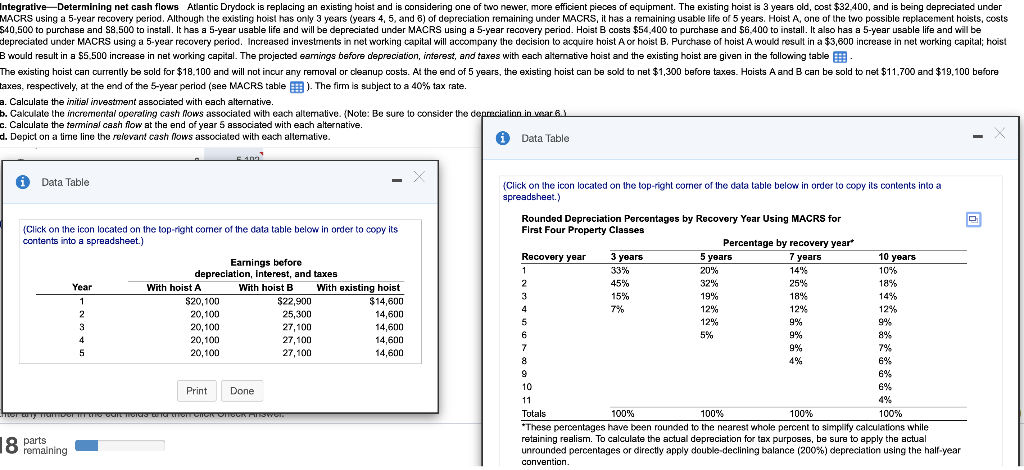

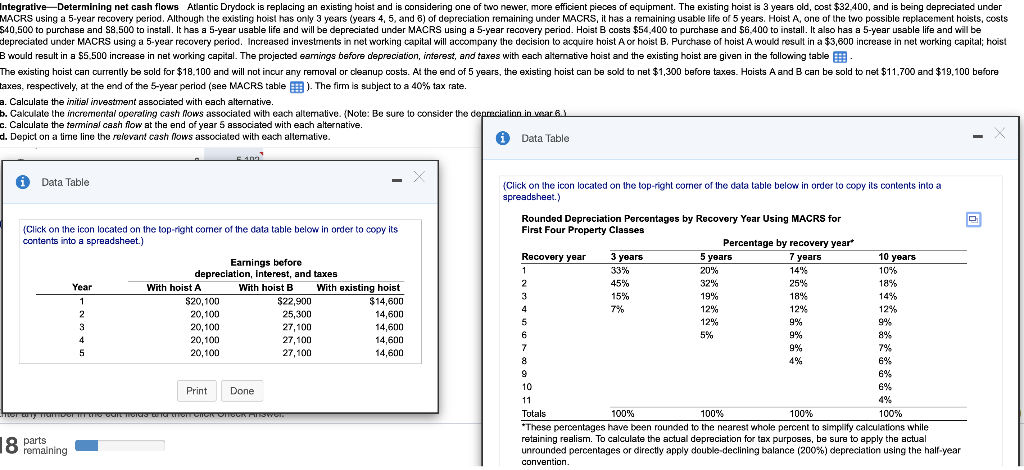

Integrative-Determining net cash flows Atlantic Drydock is replacing an existing hoist and is considering one of two newer, more efficient pieces of equipment. The existing hoist is 3 years old, cost $32,400, and is being depreciated under MACRS using a 5-year recovery period. Although the existing hoist has only 3 years (years 4, 5, and 6) of depreciation remaining under MACRS, it has a remaining usable life of 5 years. Hoist A, one of the two possible replacement hoists, costs $40,500 to purchase and S8.500 to install. It has a 5-year usable life and will be depreciated under MACRS using a 5-year recovery period. Hoist B costs $54,400 to purchase and $6,400 to install. It also has a 5-year usable life and will be depreciated under MACRS using a 5-year recovery period. Increased investments in net working capital will accompany the decision to acquire hoist A or hoist B. Purchase of hoist A would result in a $3,600 increase in net working capital; hoist B would result in a $5,500 increase in net working capital. The projected earnings before depreciation, interest, and taxes with each alternative hoist and the existing hoist are given in the following table B The existing hoist can currently be sold for $18.100 and will not incur any removal or cleanup costs. At the end of 5 years, the existing hoist can be sold to net $1,300 before taxes. Hoists A and B can be sold to net $11,700 and $19,100 before taxes, respectively, at the end of the 5-year period (see MACRS table). The firm is subject to a 40% tax rate. a. Calculate the initial investment associated with each alternative. b. Calculate the incremental oporaling cash flows associated with each altemalive. (Note: Be sure to consider the depreciation in wear 5.) c. Calculate the terminal cash flow at the end of year 5 associated with each alternative. d. Depict on a time line the relevant cash flows associated with each alterative. i Data Table ELINA i Data Table (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Year 1 2 3 3 4 5 5 Earnings before depreciation, Interest, and taxes With hoist A With hoist B With existing hoist $20,100 $22,900 $14,600 20,100 25,300 14,600 20,100 27,100 14,600 20,100 27,100 14,600 20,100 27,100 14,600 5% Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 2546 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 9% 7 7 9% 8 4% 6% 6% 6% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention Print Done TUOTTY TICIITIDOTTI ITU UCITE TIGION CONTACTO TONICI OTOCITY OPORT 8 parts remaining