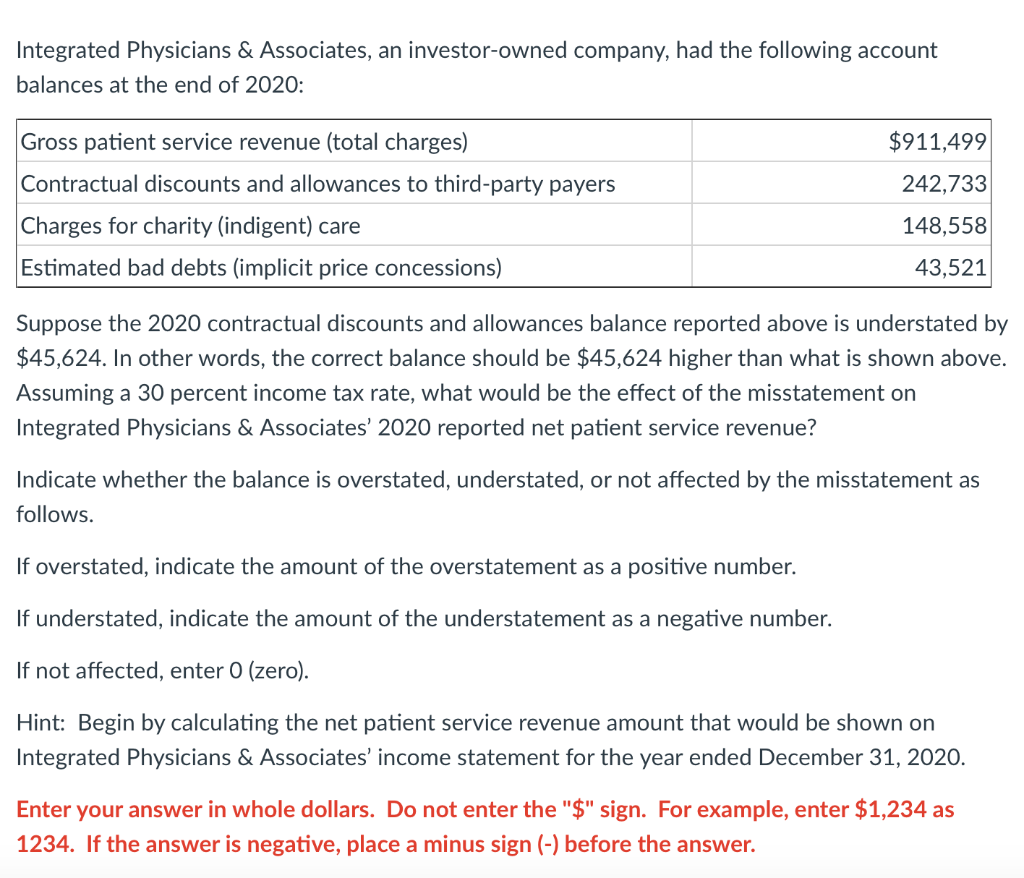

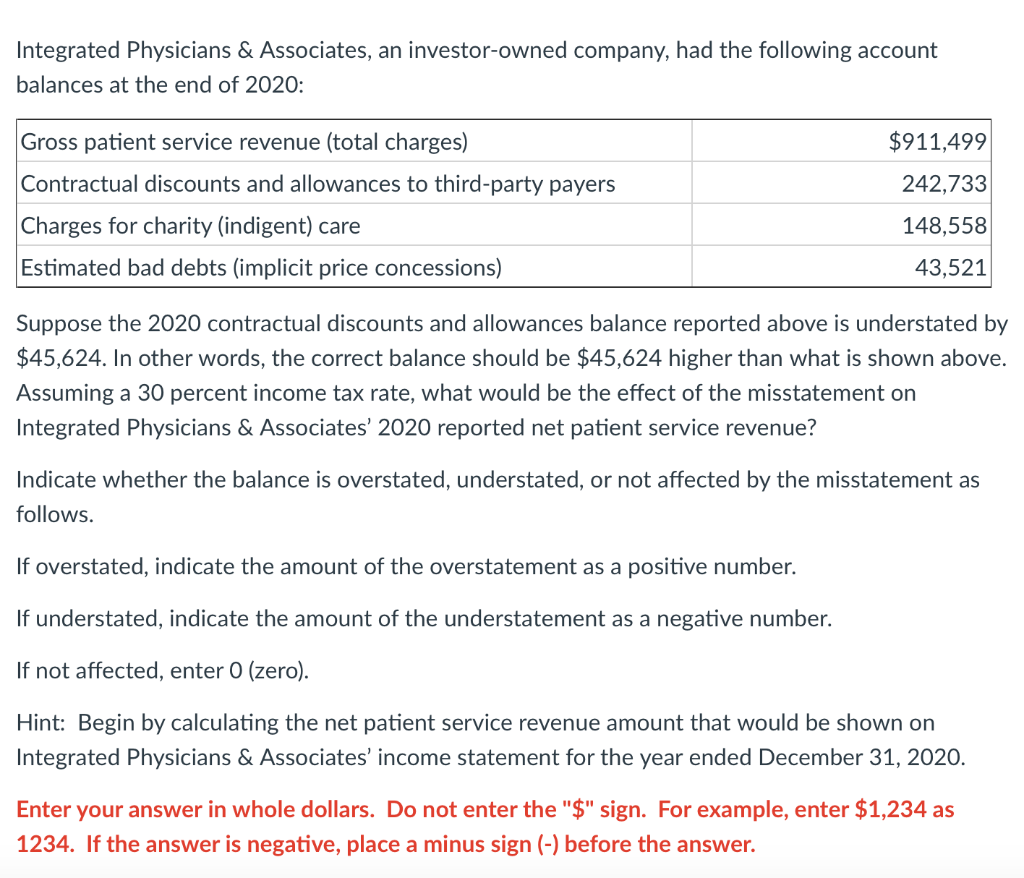

Integrated Physicians & Associates, an investor-owned company, had the following account balances at the end of 2020: $911,499 242,733 Gross patient service revenue (total charges) Contractual discounts and allowances to third-party payers Charges for charity (indigent) care Estimated bad debts (implicit price concessions) 148,558 43,521 Suppose the 2020 contractual discounts and allowances balance reported above is understated by $45,624. In other words, the correct balance should be $45,624 higher than what is shown above. Assuming a 30 percent income tax rate, what would be the effect of the misstatement on Integrated Physicians & Associates' 2020 reported net patient service revenue? Indicate whether the balance is overstated, understated, or not affected by the misstatement as follows. If overstated, indicate the amount of the overstatement as a positive number. If understated, indicate the amount of the understatement as a negative number. If not affected, enter 0 (zero). Hint: Begin by calculating the net patient service revenue amount that would be shown on Integrated Physicians & Associates' income statement for the year ended December 31, 2020. Enter your answer in whole dollars. Do not enter the "$" sign. For example, enter $1,234 as 1234. If the answer is negative, place a minus sign (-) before the answer. Integrated Physicians & Associates, an investor-owned company, had the following account balances at the end of 2020: $911,499 242,733 Gross patient service revenue (total charges) Contractual discounts and allowances to third-party payers Charges for charity (indigent) care Estimated bad debts (implicit price concessions) 148,558 43,521 Suppose the 2020 contractual discounts and allowances balance reported above is understated by $45,624. In other words, the correct balance should be $45,624 higher than what is shown above. Assuming a 30 percent income tax rate, what would be the effect of the misstatement on Integrated Physicians & Associates' 2020 reported net patient service revenue? Indicate whether the balance is overstated, understated, or not affected by the misstatement as follows. If overstated, indicate the amount of the overstatement as a positive number. If understated, indicate the amount of the understatement as a negative number. If not affected, enter 0 (zero). Hint: Begin by calculating the net patient service revenue amount that would be shown on Integrated Physicians & Associates' income statement for the year ended December 31, 2020. Enter your answer in whole dollars. Do not enter the "$" sign. For example, enter $1,234 as 1234. If the answer is negative, place a minus sign (-) before the