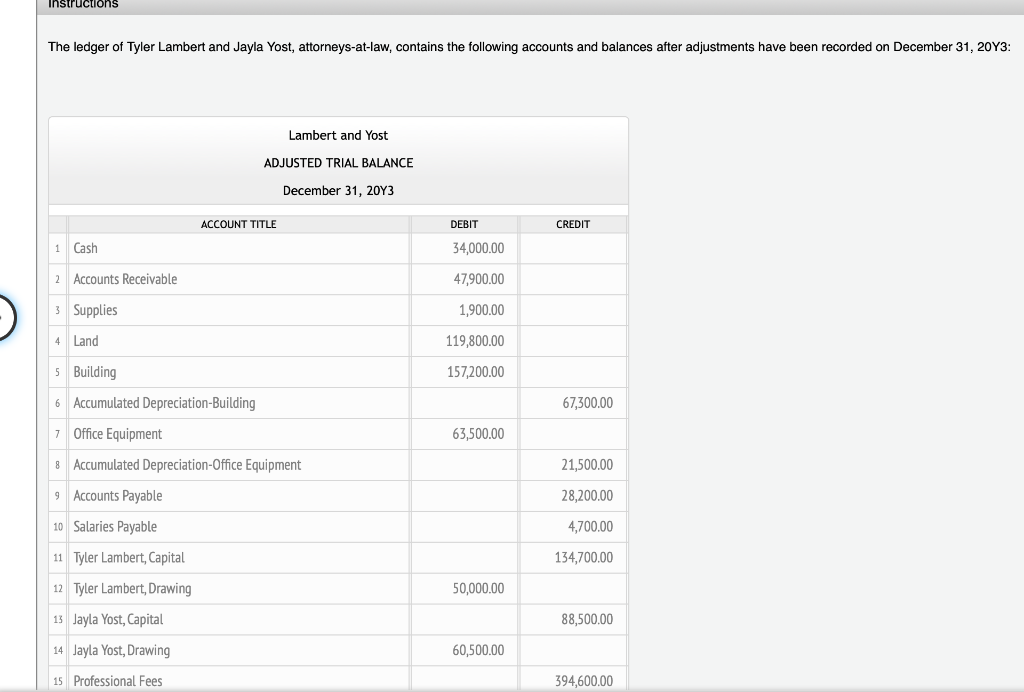

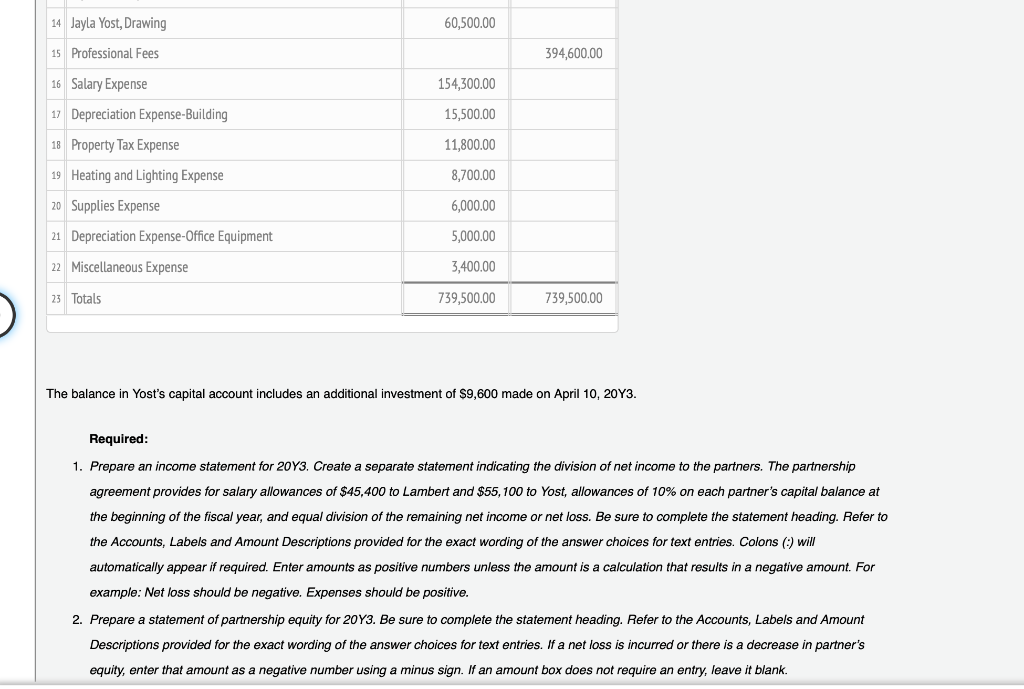

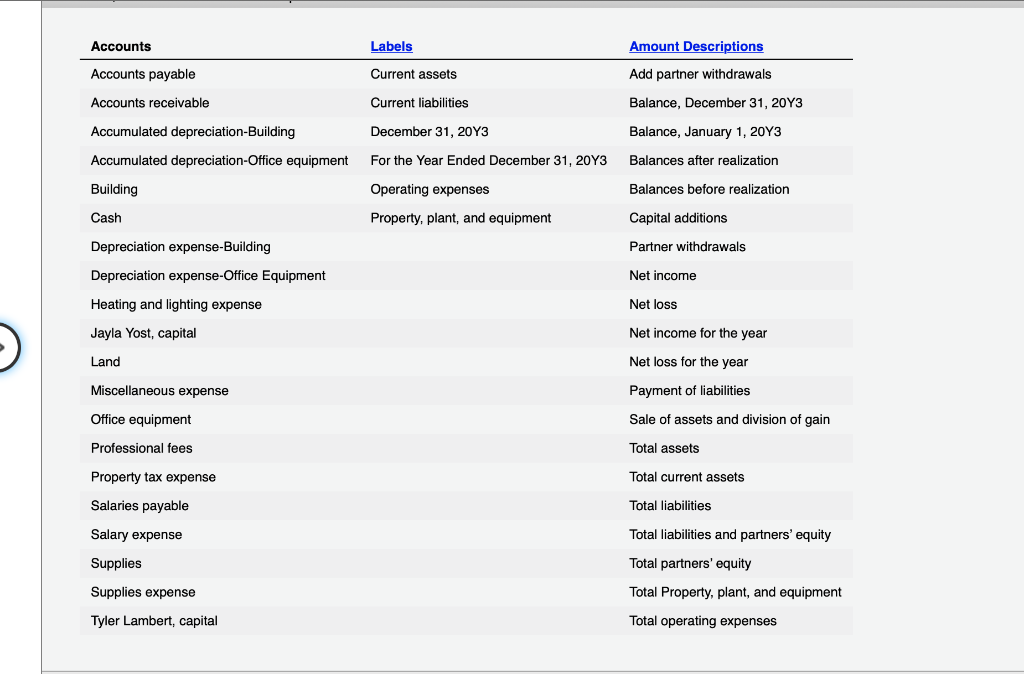

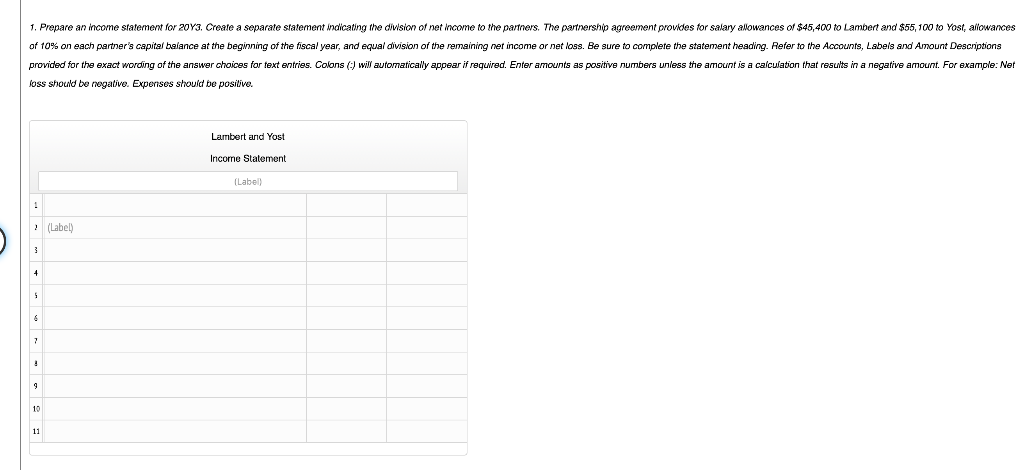

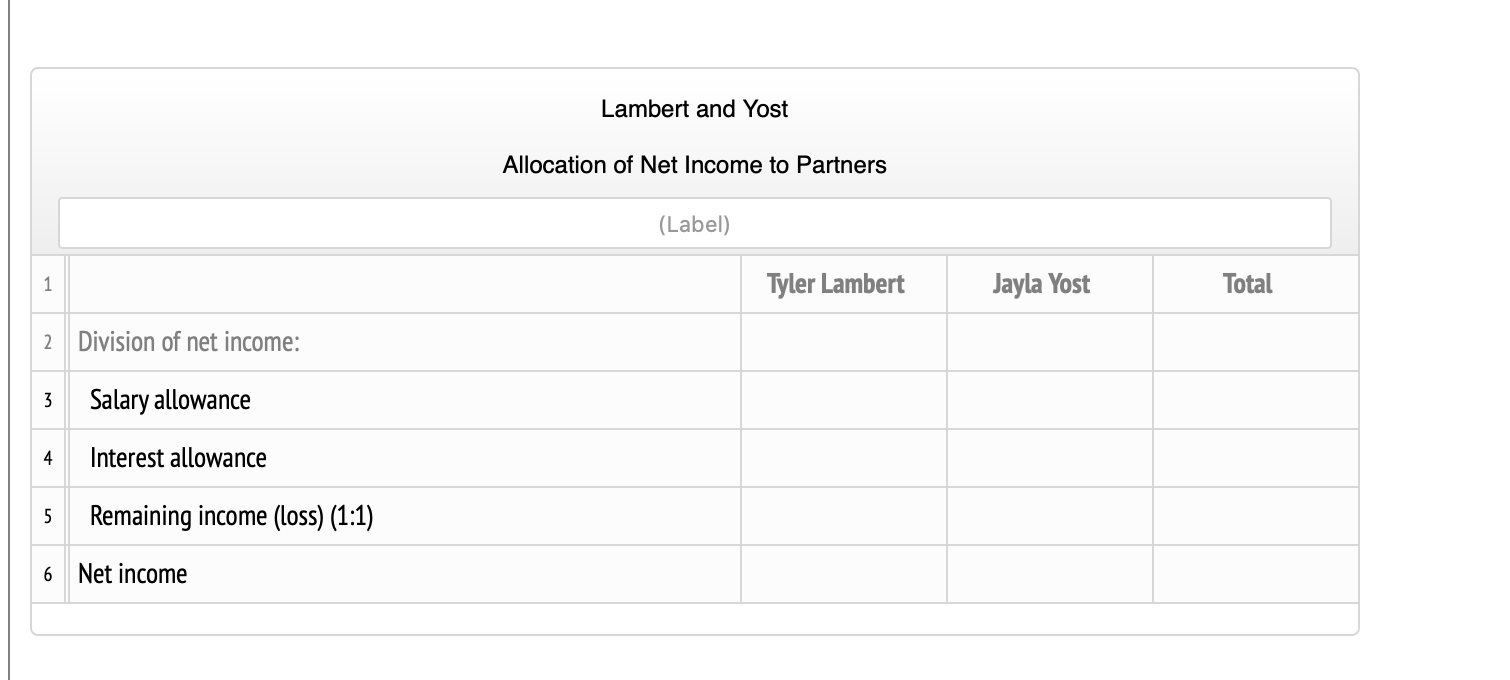

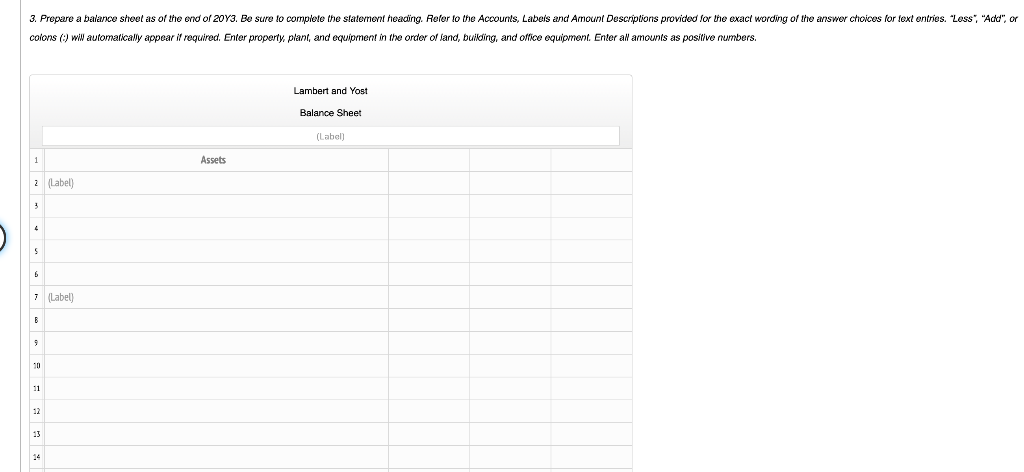

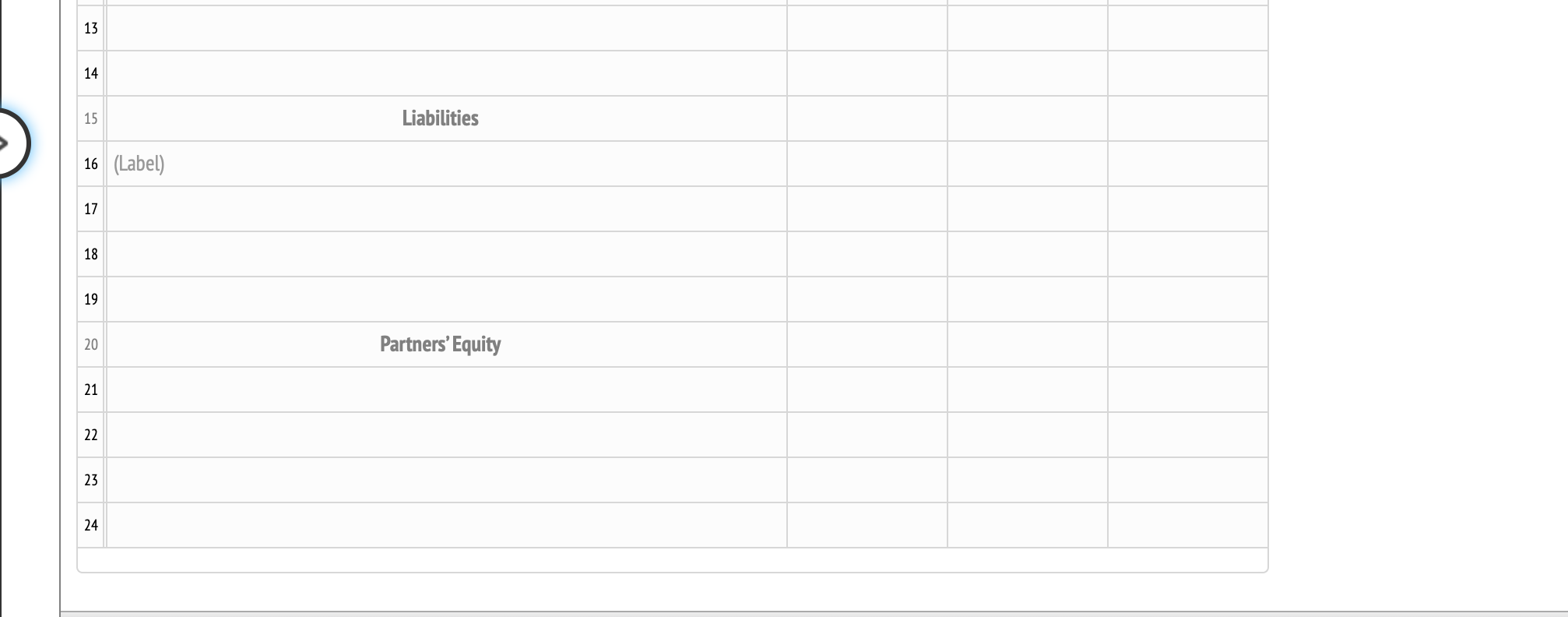

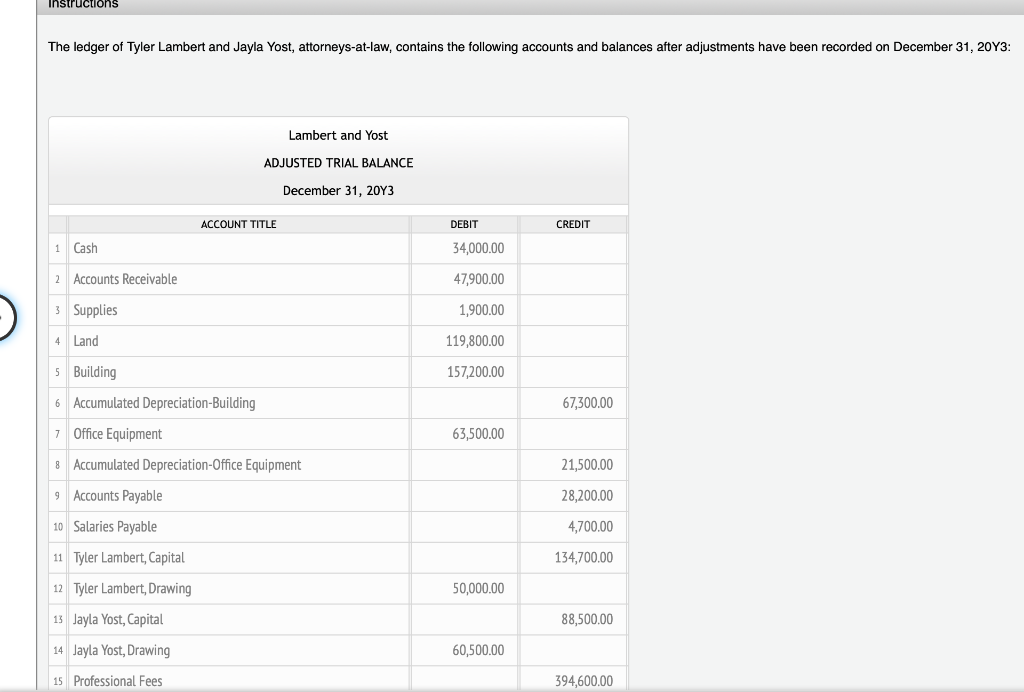

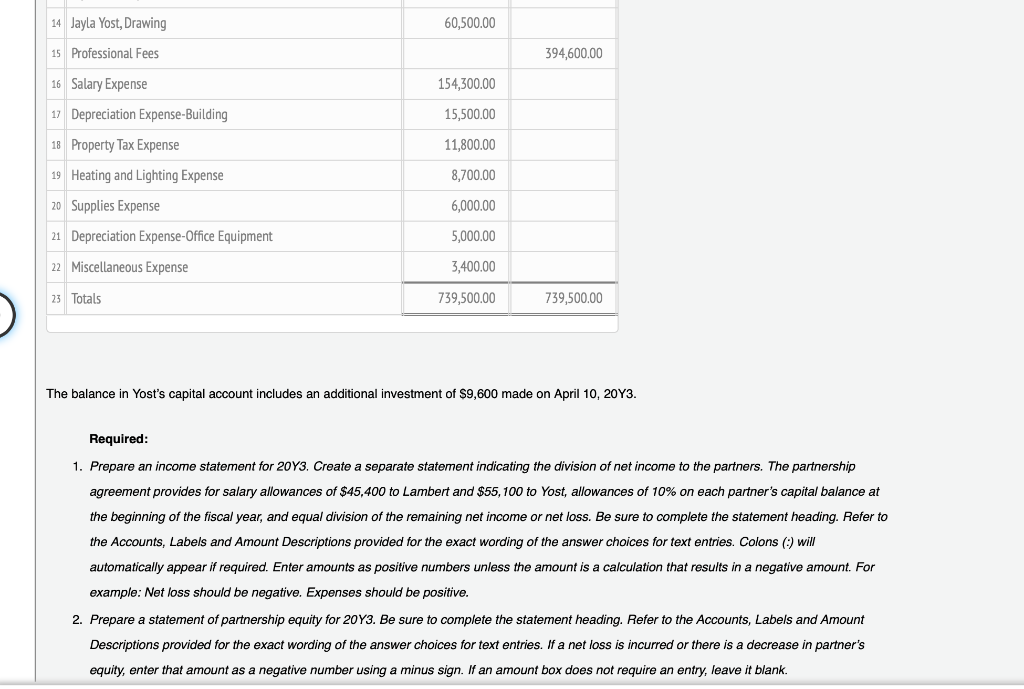

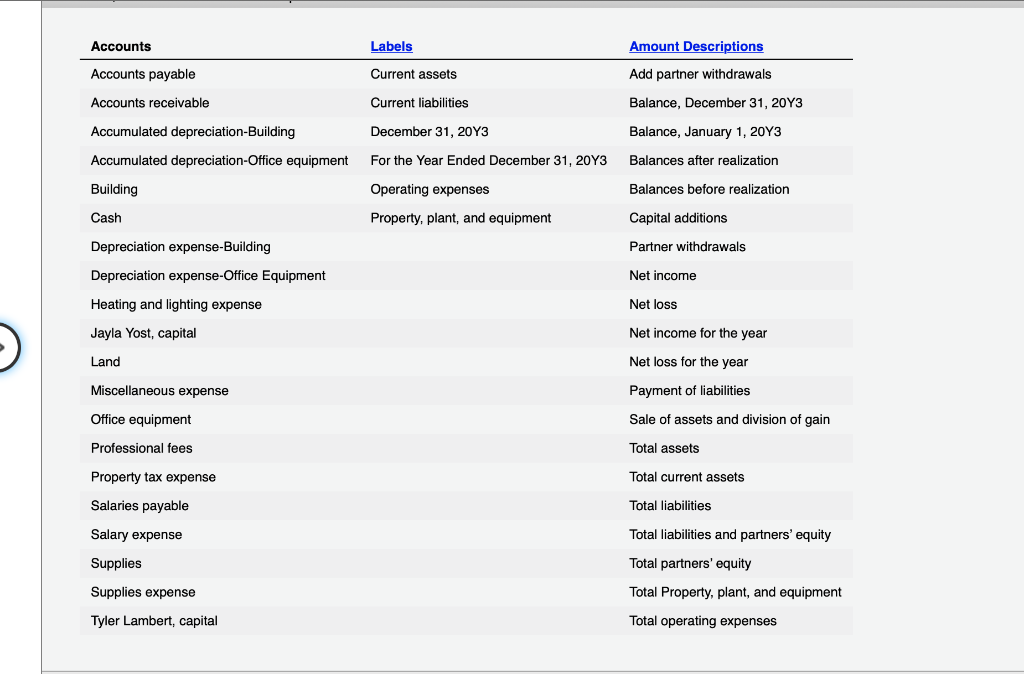

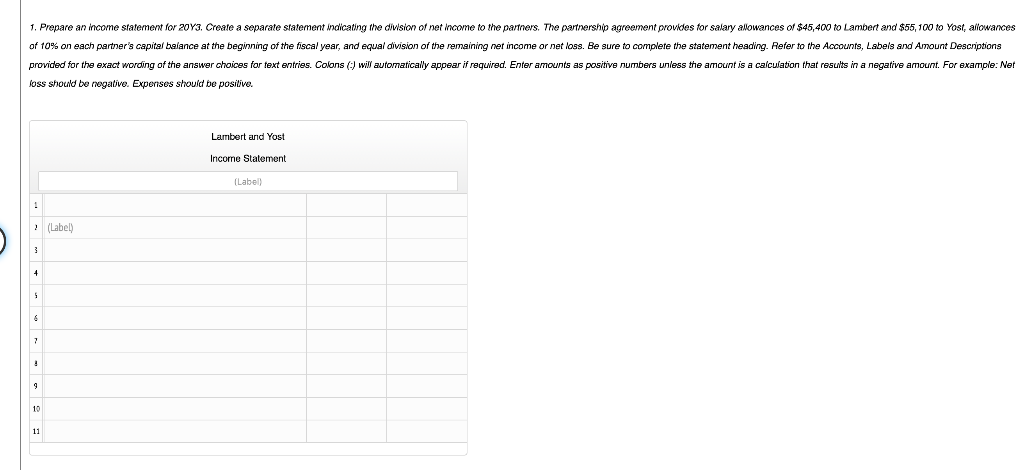

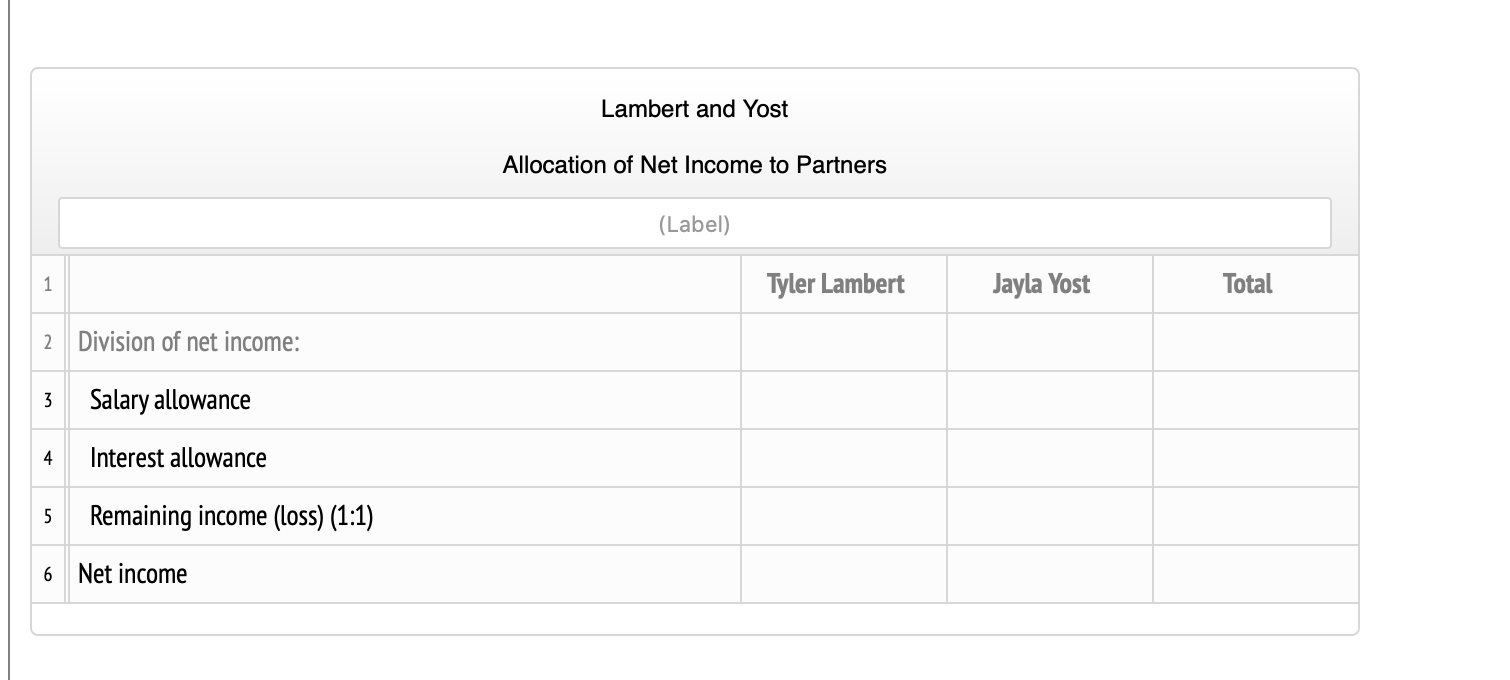

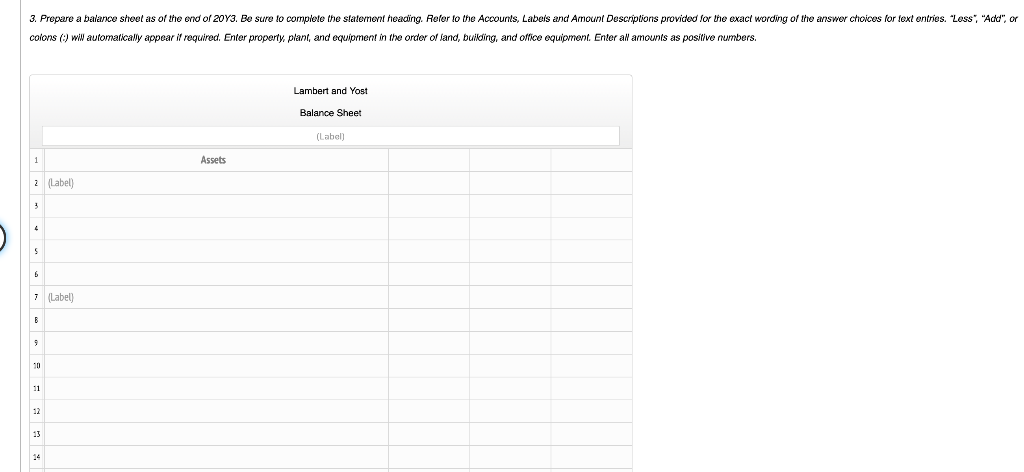

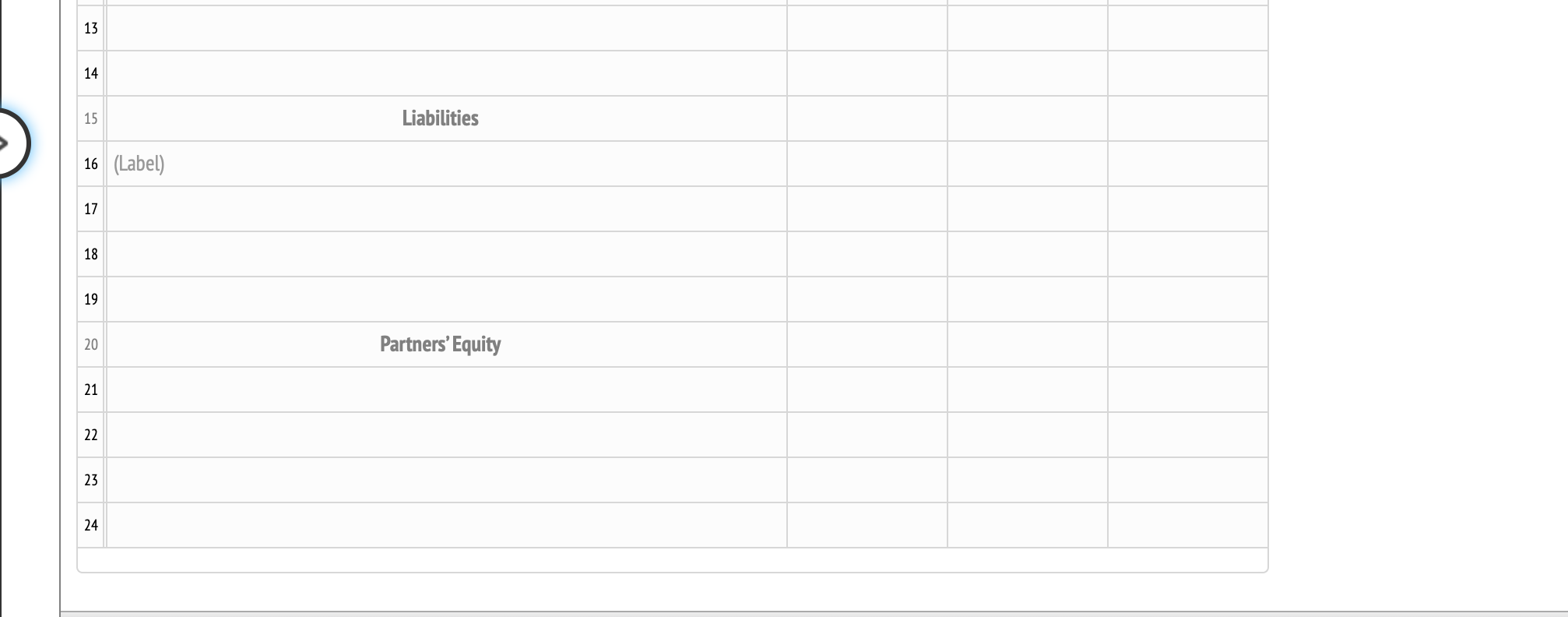

Instructions The ledger of Tyler Lambert and Jayla Yost, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 20Y3: Lambert and Yost ADJUSTED TRIAL BALANCE December 31, 20Y3 ACCOUNT TITLE DEBIT CREDIT 1 Cash 34,000.00 2 Accounts Receivable 47,900.00 3 Supplies 1,900.00 4 Land 119,800.00 Building 157,200.00 6 Accumulated Depreciation-Building 67,300.00 Office Equipment 63,500.00 8 Accumulated Depreciation Office Equipment 21,500.00 9 Accounts Payable 28,200.00 10 Salaries Payable 4,700.00 11 Tyler Lambert, Capital 134,700.00 12 Tyler Lambert, Drawing 50,000.00 13 Jayla Yost, Capital 88,500.00 14 Jayla Yost, Drawing 60,500.00 15 Professional Fees 394,600.00 14 Jayla Yost, Drawing 60,500.00 15 Professional Fees 394,600,00 16 Salary Expense 154,300.00 17 Depreciation Expense-Building 15,500.00 18 Property Tax Expense 11,800.00 8,700.00 19 Heating and Lighting Expense 20 Supplies Expense 6,000.00 21 Depreciation Expense-Office Equipment 5,000.00 22 Miscellaneous Expense 3,400.00 23 Totals 739,500.00 739,500.00 The balance in Yost's capital account includes an additional investment of $9,600 made on April 10, 20Y3. Required: 1. Prepare an income statement for 20Y3. Create a separate statement indicating the division of net income to the partners. The partnership agreement provides for salary allowances of $45,400 to Lambert and $55,100 to Yost, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or net loss. Be sure to complete the statement heading. Refer to the Accounts, Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. Colons (:) will automatically appear if required. Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount. For example: Net loss should be negative. Expenses should be positive. 2. Prepare a statement of partnership equity for 20Y3. Be sure to complete the statement heading. Refer to the Accounts, Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. If a net loss is incurred or there is a decrease in partner's equity, enter that amount as a negative number using a minus sign. If an amount box does not require an entry, leave blank. Accounts Labels Amount Descriptions Accounts payable Current assets Add partner withdrawals Accounts receivable Current liabilities Balance, December 31, 20Y3 Accumulated depreciation-Building December 31, 20Y3 Balance, January 1, 20Y3 Balances after realization Accumulated depreciation Office equipment For the Year Ended December 31, 20Y3 Building Operating expenses Balances before realization Cash Property, plant, and equipment Capital additions Partner withdrawals Depreciation expense-Building Depreciation expense-Office Equipment Net income Heating and lighting expense Net loss Jayla Yost, capital Net income for the year Land Net loss for the year Miscellaneous expense Payment of liabilities Office equipment Sale of assets and division of gain Professional fees Total assets Property tax expense Total current assets Salaries payable Total liabilities Salary expense Total liabilities and partners' equity Supplies Total partners' equity Supplies expense Tyler Lambert, capital Total Property, plant, and equipment Total operating expenses 1. Prepare an income statement for 2023. Create a separate statement indicating the diwsion of net income to the partners. The partnership agreement provides for salary allowances of $45,400 to Lambert and $55,100 to Yost, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or net loss. Be sure to complete the statement heading. Refer to the Accounts, Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. Colons (-) will automatically appear if required. Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount. For example: Net loss should be negative. Expenses should be positive. Lambert and Yost Income Statement (Label) : ! (Label) 3 + 5 7 ! 9 10 11 Lambert and Yost Allocation of Net Income to Partners (Label) 1 Tyler Lambert Jayla Yost Total 2 Division of net income: 3 Salary allowance 4 Interest allowance 5 Remaining income (Loss) (1:1) 6 Net income 3. Prepare a balance sheet as of the end of 2013. Be sure to complete the statement heacting. Refer to the Accounts, Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. "Less, "Add", or colons () will automatically appear il required. Enter property, plant, and equipment in the order of land, building, and office equipment. Enter all amounts as positive numbers. Lambert and Yost Balance Sheet (Label) 1 Assets 2 Label) 3 4 5 ; (Label) B 10 11 12 13 14 15 Liabilities 16 (Label) 17 18 19 20 Partners' Equity 21 22 23 24