Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Insurance agent Peter has learnt in his training session that there are two types of buy sell agreements. is particularly interested in the cross purchase

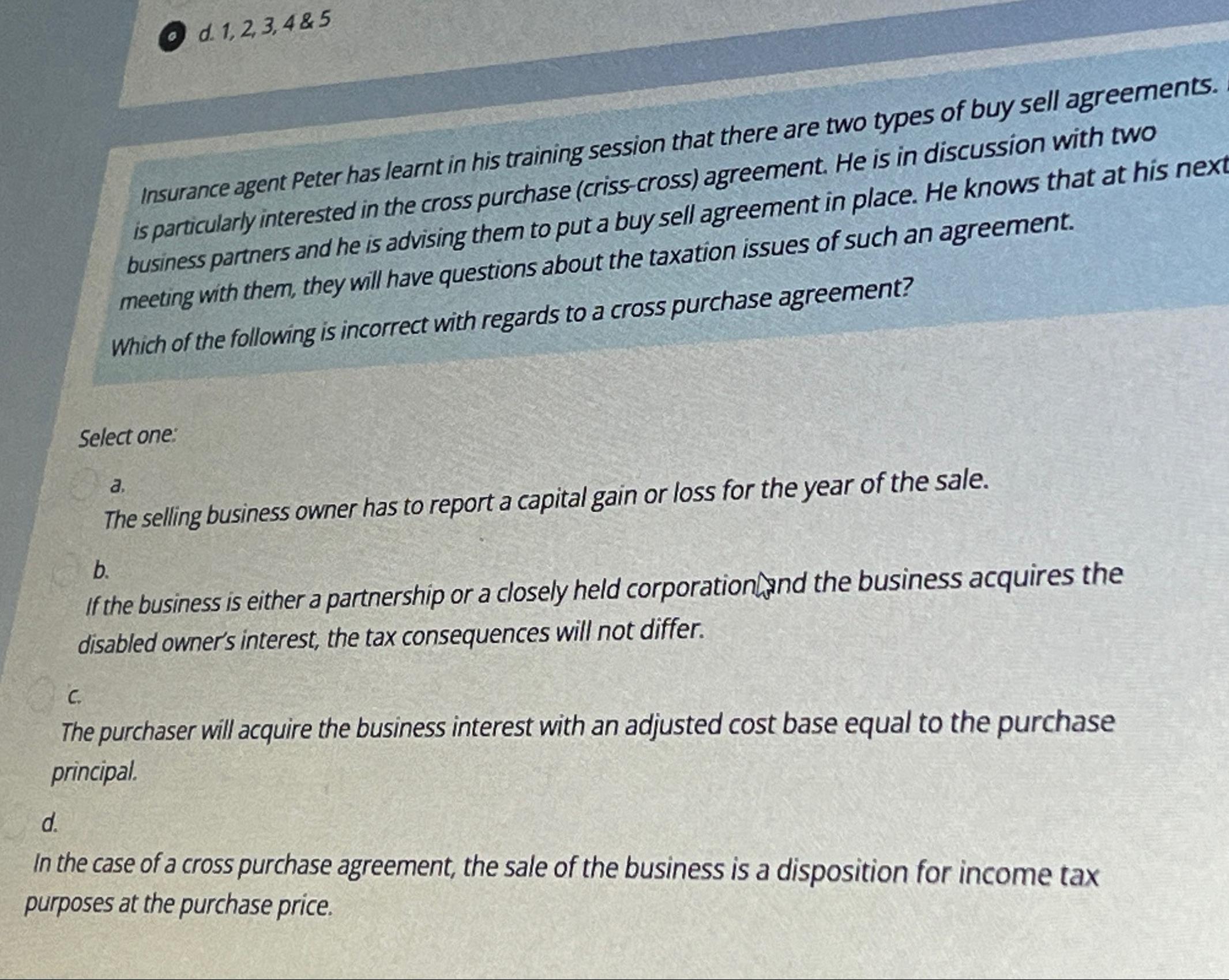

Insurance agent Peter has learnt in his training session that there are two types of buy sell agreements. is particularly interested in the cross purchase crisscross agreement. He is in discussion with two business partners and he is advising them to put a buy sell agreement in place. He knows that at his next meeting with them, they will have questions about the taxation issues of such an agreement.

Which of the following is incorrect with regards to a cross purchase agreement?

Select one:

a

The selling business owner has to report a capital gain or loss for the year of the sale.

b

If the business is either a partnership or a closely held corporationand the business acquires the disabled owner's interest, the tax consequences will not differ.

c

The purchaser will acquire the business interest with an adjusted cost base equal to the purchase principal.

d

In the case of a cross purchase agreement, the sale of the business is a disposition for income tax purposes at the purchase price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started