integrated finance

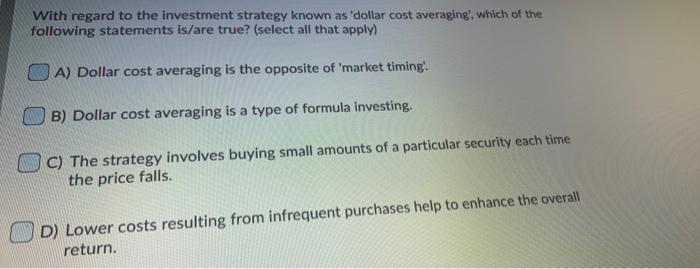

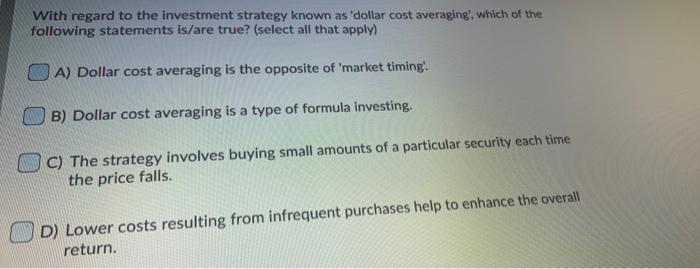

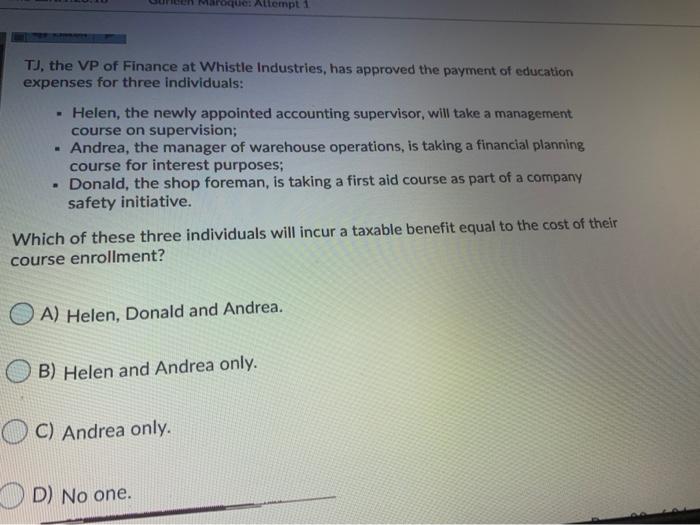

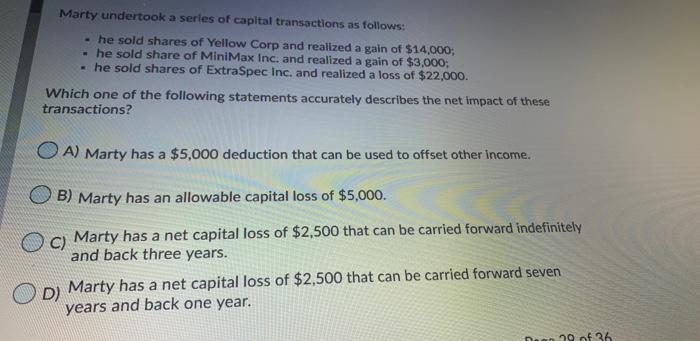

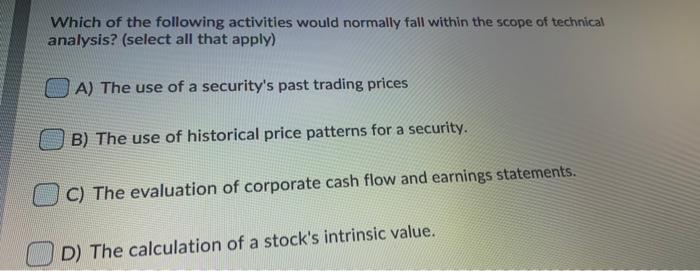

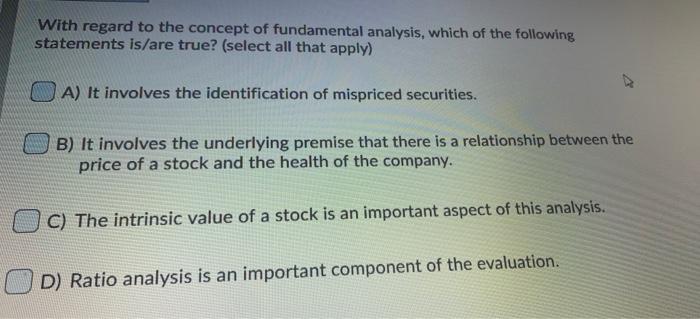

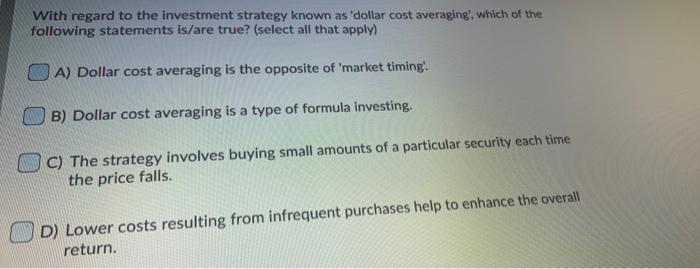

With regard to the investment strategy known as 'dollar cost averaging, which of the following statements is/are true? (select all that apply) A) Dollar cost averaging is the opposite of market timing' B) Dollar cost averaging is a type of formula investing. C) The strategy involves buying small amounts of a particular security each time the price falls. D) Lower costs resulting from infrequent purchases help to enhance the overall return. Lunch Maroque Allempl 1 TJ, the VP of Finance at Whistle Industries, has approved the payment of education expenses for three individuals: - Helen, the newly appointed accounting supervisor, will take a management course on supervision; Andrea, the manager of warehouse operations, is taking a financial planning course for interest purposes: . Donald, the shop foreman, is taking a first aid course as part of a company safety initiative. Which of these three individuals will incur a taxable benefit equal to the cost of their course enrollment? A) Helen, Donald and Andrea. B) Helen and Andrea only. C) Andrea only. D) No one. Marty undertook a series of capital transactions as follows: he sold shares of Yellow Corp and realized a gain of $14,000; - he sold share of MiniMax Inc. and realized a gain of $3,000; - he sold shares of ExtraSpec Inc. and realized a loss of $22,000. Which one of the following statements accurately describes the net impact of these transactions? OA) Marty has a $5,000 deduction that can be used to offset other income. B) Marty has an allowable capital loss of $5,000. C) Marty has a net capital loss of $2,500 that can be carried forward indefinitely and back three years. D) Marty has a net capital loss of $2,500 that can be carried forward seven years and back one year. 29 of 36 Which of the following activities would normally fall within the scope of technical analysis? (select all that apply) A) The use of a security's past trading prices B) The use of historical price patterns for a security. C) The evaluation of corporate cash flow and earnings statements. D) The calculation of a stock's intrinsic value. With regard to the concept of fundamental analysis, which of the following statements is/are true? (select all that apply) A) It involves the identification of mispriced securities. B) It involves the underlying premise that there is a relationship between the price of a stock and the health of the company. C) The intrinsic value of a stock is an important aspect of this analysis. D) Ratio analysis is an important component of the evaluation