Answered step by step

Verified Expert Solution

Question

1 Approved Answer

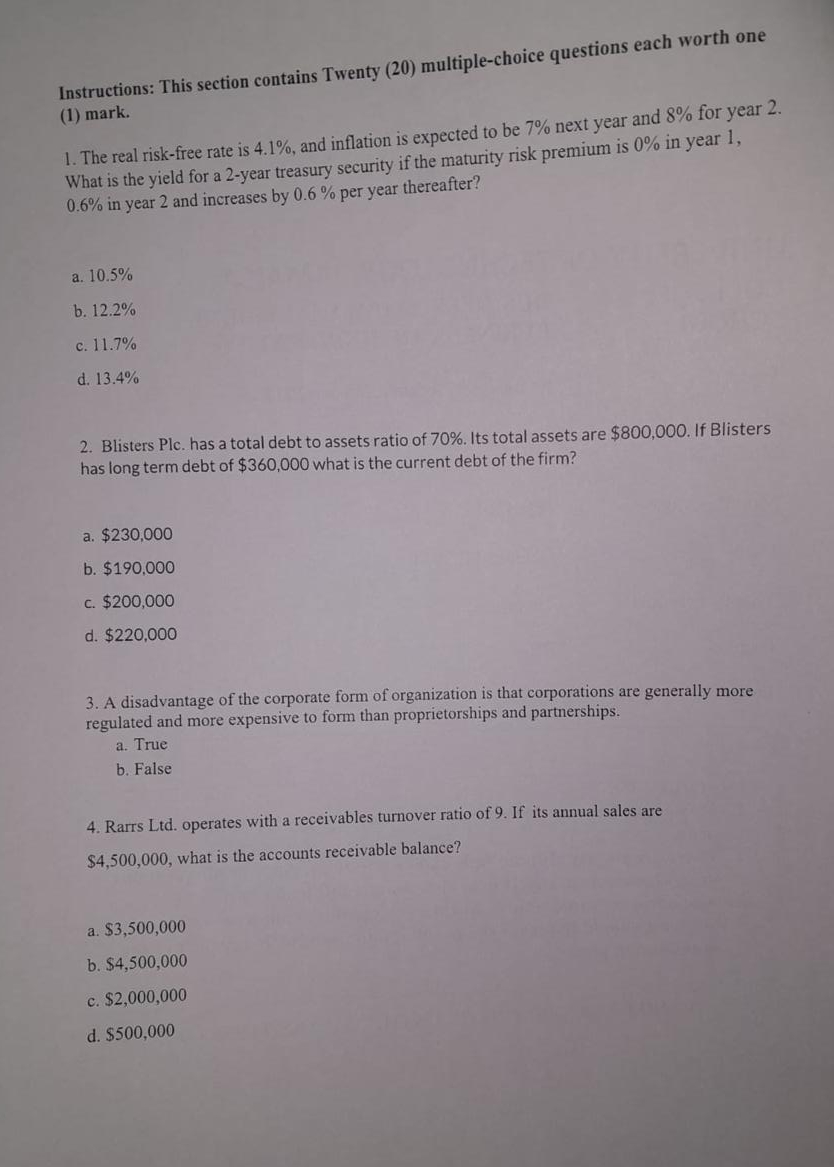

Instructions: This section contains Twenty ( 2 0 ) multiple - choice questions each worth one ( 1 ) mark. The real risk - free

Instructions: This section contains Twenty multiplechoice questions each worth one

mark.

The real riskfree rate is and inflation is expected to be next year and for year

What is the yield for a year treasury security if the maturity risk premium is in year

in year and increases by per year thereafter?

a

b

c

d

Blisters Plc has a total debt to assets ratio of Its total assets are $ If Blisters

has long term debt of $ what is the current debt of the firm?

a $

b $

c $

d $

A disadvantage of the corporate form of organization is that corporations are generally more

regulated and more expensive to form than proprietorships and partnerships.

a True

b False

Rarrs Ltd operates with a receivables turnover ratio of If its annual sales are

$ what is the accounts receivable balance?

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started