integrated finance

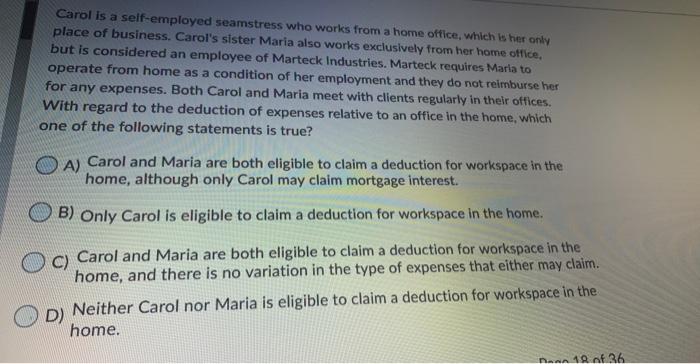

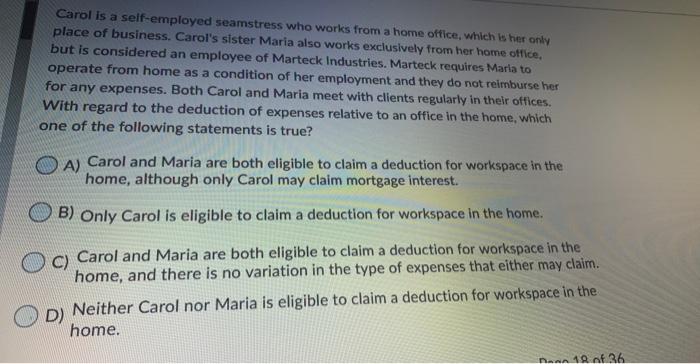

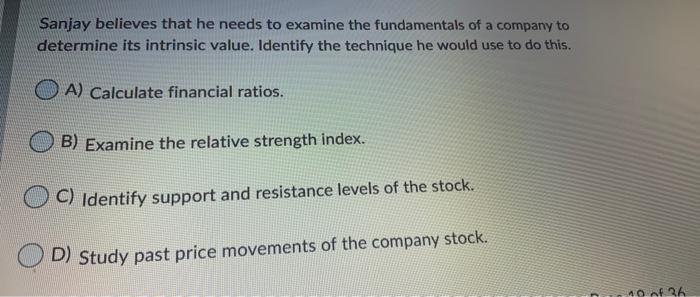

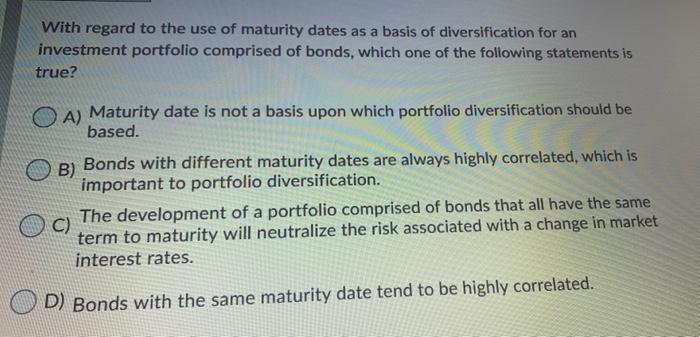

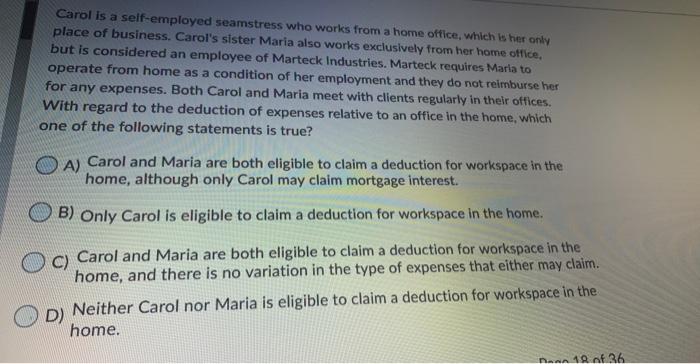

Carol is a self-employed seamstress who works from a home office, which is her only place of business. Carol's sister Maria also works exclusively from her home office, but is considered an employee of Marteck Industries. Marteck requires Maria to operate from home as a condition of her employment and they do not reimburse her for any expenses. Both Carol and Maria meet with clients regularly in their offices. With regard to the deduction of expenses relative to an office in the home, which one of the following statements is true? A) Carol and Maria are both eligible to claim a deduction for workspace in the home, although only Carol may claim mortgage interest. B) Only Carol is eligible to claim a deduction for workspace in the home. Carol and Maria are both eligible to claim a deduction for workspace in the home, and there is no variation in the type of expenses that either may claim. D) Neither Carol nor Maria is eligible to claim a deduction for workspace in the home. nan 10 of 36 Sanjay believes that he needs to examine the fundamentals of a company to determine its intrinsic value. Identify the technique he would use to do this. A) Calculate financial ratios. B) Examine the relative strength index. C) Identify support and resistance levels of the stock. D) Study past price movements of the company stock. 10 of 36 Lynne owns three adjoining townhouse units that she holds as an investment. During the year, Lynne incurred all of the following expenditures related to the rental units. Which of the expenditures listed below are fully deductible for Lynne relative to the current taxation year? (select all that apply) A) $800 for plumbing repairs. B) $2,500 for utility expenses. C) $1,500 for cleaning services. D) $5,000 for the addition of a ramp to allow easier entry for a long term tenant confined to a wheelchair. E) $500 for bookkeeping services. With regard to the use of maturity dates as a basis of diversification for an investment portfolio comprised of bonds, which one of the following statements is true? A) Maturity date is not a basis upon which portfolio diversification should be based. B) Bonds with different maturity dates are always highly correlated, which is important to portfolio diversification. The development of a portfolio comprised of bonds that all have the same C) term to maturity will neutralize the risk associated with a change in market interest rates. D) Bonds with the same maturity date tend to be highly correlated