Instructions: Use a financial statement effects template (i.e., a spreadsheet) to prepare an income statement for 2020 and a balance sheet as of December 31,

Instructions:

Use a financial statement effects template (i.e., a spreadsheet) to prepare an income statement for 2020 and a balance sheet as of December 31, 2020. You should submit an Excel spreadsheet that contains a financial statement effects template, a balance sheet, and an income statement.

During 2020, JDF entered into the following transactions.

1. Made credit sales of $1,200,000 and cash sales of $500,000. The cost of the inventory sold was $600,000.

2. Purchased $710,000 of inventory on account.

3. Made cash payments of $350,000 to employees for salaries. This amount includes the wages due employees as of December 31, 2019.

4. Purchased $160,000 of supplies by issuing a six month note that matures on March 1, 2021.

5. Collected $850,000 from customers in payment of open accounts receivable.

6. Paid suppliers $780,000 for payment of open accounts payable.

7. Sold a long term investment for $48,000. The investment had been purchased for $25,000.

8. Paid $75,000 cash for the current years advertising, $22,000 cash for rent, and $32,000 for maintenance.

10. Issued additional common stock for $135,000 cash.

11. The company declared and paid a $30,000 cash dividend.

12. The company purchased Microsoft stock as a long term investment for $40,000.

The following information is also available.

(a) 30 percent of the prepaid insurance on January 1 was still in effect as of December 31, 2020.

(b) A physical count of the supplies inventory indicated that the company had $20,000 on hand as of December 31, 2020.

(c) A review of the companys advertising campaign indicates that of the expenditures made during 2012 for advertising, $15,000 applies to promotions to be undertaken during 2021.

(d) The company is charged at a rate of $3,750 per month for its rental contracts. Note that $25,000 rent was paid in cash during the year.

(e) The company owes employees $33,000 for wages as of December 31, 2020.

(f) Machinery & equipment has an estimated useful life of ten years with no salvage value. The company uses the straight-line method to depreciate and amortize all property, plant, and equipment,.

(g) The note issued by the company (see 4 above) pays interest at a rate of 15 percent and was issued on September 1, 2020.

(h) The interest rate on the mortgage payable is 9 percent. Interest is payable each January 1, beginning January 1, 2021. The mortgage was issued on December 31, 2019.

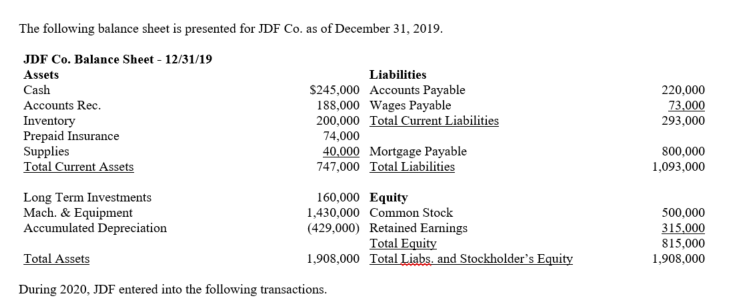

220,000 73,000 293,000 The following balance sheet is presented for JDF Co. as of December 31, 2019. JDF Co. Balance Sheet - 12/31/19 Assets Liabilities Cash $245,000 Accounts Payable Accounts Rec. 188,000 Wages Payable Inventory 200,000 Total Current Liabilities Prepaid Insurance 74,000 Supplies 40,000 Mortgage Payable Total Current Assets 747,000 Total Liabilities Long Term Investments 160,000 Equity Mach. & Equipment 1,430,000 Common Stock Accumulated Depreciation (429,000) Retained Earnings Total Equity Total Assets 1,908,000 Total Liabs. and Stockholder's Equity During 2020, JDF entered into the following transactions. 800,000 1,093,000 500,000 315.000 815,000 1,908,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started