Answered step by step

Verified Expert Solution

Question

1 Approved Answer

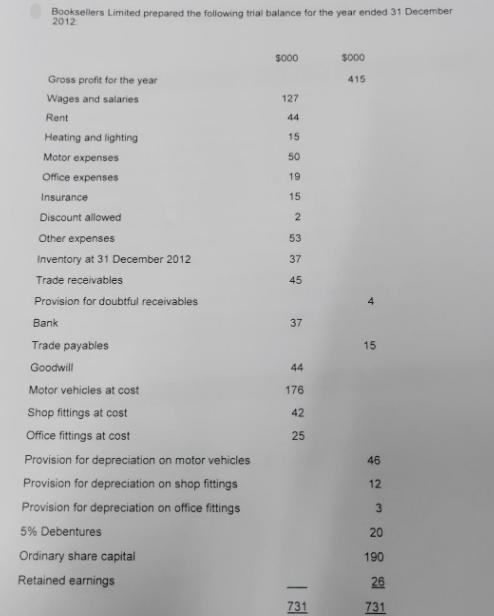

Booksellers Limited prepared the following trial balance for the year ended 31 December 2012 Gross profit for the year Wages and salaries Rent Heating

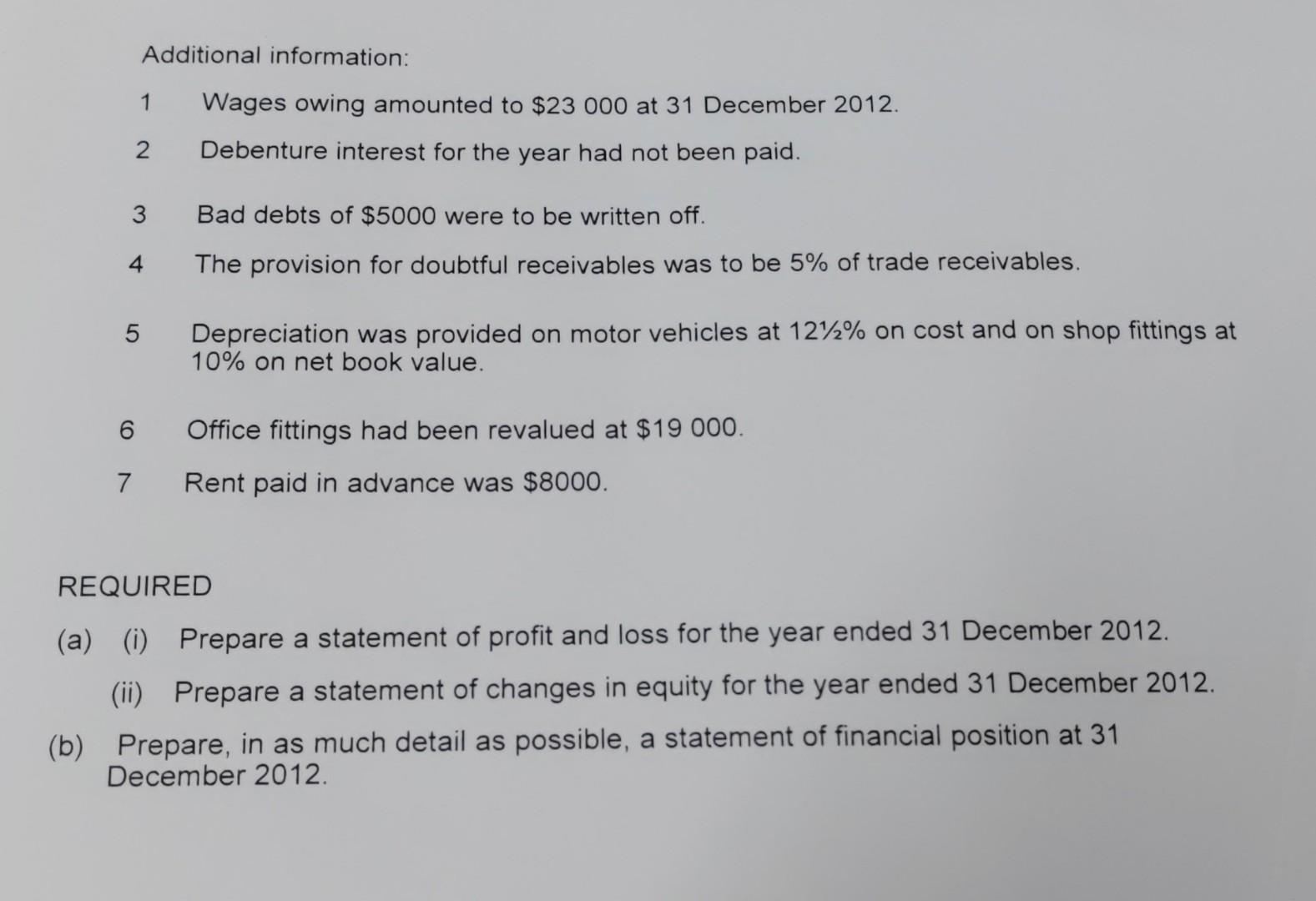

Booksellers Limited prepared the following trial balance for the year ended 31 December 2012 Gross profit for the year Wages and salaries Rent Heating and lighting Motor expenses Office expenses Insurance Discount allowed Other expenses Inventory at 31 December 2012 Trade receivables Provision for doubtful receivables Bank Trade payables Goodwill Motor vehicles at cost Shop fittings at cost Office fittings at cost Provision for depreciation on motor vehicles Provision for depreciation on shop fittings Provision for depreciation on office fittings 5% Debentures Ordinary share capital Retained earnings $000 127 44 15 50 19 15 2 53 37 45 37 44 176 42 25 731 $000 415 15 46 12 3 20 190 26 731 Additional information: 1 Wages owing amounted to $23 000 at 31 December 2012. 2 Debenture interest for the year had not been paid. 3 4 5 7 Bad debts of $5000 were to be written off. The provision for doubtful receivables was to be 5% of trade receivables. Depreciation was provided on motor vehicles at 12%2% on cost and on shop fittings at 10% on net book value. Office fittings had been revalued at $19 000. Rent paid in advance was $8000. REQUIRED (a) (i) Prepare a statement of profit and loss for the year ended 31 December 2012. (ii) Prepare a statement of changes in equity for the year ended 31 December 2012. (b) Prepare, in as much detail as possible, a statement of financial position at 31 December 2012.

Step by Step Solution

★★★★★

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1ai Statement of profit and loss for the year ended 31 December 2012 Particulars Details000 Amount00...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started