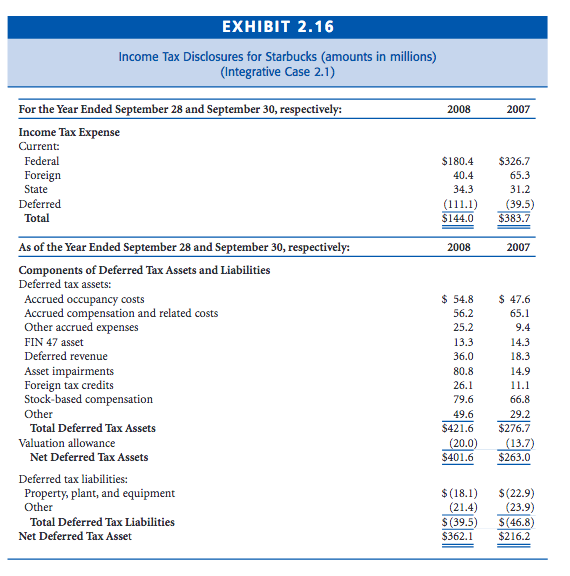

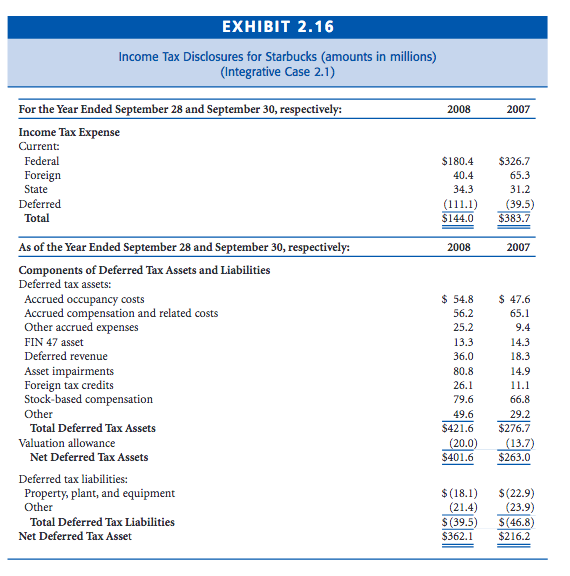

INTEGRATIVE CASE 2.1 STARBUCKS The financial statements of Starbucks Corporation are presented in Exhibits 1.26-1.28 (see pages 7880). The income tax note to those financial statements reveals the information regarding income taxes shown in Exhibit 2.16. Required a. Assuming that Starbucks had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for 2007? Explain. b. Did book income before taxes for financial reporting exceed or fall short of taxable income for 2008? Explain. EXHIBIT 2.16 Income Tax Disclosures for Starbucks (amounts in millions) (Integrative Case 2.1) 2008 2007 For the Year Ended September 28 and September 30, respectively: Income Tax Expense Current: Federal Foreign State Deferred Total $180.4 40.4 34.3 (111.1) $144.0 $326.7 65.3 31.2 (39.5) $383.7 2008 2007 As of the Year Ended September 28 and September 30, respectively: Components of Deferred Tax Assets and Liabilities Deferred tax assets: Accrued occupancy costs Accrued compensation and related costs Other accrued expenses FIN 47 asset Deferred revenue Asset impairments Foreign tax credits Stock-based compensation Other Total Deferred Tax Assets Valuation allowance Net Deferred Tax Assets Deferred tax liabilities: Property, plant, and equipment Other Total Deferred Tax Liabilities Net Deferred Tax Asset $ 54.8 56.2 25.2 13.3 36.0 80.8 26.1 79.6 49.6 $421.6 (20.0) $401.6 $ 47.6 65.1 9.4 14.3 18.3 14.9 11.1 66.8 29.2 $276.7 (13.7) $263.0 $(18.1) (21.4) $(39.5) $362.1 $(22.9) (23.9) $(46.8 $216.2 INTEGRATIVE CASE 2.1 STARBUCKS The financial statements of Starbucks Corporation are presented in Exhibits 1.26-1.28 (see pages 7880). The income tax note to those financial statements reveals the information regarding income taxes shown in Exhibit 2.16. Required a. Assuming that Starbucks had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for 2007? Explain. b. Did book income before taxes for financial reporting exceed or fall short of taxable income for 2008? Explain. EXHIBIT 2.16 Income Tax Disclosures for Starbucks (amounts in millions) (Integrative Case 2.1) 2008 2007 For the Year Ended September 28 and September 30, respectively: Income Tax Expense Current: Federal Foreign State Deferred Total $180.4 40.4 34.3 (111.1) $144.0 $326.7 65.3 31.2 (39.5) $383.7 2008 2007 As of the Year Ended September 28 and September 30, respectively: Components of Deferred Tax Assets and Liabilities Deferred tax assets: Accrued occupancy costs Accrued compensation and related costs Other accrued expenses FIN 47 asset Deferred revenue Asset impairments Foreign tax credits Stock-based compensation Other Total Deferred Tax Assets Valuation allowance Net Deferred Tax Assets Deferred tax liabilities: Property, plant, and equipment Other Total Deferred Tax Liabilities Net Deferred Tax Asset $ 54.8 56.2 25.2 13.3 36.0 80.8 26.1 79.6 49.6 $421.6 (20.0) $401.6 $ 47.6 65.1 9.4 14.3 18.3 14.9 11.1 66.8 29.2 $276.7 (13.7) $263.0 $(18.1) (21.4) $(39.5) $362.1 $(22.9) (23.9) $(46.8 $216.2