Answered step by step

Verified Expert Solution

Question

1 Approved Answer

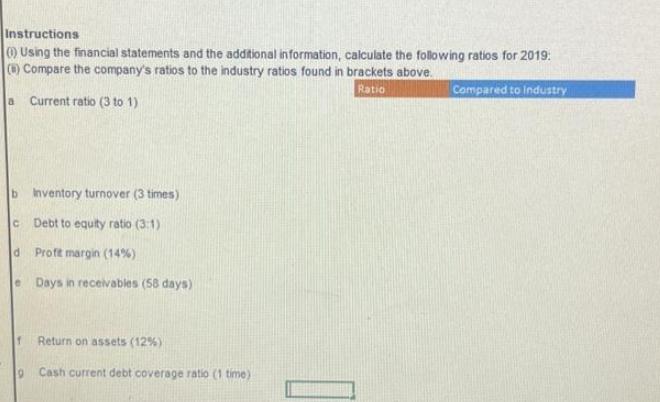

Instructions () Using the financial statements and the additional information, calculate the following ratios for 2019: () Compare the company's ratios to the industry

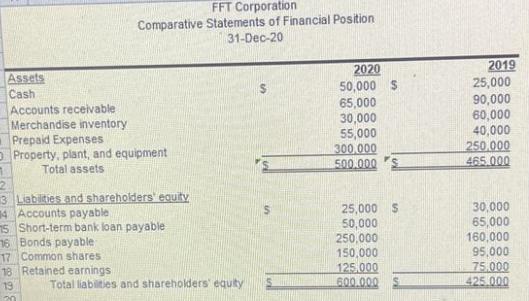

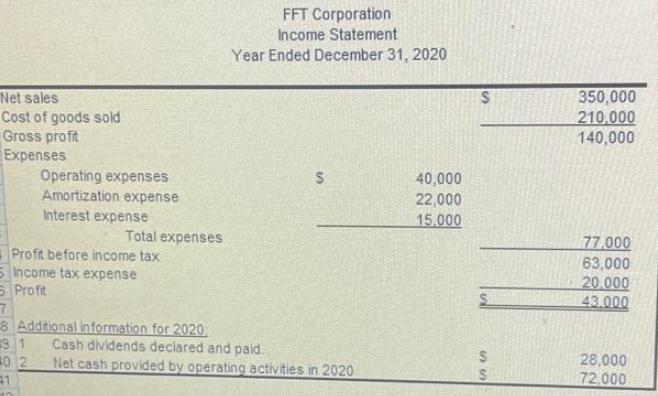

Instructions () Using the financial statements and the additional information, calculate the following ratios for 2019: () Compare the company's ratios to the industry ratios found in brackets above. Ratio a Current ratio (3 to 1) O b Inventory turnover (3 times) Debt to equity ratio (3:1) Profit margin (14%) e Days in receivables (58 days) C d Return on assets (12%) 9 Cash current debt coverage ratio (1 time) f Compared to Industry Assets Cash Accounts receivable Merchandise inventory Prepaid Expenses O Property, plant, and equipment Total assets 1 FFT Corporation Comparative Statements of Financial Position 31-Dec-20 3 Liabilities and shareholders' equity 14 Accounts payable 15 Short-term bank loan payable 16 Bonds payable 17 Common shares. 18 Retained earnings 19 20 Total liabilities and shareholders' equity 2020 50,000 $ 65,000 30,000 55,000 300.000 500.000 25,000 $ 50,000 250,000 150,000 125.000 600.000 2019 25,000 90,000 60,000 40,000 250,000 465.000 30,000 65,000 160,000 95,000 75.000 425.000 Net sales Cost of goods sold Gross profit Expenses Operating expenses Amortization expense Interest expense Total expenses Profit before income tax 5 Income tax expense S Profit 7 8 Additional information for 2020 91 40 2 41 FFT Corporation Income Statement Year Ended December 31, 2020 S Cash dividends declared and paid. Net cash provided by operating activities in 2020 40,000 22,000 15,000 $ 55 350,000 210,000 140,000 77,000 63,000 20.000 43.000 28,000 72,000

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the ratios for 2019 and compare them to the industry ratios we need to use the given financial statements and additional informa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started