Answered step by step

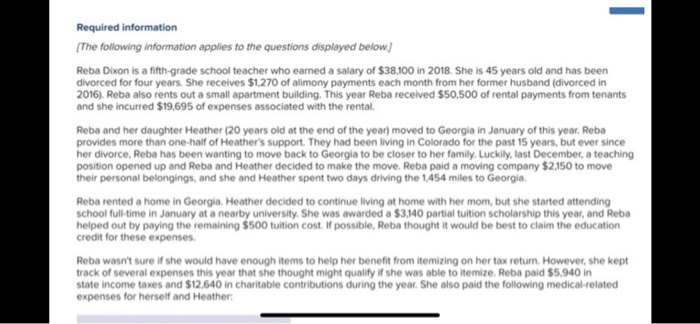

Verified Expert Solution

Question

1 Approved Answer

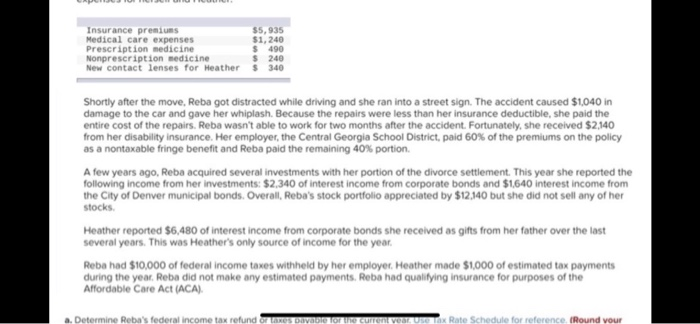

Insurance premiums Medical care expenses Prescription medicine Nonprescription sedicine New contact lenses for Heather $5,935 $1,240 490 S 240 340 Shortly after the move, Reba

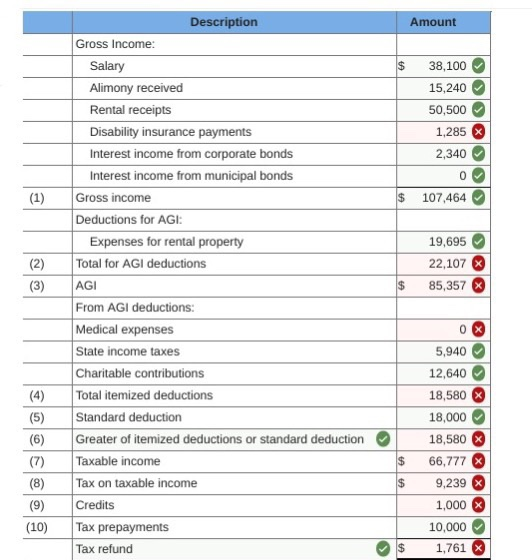

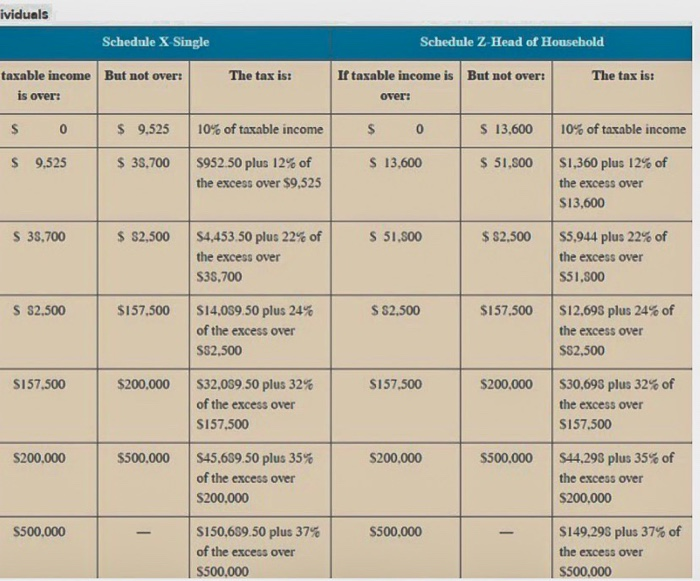

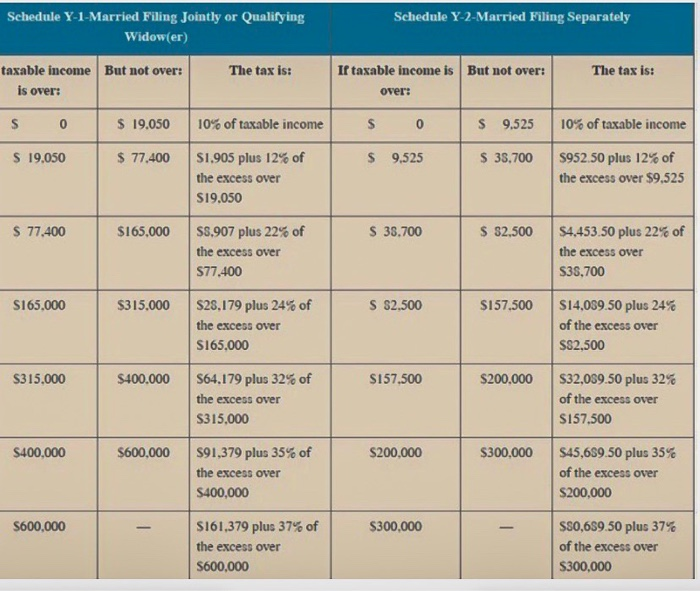

Insurance premiums Medical care expenses Prescription medicine Nonprescription sedicine New contact lenses for Heather $5,935 $1,240 490 S 240 340 Shortly after the move, Reba got distracted while driving and she ran into a street sign. The accident caused $1,040 in damage to the car and gave her whiplash. Because the repairs were less than her insurance deductible, she paid the entire cost of the repairs. Reba wasn't able to work for two months after the accident. Fortunately, she received $2,140 from her disability insurance. Her employer, the Central Georgia School District, paid 60% of the premiums on the policy as a nontaxable fringe benefit and Reba paid the remaining 40% portion. A few years ago, Reba acquired several investments with her portion of the divorce settlement. This year she reported the following income from her investments: $2,340 of interest income from corporate bonds and $1,640 interest income from the City of Denver municipal bonds. Overall, Reba's stock portfolio appreciated by $12,140 but she did not sell any of her stocks. Heather reported $6,480 of interest income from corporate bonds she received as gifts from her father over the last several years. This was Heather's only source of income for the year Reba had $10,000 of federal income taxes withheld by her employer Heather made $1,000 of estimated tax payments during the year Reba did not make any estimated payments. Reba had qualifying insurance for purposes of the Affordable Care Act (ACA) a. Determine Reba's federal income tax refund Rate Schedule for reference. (Round vour ividual Schedule X Single Schedule Z-Head of Household taxable income But not over: The tax ist If taxable income is But not over: The tax ist is over: over 0 9,525 | 10% of taxable income 0 $ 13,600 | 10% of taxable income S 9.525 $ 3S700 | S952.50 plus 12% of S 13,600 $ 5 1.S00 | S 1.360 plus 12% of the excess over $9,525 the excess over S13,600 S 33.700 $ S2.500 | S4.453 50 plus 22% of S 51,800 $ $2.500 | ss,944 plus 22% of the excess over S33,700 the excess over S51,300 S S2.500 SI 57.500 | S 14.039 50 plus 24% S $2,500 $1 57,500 | S 12,698 plus 24% of of the excess over S32,500 the excess over SS2,500 S157.500 $200.000 | S32.039 50 plus 32% S157.500 $200,000 | S30.093 plus 32% of of the excess over S157,500 the excess over $157.500 S200.000 5500.000 | S45.639 50 plus 35% S200,000 500.000 | S44.298 plus 35% of of the excess over S200,000 the excess over S200,000 SI 49,293 plus 37% of the excess over S500,000 S500.000 SI 50,639.50 plus 37% of the excess over S500,000 S500,000 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) Schedule Y-2-Married Filing Separately taxable income But not over: The tax is: If taxable income is But not over: The tax is is over: over: 0 $ 19,050 | 10% of taxable income s 9,525 | 10% of taxable income S 19.050 $ 77,400 | SI,905 plus 12% of $ 9.525 $ 3.700 | S952.50 plus 12% of the excess over $9.525 the excess over S19.050 S 77.400 s 165.000 | ss.907 plus 22% of S 38.700 $ S2.500 | S4.453-50 plus 22% of the excess over the excess over S77.400 S33,700 S165.000 S3 15.000 | S28, 179 plus 24% of S S2.500 SI 57,500 | S 14,039.50 plus 24% of the excess over S32,500 the excess over S165,000 S315.000 $400.000 | S64, 179 plus 32% of S157.500 $200.000 | S32.03950 plus 32% of the excess over S157.500 the excess over S315,000 $400,000 600.000 | S91.379 plus 35% of S200,000 S300.000 | S45.65950 plus 35% of the excess over $200,000 the excess over 400,000 S 161.379 plus 37% of the excess over S600,000 $600,000 S300,000 sso,6S950 plus 37% of the excess over S300,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started