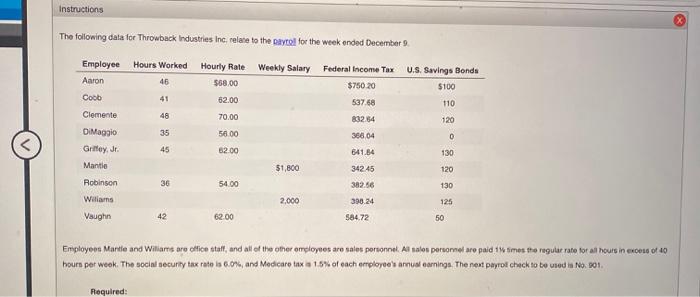

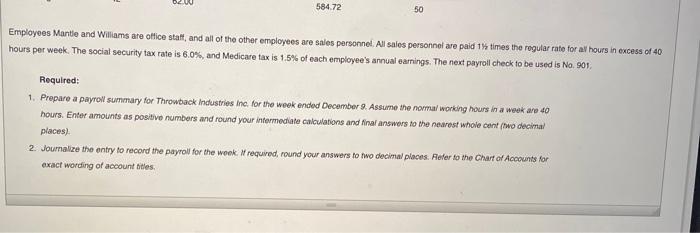

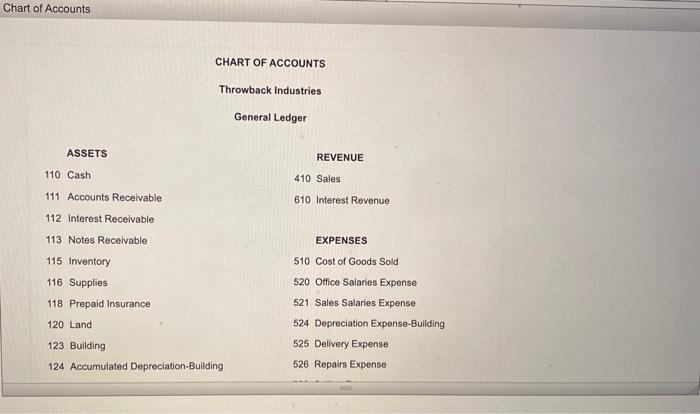

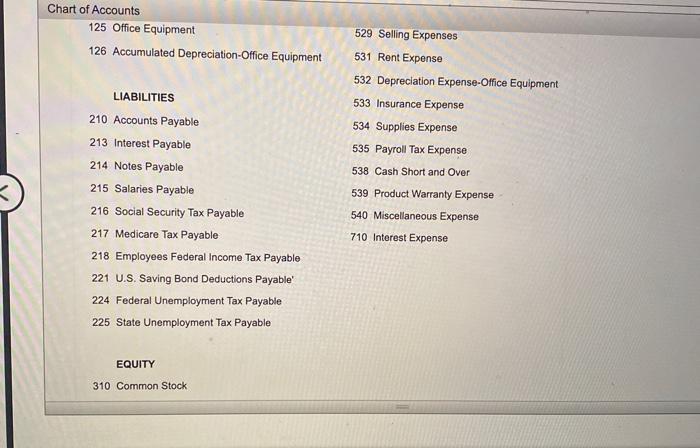

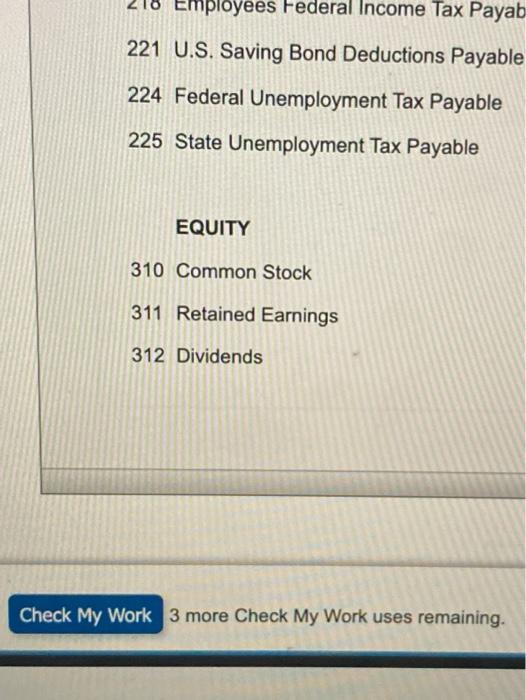

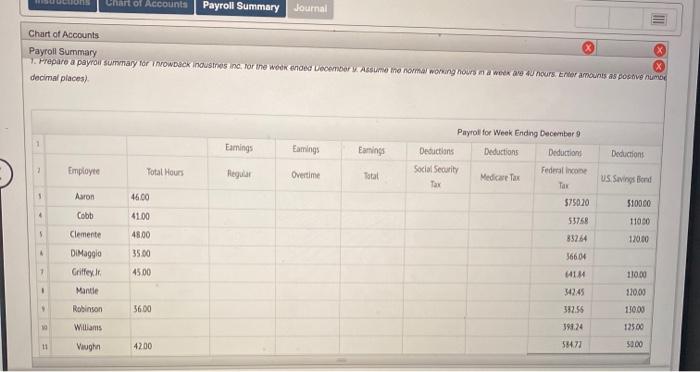

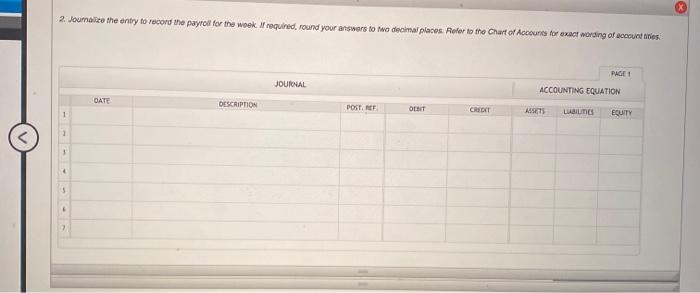

Instructions The following data for Throwback Industries Inc, relate to the payroll for the week ended December 9 Employee Aaron Hours Worked 46 41 Weekly Salary Federal Income Tax U.S. Savings Bonda $750.20 $100 Hourly Rate $68.00 62.00 70.00 Cobb 53768 110 48 832 54 120 35 56.00 Clemente DiMaggio Griffey Jr. Mantie 0 366.04 141.84 45 52.00 130 51,800 34245 120 Robinson 36 5400 382.66 130 2,000 390.24 Wiliams Vaughn 125 50 42 62.00 584.72 Employees Mantle and Williams are office staff, and all of the other employees are sales personnel Al salos personnel are paid 1 times the regular rate for all hours in excess of 40 hours per week. The socini security tax rate is 6.0%, and Medicare tax a 15% of each employee's annus earnings. The next payrol check to be used in No 001. Required: 584.72 50 Employees Mantle and Williams are office staff, and all of the other employees are sales personnel. All sales personnel are paid 1 times the regular rate for all hours in excess of 40 hours per week. The social security tax rate is 6.0% and Medicare tax is 1.5% of each employee's annual earnings. The next payroll check to be used is No. 901 Required: 1. Prepare a payroll summary for Throwback Industries Inc. for the wook ended December 9. Assume the normal working hours in a week are 40 hours. Enter amounts as positive numbers and round your intermediate calculations and final answers to the nearest whole cent (180 decimal places) 2. Journalize the entry to record the payroll for the week. W required, round your answers to two decimal places. Refer to the Chart of Accounts for exact wording of account bites Chart of Accounts CHART OF ACCOUNTS Throwback Industries General Ledger ASSETS REVENUE 110 Cash 410 Sales 610 Interest Revenue EXPENSES 510 Cost of Goods Sold 111 Accounts Receivable 112 Interest Receivable 113 Notes Receivable 115 Inventory 116 Supplies 118 Prepaid Insurance 120 Land 123 Building 124 Accumulated Depreciation-Building 520 Office Salaries Expense 521 Sales Salaries Expense 524 Depreciation Exponse-Building 525 Delivery Expense 526 Repairs Expense Chart of Accounts 125 Office Equipment 126 Accumulated Depreciation Office Equipment 529 Selling Expenses 531 Rent Expense 532 Depreciation Expense-Office Equipment 533 Insurance Expense 534 Supplies Expense 535 Payroll Tax Expense 538 Cash Short and Over 539 Product Warranty Expense 540 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 213 Interest Payable 214 Notes Payable 215 Salaries Payable 216 Social Security Tax Payable 217 Medicare Tax Payable 218 Employees Federal Income Tax Payable 221 U.S. Saving Bond Deductions Payable' 224 Federal Unemployment Tax Payable 225 State Unemployment Tax Payable