Answered step by step

Verified Expert Solution

Question

1 Approved Answer

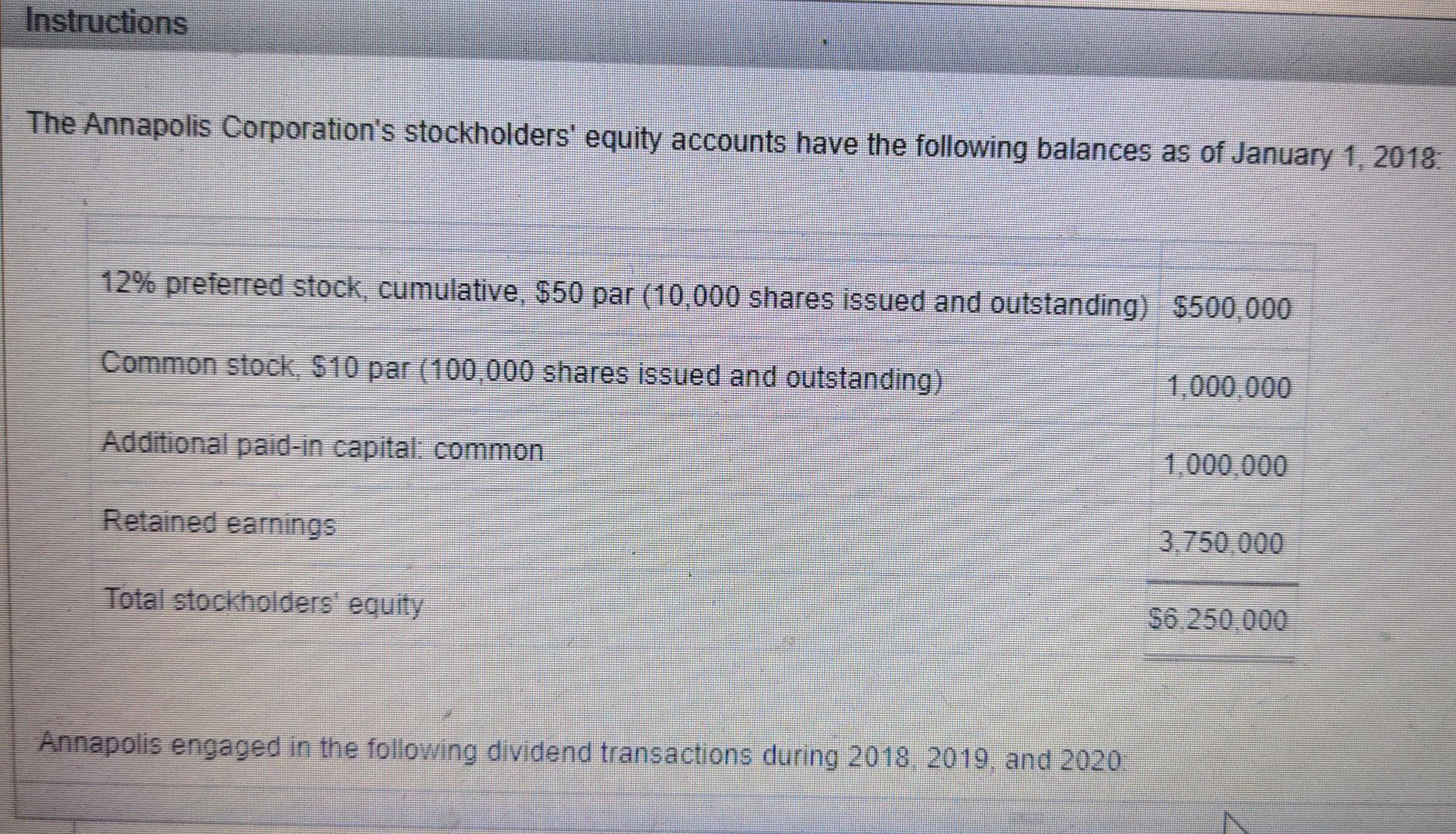

Instructions The Annapolis Corporation's stockholders' equity accounts have the following balances as of January 1, 2018 12% preferred stock, cumulative, $50 par (10 000 shares

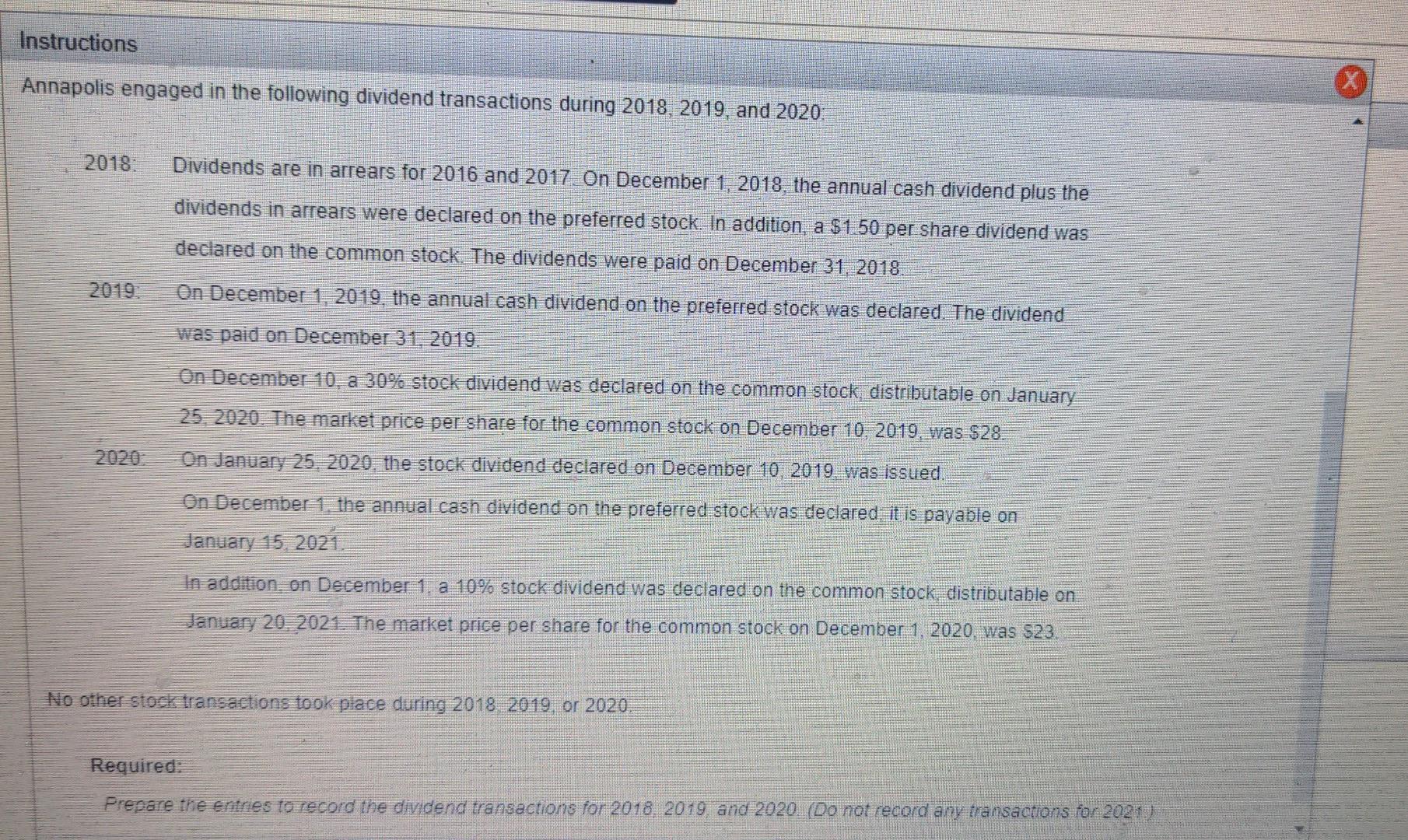

Instructions The Annapolis Corporation's stockholders' equity accounts have the following balances as of January 1, 2018 12% preferred stock, cumulative, $50 par (10 000 shares issued and outstanding) $500,000 Common stock $10 par (100 000 shares issued and outstanding) 1.000.000 Additional pad-in capital: common 1.000.000 Retained earnings 3.750.000 Total stockholders' equity $6.250.000 Annapolis engaged in the following dividend transactions during 2018 2019 and 2020 Instructions Annapolis engaged in the following dividend transactions during 2018, 2019, and 2020: 2018: Dividends are in arrears for 2016 and 2017 On December 1, 2018, the annual cash dividend plus the dividends in arrears were declared on the preferred stock. In addition, a $1.50 per share dividend was declared on the common stock. The dividends were paid on December 31, 2018. On December 1, 2019, the annual cash dividend on the preferred stock was declared. The dividend was paid on December 31, 2019. On December 10. a 30% stock dividend was declared on the common stock, distributable on January 25.2020. The market price pershare for the common stock on December 10, 2019, was $28. 2020: On January 25, 2020. the stock dividend declared on December 10, 2019 was issued. On December 1. the annual cash dividend on the preferred stock was declared it is payable on January 15, 2021. In addition, on December 1. a 10% stock dividend was declared on the common stock, distributable on January 20, 2021. The market price per share for the common stock on December 1, 2020, was $23. No other stock transactions took place during 2018. 2019. or 2020. Required: Prepare the entries to record the dividend transactions for 2018 2019 and 2020. (Do not record any transactions for 2021)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started