integrated finance

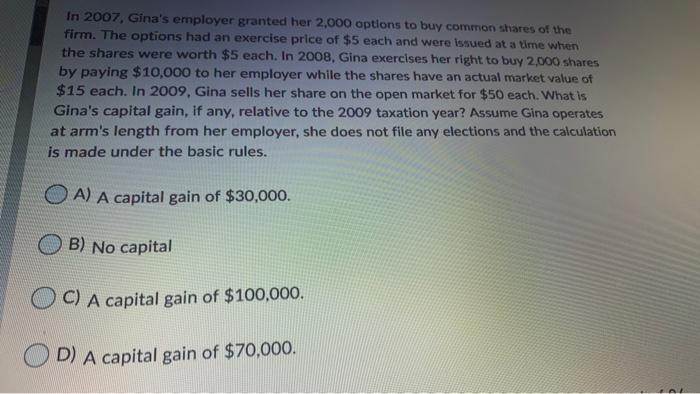

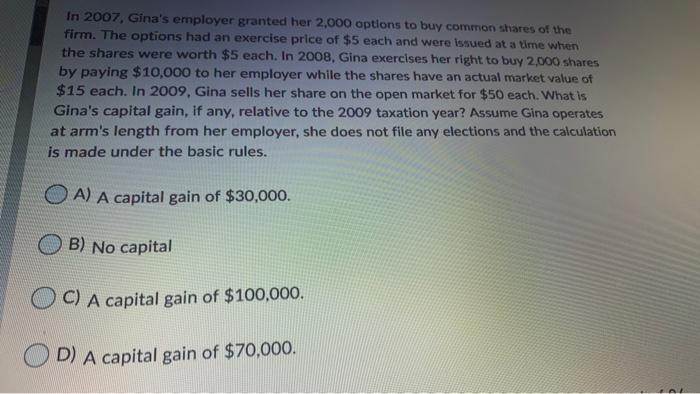

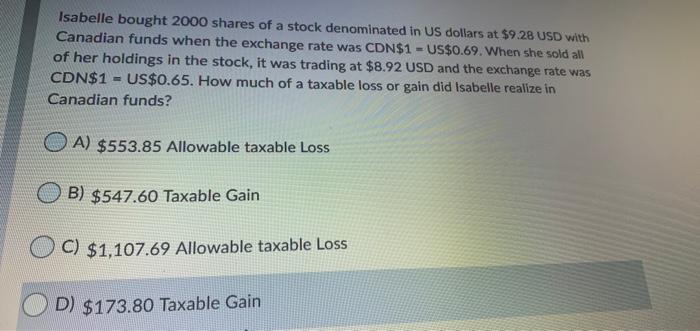

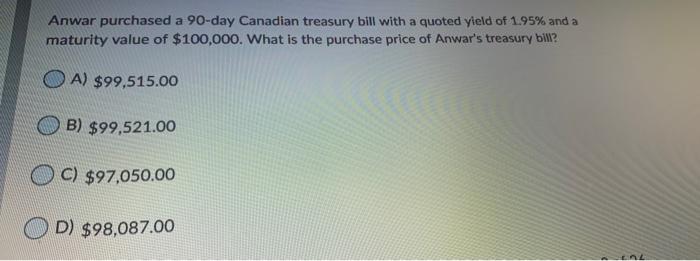

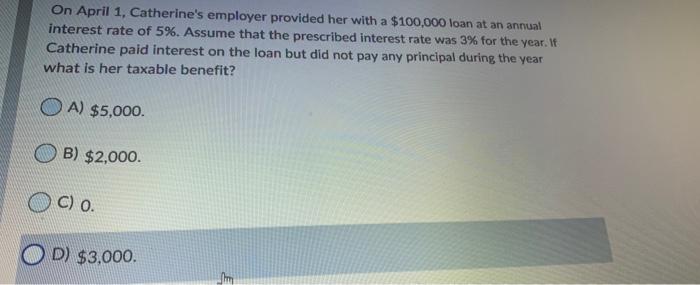

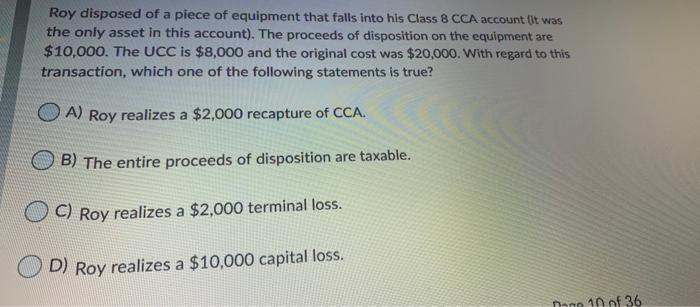

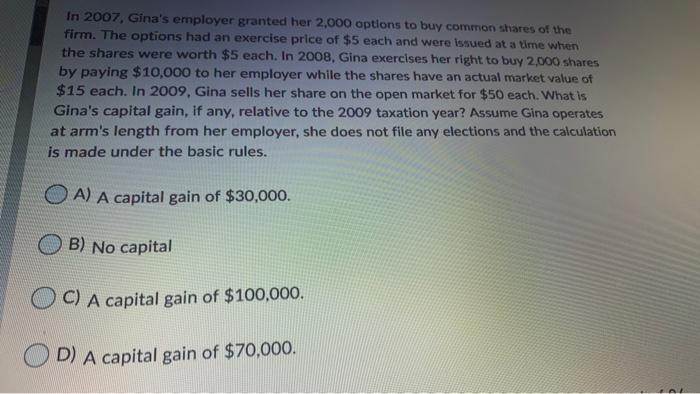

In 2007, Gina's employer granted her 2,000 options to buy common shares of the firm. The options had an exercise price of $5 each and were issued at a time when the shares were worth $5 each. In 2008, Gina exercises her right to buy 2,000 shares by paying $10,000 to her employer while the shares have an actual market value of $15 each. In 2009, Gina sells her share on the open market for $50 each. What is Gina's capital gain, if any, relative to the 2009 taxation year? Assume Gina operates at arm's length from her employer, she does not file any elections and the calculation is made under the basic rules. OA) A capital gain of $30,000. B) No capital C) A capital gain of $100,000. D) A capital gain of $70,000. Isabelle bought 2000 shares of a stock denominated in US dollars at $9.28 USD with Canadian funds when the exchange rate was CDN$1 = US$0.69. When she sold all of her holdings in the stock, it was trading at $8.92 USD and the exchange rate was CDN$1 = US$0.65. How much of a taxable loss or gain did Isabelle realize in Canadian funds? A) $553.85 Allowable taxable Loss B) $547.60 Taxable Gain C) $1,107.69 Allowable taxable Loss D) $173.80 Taxable Gain Anwar purchased a 90-day Canadian treasury bill with a quoted yield of 1.95% and a maturity value of $100,000. What is the purchase price of Anwar's treasury bill? A) $99,515.00 B) $99,521.00 C) $97,050.00 D) $98,087.00 AL On April 1, Catherine's employer provided her with a $100,000 loan at an annual interest rate of 5%. Assume that the prescribed interest rate was 3% for the year. It Catherine paid interest on the loan but did not pay any principal during the year what is her taxable benefit? OA) $5,000. B) $2,000. C) O. D) $3,000. F Roy disposed of a piece of equipment that falls into his Class 8 CCA account (it was the only asset in this account). The proceeds of disposition on the equipment are $10,000. The UCC is $8,000 and the original cost was $20,000. With regard to this transaction, which one of the following statements is true? A) Roy realizes a $2,000 recapture of CCA. B) The entire proceeds of disposition are taxable. C) Roy realizes a $2,000 terminal loss. D) Roy realizes a $10,000 capital loss. Dane 10 of 36