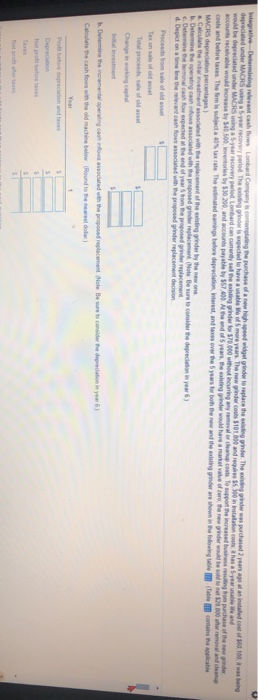

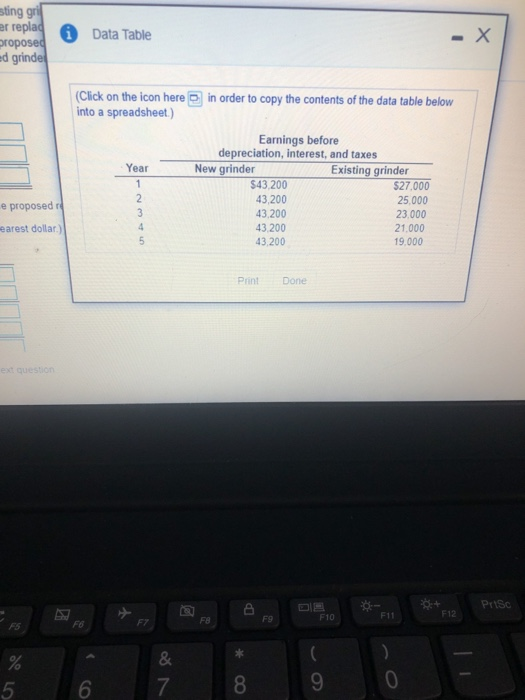

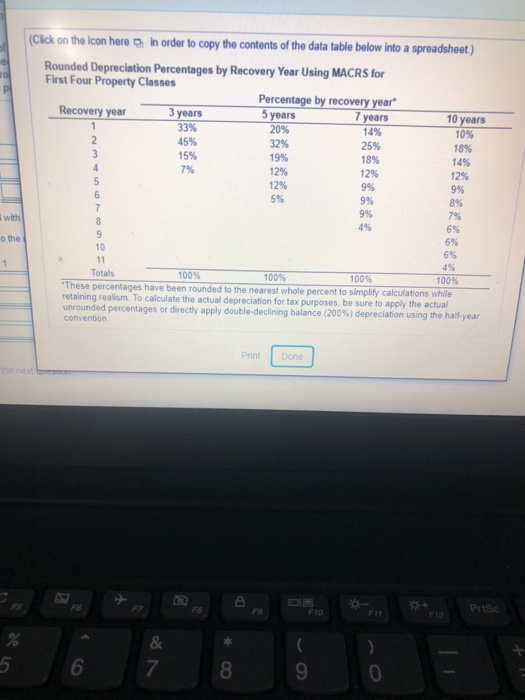

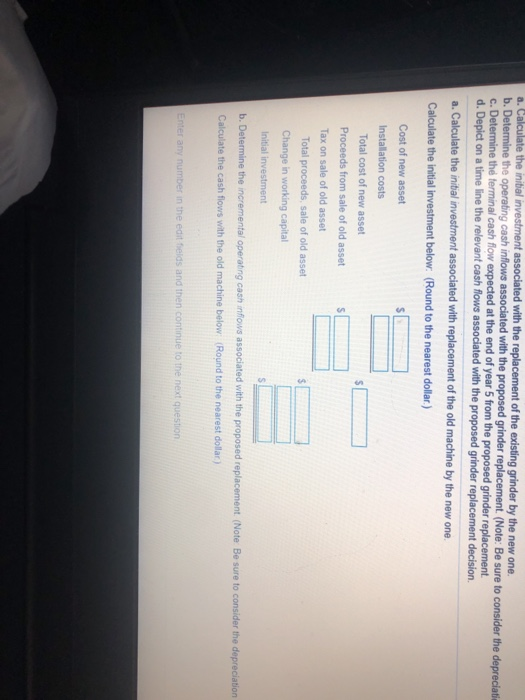

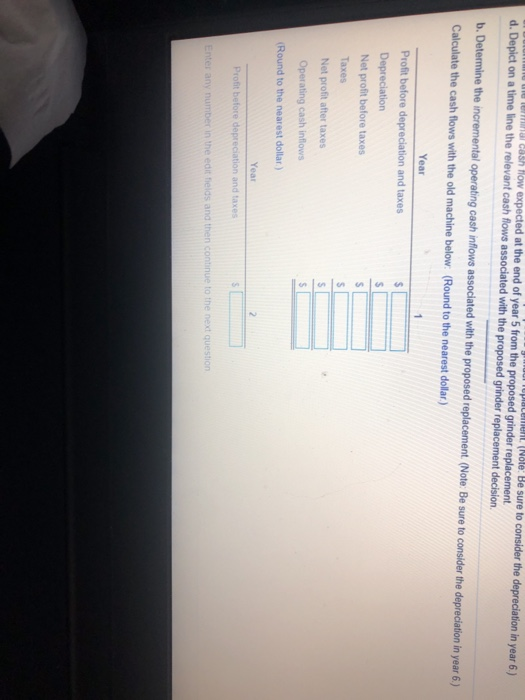

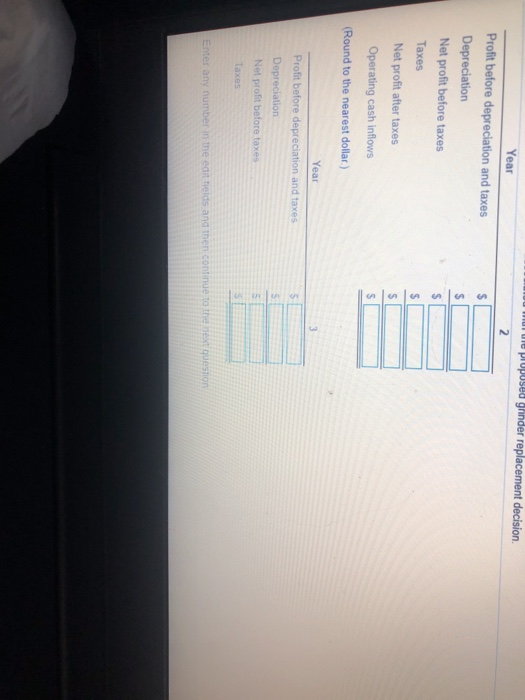

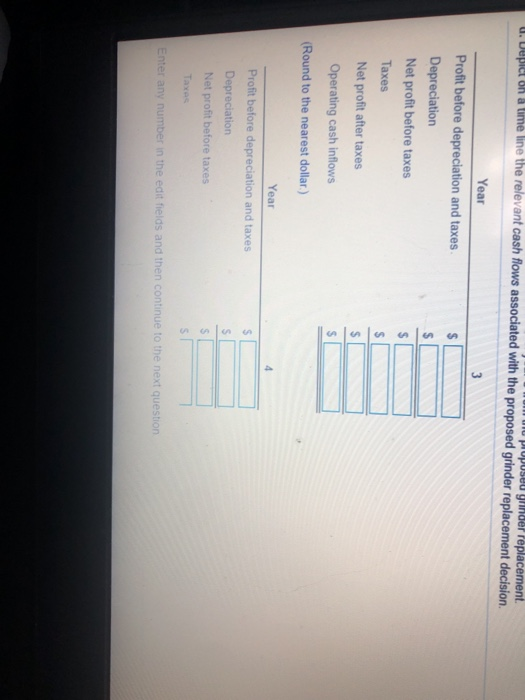

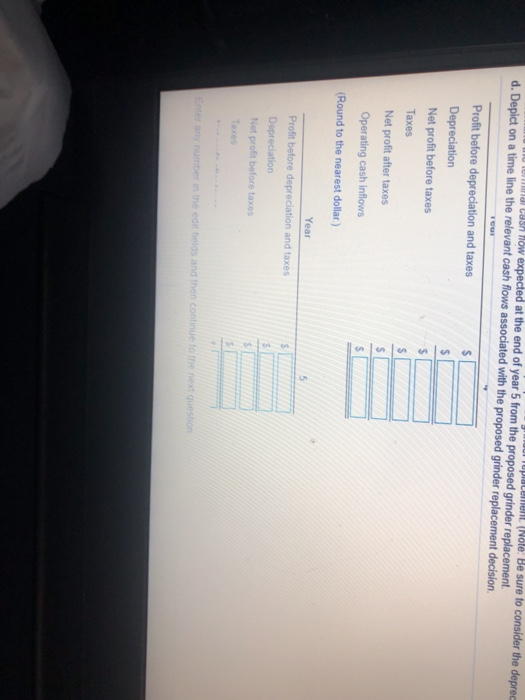

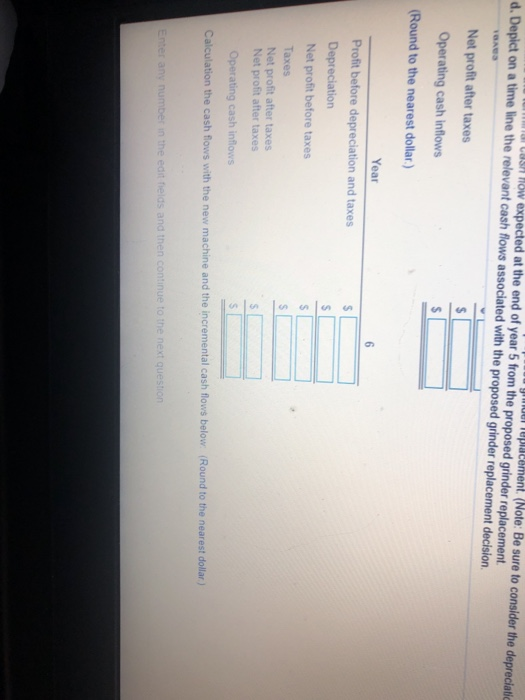

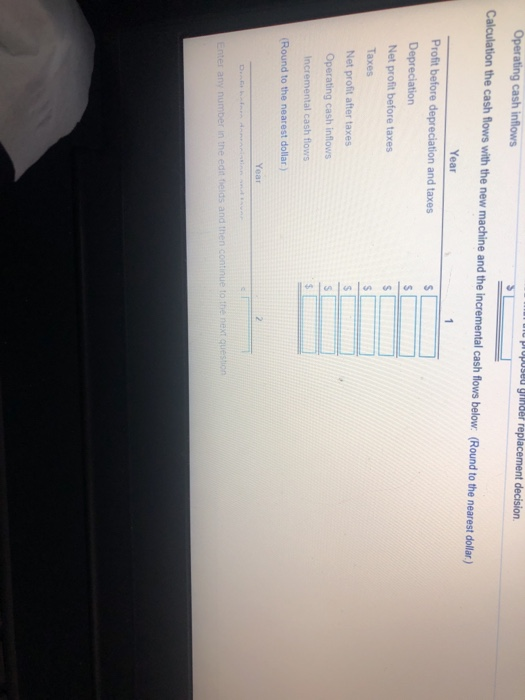

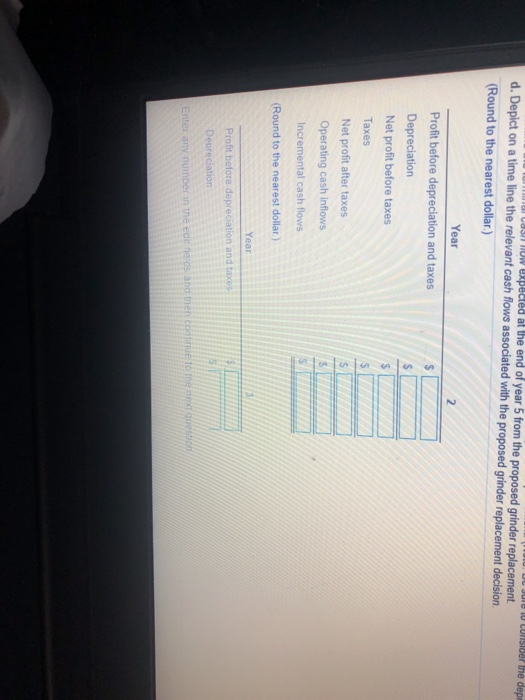

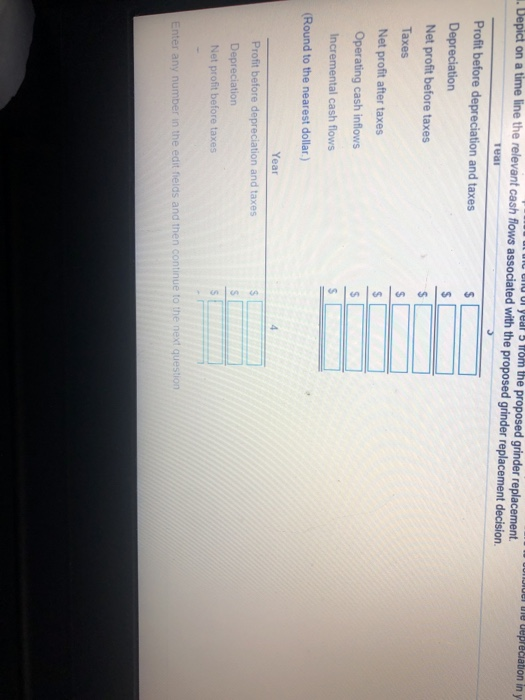

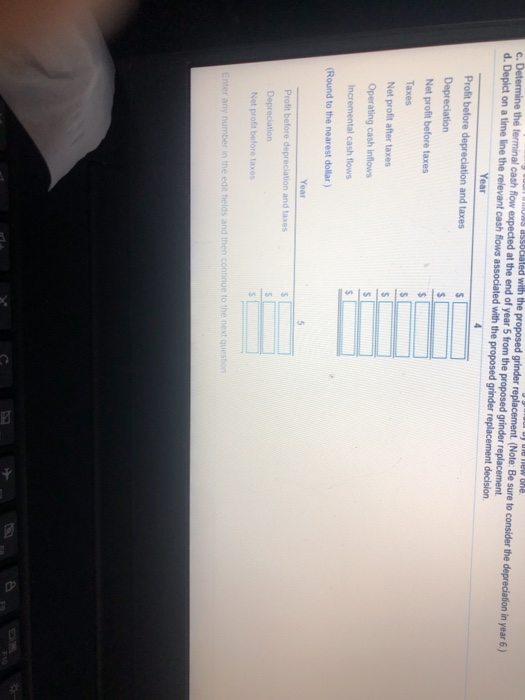

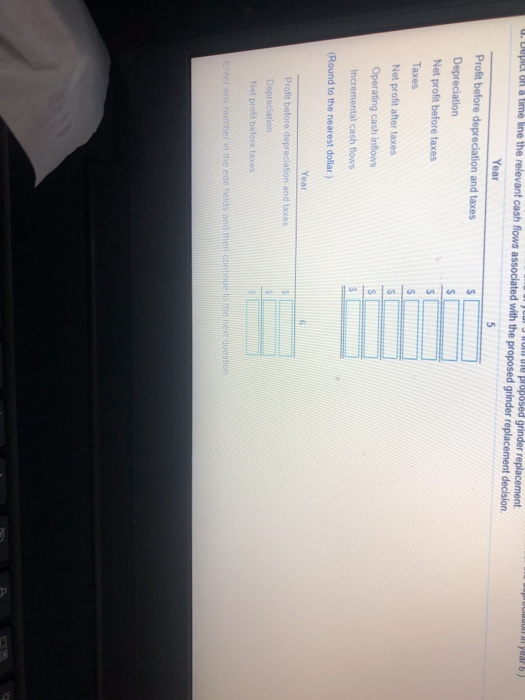

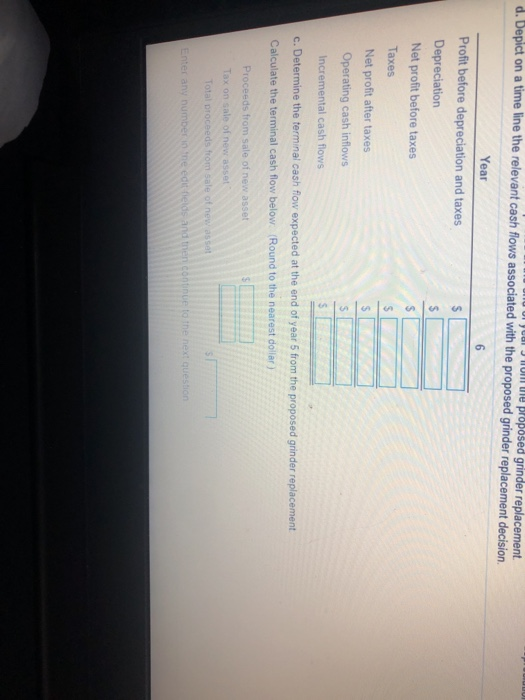

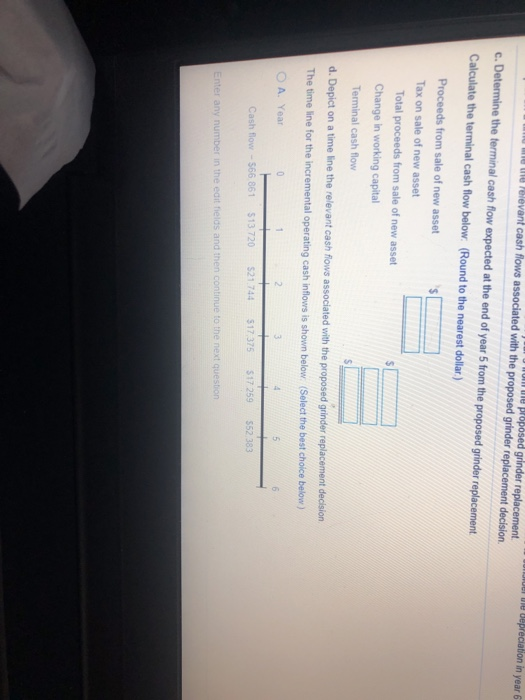

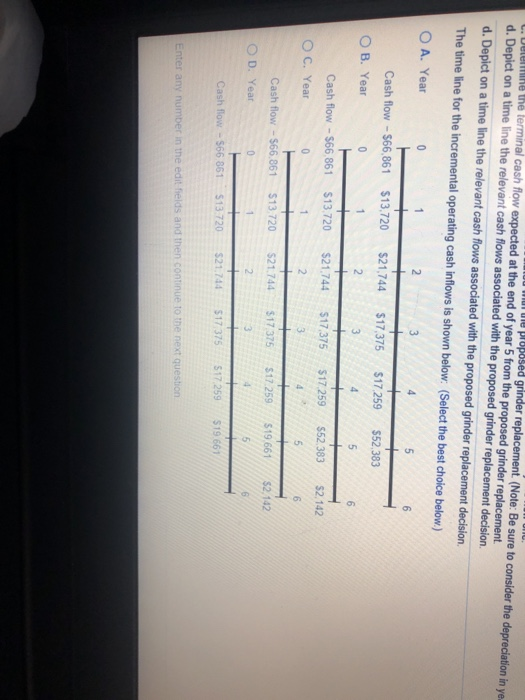

Integrative Ostermining relevant cash flow mbard Company is coming the purchase of a new high speed wilgot grinder to replace the wine grinder The waiting grinder was purchased 2 years ago at an installed cost of 0.100 was being deprecated under MACRS using a 5-year cyperiod. The winner is expected to have a sale of more years. The new grinder costs 10000 and 55.300 in installation cost has a year alle and would be deprecated under MACRS using as your recovery period. Lombard can content of the waiting grinder for 570.000 without incurring any removal or clean come to oport the increased the resulting from purchase of the new gider counts recevable would increase by S500 nors by 530 200, and its payable by 57.400 At the end of years, the existing rider would have a marital of the rende would be sold to 100 after one and dance couts and before tases. The firm is what the imated carings before depreciation test and taxes over the years for both the new and the existing prinder are shown in the flowing we (Taman The applicat MACRS depreciation percentages Calculate the internet sted with the replacement of the wasting gider by the new one b. Detin e persing cash flow scaled with the proposed under replacement. Not Be sure to consider the depreciation in year 6) c. Determine the final chow expected at the end of years from the proposed grinder replacement d. Depict on a time in the relevant confowed with the proposed grinder replacement decision Proces rose of old Total proceeds of Change is working capital b. Din the incrementering cash flows cated with the proposed replacement Not Be sure to consider the direction in year 6) Calculate the cash flows the machine bow Round to the Year S 5 3 5 Net sting grill er replad proposed ed grinde 0 Data Table - X (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Earnings before depreciation, interest, and taxes Year New grinder Existing grinder $43 200 $27,000 43,200 25,000 3 43,200 23.000 43.200 21.000 43,200 19.000 1 2 e proposed earest dollar) 4 5 Print Done ext question Prisc + P F9 F10 F11 F12 F8 F8 F7 & 7 5 6 8 9 0 10 years (Click on the Icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for TO First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 33% 20% 2 14% 10% 45% 32% 25% 3 15% 18% 19% 18% 4 14% 7% 12% 12% 5 12% 12% 9% 6 9% 5% 7 8% I with 9% 8 6% o the 9 10 6% 6% 1 11 49 Totals 100% 100% 100% "These percentages have been rounded to the nearest whole percent to simplify calculations while 1009 retaining realism to calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance 200%) depreciation using the half year convention 9% 79 Print Done F8 FIO FIT Peso % & * 8 6 7 9 0 a. Calculate the initial investment associated with the replacement of the existing grinder by the new one. b. Determine the operating cash inflows associated with the proposed grinder replacement. (Note: Be sure to consider the depreciati c. Determine the terminal cash flow expected at the end of year 5 from the proposed grinder replacement. d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision a. Calculate the initial investment associated with replacement of the old machine by the new one. Calculate the initial investment below: (Round to the nearest dollar.) Cost of new asset Installation costs Total cost of new asset Proceeds from sale of old asset Tax on sale of old asset Total proceeds, sale of old asset Change in working capital $ Initial investment s b. Determine the incremental operating cash inflows associated with the proposed replacement (Note: Be sure to consider the depreciation Calculate the cash flows with the old machine below (Round to the nearest dollar) Enter any number in the edit fields and then continue to the next question A cash flow expected at the end of year 5 from the proposed grinder replacement Lement (Note: Be sure to consider the depreciation in year 6.) d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision b. Determine the incremental operating cash inflows associated with the proposed replacement. (Note: Be sure to consider the depreciation in year 6.) Calculate the cash flows with the old machine below: (Round to the nearest dollar) Year Profit before depreciation and taxes Depreciation Net profit before taxes 1 $ S s Taxes S Net profit after taxes Operating cash inflows $ (Round to the nearest dollar) Year Profit before depreciation and taxes Enter any number in the edit fields and then continue to the next question Nu ne propused grinder replacement decision. 2 Year Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows (Round to the nearest dollar) I en lan nlanan S Year Profit before depreciation and taxes Depreciation Net profit before taxes Taxes 5 Enter any number in the edit fields and then continue to the next question puseu ynndel ieplacement. U. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision. 3 $ Year Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows (Round to the nearest dollar) Year S Profit before depreciation and taxes Depreciation Net profit before taxes Taxes $ S Enter any number in the edit fields and then continue to the next question Ident (Note: Be sure to consider the deprec Hacas, now expected at the end of year 5 from the proposed grinder replacement d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision. TE $ s $ Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows (Round to the nearest dollar.) $ $ Year 5 $ Profit before depreciation and taxes Depreciation Net profit before taxes numberedelds and then continue to the next question 1001 Teplacement. (Note: Be sure to consider the depreciatic USA now expected at the end of year 5 from the proposed grinder replacement d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision TOARD Net profit after taxes Operating cash inflows (Round to the nearest dollar.) CA S Year Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Net profit after taxes Operating cash inflows s S Calculation the cash flows with the new machine and the incremental cash flows below. Round to the nearest dollar) Enter any number in the edit helds and then continue to the next question propuse yinder replacement decision. Operating cash inflows Calculation the cash flows with the new machine and the incremental cash flows below. (Round to the nearest dollar) S s Year Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows Incremental cash flows S $ $ $ $ (Round to the nearest dollar) Year 2 Enter any number in the edit Delds and then continue to the next question le consider the dep CON NOW expected at the end of year 5 from the proposed grinder replacement. d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision (Round to the nearest dollar.) $ $ Year Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows 5 S $ Incremental cash flows (Round to the nearest dollar) Year Profit before depreciation and taxes Depreciation Enter any number in the edit fields and then continue to the next questo Une vie vepreciation in y 1.Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision. 10 l year rom the proposed grinder replacement. TEA Profit before depreciation and taxes s Depreciation $ Net profit before taxes Taxes $ Net profit after taxes Operating cash inflows $ Incremental cash flows $ (Round to the nearest dollar) GA Year 4 $ Profit before depreciation and taxes Depreciation Net profit before taxes S $ Enter any number in the edit fields and then continue to the next question new one Ussociated with the proposed grinder replacement. (Note: Be sure to consider the depreciation in year 6.) c. Determine the terminal cash flow expected at the end of year 5 from the proposed grinder replacement d. Depict on a timeline the relevant cash flows associated with the proposed grinder replacement decision Year Profit before depreciation and taxes $ Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows $ Incremental cash flows $ $ $ s $ (Round to the nearest dollar) $ Year Profit before depreciation and taxes Depreciation Net profit before taxes s 5 Enter any number in the edit hields and then continue to the next question year b.) S U. Lepid on & Lime line the relevant cash flows associated with the proposed grinder replacement decision, No te proposed grinder replacement Year 5 Profit before depreciation and taxes $ Depreciation Net profit before taxes $ Taxes Net profit after taxes Operating cash inflows Incremental cash flows onun S (Round to the nearest dollar Year 6 Profit before depreciation and taxes Depreciation Net profit before taxes 5 Enter any number in the eduelds and then con 6 d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision JUHI Joll de proposed grinder replacement Year Profit before depreciation and taxes s Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows Incremental cash flows c. Determine the terminal cash flow expected at the end of year 5 from the proposed grinder replacement S Calculate the terminal cash flow below. Round to the nearest dollar Proceeds from sale of new asset Tax on sale of now asset Total proceeds from sale of new asset Enter any number in the edit beds and then continue to the next question vel e bepreciation in year 6 Tule proposed grinder replacement. Toto Yesevant cash flows associated with the proposed grinder replacement decision c. Determine the terminal cash flow expected at the end of year 5 from the proposed grinder replacement Calculate the terminal cash flow below. (Round to the nearest dollar) S Proceeds from sale of new asset Tax on sale of new asset Total proceeds from sale of new asset Change in working capital Terminal cash flow d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision The time line for the incremental operating cash inflows is shown below. (Select the best choice below) $ A Year 0 5 G Cash flow - 566 861 513 720 $21.744 517 375 517259 552 383 Enter any number in the edit felds and then continue to the next question proposed grinder replacement. (Note: Be sure to consider the depreciation in ye. L. Determine the terminal cash flow expected at the end of year 5 from the proposed grinder replacement d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision. The time line for the incremental operating cash inflows is shown below: (Select the best choice below.) O A. Year 0 2 3 4 5 6 Cash flow - $66.861 $13.720 $21.744 $17,375 $17259 $52.383 OB. Year 0 2 3 4 5 6 Cash flow - $66 861 $13.720 $21.744 $17.375 $17 259 $52.383 $2.142 O C. Year 0 1 2 3 5 6 Cash flow - $66.861 $13.720 $21.744 $17375 $17.259 S19661 $2.142 OD. Year 0 2 6 Cash flow - 566 861 513 720 $21,714 $17375 517259 $19.661 Enter any number in the edit fields and then continue to the next