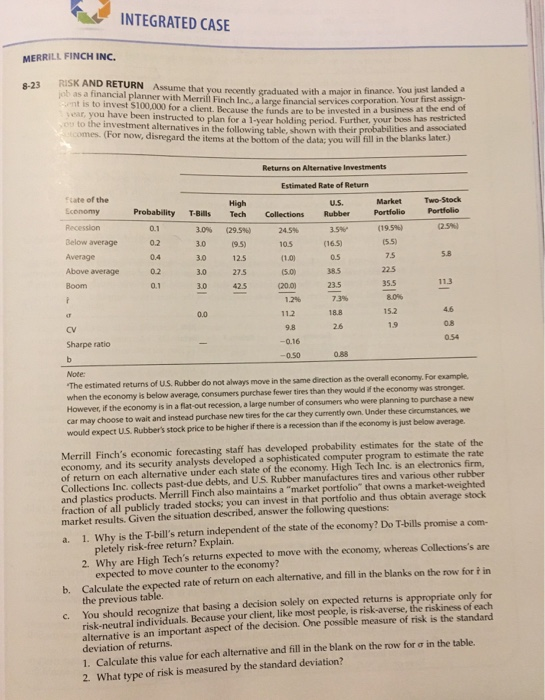

INTEGRATED CASE MERRILL FINCH INC. 8-23 RISK AND RETURN Assume that you recently graduated with a major in finance. You just landed a job as a financial planner with Merrill Finch Inc. Lange financial services corporation. Your first assign sear, you have been instructed to plan for a 1-year holding period. Further, your boss has restricted ou to the investment alternatives in the following table, shown with their probabilities and associated comes. (For now, disregard the items at the bottom of the data; you will fill in the blanks later.) 125 Returns on Alternative Investments Estimated Rate of Return State of the High U.S. Market Two-Stock Economy Probability T-Bills Tech Collections Rubber Portfolio Portfolio Recession 0.1 3.09 (29.5%) 24.5 3.59 (19.546) Below average 02 30 19.5) 10.5 (16.5) 15.50 Average 0.4 3.0 11.01 0.5 7.5 5.8 Above average 0.2 3.0 27.5 15.00 38.5 225 Boom 0.1 3.0 42.5 (20.01 23.5 35.5 11.3 1.24 7.39 8096 0.0 112 18.8 152 4,6 CV 9.8 26 1.9 0.8 Sharpe ratio -0.16 0.54 b -0.50 Note: "The estimated returns of U.S. Rubber do not always move in the same direction as the overall economy. For example. when the economy is below average, consumers purchase fewer tires than they would if the economy was stronger. However, if the economy is in a flat-out recession, a large number of consumers who were planning to purchase a new car may choose to wait and instead purchase new tires for the car they currently own. Under these circumstances, we would expect U.S. Rubber's stock price to be higher if there is a recession than if the economy is just below average. Merrill Finch's economic forecasting staff has developed probability estimates for the state of the economy, and its security analysts developed a sophisticated computer program to estimate the rate of return on each alternative under each state of the economy. High Tech Inc. is an electronics firm, Collections Inc. collects past-due debts, and U.S. Rubber manufactures tires and various other rubber and plastics products. Merrill Finch also maintains a "market portfolio" that owns a market-weighted fraction of all publicly traded stocks, you can invest in that portfolio and thus obtain average stock market results. Given the situation described, answer the following questions: a. 1. Why is the T-bill's return independent of the state of the economy? Do T-bills promise a com- pletely risk-free return? Explain. 2. Why are High Tech's returns expected to move with the economy, whereas Collections's are expected to move counter to the economy? b. Calculate the expected rate of return on each alternative, and fill in the blanks on the row for tin the previous table You should recognize that basing a decision solely on expected returns is appropriate only for risk-neutral individuals. Because your client, like most people, is risk-averse, the riskiness of each alternative is an important aspect of the decision. One possible measure of risk is the standard deviation of returns. 1. Calculate this value for each alternative and fill in the blank on the row fore in the table. 2. What type of risk is measured by the standard deviation? c