Answered step by step

Verified Expert Solution

Question

1 Approved Answer

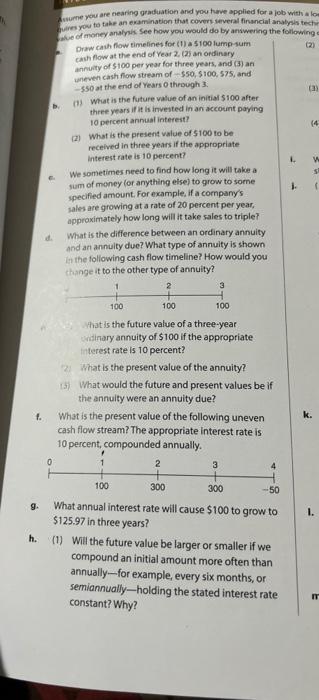

integrative problem wheh fouw timellines for it) a 5100 hamp sum Sin tow at the end of War 2 (2) an ordinary Mevert cath flow

integrative problem

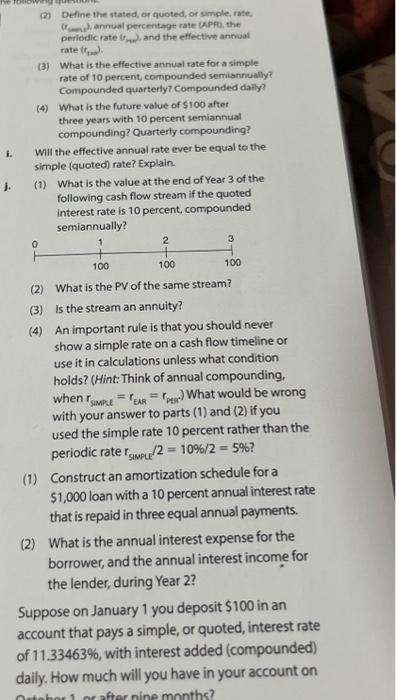

wheh fouw timellines for it) a 5100 hamp sum Sin tow at the end of War 2 (2) an ordinary Mevert cath flow atream of - 530,5100 s. 5 , and 5s0 at the end of vears o through 2 . 575 , and 2.) What is the future value of art initial 5100 after three years if it is invested in an account paying to percent annual interest? 2) What is the present value of $100 to be recrived in three years if the appropriate interest rate is 10 percent? e. We sometimes need to find how long it will take a wum of money for arything else) to grow to some specified amount. For example, if a company's sales are growing at a rate of 20 percent per yeac, approximately how long will it take sales to triple? What is the difference between an ordinary annuity and an annuity due? What type of annuity is shown in the following cash flow timeline? How would you change it to the other type of annuity? (1) What is the future value of a three-year ordinary annuity of $100 if the appropriate interest rate is 10 percent? 2) What is the present value of the annulty? What would the future and present values be if the annuity were an annuity due? at is the present value of the following uneven hlow stream? The appropriate interest rate is ercent, compounded annually. nnual interest rate will cause $100 to grow to in three years? the future value be larger or smaller if we pound an initial amount more often than dally-for example, every six months, or andialy-holding the stated interest rate ant? Why? (ir D, annual percentage rate (APF), the periodic rate i rma) and the effective annual rate (rian). (3) What is the effective annual rate for a simple Whate of 10 percent, compounded semiannually? Compounded quarterly? Compounded dally? (4) What is the future value of 5100 after What is the future value of 100 after compounding? Quarterly compounding? 1. Will the effective annual rate ever be equal to the simple (quoted) rate? Explain. i. (1) What is the value at the end of Year 3 of the following cash flow stream if the quoted interest rate is 10 percent, compounded comiannually? (2) What is the PV of the same stream? (B) Is the stream an annuity? (4) An important rule is that you should never show a simple rate on a cash flow timeline or use it in calculations unless what condition holds? (Hint: Think of annual compounding. when rsape=rear=rprN. What would be wrong with your answer to parts (1) and (2) if you used the simple rate 10 percent rather than the periodic rate rsamu/2=10%/2=5% ? k. (1) Construct an amortization schedule for a $1,000 loan with a 10 percent annual interest rate that is repaid in three equal annual payments. (2) What is the annual interest expense for the borrower, and the annual interest income for the lender, during Year 2? 1. Suppose on danuary 1 you deposit $100 in an account that pays a simple, or quoted, interest rate of 1133463%, with interest added (compounded) dally. How much will you have in your account on October 1, or after nine months? m. Now suppose you leave your money in the bank for 21 months. Thus, on January 1 you deposit Pusume you are nearing graduation and you turve applied for a job with guires you to take an examination that covern several firmecial anabyes te gue of money analysis see how you would do by answering the followis Draw cayh fow timelines for (1) a 5100 lump- sum cash flow at the end of Year 2 . (21) an ondinary) anminty of 5100 per year for three years, and (3) an uneven cash fow stream of 550,5100,575, and -550 at the end of Years 0 throogh 3 . b. (1) What is the future value of an initial $100 after three years if it is inveited in an account poying 10 percent annual interest? (2) What is the present value of 5100 to be received in three years if the appropriate interest rate is 10 percent? c. We sometimes need to find how long it will take a sum of meney (or anything ejse) to grow to some specified amount. For example. if a company's sales are growing at a rate of 20 percent per year. approximately how long will it take sales to triple? d. What is the difference between an ordinary annuity and an annuity due? What type of annuity is shown It the following cash flow timeline? How would you thange it to the other type of annuity? What is the future value of a three-year visinary annuity of $100 if the appropriate terest rate is 10 percent? 24. What is the present value of the annuity? 13) What would the future and present values be if the annuity were an annuity due? f. What is the present value of the following uneven cash flow stream? The appropriate interest rate is 10 percent, compounded annually. g. What annual interest rate will cause $100 to grow to $125.97 in three years? h. (1) Will the future value be larger or smaller if we compound an initial amount more often than annually-for example, every six months, or semiannually-holding the stated interest rate constant? Why? (2) Define the stated, or quoted, or sumple, rate. (r1q1), annual percentage rate UAPf, the periodic rate (tm+2), and the effective anmaal rate (r1+ap). (3) What is the effective annual rate for a simple rate of 10 percent, compounded semiannually? Compounded quarterly? Compounded dally? (4) What is the future value of $100 after three years with 10 percent semiannual compounding? Quarterly compounding? i. Will the effective annual rate ever be equal to the simple (quoted) rate? Explain. j. (1) What is the value at the end of Year 3 of the following cash flow stream if the quoted interest rate is 10 percent, compounded semiannually? (2) What is the PV of the same stream? (3) Is the stream an annuity? (4) An important rule is that you should never show a simple rate on a cash flow timeline or use it in calculations unless what condition holds? (Hint: Think of annual compounding, when rsimput=rEAR=rpset) What would be wrong with your answer to parts (1) and (2) if you used the simple rate 10 percent rather than the periodic rate rsimpue/2=10%/2=5% ? (1) Construct an amortization schedule for a $1,000 loan with a 10 percent annual interest rate that is repaid in three equal annual payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started