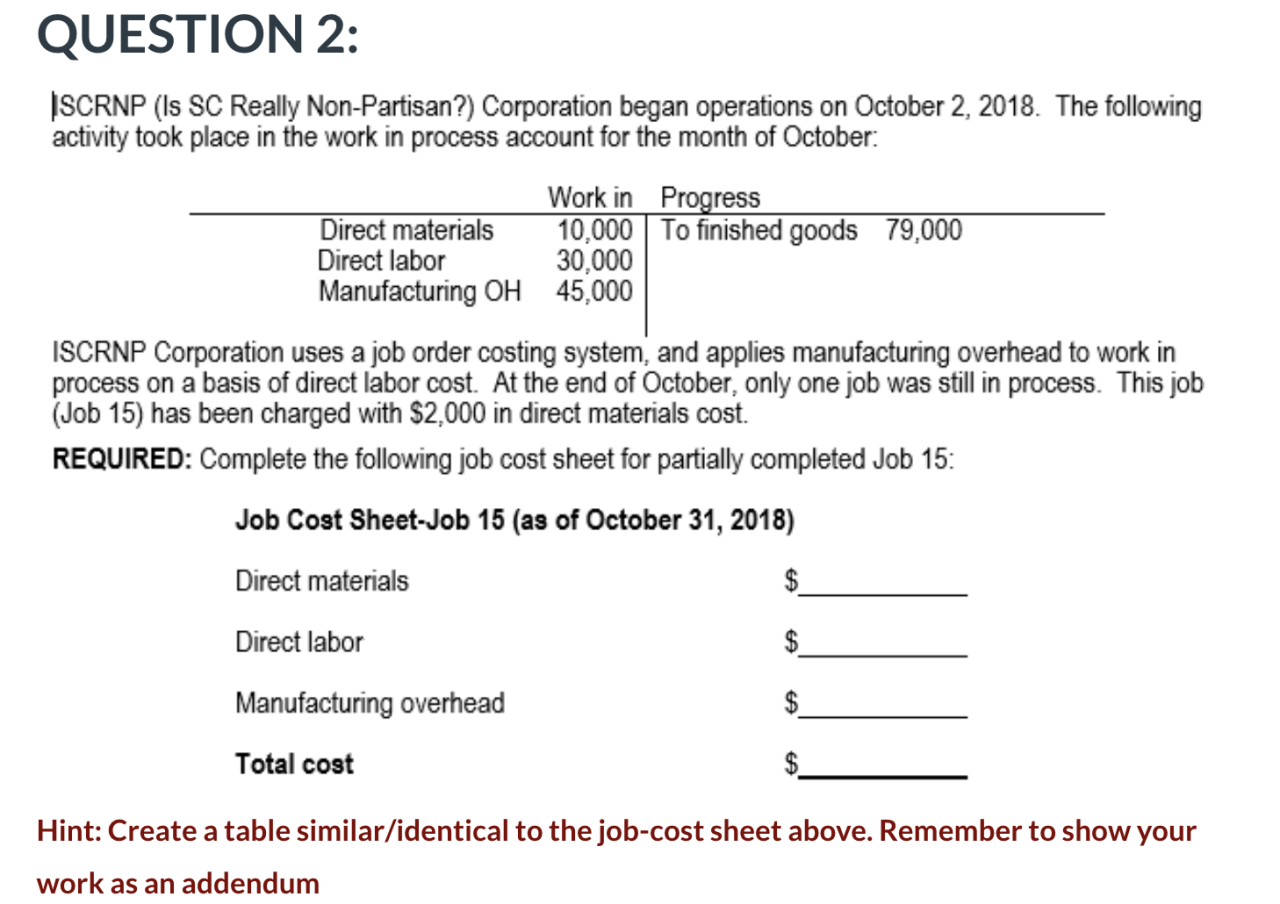

Question

INSTRUCTIONS: Welcome to Module 5. Below are two questions; you only need to answer one . Remember to respond in essay format (except when calculations

INSTRUCTIONS: Welcome to Module 5. Below are two questions; you only need to answer one. Remember to respond in essay format (except when calculations need to be shown mathematically...for mathematical calculations, please show all your steps). Be detailed and clear. Support your answer with applicable sources.

Note: Discussion entries and comments must be substantive and detailed.

As usual, creativity is highly rewarded.

Note: How to show your work (minimum steps): Step 1: Show the formula: e.g.: POHR = Total Estimated MOH / Total Estimated Allocation Base Step 2: Apply values to the formula: = $400,000 / 20,000 DLHs

Step 3: Solve = $20.00 per DLH

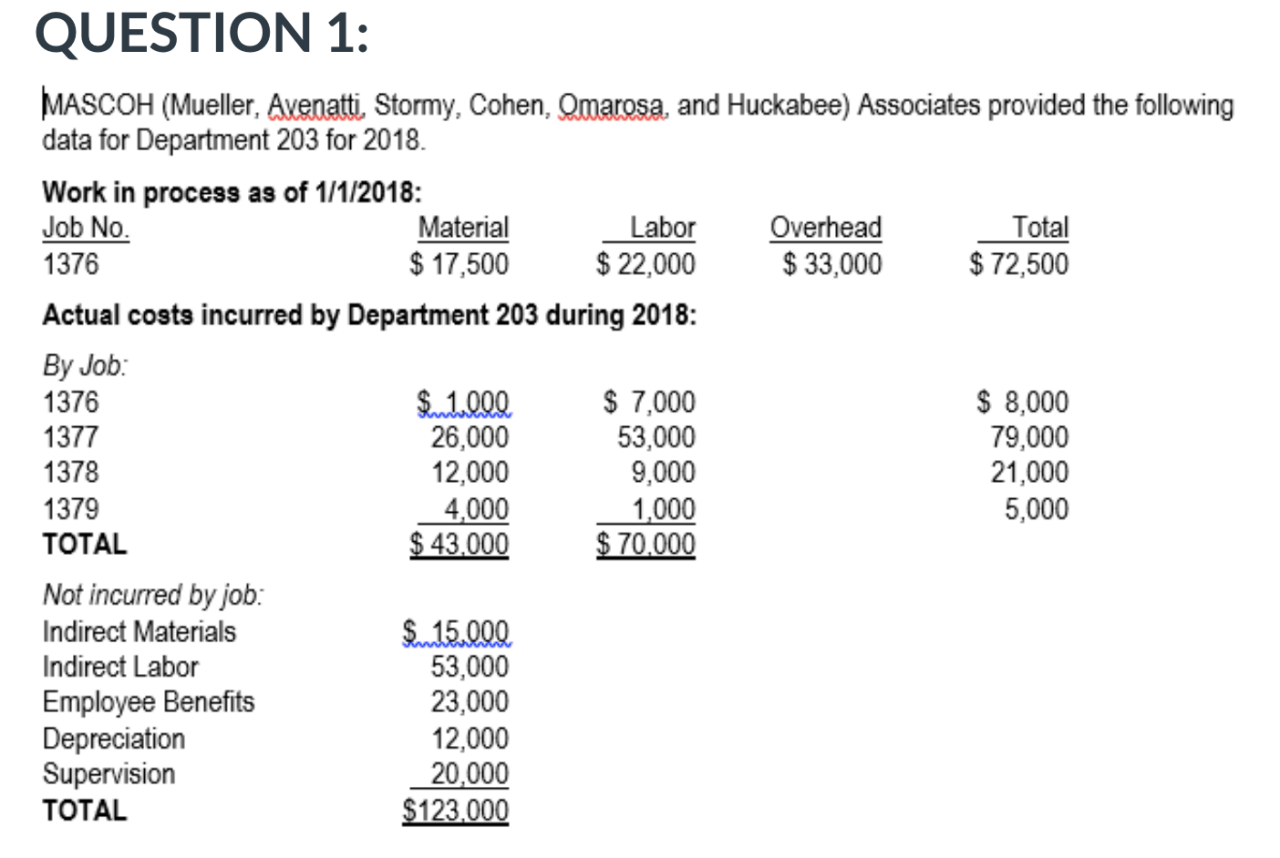

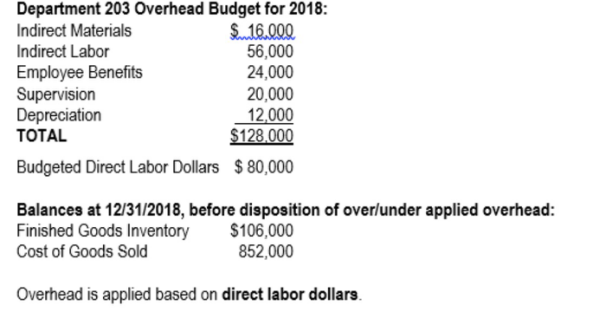

REQUIRED:

- What is the predetermined overhead rate for 2018 for Department 203?

- Apply overhead to each of the jobs worked on in 2018.

- Jobs 1376 and 1377 were completed during 2018. The jobs yielded 5,000 and 3,000 units of product, respectively. What was the unit cost for each of these products?

- What is the value of work in process inventory on 12/31/2018? What jobs are included?

- Was overhead over- or under applied for 2018 in Department 203? By how much?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started