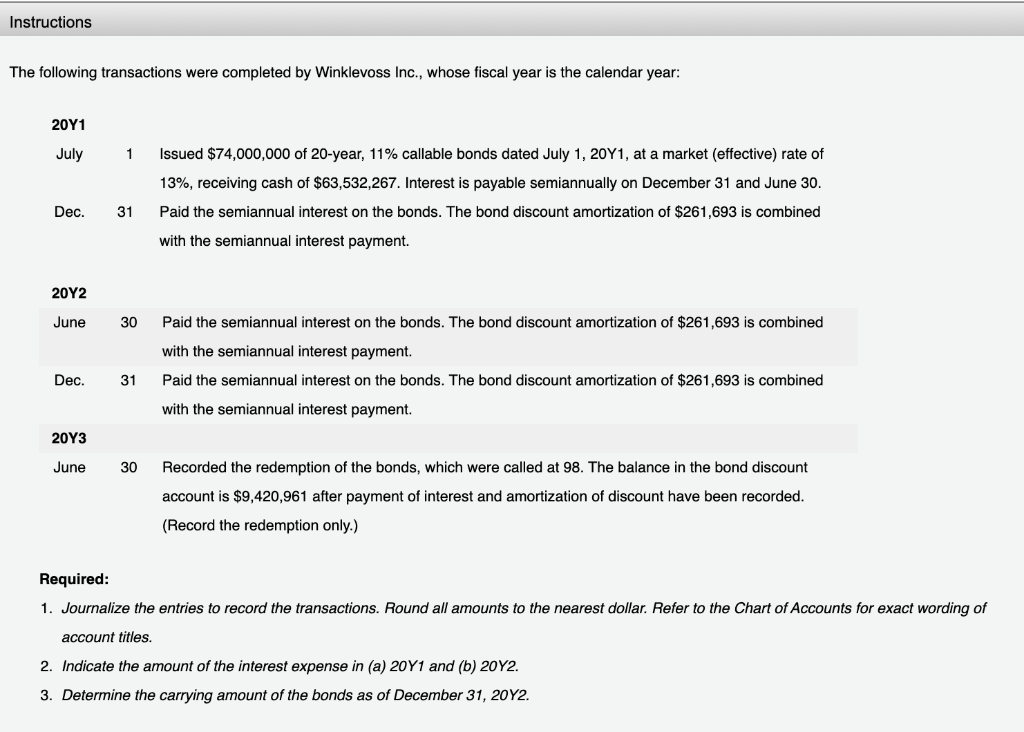

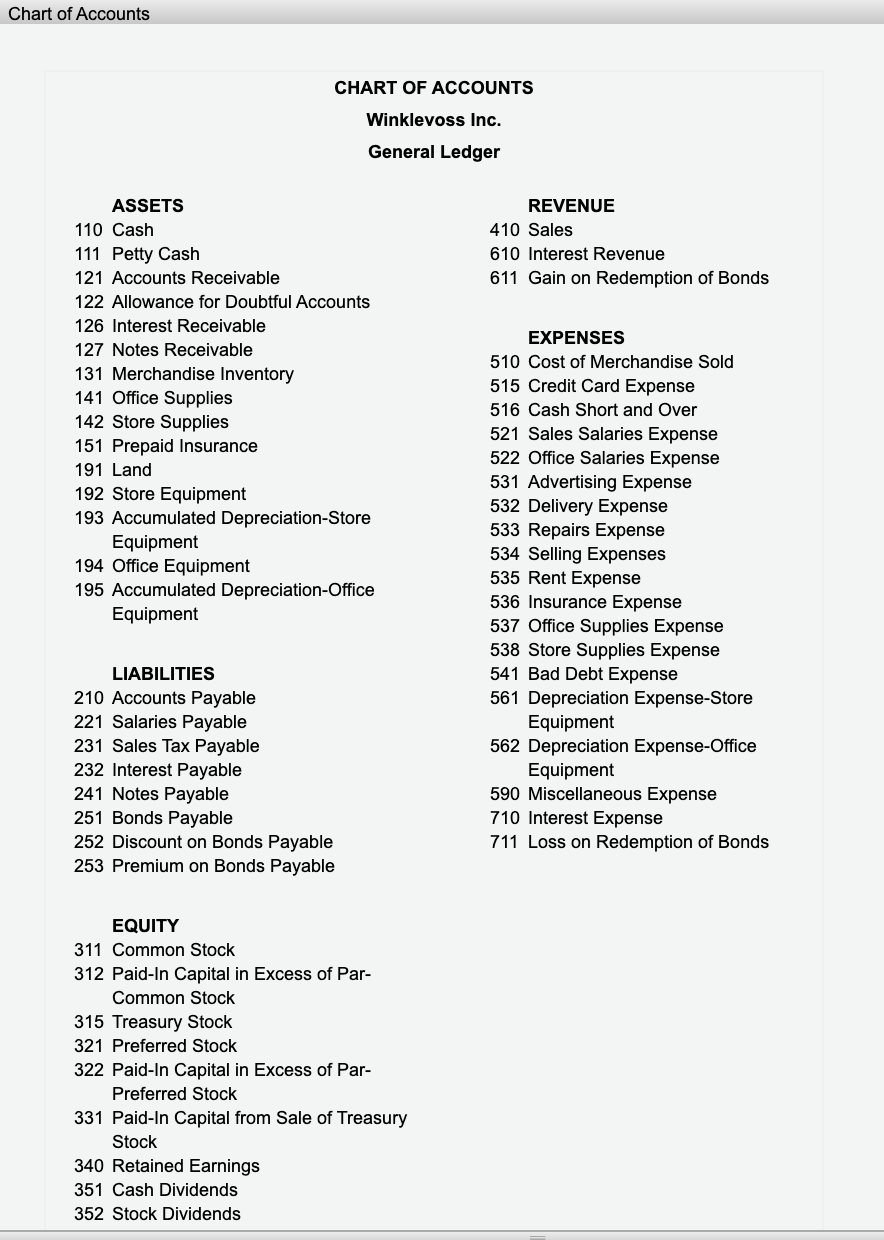

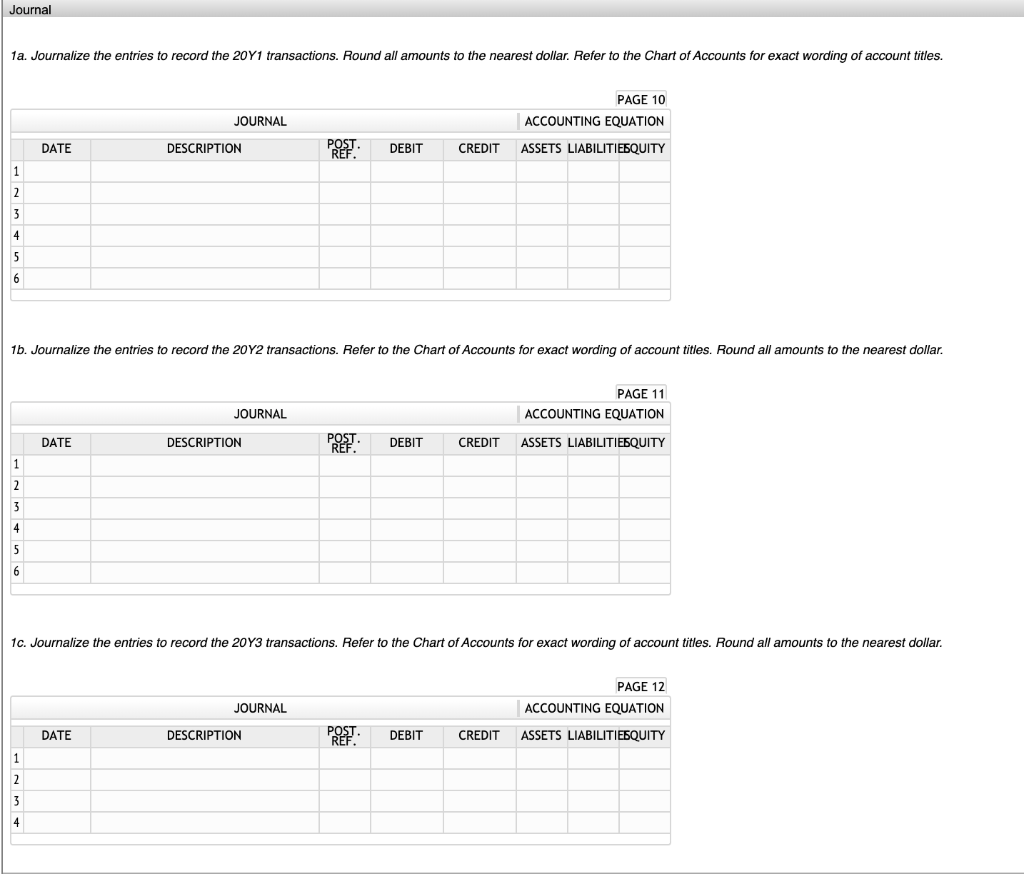

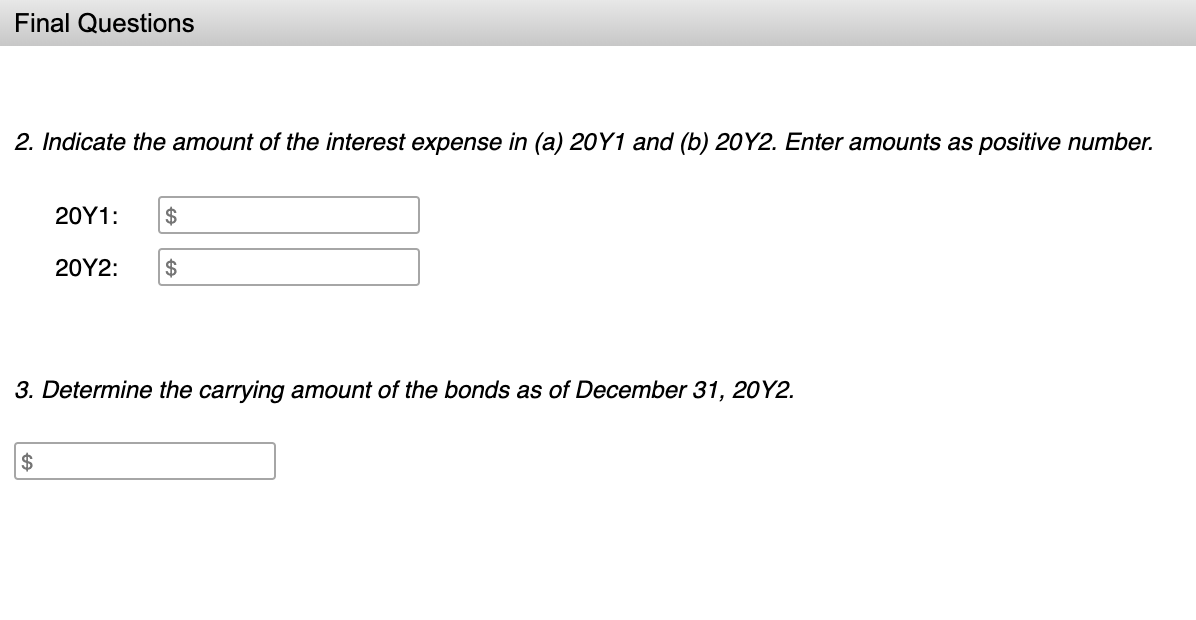

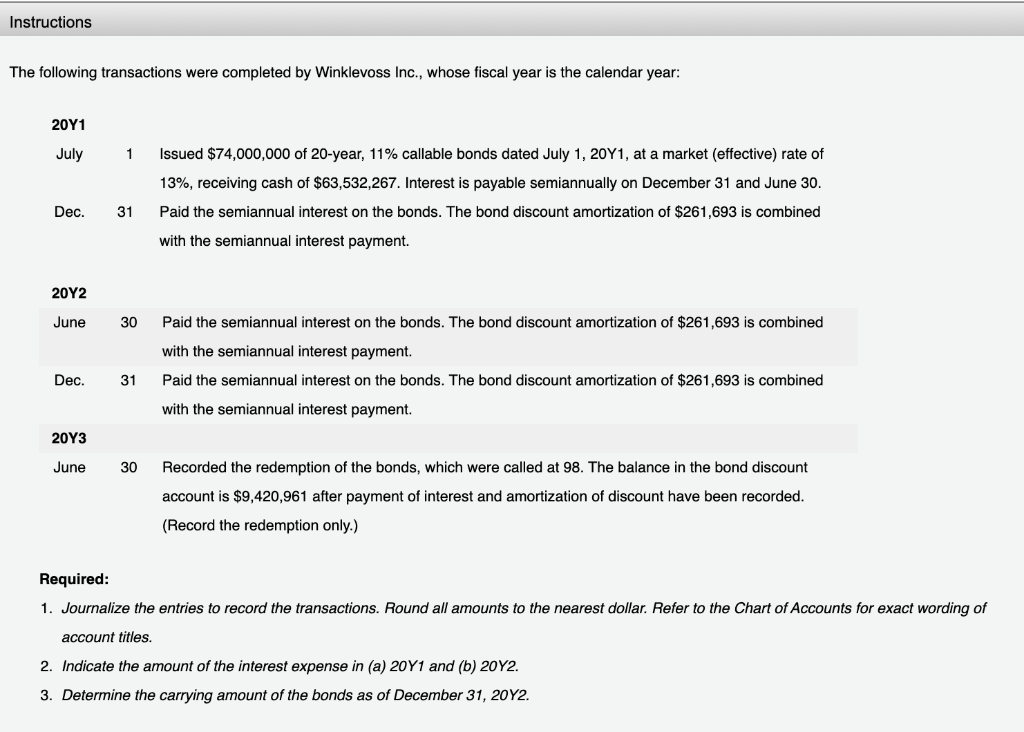

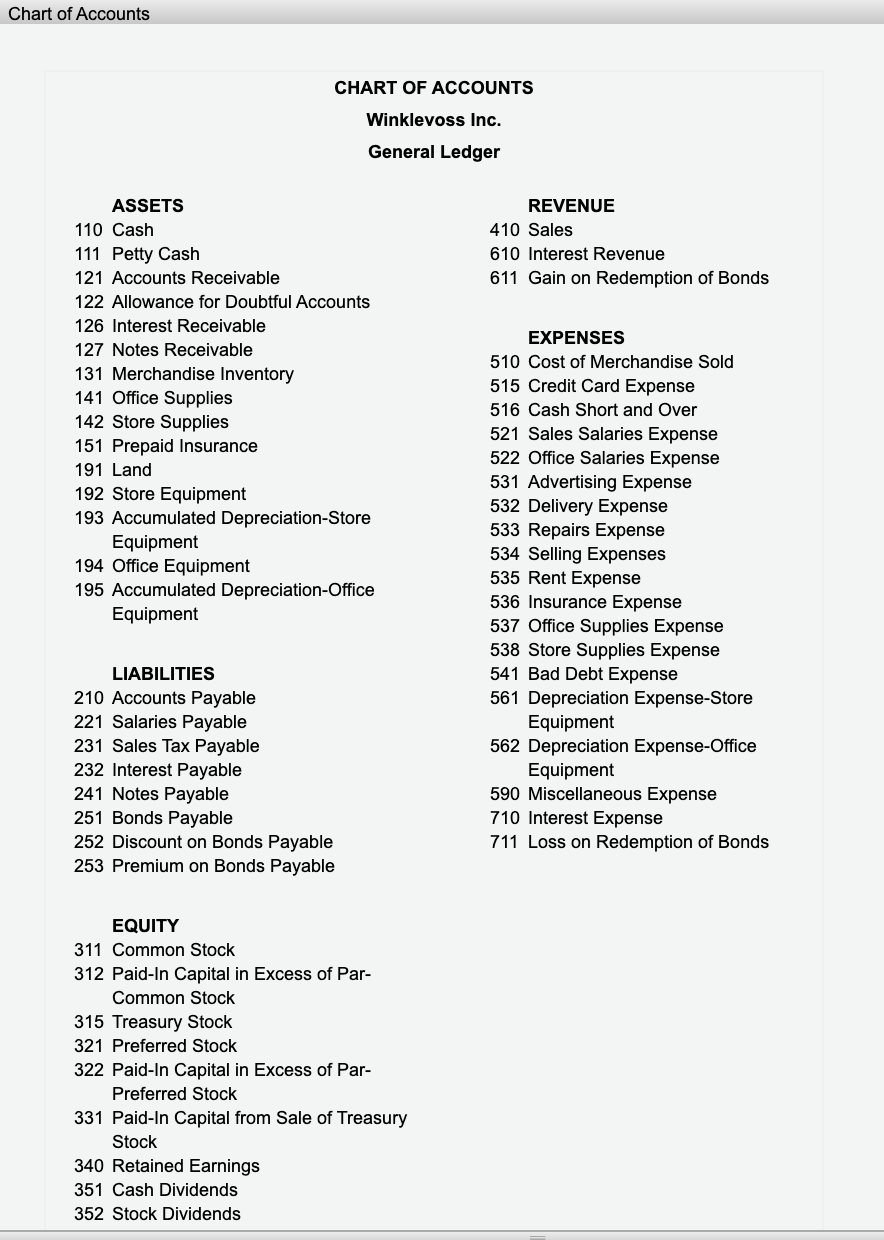

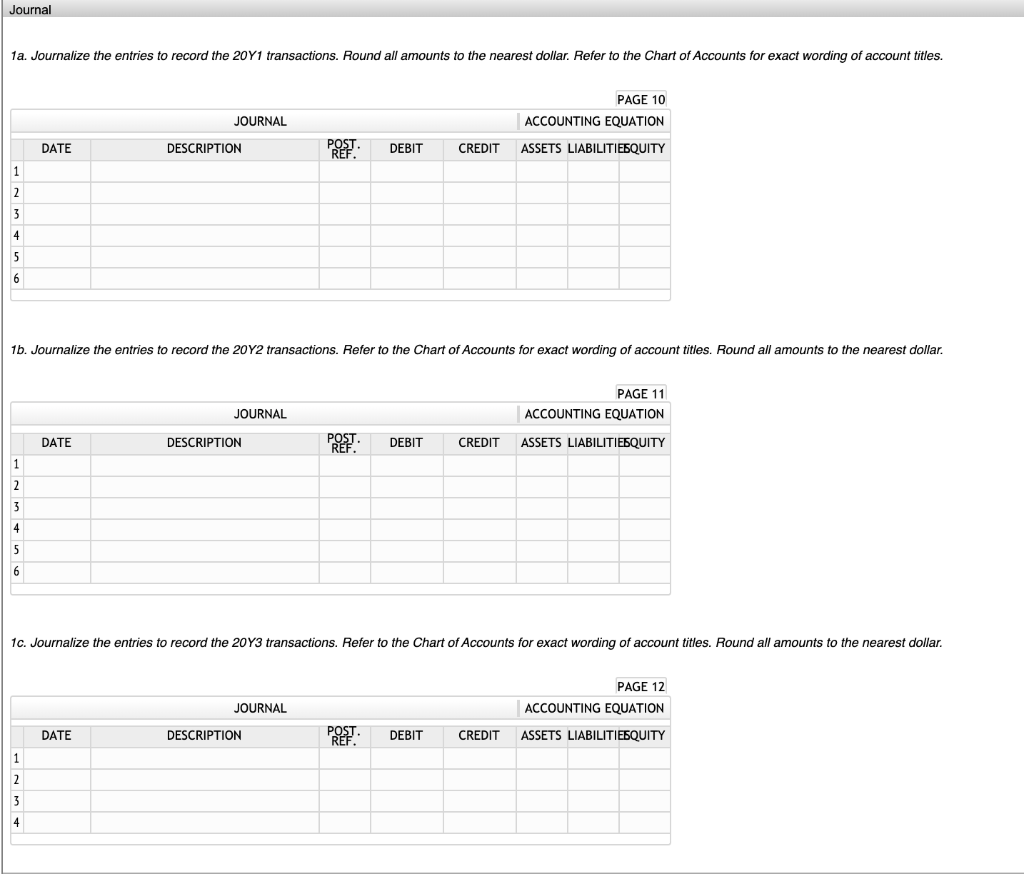

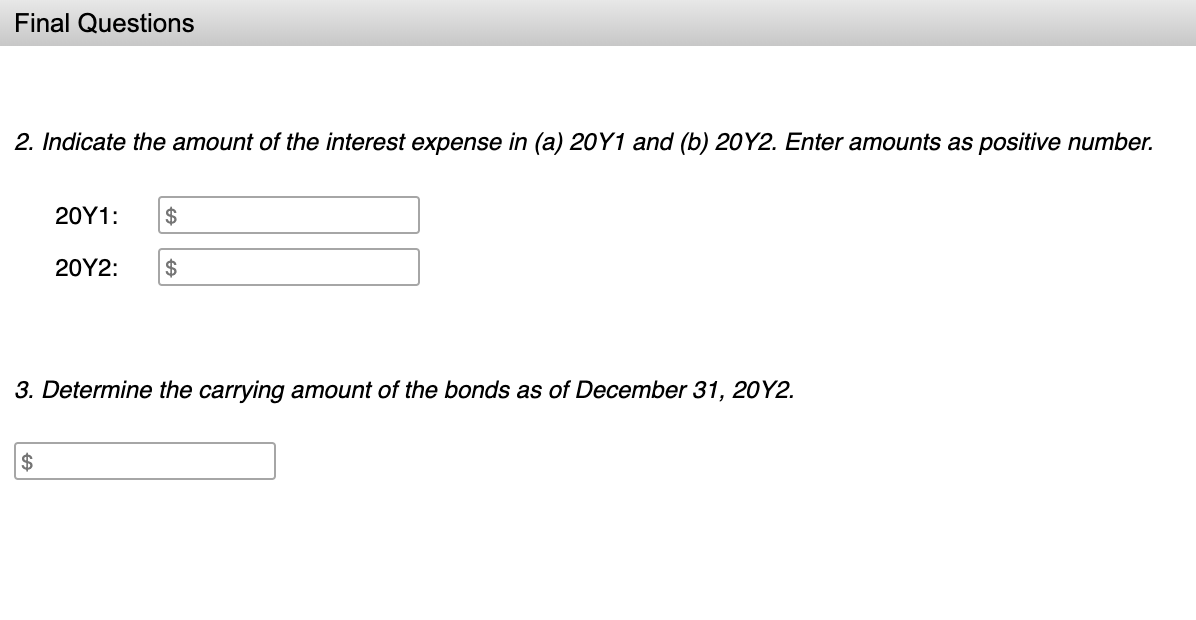

Instructions The following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar year: 20Y1 July 1 Issued $74,000,000 of 20-year, 11% callable bonds dated July 1, 20Y1, at a market (effective) rate of 13%, receiving cash of $63,532,267. Interest is payable semiannually on December 31 and June 30. Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined Dec. 31 with the semiannual interest payment. 20Y2 30 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. Dec. 31 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. 20Y3 June 30 Recorded the redemption of the bonds, which were called at 98. The balance in the bond discount account is $9,420,961 after payment of interest and amortization of discount have been recorded. (Record the redemption only.) Required: 1. Journalize the entries to record the transactions. Round all amounts to the nearest dollar. Refer to the Chart of Accounts for exact wording of account titles. 2. Indicate the amount of the interest expense in (a) 20Y1 and (b) 20Y2. 3. Determine the carrying amount of the bonds as of December 31, 20Y2. Chart of Accounts CHART OF ACCOUNTS Winklevoss Inc. General Ledger REVENUE 410 Sales 610 Interest Revenue 611 Gain on Redemption of Bonds ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable 122 Allowance for Doubtful Accounts 126 Interest Receivable 127 Notes Receivable 131 Merchandise Inventory 141 Office Supplies 142 Store Supplies 151 Prepaid Insurance 191 Land 192 Store Equipment 193 Accumulated Depreciation-Store Equipment 194 Office Equipment 195 Accumulated Depreciation Office Equipment EXPENSES 510 Cost of Merchandise Sold 515 Credit Card Expense 516 Cash Short and Over 521 Sales Salaries Expense 522 Office Salaries Expense 531 Advertising Expense 532 Delivery Expense 533 Repairs Expense 534 Selling Expenses 535 Rent Expense 536 Insurance Expense 537 Office Supplies Expense 538 Store Supplies Expense 541 Bad Debt Expense 561 Depreciation Expense-Store Equipment 562 Depreciation Expense-Office Equipment 590 Miscellaneous Expense 710 Interest Expense 711 Loss on Redemption of Bonds LIABILITIES 210 Accounts Payable 221 Salaries Payable 231 Sales Tax Payable 232 Interest Payable 241 Notes Payable 251 Bonds Payable 252 Discount on Bonds Payable 253 Premium on Bonds Payable EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par- Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par- Preferred Stock 331 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock Dividends Journal 1a. Journalize the entries to record the 20Y1 transactions. Round all amounts to the nearest dollar. Refer to the Chart of Accounts for exact wording of account titles. PAGE 10 ACCOUNTING EQUATION JOURNAL DATE DESCRIPTION PE DEBIT CREDIT ASSETS LIABILITIESQUITY 1b. Journalize the entries to record the 20Y2 transactions. Refer to the Chart of Accounts for exact wording of account titles. Round all amounts to the nearest dollar. JOURNAL PAGE 11 ACCOUNTING EQUATION ASSETS LIABILITIESQUITY DATE DESCRIPTION POST DEBIT CREDIT 1c. Journalize the entries to record the 20Y3 transactions. Refer to the Chart of Accounts for exact wording of account titles. Round all amounts to the nearest dollar. PAGE 12 ACCOUNTING EQUATION JOURNAL DATE DESCRIPTION POST DEBIT CREDIT ASSETS LIABILITIESQUITY Final Questions 2. Indicate the amount of the interest expense in (a) 20Y1 and (b) 20Y2. Enter amounts as positive number. 20Y1: 20Y2: $ 3. Determine the carrying amount of the bonds as of December 31, 20Y2. Instructions The following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar year: 20Y1 July 1 Issued $74,000,000 of 20-year, 11% callable bonds dated July 1, 20Y1, at a market (effective) rate of 13%, receiving cash of $63,532,267. Interest is payable semiannually on December 31 and June 30. Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined Dec. 31 with the semiannual interest payment. 20Y2 30 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. Dec. 31 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. 20Y3 June 30 Recorded the redemption of the bonds, which were called at 98. The balance in the bond discount account is $9,420,961 after payment of interest and amortization of discount have been recorded. (Record the redemption only.) Required: 1. Journalize the entries to record the transactions. Round all amounts to the nearest dollar. Refer to the Chart of Accounts for exact wording of account titles. 2. Indicate the amount of the interest expense in (a) 20Y1 and (b) 20Y2. 3. Determine the carrying amount of the bonds as of December 31, 20Y2. Chart of Accounts CHART OF ACCOUNTS Winklevoss Inc. General Ledger REVENUE 410 Sales 610 Interest Revenue 611 Gain on Redemption of Bonds ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable 122 Allowance for Doubtful Accounts 126 Interest Receivable 127 Notes Receivable 131 Merchandise Inventory 141 Office Supplies 142 Store Supplies 151 Prepaid Insurance 191 Land 192 Store Equipment 193 Accumulated Depreciation-Store Equipment 194 Office Equipment 195 Accumulated Depreciation Office Equipment EXPENSES 510 Cost of Merchandise Sold 515 Credit Card Expense 516 Cash Short and Over 521 Sales Salaries Expense 522 Office Salaries Expense 531 Advertising Expense 532 Delivery Expense 533 Repairs Expense 534 Selling Expenses 535 Rent Expense 536 Insurance Expense 537 Office Supplies Expense 538 Store Supplies Expense 541 Bad Debt Expense 561 Depreciation Expense-Store Equipment 562 Depreciation Expense-Office Equipment 590 Miscellaneous Expense 710 Interest Expense 711 Loss on Redemption of Bonds LIABILITIES 210 Accounts Payable 221 Salaries Payable 231 Sales Tax Payable 232 Interest Payable 241 Notes Payable 251 Bonds Payable 252 Discount on Bonds Payable 253 Premium on Bonds Payable EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par- Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par- Preferred Stock 331 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock Dividends Journal 1a. Journalize the entries to record the 20Y1 transactions. Round all amounts to the nearest dollar. Refer to the Chart of Accounts for exact wording of account titles. PAGE 10 ACCOUNTING EQUATION JOURNAL DATE DESCRIPTION PE DEBIT CREDIT ASSETS LIABILITIESQUITY 1b. Journalize the entries to record the 20Y2 transactions. Refer to the Chart of Accounts for exact wording of account titles. Round all amounts to the nearest dollar. JOURNAL PAGE 11 ACCOUNTING EQUATION ASSETS LIABILITIESQUITY DATE DESCRIPTION POST DEBIT CREDIT 1c. Journalize the entries to record the 20Y3 transactions. Refer to the Chart of Accounts for exact wording of account titles. Round all amounts to the nearest dollar. PAGE 12 ACCOUNTING EQUATION JOURNAL DATE DESCRIPTION POST DEBIT CREDIT ASSETS LIABILITIESQUITY Final Questions 2. Indicate the amount of the interest expense in (a) 20Y1 and (b) 20Y2. Enter amounts as positive number. 20Y1: 20Y2: $ 3. Determine the carrying amount of the bonds as of December 31, 20Y2