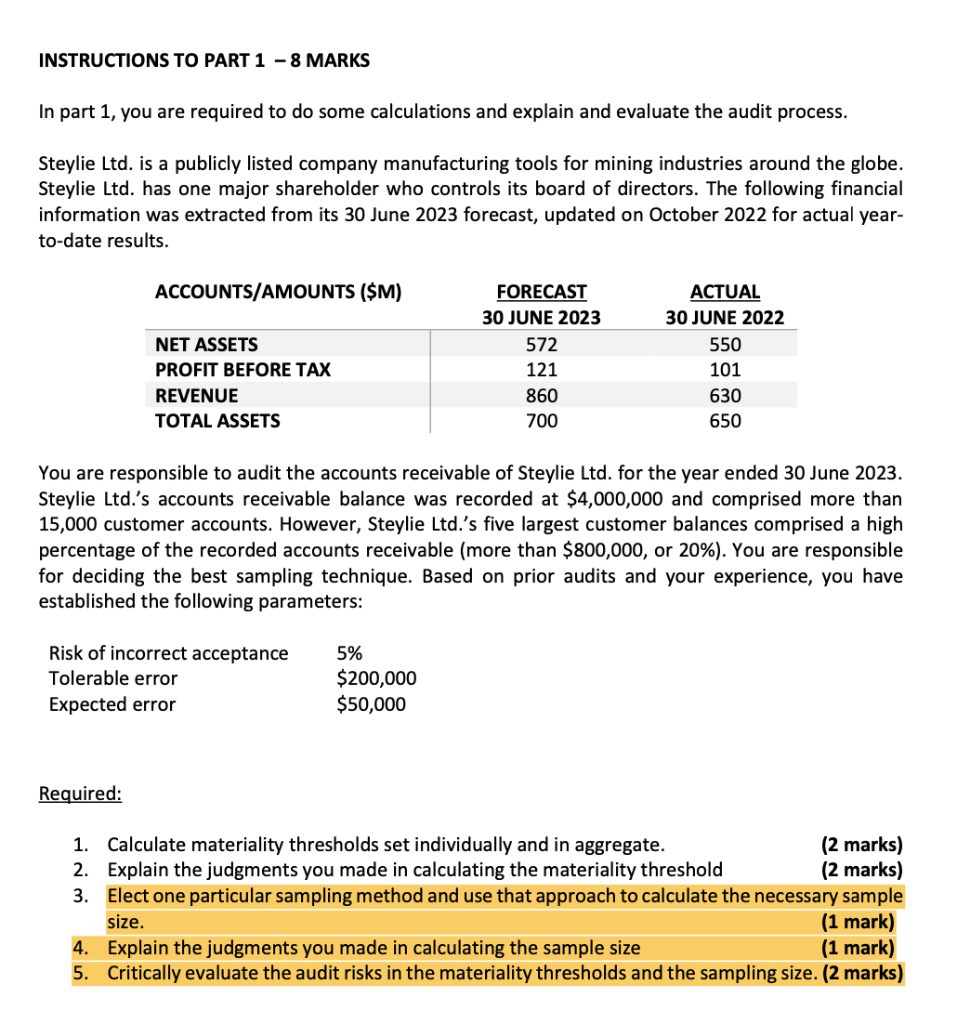

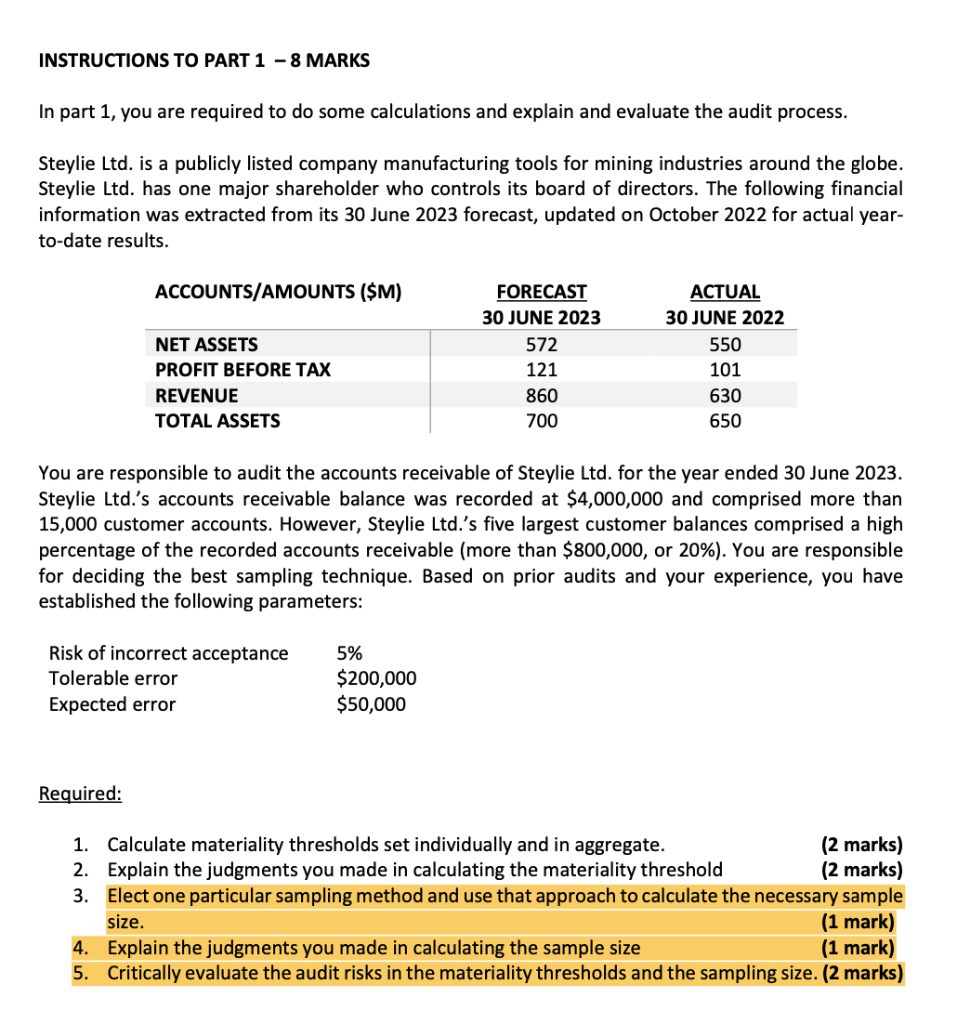

INSTRUCTIONS TO PART 1 - 8 MARKS In part 1 , you are required to do some calculations and explain and evaluate the audit process. Steylie Ltd. is a publicly listed company manufacturing tools for mining industries around the globe. Steylie Ltd. has one major shareholder who controls its board of directors. The following financial information was extracted from its 30 June 2023 forecast, updated on October 2022 for actual yearto-date results. You are responsible to audit the accounts receivable of Steylie Ltd. for the year ended 30 June 2023. Steylie Ltd.'s accounts receivable balance was recorded at $4,000,000 and comprised more than 15,000 customer accounts. However, Steylie Ltd.'s five largest customer balances comprised a high percentage of the recorded accounts receivable (more than $800,000, or 20% ). You are responsible for deciding the best sampling technique. Based on prior audits and your experience, you have established the following parameters: Required: 1. Calculate materiality thresholds set individually and in aggregate. (2 marks) 2. Explain the judgments you made in calculating the materiality threshold (2 marks) 3. Elect one particular sampling method and use that approach to calculate the necessary sample size. 4. Explain the judgments you made in calculating the sample size (1 mark) 5. Critically evaluate the audit risks in the materiality thresholds and the sampling size. ( 2 marks) INSTRUCTIONS TO PART 1 - 8 MARKS In part 1 , you are required to do some calculations and explain and evaluate the audit process. Steylie Ltd. is a publicly listed company manufacturing tools for mining industries around the globe. Steylie Ltd. has one major shareholder who controls its board of directors. The following financial information was extracted from its 30 June 2023 forecast, updated on October 2022 for actual yearto-date results. You are responsible to audit the accounts receivable of Steylie Ltd. for the year ended 30 June 2023. Steylie Ltd.'s accounts receivable balance was recorded at $4,000,000 and comprised more than 15,000 customer accounts. However, Steylie Ltd.'s five largest customer balances comprised a high percentage of the recorded accounts receivable (more than $800,000, or 20% ). You are responsible for deciding the best sampling technique. Based on prior audits and your experience, you have established the following parameters: Required: 1. Calculate materiality thresholds set individually and in aggregate. (2 marks) 2. Explain the judgments you made in calculating the materiality threshold (2 marks) 3. Elect one particular sampling method and use that approach to calculate the necessary sample size. 4. Explain the judgments you made in calculating the sample size (1 mark) 5. Critically evaluate the audit risks in the materiality thresholds and the sampling size. ( 2 marks)