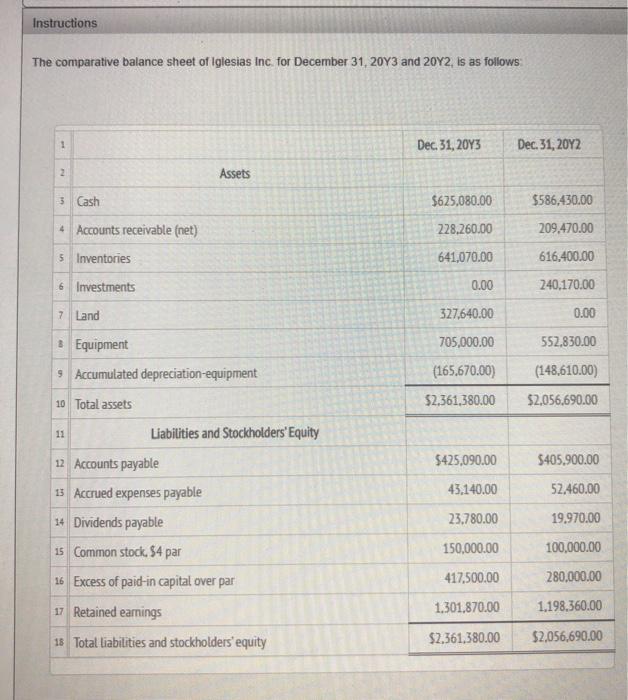

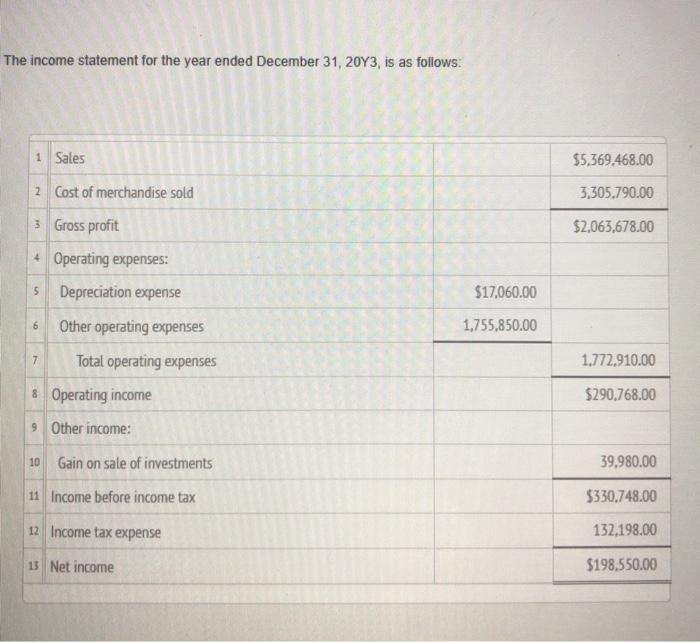

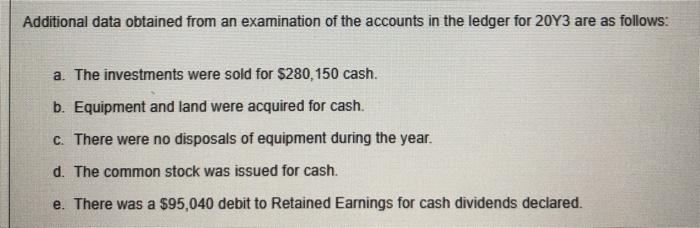

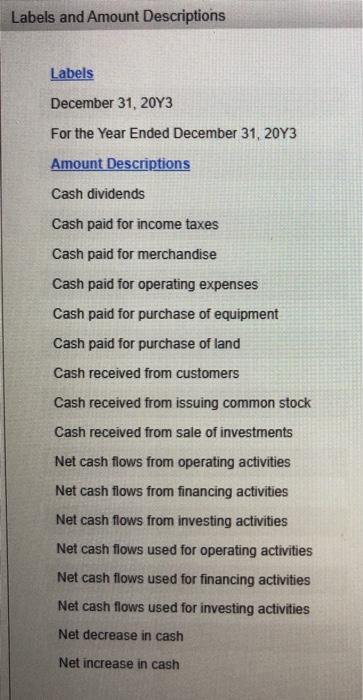

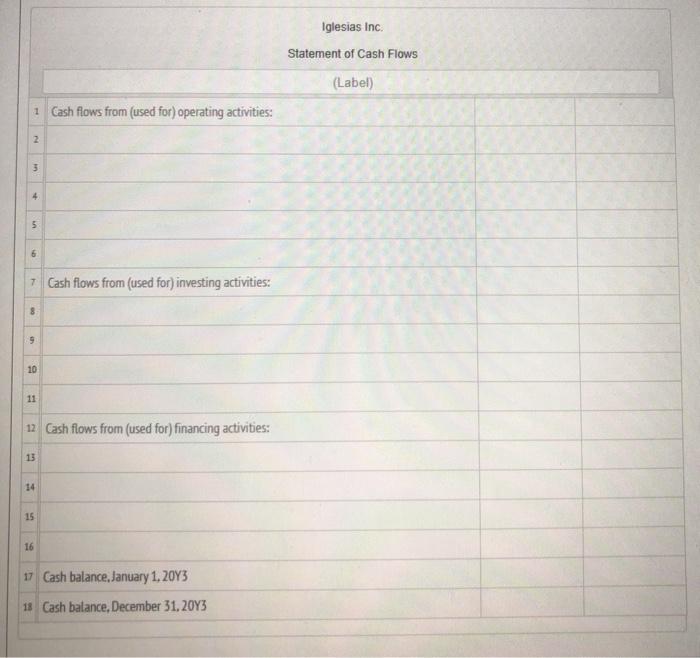

Instructions The comparative balance sheet of Iglesias Inc. for December 31, 2013 and 2082is as follows 1 Dec. 31, 20Y3 Dec 31, 2012 2 Assets 3 Cash $625,080.00 $586,430.00 209.470.00 228.260.00 4 Accounts receivable (net) 5 Inventories 641,070.00 616.400.00 6 Investments 0.00 240.170.00 7 Land 327,640.00 0.00 705,000.00 552,830.00 Equipment 9 Accumulated depreciation equipment (165.670.00) (148.610.00) 10 Total assets $2,361,380.00 $2.056,690.00 11 $425,090.00 $405,900.00 43.140.00 52.460.00 23.780.00 19,970.00 Liabilities and Stockholders' Equity 12 Accounts payable 13 Accrued expenses payable 14 Dividends payable 15 Common stock. 54 par 16 Excess of paid-in capital over par 17 Retained earnings 16 Total liabilities and stockholders' equity 150,000.00 100,000.00 417,500.00 280,000.00 1.301.870.00 1.198.360.00 $2,361,380.00 $2,056,690.00 The income statement for the year ended December 31, 2013, is as follows: 1 Sales $5,369.468.00 3,305.790.00 2 Cost of merchandise sold 3 Gross profit $2,063,678.00 + Operating expenses: Depreciation expense 5 $17,060.00 6 Other operating expenses 1.755,850.00 7 1.772.910.00 Total operating expenses & Operating income $290,768.00 9 Other income: 10 39.980.00 Gain on sale of investments 11 Income before income tax $330.748.00 12 Income tax expense 132.198.00 13 Net income $198.550.00 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: a. The investments were sold for $280,150 cash. b. Equipment and land were acquired for cash. c. There were no disposals of equipment during the year. d. The common stock was issued for cash. e. There was a $95,040 debit to Retained Earnings for cash dividends declared. Labels and Amount Descriptions Labels December 31, 20Y3 For the Year Ended December 31, 20Y3 Amount Descriptions Cash dividends Cash paid for income taxes Cash paid for merchandise Cash paid for operating expenses Cash paid for purchase of equipment Cash paid for purchase of land Cash received from customers Cash received from issuing common stock Cash received from sale of investments Net cash flows from operating activities Net cash flows from financing activities Net cash flows from investing activities Net cash flows used for operating activities Net cash flows used for financing activities Net cash flows used for investing activities Net decrease in cash Net increase in cash Iglesias Inc Statement of Cash Flows (Label) i Cash flows from (used for) operating activities: 2 3 4 5 6 7 Cash flows from (used for) investing activities: 9 10 11 12 Cash flows from (used for financing activities: 13 14 15 16 17 Cash balance, January 1, 2083 18 Cash balance, December 31, 2043