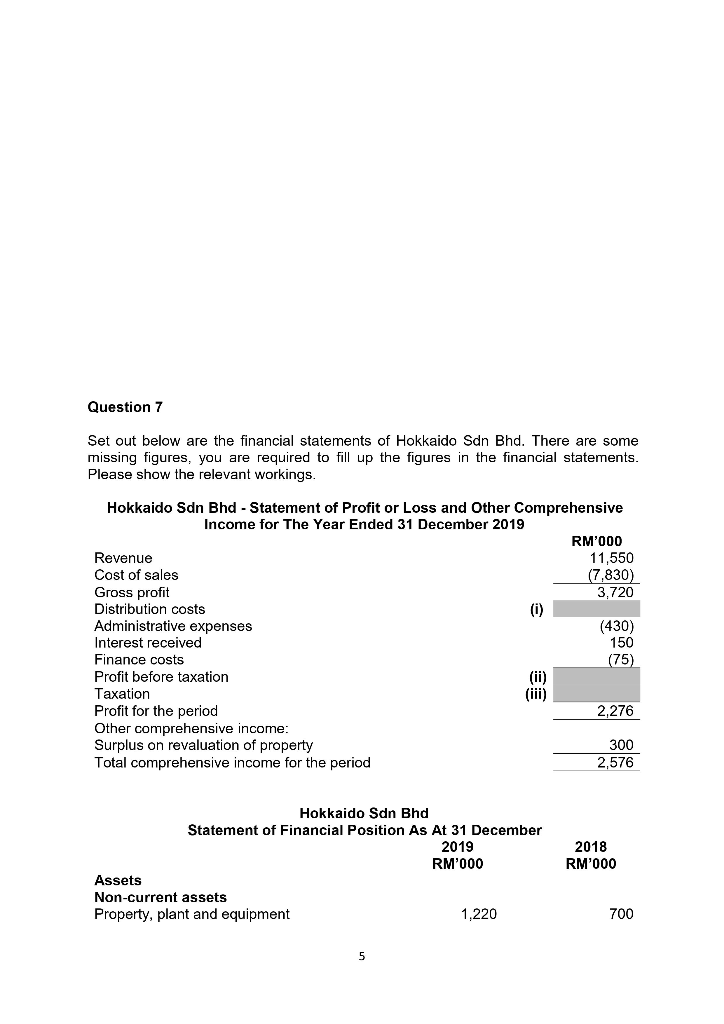

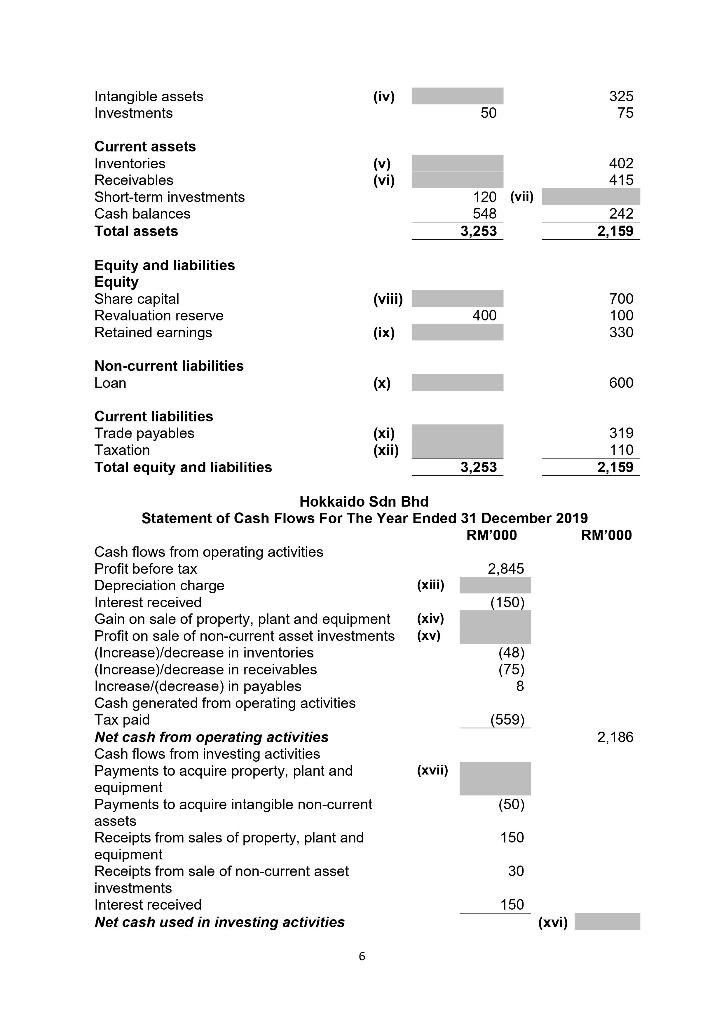

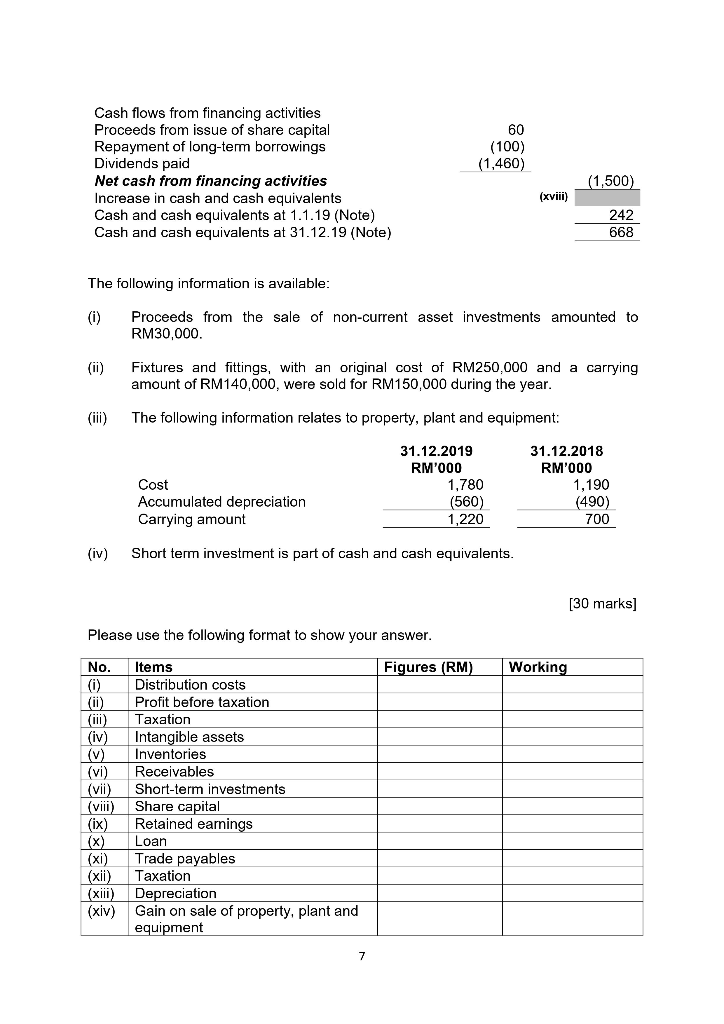

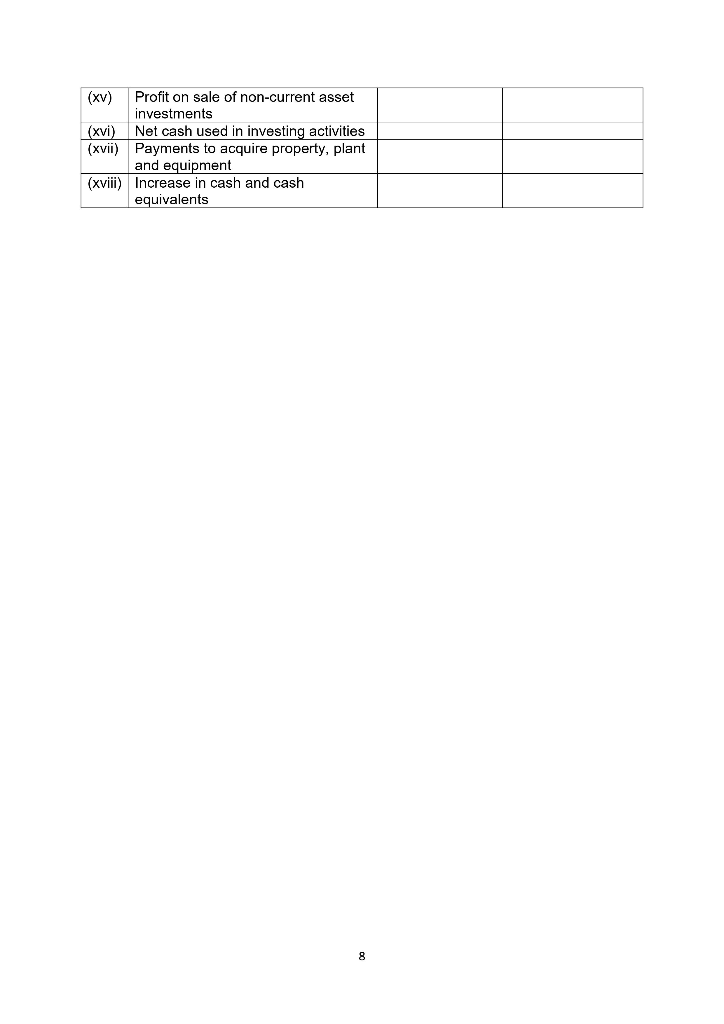

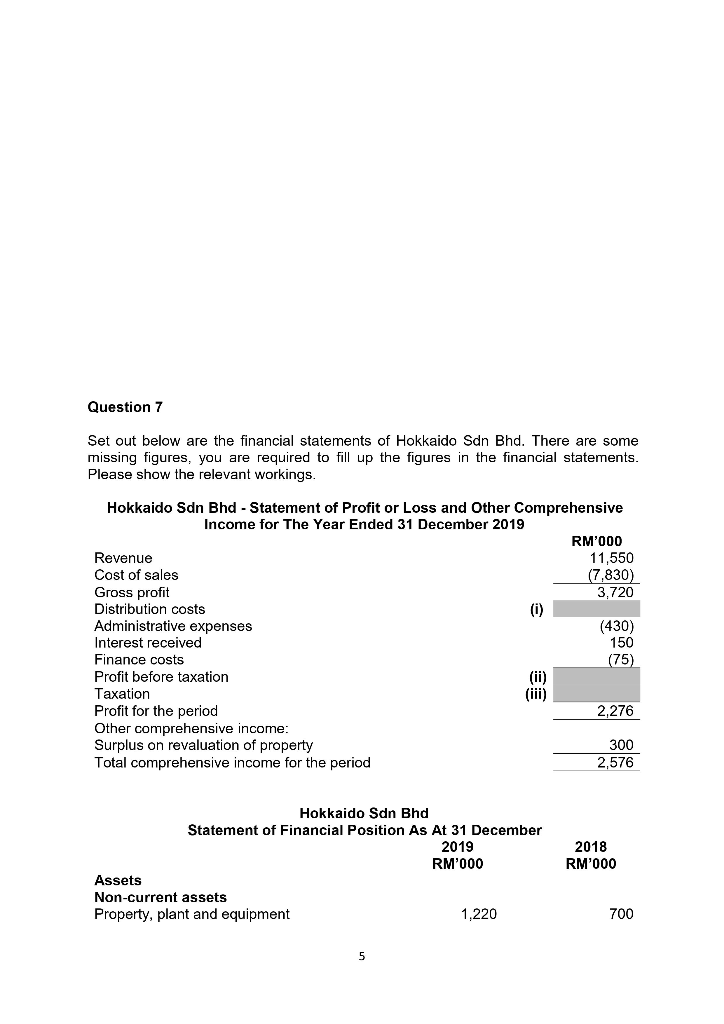

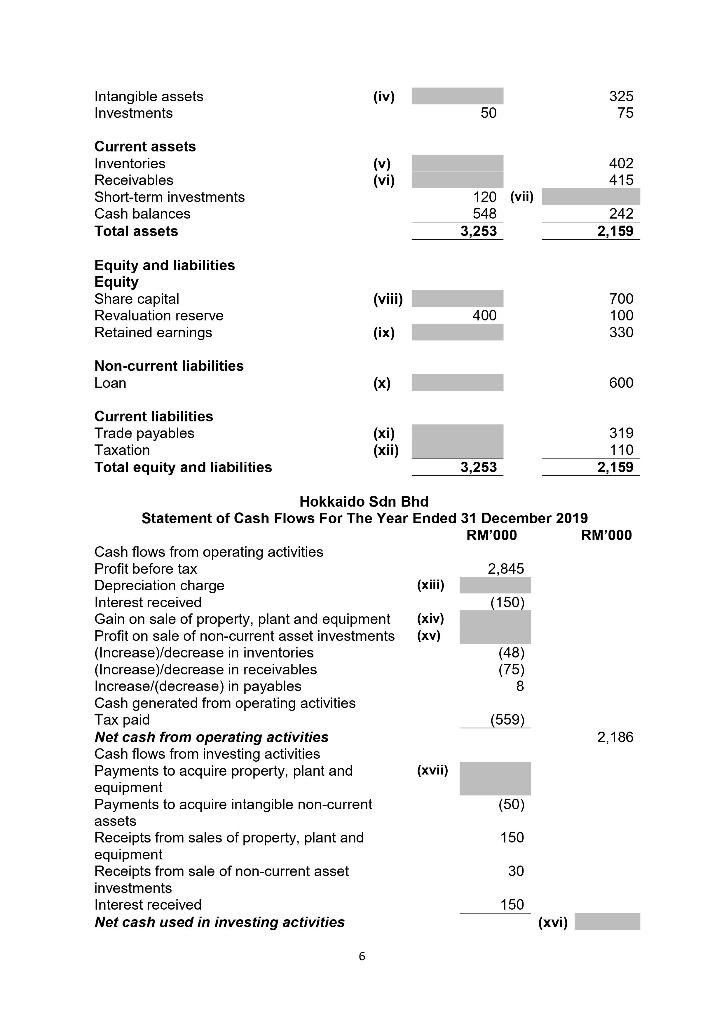

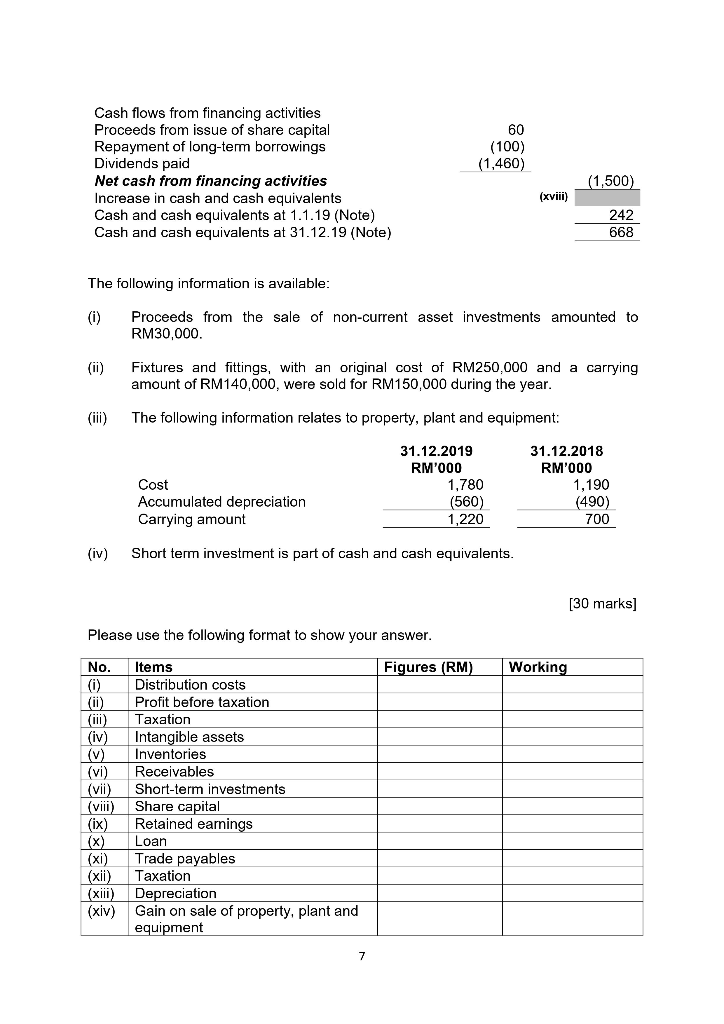

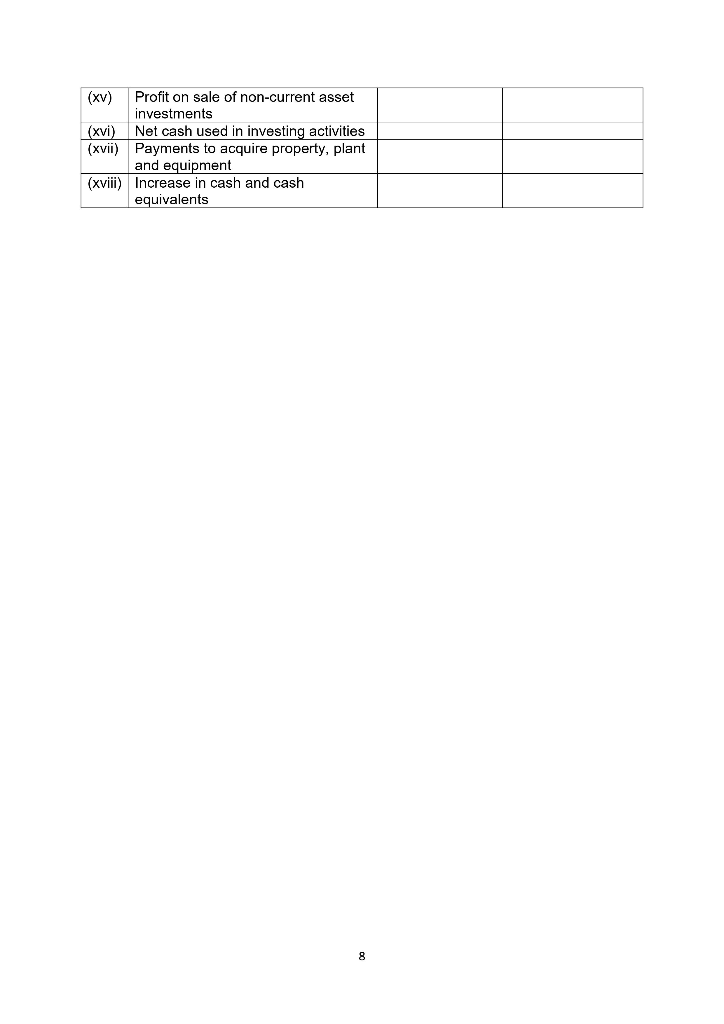

Intangible assets Investments (iv) 325 75 50 Current assets Inventories Receivables Short-term investments Cash balances Total assets (v) (vi) 402 415 120 (vii) 548 3,253 242 2,159 Equity and liabilities Equity Share capital Revaluation reserve Retained earnings (viii) 400 700 100 330 (ix) Non-current liabilities Loan (x) 600 Current liabilities Trade payables Taxation Total equity and liabilities (xi) (xii) 319 110 2,159 3,253 (48) Hokkaido Sdn Bhd Statement of Cash Flows For The Year Ended 31 December 2019 RM'000 RM'000 Cash flows from operating activities Profit before tax 2,845 Depreciation charge (xiii) Interest received (150) Gain on sale of property, plant and equipment (xiv) Profit on sale of non-current asset investments (xv) (Increase)/decrease in inventories (Increase)/decrease in receivables (75) increase/(decrease) in payables 8 Cash generated from operating activities Tax paid (559) Net cash from operating activities 2,186 Cash flows from investing activities Payments to acquire property, plant and (xvii) equipment Payments to acquire intangible non-current (50) assets Receipts from sales of property, plant and 150 equipment Receipts from sale of non-current asset 30 investments Interest received 150 Net cash used in investing activities (xvi) 60 (100) (1,460) Cash flows from financing activities Proceeds from issue of share capital Repayment of long-term borrowings Dividends paid Net cash from financing activities Increase in cash and cash equivalents Cash and cash equivalents at 1.1.19 (Note) Cash and cash equivalents at 31.12.19 (Note) (1,500) (xviii) 242 668 The following information is available: (0) Proceeds from the sale of non-current asset investments amounted to RM30,000. (ii) Fixtures and fittings, with an original cost of RM250,000 and a carrying amount of RM140,000, were sold for RM150,000 during the year. (iii) The following information relates to property, plant and equipment: Cost Accumulated depreciation Carrying amount 31.12.2019 RM'000 1,780 (560) 1,220 31.12.2018 RM'000 1,190 (490) 700 (iv) Short term investment is part of cash and cash equivalents. [30 marks] Working Please use the following format to show your answer. No. Items Figures (RM) (0) Distribution costs (1) Profit before taxation (111) Taxation (iv) Intangible assets (V) Inventories (vi) Receivables (vii) Short-term investments (viii) Share capital (ix) Retained earnings (x) Loan (xi) Trade payables (xii) Taxation (xiii) Depreciation (xiv) Gain on sale of property, plant and equipment 7 (xv) Profit on sale of non-current asset investments (xvi) Net cash used in investing activities (xvii) Payments to acquire property, plant and equipment (xviii) Increase in cash and cash equivalents 8 Intangible assets Investments (iv) 325 75 50 Current assets Inventories Receivables Short-term investments Cash balances Total assets (v) (vi) 402 415 120 (vii) 548 3,253 242 2,159 Equity and liabilities Equity Share capital Revaluation reserve Retained earnings (viii) 400 700 100 330 (ix) Non-current liabilities Loan (x) 600 Current liabilities Trade payables Taxation Total equity and liabilities (xi) (xii) 319 110 2,159 3,253 (48) Hokkaido Sdn Bhd Statement of Cash Flows For The Year Ended 31 December 2019 RM'000 RM'000 Cash flows from operating activities Profit before tax 2,845 Depreciation charge (xiii) Interest received (150) Gain on sale of property, plant and equipment (xiv) Profit on sale of non-current asset investments (xv) (Increase)/decrease in inventories (Increase)/decrease in receivables (75) increase/(decrease) in payables 8 Cash generated from operating activities Tax paid (559) Net cash from operating activities 2,186 Cash flows from investing activities Payments to acquire property, plant and (xvii) equipment Payments to acquire intangible non-current (50) assets Receipts from sales of property, plant and 150 equipment Receipts from sale of non-current asset 30 investments Interest received 150 Net cash used in investing activities (xvi) 60 (100) (1,460) Cash flows from financing activities Proceeds from issue of share capital Repayment of long-term borrowings Dividends paid Net cash from financing activities Increase in cash and cash equivalents Cash and cash equivalents at 1.1.19 (Note) Cash and cash equivalents at 31.12.19 (Note) (1,500) (xviii) 242 668 The following information is available: (0) Proceeds from the sale of non-current asset investments amounted to RM30,000. (ii) Fixtures and fittings, with an original cost of RM250,000 and a carrying amount of RM140,000, were sold for RM150,000 during the year. (iii) The following information relates to property, plant and equipment: Cost Accumulated depreciation Carrying amount 31.12.2019 RM'000 1,780 (560) 1,220 31.12.2018 RM'000 1,190 (490) 700 (iv) Short term investment is part of cash and cash equivalents. [30 marks] Working Please use the following format to show your answer. No. Items Figures (RM) (0) Distribution costs (1) Profit before taxation (111) Taxation (iv) Intangible assets (V) Inventories (vi) Receivables (vii) Short-term investments (viii) Share capital (ix) Retained earnings (x) Loan (xi) Trade payables (xii) Taxation (xiii) Depreciation (xiv) Gain on sale of property, plant and equipment 7 (xv) Profit on sale of non-current asset investments (xvi) Net cash used in investing activities (xvii) Payments to acquire property, plant and equipment (xviii) Increase in cash and cash equivalents 8