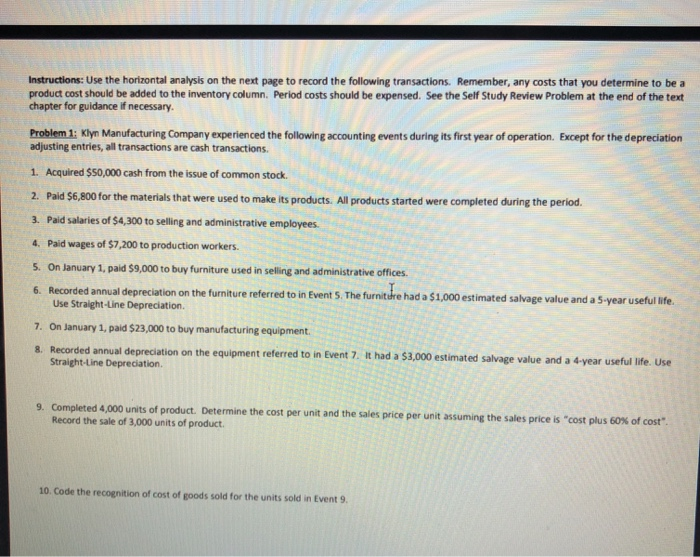

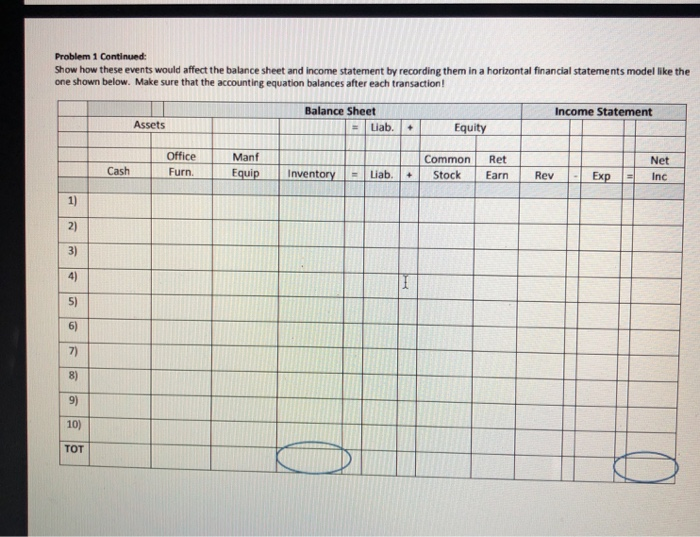

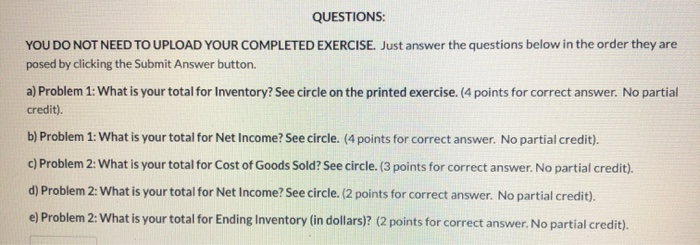

Instructions: Use the horizontal analysis on the next page to record the following transactions. Remember, any costs that you determine to be a product cost should be added to the inventory column. Period costs should be expensed. See the Self Study Review Problem at the end of the text chapter for guidance if necessary. Problem 1: Klyn Manufacturing Company experienced the following accounting events during its first year of operation. Except for the depreciation adjusting entries, all transactions are cash transactions 1. Acquired $50,000 cash from the issue of common stock. 2. Pald $6,800 for the materials that were used to make its products. All products started were completed during the period. 3. Paid salaries of $4,300 to selling and administrative employees. 4. Paid wages of $7,200 to production workers. 5. On January 1, paid $9,000 to buy furniture used in selling and administrative offices. 6. Recorded annual depreciation on the furniture referred to in Events. The furniture had a $1,000 estimated salvage value and a 5-year useful life. Use Straight-Line Depreciation. 7. On January 1, paid $23,000 to buy manufacturing equipment 8. Recorded annual depreciation on the equipment referred to in Event 7. It had a $3,000 estimated salvage value and a 4-year useful life. Use Straight-Line Depreciation. 9. Completed 4,000 units of product. Determine the cost per unit and the sales price per unit assuming the sales price is "cost plus 60% of cost". Record the sale of 3,000 units of product. 10. Code the recognition of cost of goods sold for the units sold in Event 9. Problem 1 Continued: Show how these events would affect the balance sheet and income statement by recording them in a horizontal financial statements model like the one shown below. Make sure that the accounting equation balances after each transaction! Balance Sheet Income Statement Assets = Liab. Equity + Office Furn. Cash Manf Equip Inventory Common Stock Ret Earn Net Inc Liab. + Rev Exp 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) TOT QUESTIONS: YOU DO NOT NEED TO UPLOAD YOUR COMPLETED EXERCISE. Just answer the questions below in the order they are posed by clicking the Submit Answer button. a) Problem 1: What is your total for Inventory? See circle on the printed exercise. (4 points for correct answer. No partial credit). b) Problem 1: What is your total for Net Income? See circle. (4 points for correct answer. No partial credit). c) Problem 2: What is your total for Cost of Goods Sold? See circle. (3 points for correct answer. No partial credit). d) Problem 2: What is your total for Net Income? See circle. (2 points for correct answer. No partial credit). e) Problem 2: What is your total for Ending Inventory (in dollars)? (2 points for correct answer. No partial credit)