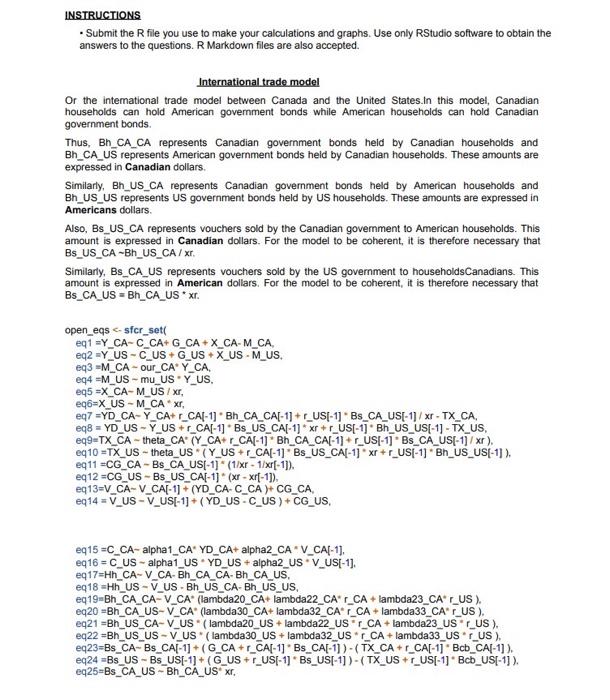

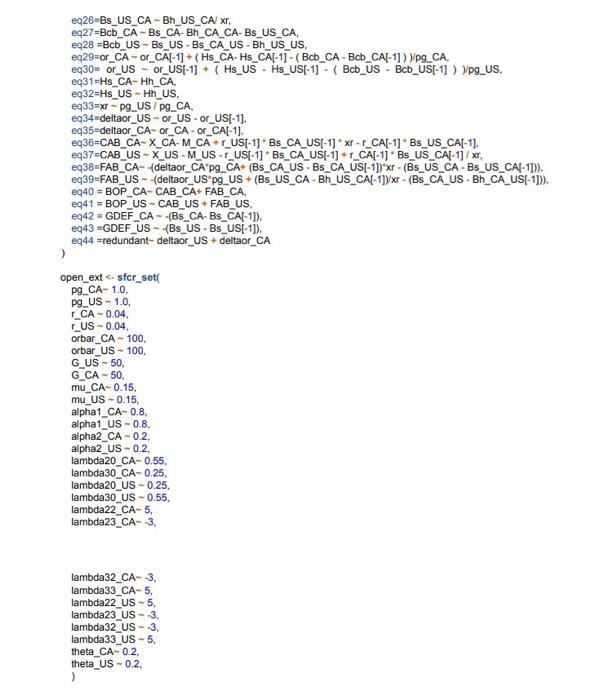

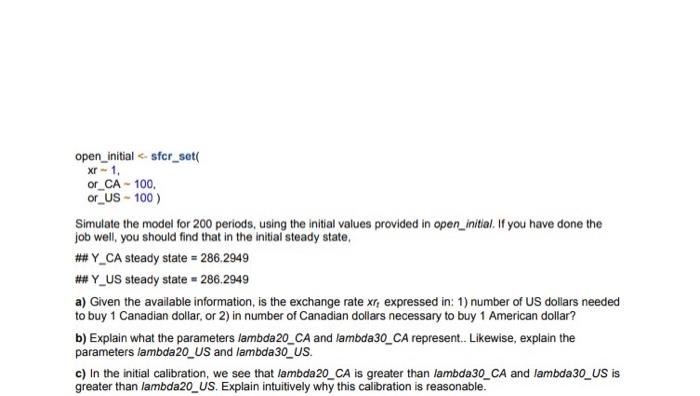

INSTRUCTIONS - Submit the R file you use to make your calculations and graphs. Use only RStudio software to obtain the answers to the questions. R Markdown files are also accepted. International trade model Or the intemational trade model between Canada and the United States.In this model, Canadian households can hold American government bonds while American households can hold Canadian government bonds. Thus, Bh_CA_CA represents Canadian government bonds held by Canadian households and Bh_CA_US represents American government bonds held by Canadian households. These amounts are expressed in Canadian dollars. Similarly, Bh_US_CA represents Canadian government bonds held by American households and Bh_US_US represents US government bonds held by US households. These amounts are expressed in Americans dollars. Also, Bs_US_CA represents vouchers sold by the Canadian govemment to American households. This amount is expressed in Canadian dollars. For the model to be coherent, it is therefore necessary that Bs_US_CA Bh_US_CA / xr. Similarly, Bs_CA_US represents vouchers sold by the US government to householdsCanadians. This amount is expressed in American dollars. For the model to be coherent, it is therefore necessary that Bs_CA_US = Bh_CA_US *xr. open_eqs 1=Y_CAC_CA+G_CA+X_CAM_CA, eq 2=YUSCUS+GUS+XUSMUS. eq 3=MCA our_CA YCA, eq 4= M_US - mu_US * Y_US, eq 5= X_CA-M_US /xr, eq 6=X _US - M_CA * x, eq 7=YD _CA Y_CA+r_CA[1] *Bh_CA_CA[-1] + r_US[-1] *Bs_CA_US[-1]/xr - TX_CA, eq 11= CG_CA - Bs_CA_US[-1] (1/xr1/xr[1]). eq 12 =CG_US - Bs_US_CA[-1] * (xrxr[1]), eq 13=VCA VCA[1]+(YD_CAC_CA)+C_ CA, eq 15= C_CA - alpha1_CA* YD_CA+ alpha2_CA * V_CA[-1], eq16 = C_US - alpha1_US * YD_US + alpha2_US * V_US[-1]. eq 17=Hh _CA V CA - Bh_CA_CA-Bh_CA_US, eq 18= Hh_US - V_US - Bh_US_CA-Bh_US_US, eq19=Bh_CA_CA-V_CA* (lambda20_CA+lambda22_CA* r_CA + lambda23_CA* r_US). eq21 =Bh_US_CA-V_US * ( lambda20_US + lambda22_US *r_CA + lambda23_US " r_US ). eq25=Bs_CA_US - Bh_CA_US* x. eq26=Bs_US_CA - Bh_US_CA x, eq27 =Bcb_CABsCABh _CA_CA-Bs_US_CA, eq28 =BCb_US - Bs_US - Bs_CA_US - Bh_US_US, eq30 = or_US - or_US[-1] + ( Hs_US - Hs_US[-1] - ( Bcb_US - Bcb_US[-1]) )pg_US, eq31=Hs_CA - Hh_ C. eq 32=Hs _US HhZ US, eq 33=xr=pg_US /pg_CA, eq 34= deltaor_US - or_US - or_US[-1]. eq35=deltaor_CA- or_CA - or_CA[-1]. eq38-FAB_CA- (deltaor_CA'pg_CA+ (Bs_CA_US - Bs_CA_US[-1]) xr - (Bs_US_CA - Bs_US_CA[-1])). eq39 =FAB _US - (deltaor_US'pg_US + (Bs_US_CA - Bh_US_CA[-1])xr - (Bs_CA_US - Bh_CA_US[-1])). eq4 40= BOP_CA - CAB_CA + FAB_CA, eq4 4 = BOP_US - CAB_US + FAB_US, eq43 =GDEF_US - (Bs_US - Bs_US[-1]). eq44 =redundant- deltaor_US + deltaor_CA ) open_ext =286.2949 \#\# Y_US steady state =286.2949 a) Given the available information, is the exchange rate xrt expressed in: 1) number of US dollars needed to buy 1 Canadian dollar, or 2 ) in number of Canadian dollars necessary to buy 1 American dollar? b) Explain what the parameters lambda20_CA and lambda30_CA represent.. Likewise, explain the parameters lambda20_US and lambda30_US. c) In the initial calibration, we see that lambda20_CA is greater than lambda30_CA and lambda30_US is greater than lambda20_US. Explain intuitively why this calibration is reasonable