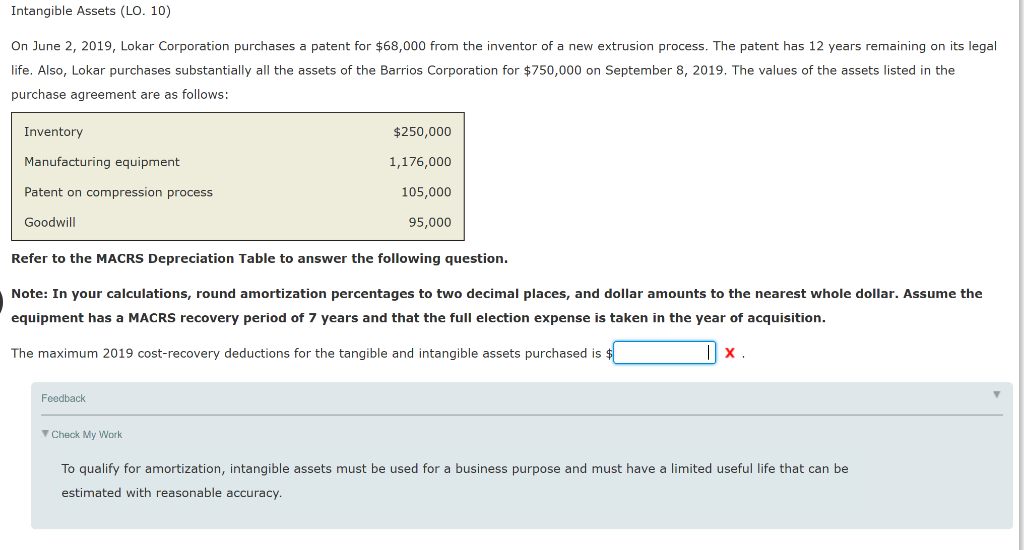

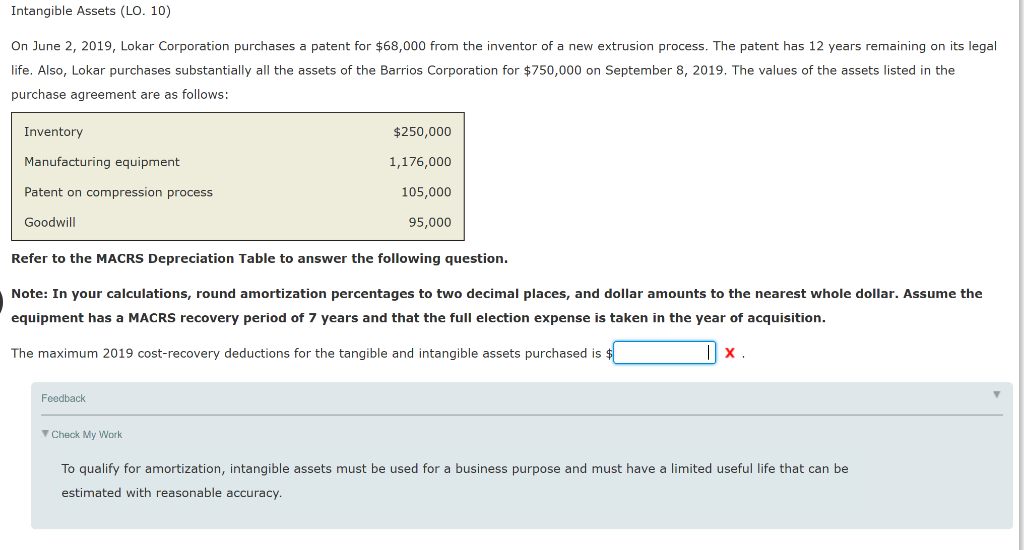

Intangible Assets (LO. 10) On June 2, 2019, Lokar Corporation purchases a patent for $68,000 from the inventor of a new extrusion process. The patent has 12 years remaining on its legal life. Also, Lokar purchases substantially all the assets of the Barrios Corporation for $750,000 on September 8, 2019. The values of the assets listed in the purchase agreement are as follows: Inventory $250,000 Manufacturing equipment 1,176,000 Patent on compression process 105,000 Goodwill 95,000 Refer to the MACRS Depreciation Table to answer the following question. Note: In your calculations, round amortization percentages to two decimal places, and dollar amounts to the nearest whole dollar. Assume the equipment has a MACRS recovery period of 7 years and that the full election expense is taken in the year of acquisition. The maximum 2019 cost-recovery deductions for the tangible and intangible assets purchased is $ Feedback Check My Work To qualify for amortization, intangible assets must be used for a business purpose and must have a limited useful life that can be estimated with reasonable accuracy Intangible Assets (LO. 10) On June 2, 2019, Lokar Corporation purchases a patent for $68,000 from the inventor of a new extrusion process. The patent has 12 years remaining on its legal life. Also, Lokar purchases substantially all the assets of the Barrios Corporation for $750,000 on September 8, 2019. The values of the assets listed in the purchase agreement are as follows: Inventory $250,000 Manufacturing equipment 1,176,000 Patent on compression process 105,000 Goodwill 95,000 Refer to the MACRS Depreciation Table to answer the following question. Note: In your calculations, round amortization percentages to two decimal places, and dollar amounts to the nearest whole dollar. Assume the equipment has a MACRS recovery period of 7 years and that the full election expense is taken in the year of acquisition. The maximum 2019 cost-recovery deductions for the tangible and intangible assets purchased is $ Feedback Check My Work To qualify for amortization, intangible assets must be used for a business purpose and must have a limited useful life that can be estimated with reasonable accuracy