Question

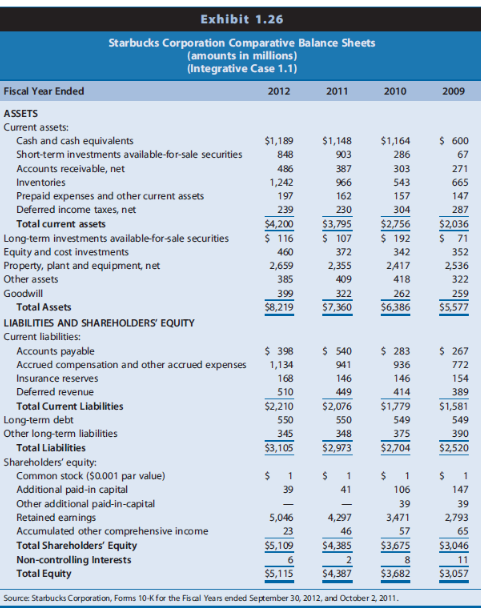

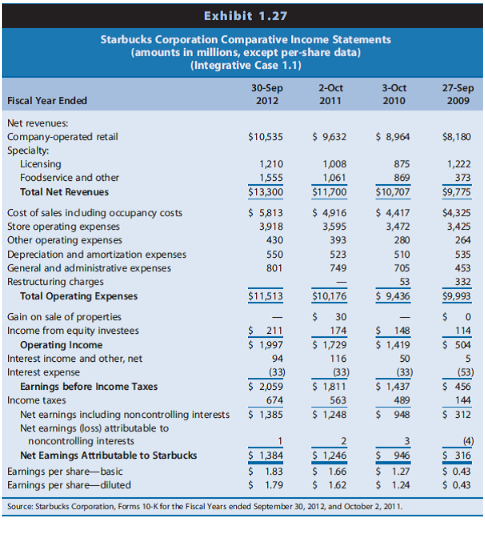

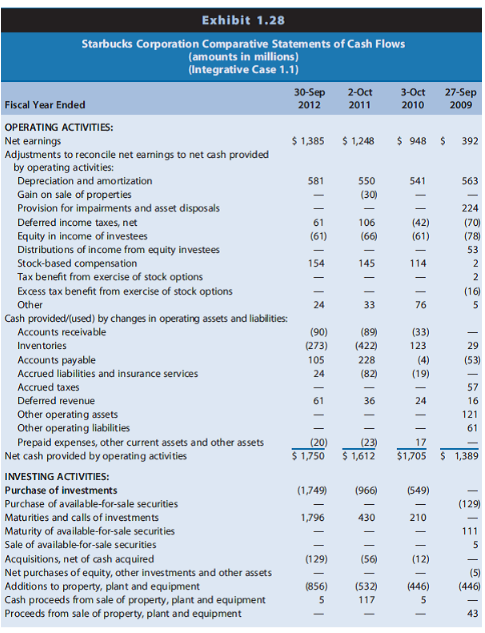

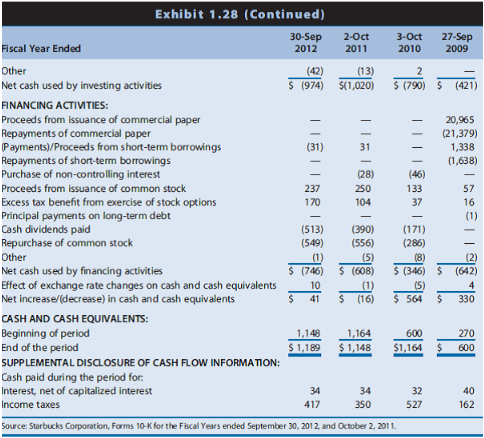

Integrative 6.1 Based of the Starbucls Summary of Significant Accounting Policies and the below tables, please answer the following. A. Given you knowledge of Starbuck's

Integrative 6.1

Based of the Starbucls Summary of Significant Accounting Policies and the below tables, please answer the following.

A. Given you knowledge of Starbuck's Key success and risk factors, use the note information presented above evaluate Starbucks' accounting quality?

B. If you believe that Starbucks' accounting policy does not yield measurments of assets and liabilities that reflect economic reality and a measurement of net income that is a predictive of future earnings, suggest any changes that you would make to assets, liabilities, and earningsto improve accounting quality.

C. Evaluate whether you proposed adjustments are necessary for, credit analysis, equity valuation, and managment evaluation.

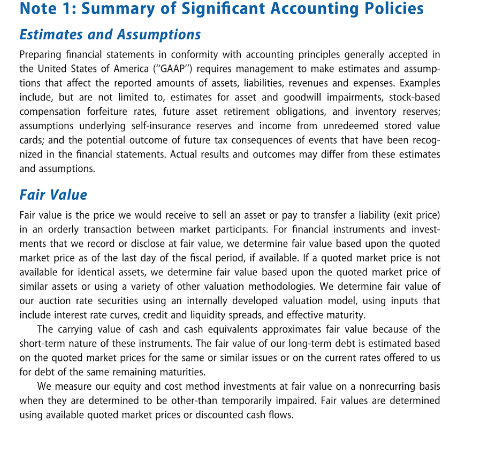

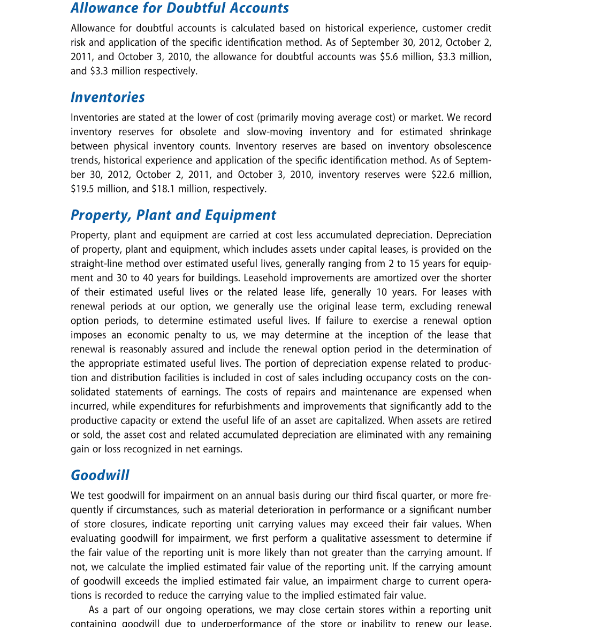

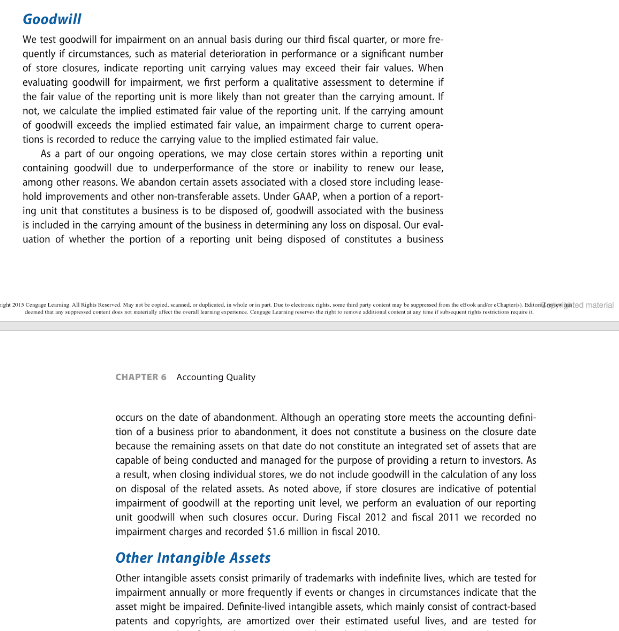

Note 1: Summary of Significant Accounting Policies Estimates and Assumptions Preparing financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP requires management to make estimates and assump- tions that affect the reported amounts of assets, liabilities, revenues and expenses. Examples include, but are not limited to, estimates for asset and goodwill impairments, stock-based compensation forfeiture rates, future asset retirement obligations, and inventory reserves; assumptions underlying self-insurance reserves and income from unredeemed stored value cards, and the potential outcome of future tax consequences of events that have been recog nized in the financial statements. Actual results and outcomes may differ from these estimates nd assumption Fair Value Fair value is the price we would receive to sell an asset or pay to transfer a liability (exit price) in an orderly transaction between market participants. For financial instruments and invest ments that we record or disclose at fair value, we determine fair value based upon the quoted market price as of the last day of the fiscal period, if available. If a quoted market price is not available for identical assets, we determine fair value based upon the quoted market price of similar assets or using a variety of other valuation methodologies. We determine fair value of our auction rate securities using an internally developed valuation model, using inputs that include interest rate curves, credit and liquidity spreads, and effective maturity The carrying value of cash and cash equivalents approximates fair value because of the short-term nature of these instruments. The fair value of our long-term debt is estimated based on the quoted market prices for the same or similar issues or on the current rates offered to us for debt of the same remaining maturities We measure our equity and cost method investments at fair value on a nonrecurring basis when they are determined to be other than temporarily impaired. Fair values are determined using available quoted market prices or discounted cash flowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started