Answered step by step

Verified Expert Solution

Question

1 Approved Answer

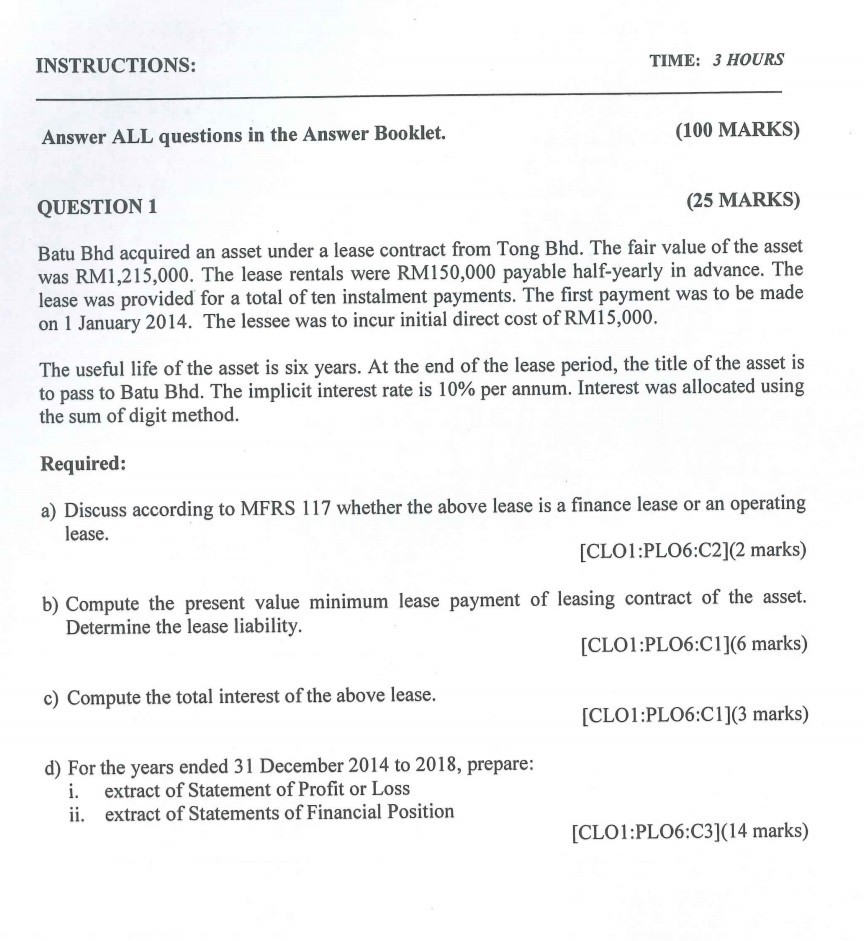

INSTRUCTIONS: TIME: 3 HOURS Answer ALL questions in the Answer Booklet. (100 MARKS) QUESTION 1 (25 MARKS) Batu Bhd acquired an asset under a lease

INSTRUCTIONS: TIME: 3 HOURS Answer ALL questions in the Answer Booklet. (100 MARKS) QUESTION 1 (25 MARKS) Batu Bhd acquired an asset under a lease contract from Tong Bhd. The fair value of the asset was RM1,215,000. The lease rentals were RM150,000 payable half-yearly in advance. The lease was provided for a total of ten instalment payments. The first payment was to be made on 1 January 2014. The lessee was to incur initial direct cost of RM15,000. The useful life of the asset is six years. At the end of the lease period, the title of the asset is to pass to Batu Bhd. The implicit interest rate is 10% per annum. Interest was allocated using the sum of digit method. Required: a) Discuss according to MFRS 117 whether the above lease is a finance lease or an operating lease. [CLO1:PL06:02](2 marks) b) Compute the present value minimum lease payment of leasing contract of the asset. Determine the lease liability. [CLO1:PL06:01](6 marks) c) Compute the total interest of the above lease. [CLO1:PLO6:01](3 marks) d) For the years ended 31 December 2014 to 2018, prepare: i. extract of Statement of Profit or Loss ii. extract of Statements of Financial Position [CLO1:PL06:C3](14 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started