Question

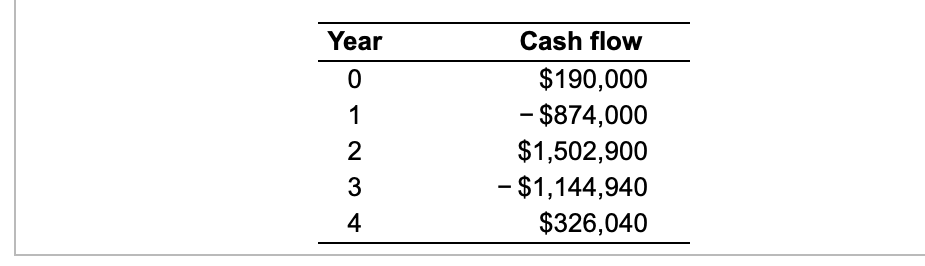

Integrative: Multiple IRRs: Froogle Enterprises is evaluating an investment project with an unusual stream of cash inflows and outflows shown in the following? table: a.Why

Integrative: Multiple IRRs: Froogle Enterprises is evaluating an investment project with an unusual stream of cash inflows and outflows shown in the following?

table:

a. Why is it difficult to calculate the payback period for this project?

(choose)

A.The short life of the project makes it difficult to compute the payback period.

B.The huge amount of cash outflow in year 3 makes the calculation difficult.

C.The oscillating cash flows make it difficult to compute the payback period.

D.It is unreal for a project to have a cash inflow as an initial investment.

b. Calculate the investment's net present value at each of the following discount rates: 0%, 5%, 10%, 15%, 20%, 25%, 30%, 35%. ( Round to the two decimal places)

c. What does your answer to part b tell you about this project's IRR? ( Round to the two decimal places)

d. Should Froogle invest in this project if its cost of capital is 5%? What if the cost of capital is 15%? ( Round to the two decimal places)

e. In general, when faced with a project like this, how should a firm decide whether to invest in the project or reject it? ( Round to the two decimal places)

2. NPV for varying costs of capital LePew Cosmetics is evaluating a new fragrance-mixing machine. The machine requires an initial investment of $320,000 and will generate cash inflows of $61,850 per year for 8 years. If the cost of capital is 13%, calculate the net present value (NPV) and indicate whether to accept or reject the machine.

The NPV of the project is $____________-Round to the nearest cent.)

Will Accept ( YES or NO)

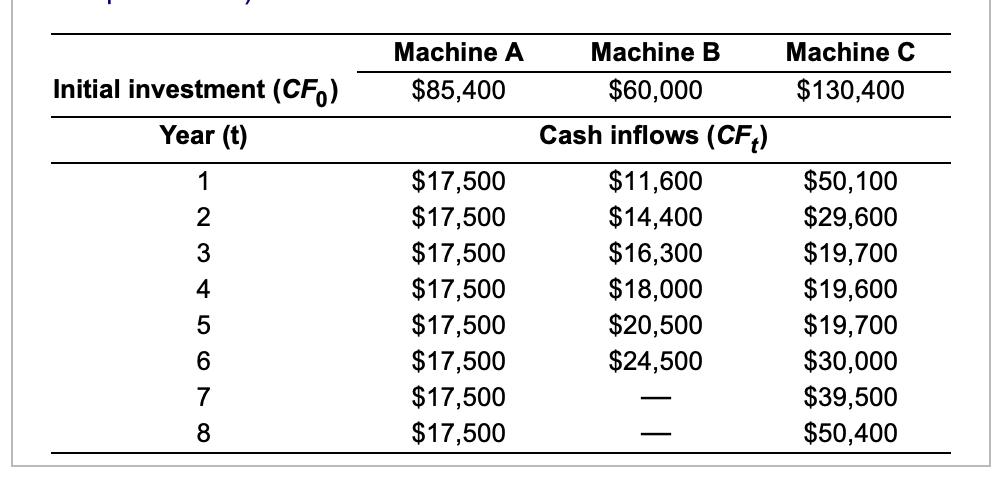

3. NPV—Mutually exclusive projects Hook Industries is considering the replacement of one of its old metal stamping machines. Three alternative replacement machines are under consideration. The cash flows associated with each are shown in the following table:

Calculate the net present value (NPV) of each press. (Round to the two decimal places)

b. Using NPV, evaluate the acceptability of each press. (Round to the two decimal places)

c. Rank the presses from best to worst using NPV. (Round to the two decimal places)

d. Calculate the profitability index (PI) for each press. (Round to the two decimal places)

e. Rank the presses from best to worst using PI. (Round to the two decimal places)

Year 0 1 234 4 Cash flow $190,000 - $874,000 $1,502,900 - $1,144,940 $326,040

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Machine A NPV at 0 discount rate 1734200 NPV at 5 discount rate 145130848 NPV at 10 discount rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started