Answered step by step

Verified Expert Solution

Question

1 Approved Answer

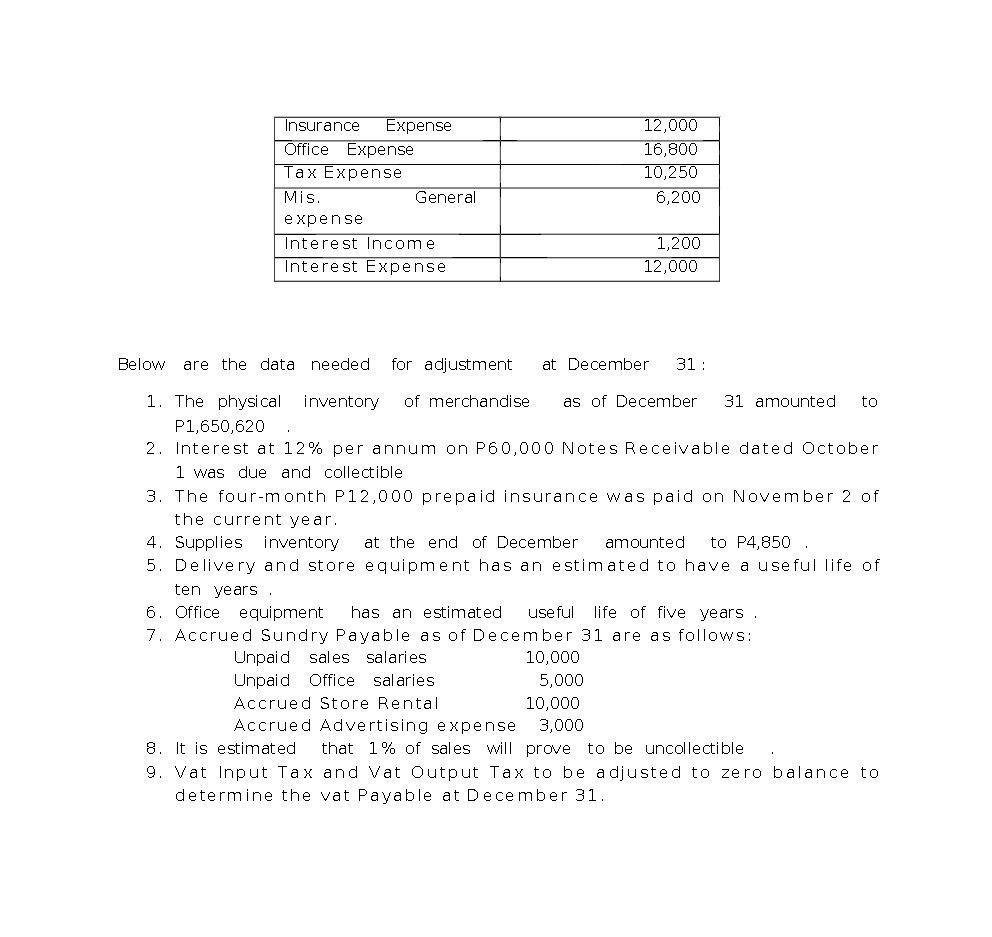

1. Prepare the adjusting journal entries at December 31. 2. Prepare a Ten-column worksheet for the year ended December 31 of the current year.

1. Prepare the adjusting journal entries at December 31. 2. Prepare a Ten-column worksheet for the year ended December 31 of the current year. Insurance Expense Office Expense Tax Expense Mis. General expense. Interest Income Interest Expense 12,000 16,800 10,250 6,200 1,200 12,000 Below are the data needed for adjustment at December 31: 1. The physical inventory of merchandise as of December 31 amounted to P1,650,620 2. Interest at 12% per annum on P60,000 Notes Receivable dated October 1 was due and collectible 3. The four-month P12,000 prepaid insurance was paid on November 2 of the current year. 10,000 5,000 10,000 3,000 4. Supplies inventory at the end of December amounted to P4,850. 5. Delivery and store equipment has an estimated to have a useful life of ten years. 6. Office equipment has an estimated useful life of five years. 7. Accrued Sundry Payable as of December 31 are as follows: Unpaid sales salaries Unpaid Office salaries Accrued Store Rental Accrued Advertising expense 8. It is estimated that 1% of sales will prove to be uncollectible 9. Vat Input Tax and Vat Output Tax to be adjusted to zero balance to determine the vat Payable at December 31.

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Adjusting entry for inventory Inventory 1650620 Cost of Sales 1650620 Adjusting entry for interest i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started