade for the course. God bless you. PARTI: STATEMENT OF CASH FLOWS- Value: 32 points Prepare the Statement of Cash Flows based on the information sent by Divetco Corporation. Divetco Corporation Income Statement 2020 2019 $22,500 12. 600 9,900 2,500 2,100 $19,725 9. 200 10,525 1, 675 3,700 515 550 Sales revenue Cost of goods sold Gross Profits Selling expense General and administrative expense Depreciation expense Total Expenses Operating profits Interest expense Net profit before taxes Taxes Net profit after taxes 5.890 5.150 4,750 1,000 $ 3,750 4,635 875 3,760 1.203 $2.557 1.200 $ 2.550 COMPLETE THE FOLLOWING AND THEN CONSTRUCT THE STATEMENT OF CASH FLOWS Divetco Corporation Balance Sheet For the Years Ended December 31, 2020 and 2019 Assets 2020 2019 Change (source or Use) Cash Marketable secunties Accounts receivable Inventory Total Current Assets $ 330 3.100 4,500 5.400 13,330 S 560 3,985 3,200 4,425 $12,170 4,500 2,500 Fixed assets Buildings Machinery Equipments Gross-total fixed assets Less Acc. Depreciation Net fixed assets 800 7,000 3.000 700 10,700 3,275 7.425 $7,800 2.725 5,075 Total assets $20.755 $17.245 Liabilities and Equity Accounts payable Notes payable Accruals Total Current Liabilities Long-term debts Total Liabilities $ 725 1,575 525 2,825 12.200 15,025 S 400 1.945 1.100 3,445 10,000 13,445 Common stock at par Paid-in capital in excess of par Retained earnings Total Equity Total liabilities and equity 2.900 700 2.130 5,730 $20.755 2,000 600 1.200 3,800 $17.245 Prepare a Statement of Cash Flows for the year ended December 31, 2020, organized by cash flow from operating activities, cash flow from investment activities, and cash flow from financing activities. (Value: 26 points, 18 issues @ 1.44 each) Divetco Corporation Statement of Cash Flows For the Year Ended December 31, 2020 b. Compute the cash dividends paid, if any. (3 points) c. Evaluate each part of the statement with a minimum of two sentences each. (3 points) 1. Operating activities 2. Financing Activities 3. Investing Activities Instructions: Study chapter 4 of the text on the topic of Statement of Cash Flows and review your notes from the remote class; then do what is required in each part. Steps: 1. Write down your name and section of the course. 2. The problem must be done in manuscript (a manuscrito, no computadora), in a clear and legible form and that is not interpreted when in doubt. Then you need to take a sharp photo of your work. 3. I will not accept computer work (even if it benefits me). Check the sharpness of the photo before it is sent, please. 4. The work must be sent to Google Classroom or to the email lpena@pucpr.edu, with a deadline of Thursday, April 2, 2020. Late work will not be accepted, try to send the work before the scheduled class, to corroborate the receipt with the professor The work, together with the Cash Budget, represents around 10% of the grade for the course. God bless you. PARTI: STATEMENT OF CASH FLOWS- Value: 32 points Prepare the Statement of Cash Flows based on the information sent by Divetco Corporation. Divetco Corporation Income Statement 2020 2019 $22,500 12. 600 9,900 2,500 2,100 $19,725 9. 200 10,525 1, 675 3,700 515 550 Sales revenue Cost of goods sold Gross Profits Selling expense General and administrative expense Depreciation expense Total Expenses Operating profits Interest expense Net profit before taxes Taxes Net profit after taxes 5.890 5.150 4,750 1,000 $ 3,750 4,635 875 3,760 1.203 $2.557 1.200 $ 2.550 COMPLETE THE FOLLOWING AND THEN CONSTRUCT THE STATEMENT OF CASH FLOWS Divetco Corporation Balance Sheet For the Years Ended December 31, 2020 and 2019 Assets 2020 2019 Change (source or Use) Cash Marketable secunties Accounts receivable Inventory Total Current Assets $ 330 3.100 4,500 5.400 13,330 S 560 3,985 3,200 4,425 $12,170 4,500 2,500 Fixed assets Buildings Machinery Equipments Gross-total fixed assets Less Acc. Depreciation Net fixed assets 800 7,000 3.000 700 10,700 3,275 7.425 $7,800 2.725 5,075 Total assets $20.755 $17.245 Liabilities and Equity Accounts payable Notes payable Accruals Total Current Liabilities Long-term debts Total Liabilities $ 725 1,575 525 2,825 12.200 15,025 S 400 1.945 1.100 3,445 10,000 13,445 Common stock at par Paid-in capital in excess of par Retained earnings Total Equity Total liabilities and equity 2.900 700 2.130 5,730 $20.755 2,000 600 1.200 3,800 $17.245 Prepare a Statement of Cash Flows for the year ended December 31, 2020, organized by cash flow from operating activities, cash flow from investment activities, and cash flow from financing activities. (Value: 26 points, 18 issues @ 1.44 each) Divetco Corporation Statement of Cash Flows For the Year Ended December 31, 2020 b. Compute the cash dividends paid, if any. (3 points) c. Evaluate each part of the statement with a minimum of two sentences each. (3 points) 1. Operating activities 2. Financing Activities 3. Investing Activities