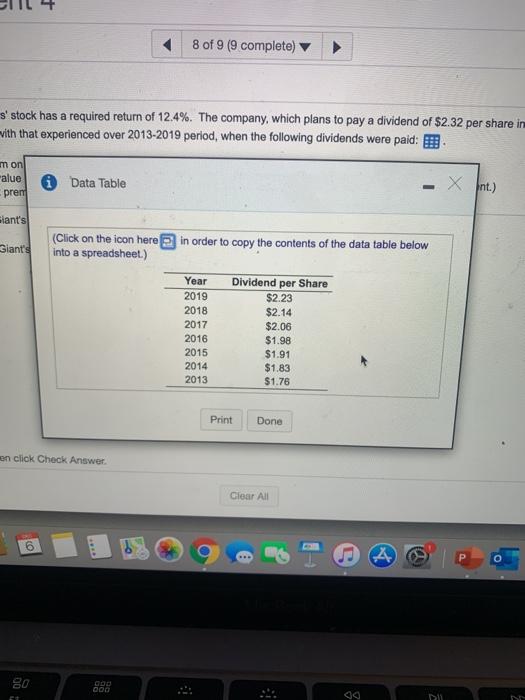

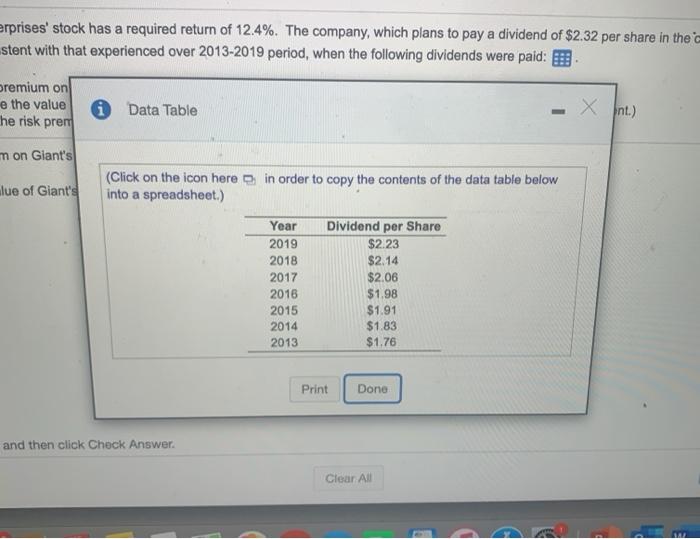

Integrative Rise and valuation and Etos are the boy w plans to pay the show, vino in se on ihan 2017010 www Imam on b. We constant role of Hound the cover c. Es what we are determm when the the premium on koond to ne id) . Un contre growth more the west Mount to the rear ) Destion Help Integrative-Risk and valuation Giant Enterprises stock has a required rotum of 124%. The company, which plans to pay a hudondo 52.32 per share in the coming year cutes that its future dividends will increase at an annual rate consistent with that provet 2015-2019 period when the following dividends were paid a. I thank from what is the premium on Giants stock? 1. Using the constant growth molestimate the value of Giants lock Hint Round the come dividend growth rate to the rest whole percent 6. Explain what effectif any, a decrease in the premium would have on the value of Stock the tree them on socks 1.4 (found to one fecimale) Uthe 8 of 9 (9 complete) s' stock has a required return of 12.4%. The company, which plans to pay a dividend of $2.32 per share in with that experienced over 2013-2019 period, when the following dividends were paid: mon alue prent Data Table X Int.) ant's Giant's (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year Dividend per Share 2019 $2.23 2018 $2.14 2017 $2.06 2016 $1.98 2015 $1.91 2014 $1.83 2013 $1.76 Print Done en click Check Answer Clear All 6 A P o 80 000 D P7-23 (similar to) Question Heb Integrative Risk and valuation Game Enterprises stock has a required return of 124%. The company, which plans to pay a dividend of 232 per share in the coming yeac anticipates that its te dividends will increase at an annual rate consistent with that experienced over 2015-2019 period, when the following dividends were paid m 2. If the risk-free rate is 4% what is the risk premium on Giants took? b. Using the constant growth model, estimate the value of Glantwock et Round the condividert growth rate to the natural whole percent) c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giants took At the rlok free rate is 4%, this rok premium on Clonfa tocka (Round so ona decimal place b. Using the constant-grown model the value of Clans ockscreouna 1o the nearest cont.) erprises' stock has a required return of 12.4%. The company, which plans to pay a dividend of $2.32 per share in the stent with that experienced over 2013-2019 period, when the following dividends were paid: E premium on e the value he risk pren 0 Data Table Int.) mon Giant's lue of Giants (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year Dividend per Share 2019 $2.23 2018 $2.14 2017 $2.06 2016 $1.98 2015 $1.91 2014 $1.83 2013 $1.76 Print Done and then click Check Answer. Clear All