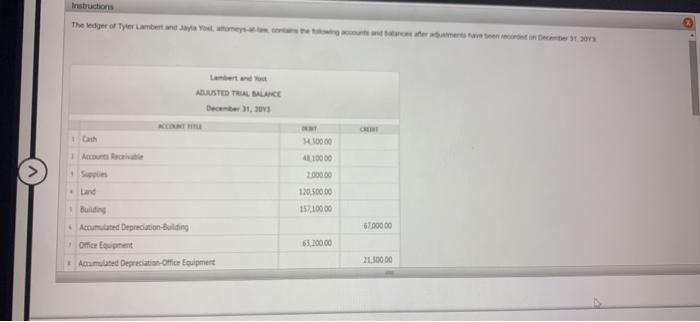

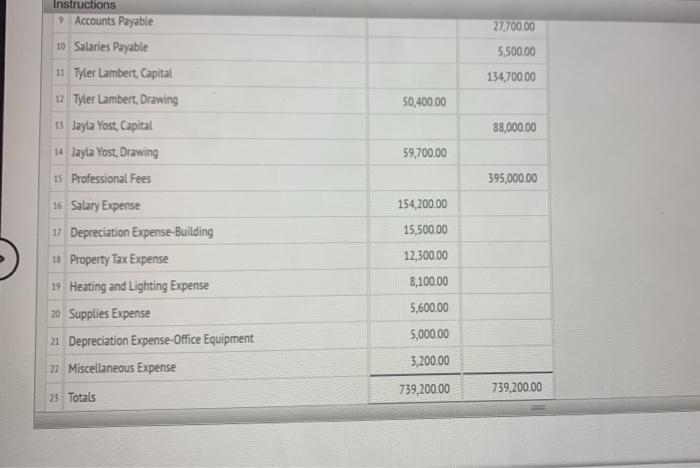

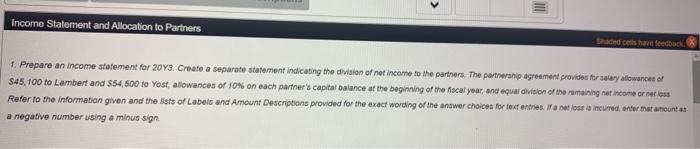

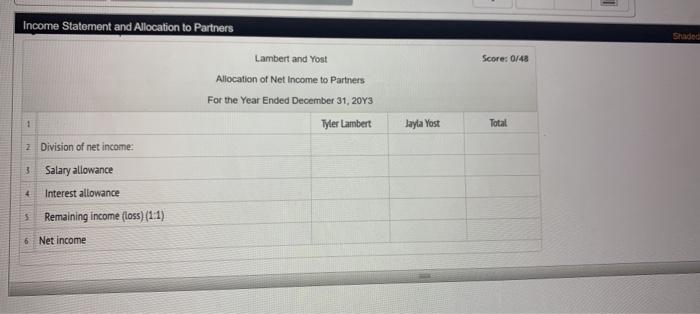

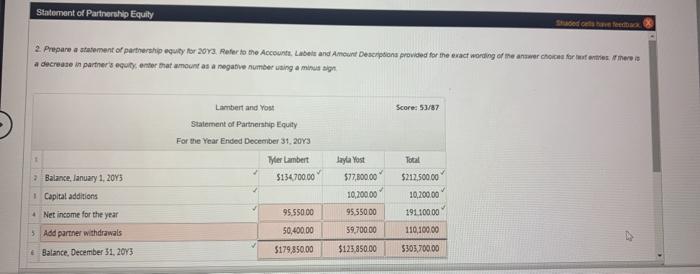

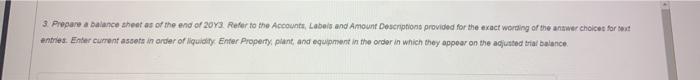

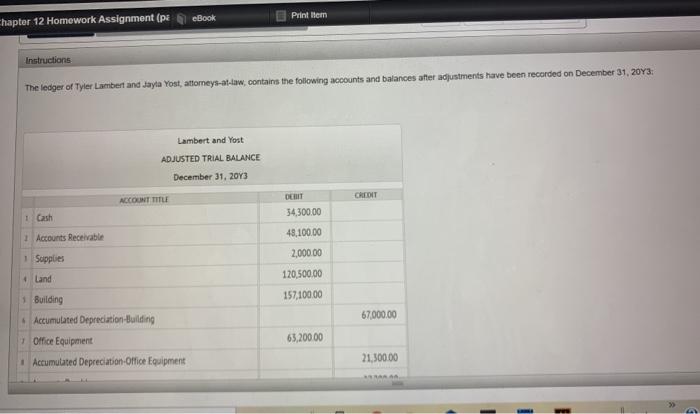

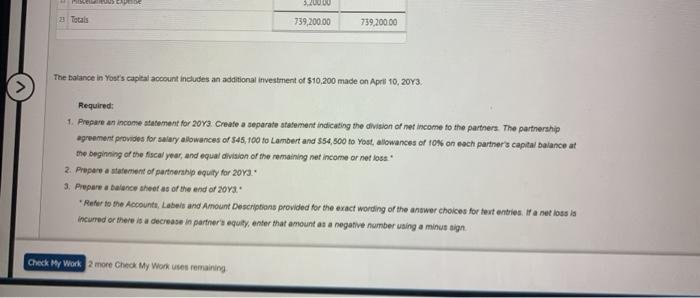

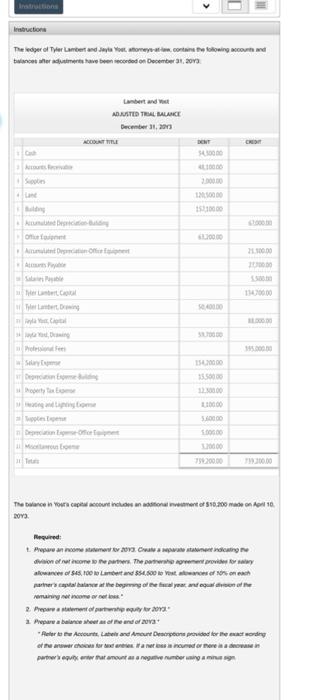

Instructions The edge of the Lambertanyaan inte ADJUSTED TRIAL MALANCE December 1, 2013 CE Cath 10000 10000 200000 120,500.00 157.100.00 6.000.00 Building Accumulated Depreciation Building Office Count Amated Depreciation Office Equipment 65.700.00 21.500.00 Instructions 9 Accounts Payable 10 Salaries Payable 27,700.00 5,500.00 134,700.00 11 Tyler Lambert, Capital 12 Tyler Lambert, Drawing 50,400.00 88,000.00 59,700.00 395,000.00 154,200.00 15,500.00 13 Jayla Yost, Capital 14 Jayla Yost, Drawing Is Professional Fees 16 Salary Expense 17 Depreciation Expense-Building 18 Property Tax Expense 19 Heating and Lighting Expense 20 Supplies Expense 21 Depreciation Expense-Office Equipment 7 Miscellaneous Expense 12,300.00 8,100.00 5,600.00 5,000,00 3,200.00 739,200.00 739,200.00 25 Totals Income Statement and Allocation to Partners Sanders have feedback 1. Prepare an income statement for 2073. Create a separate statement indicating the division of net income to the partners. The partnership agreement provides for salwy alowance of S45, 100 to Lambert and 854,500 to Yost, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income ornet loss Refer to the information given and the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entre 11 et loss is incurved enter at amount as a negative number using a minus sign Shaded Score: 0/48 Income Statement and Allocation to Partners Lambert and Yout Allocation of Net Income to Partners For the Year Ended December 31, 20Y3 Tyler Lambert 1 Jayla Yost Total 2 Division of net income 3 Salary allowance 4 Interest allowance 5 Remaining income (Loss) (1:1) 6 Net income Statement of Partnership Equity Sheet 2. Prepare a statement of partnership equity for 2073. Refer to the Accounts. Label and Amount Descriptions provided for the exact wording of the answer choice for most entries. There a decrease in partner's equity enter that amount as a negative number using a minus sign Score: 53/87 Lambert and Yout Statement of Partnership Equity For the Year Ended December 31, 2073 Tyler Lambert $134 700.00 Jayla Yost $77,800.00 Balance, lanuary 1, 2013 1 Capital additions Total $212,500.00 10,200.00 191.100.00 110,100.00 Net income for the year 10,200.00 9555000 59,70000 95.950.00 50,400.00 5 Add partner withdrawals Balance, December 31, 2013 $179,850.00 $125,850.00 $305,700.00 3. Prepare a balance sheet as of the end of 20Y3. Refer to the Accounts Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. Enter current assets in order of liquidity Enter Property plant and equipment in the order in which they appear on the adjusted trial balance eBook Printem Chapter 12 Homework Assignment (pe Instructions The ledger of Tyler Lambert and Jayta Yost, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 2013: Lambert and Yost ADJUSTED TRIAL BALANCE December 31, 2013 DET CREDIT ACCOUNT TITLE 1 Cash 34,300.00 48,100.00 1 Accounts Receivable 1 Supplies 2,000.00 Land 120,500.00 157,100.00 67,000.00 1 Building Accumulated Depreciation-Building Office Equipment Accumulated Depreciation Office Equipment 63,200.00 21,500.00 - i DE 3,20000 Totals 739,200.00 759,200.00 The balance in Your's capital account includes an additional investment of $10,200 made on April 10, 203, Required: 1. Prepare an income statement for 2073. Create a separate statement indicating the division of net income to the partners. The partnership agreement provides for salary allowances of 545,100 to Lambert and $54,500 to Yout, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or not loss 2. Prepare a statement of partnership equity for 2013 3. Prepare a balance sheer as of the end of 20Y3.. * Puter to the Accounts, Label and Amount Descriptions provided for the exact wording of the answer choices for tout entries. Ita net loss is incurred or there is a decrease in partnera equity, enter that amount as a negative number using a minus sign Check My Work 2 more Check My Work uses remaining ristruction The edge of Ter Lambert Joye contain the following cod bace where have becoded on December 31, 20 ADAUSTED TRAL MALACE December 1, 2013 DODATTLE G 10 La 13.00 10000 0.000 Phoes 12000 100 0000 The balance in your capiunt includes anton mement of $50.200 made on 10 Required . Per acometem 2000. Chwa medicating division of outcomes the parties. The present provider aware of Saroo Land $4.500 to Verone porter capital hate at the borgere for your requirente income are 2. Preparate per quity 2013 2. Prepare able to me and of cova *Refer Accurate and Amount Dempton provided for the word of the answer them tornare antes a noun or more per entrat amount as a regeneratering Instructions The edge of the Lambertanyaan inte ADJUSTED TRIAL MALANCE December 1, 2013 CE Cath 10000 10000 200000 120,500.00 157.100.00 6.000.00 Building Accumulated Depreciation Building Office Count Amated Depreciation Office Equipment 65.700.00 21.500.00 Instructions 9 Accounts Payable 10 Salaries Payable 27,700.00 5,500.00 134,700.00 11 Tyler Lambert, Capital 12 Tyler Lambert, Drawing 50,400.00 88,000.00 59,700.00 395,000.00 154,200.00 15,500.00 13 Jayla Yost, Capital 14 Jayla Yost, Drawing Is Professional Fees 16 Salary Expense 17 Depreciation Expense-Building 18 Property Tax Expense 19 Heating and Lighting Expense 20 Supplies Expense 21 Depreciation Expense-Office Equipment 7 Miscellaneous Expense 12,300.00 8,100.00 5,600.00 5,000,00 3,200.00 739,200.00 739,200.00 25 Totals Income Statement and Allocation to Partners Sanders have feedback 1. Prepare an income statement for 2073. Create a separate statement indicating the division of net income to the partners. The partnership agreement provides for salwy alowance of S45, 100 to Lambert and 854,500 to Yost, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income ornet loss Refer to the information given and the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entre 11 et loss is incurved enter at amount as a negative number using a minus sign Shaded Score: 0/48 Income Statement and Allocation to Partners Lambert and Yout Allocation of Net Income to Partners For the Year Ended December 31, 20Y3 Tyler Lambert 1 Jayla Yost Total 2 Division of net income 3 Salary allowance 4 Interest allowance 5 Remaining income (Loss) (1:1) 6 Net income Statement of Partnership Equity Sheet 2. Prepare a statement of partnership equity for 2073. Refer to the Accounts. Label and Amount Descriptions provided for the exact wording of the answer choice for most entries. There a decrease in partner's equity enter that amount as a negative number using a minus sign Score: 53/87 Lambert and Yout Statement of Partnership Equity For the Year Ended December 31, 2073 Tyler Lambert $134 700.00 Jayla Yost $77,800.00 Balance, lanuary 1, 2013 1 Capital additions Total $212,500.00 10,200.00 191.100.00 110,100.00 Net income for the year 10,200.00 9555000 59,70000 95.950.00 50,400.00 5 Add partner withdrawals Balance, December 31, 2013 $179,850.00 $125,850.00 $305,700.00 3. Prepare a balance sheet as of the end of 20Y3. Refer to the Accounts Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. Enter current assets in order of liquidity Enter Property plant and equipment in the order in which they appear on the adjusted trial balance eBook Printem Chapter 12 Homework Assignment (pe Instructions The ledger of Tyler Lambert and Jayta Yost, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 2013: Lambert and Yost ADJUSTED TRIAL BALANCE December 31, 2013 DET CREDIT ACCOUNT TITLE 1 Cash 34,300.00 48,100.00 1 Accounts Receivable 1 Supplies 2,000.00 Land 120,500.00 157,100.00 67,000.00 1 Building Accumulated Depreciation-Building Office Equipment Accumulated Depreciation Office Equipment 63,200.00 21,500.00 - i DE 3,20000 Totals 739,200.00 759,200.00 The balance in Your's capital account includes an additional investment of $10,200 made on April 10, 203, Required: 1. Prepare an income statement for 2073. Create a separate statement indicating the division of net income to the partners. The partnership agreement provides for salary allowances of 545,100 to Lambert and $54,500 to Yout, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or not loss 2. Prepare a statement of partnership equity for 2013 3. Prepare a balance sheer as of the end of 20Y3.. * Puter to the Accounts, Label and Amount Descriptions provided for the exact wording of the answer choices for tout entries. Ita net loss is incurred or there is a decrease in partnera equity, enter that amount as a negative number using a minus sign Check My Work 2 more Check My Work uses remaining ristruction The edge of Ter Lambert Joye contain the following cod bace where have becoded on December 31, 20 ADAUSTED TRAL MALACE December 1, 2013 DODATTLE G 10 La 13.00 10000 0.000 Phoes 12000 100 0000 The balance in your capiunt includes anton mement of $50.200 made on 10 Required . Per acometem 2000. Chwa medicating division of outcomes the parties. The present provider aware of Saroo Land $4.500 to Verone porter capital hate at the borgere for your requirente income are 2. Preparate per quity 2013 2. Prepare able to me and of cova *Refer Accurate and Amount Dempton provided for the word of the answer them tornare antes a noun or more per entrat amount as a regeneratering