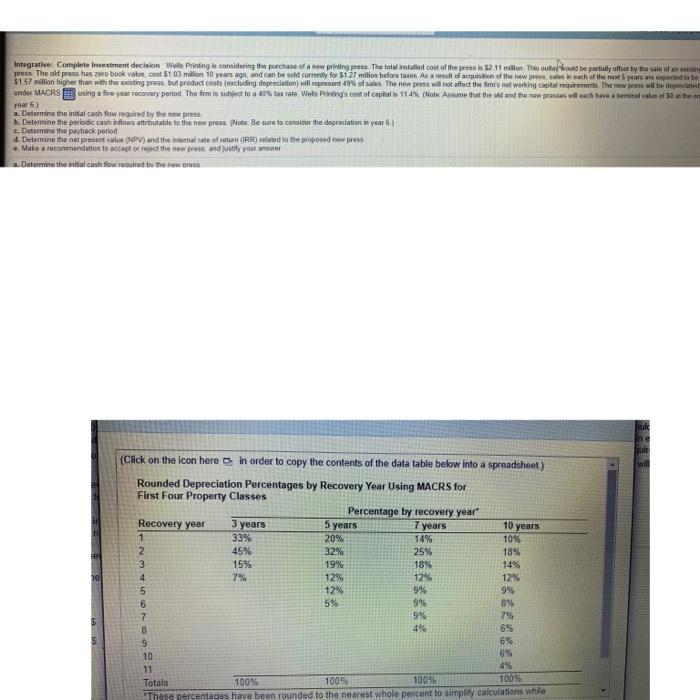

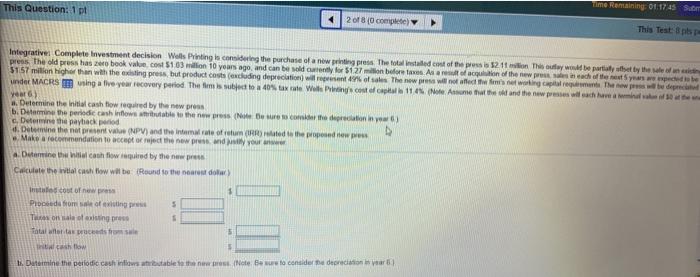

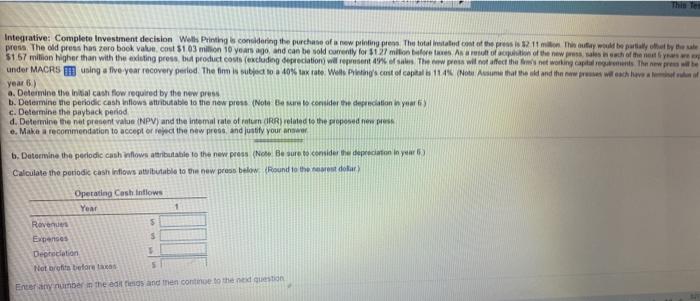

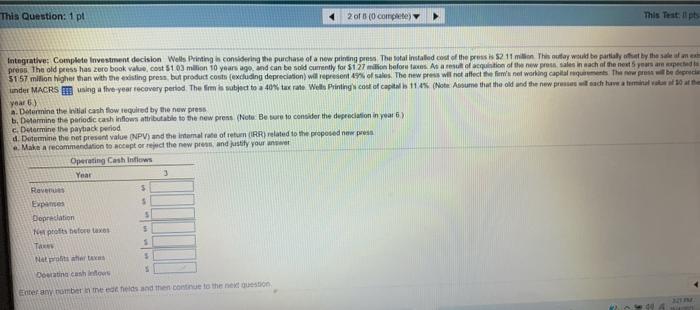

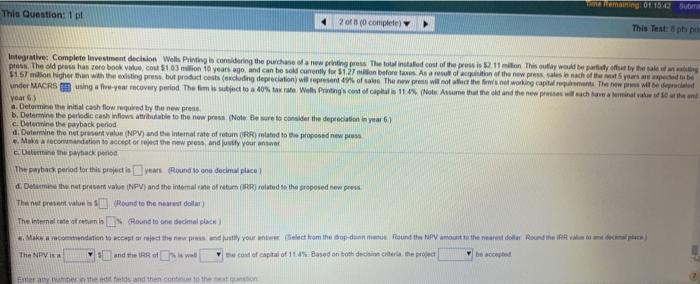

Integrative Complete Investment decision Wells Pring is considering the purchase of a new prining press The total installed cost of the press is 2.1 milion. This farould be partially affe by the sale of an press The old press has zero book value cost $10 million 10 years ago, and can be sold curly for 5127 milion before anos. As of action of the new reseach of the next years are expected to the 5157 million higher than with the existing press but product costs (excluding depreciation will present 49% of sales. The new press will not affect the firm's not working capital requirementsThe new grass will be depreciated under MACRS using a five your recovery period. The firm is subject to a tarte Wels Piringsstof capital is 1145 Cote Assume that the old and the news with total value of 50 m year 6) 2. Determine the initial cash flow required by the new press 8. Determine the periodic cash flows attributable to the new press. Note: Be sure to consider the depreciation in year f.) Dettemine the payback period d. Determine the ne present value (NPV) and the internal rate of return (IRR) related to the proposed sewe . Make a recommendation to accept or reject the new prow, and Justity you non a. Determine the initial cash flow required to me new ress 3 years (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 75 8 4% 10 69 11 495 Totals 10096 100 10092 100% That percentages have been rounded to the nearest wholo percent to implity calculations while This Question: 1 pt Time Remaining:01. 17.45 S 2 of 8 (0 complete This Tests Integrative Complete Investment decision Wells Printing is considering the purchase of a new genres. The total installed cont of the press is 12.11n This would be partially used by the en press the old press has 20 book value 5103 million 10 years ago, and can be sold only for $1.21 before we are o cun of the new presin each of the years 5157 milion Higher than with the existing press but product costs (excluding depreciation will represent of the news will not affect the working capital in the www under MACRS T using a five year recovery period. The film is subject to 40% tax rate Weiteren cost of 11 4 (Note Assume that the stand the new presses will achama Year) 3. Determine the initial cash flow required by the new press b. Dine the periode cash Infowe tributable to the new presures comme derin c. Determine the payback period Det the nel present Value (NPV) and the intamal rate of return (Rated to the proposed to press Make a recommendation to become the new press and will your Dutamine the cash flow required by the new Calculate the vital cash flow will be Round to the neare dhe In out of new press 1 Proceeds from salong 5 Tonalisting prese Total words from 5 Thow 1. Determine the periodic cash inlows able the new rest. Nate Becure to considers dereito This les Integrative: Complete Investment decision Wolls Printing is considering the purchase of a new printing press The totalitate cost of the 11 months auty would be played by the press The old press has zero book valuecout 51 63 milion 10 years ago, and can be sold currently for $127 million for Art of our tion of the neweshof the 5157 milion Nigher than with the exciting press but product costs (excluding depreciation will represent of the press will not affect the networking capitales The under MACRS sing a five-year recovery period. The firm is subject to 40% tax rate. Well somst of capital 11.45 (Not Asume that the old and the presche year 6) a. Determine the initial cash flow required by the new press b. Determine the periodic cash inflows attributable to the new press (Note Bento consider the depreciation year c. Determine the payback period d. Determine the net present value (NPV) and the intemal rate of rotum (RR) related to the proposed new pre e. Make a recommendation to accept or reject the new press and justify your an b. Determine the periodic cash flows attributable to the new press (Nore. Be sure to consider the depreciation in year 6) Calculate the periodic cash inflows atributable to the new press below (Round to the rest dolar Operating Cash Intlows Year 1 5 S Ravenue Expenses Depreciation Not bruit before 1 5 Enter any number in the edities and men continue to the This Question: 1 pl 2 of 8 (0 complete This Teat. pts Integrative: Complete Investment decision Wells Printing considering the purchase of a new printing press the total installed cost of the press is 82 11 milion This oulay we be partially by the sea press The old press has zero book value, cost 5103 million 10 years ago, and can be sold currently for $127 mln before As a result of action of the new press sales in each of the new years aspected 5157 milion higher than with the existing press but product costs (excluding depreciation will represent 49% of sales. The new press will not affect the final working capital qui The presse deprecies under MACRS TE sing a five year recovery period. The subject to a 40% tax rate Wells Printing cout of capital is 1145 (Note Assume that the old and the new presies wachawi year 6) A. Determine the initial cash flow required by the new press b. Determine the periodic cash Infows attributable to the new press (Note: Be sure to consider the depreciation in year 6) c. Determine the payback period d. Determine the not present value (NPV) and the intamal rate of return (IRR) related to the proposed new press e. Make a recommendation to accept or reject the new pro and justify your Operating Cash Inflows Year 3 Ravens 5 Expanse 5 Dopredation $ No pots before anos 5 TA 5 Na wote $ Dorina Casino Enter any bomber in the dels and then continue to the next question emaining: 01150 This Question: 1 pt 2 of 8 (0 complete This Test Integratives Complete investment decision Wells Printing comidering the purchase of a new printing press the total installed cost of the press is 2.11 in This tyd be part of the sale pro The old press has to book ale co 5103 milion 10 years ago and can be sold currently for $1.27 ion before. As a result of the new press, te ach of the parede $1.57 higher than with the existing press but product costs (excluding depreciation will present of the press will not let the wet working capital. There will be under MACRS using a year recovery period. The firm is subject to 40% tax rate With Profa 1 (Not Assume that the old and the news channel seed Year) a. Determine the initial cash flow required by the new press b. Determine the periodic cash inflows attributable to the new press (Note Blewe consider the depreciation ya 61 c. Determine the payback period 1. Dutamine the nut present value (NPV) and the internal rate of retur Related to the proposed new Make condition to accept or the press and july your answer c. the pack period The wyback period for this proyes Round one decimal place d. Detimentale (NPV) and the intemale or related to the proposed news The ne present value Round to the nearest dollar) The internet tate of retam o N Round to one decimal place Make a recommendation to cost are the news and your new Select from the drop-down found the NPV amount to the rear ou Round the Red The NPVIS WS and the wall cond of capital of 14%. Based on both deather Enter any aner in the fields and then content