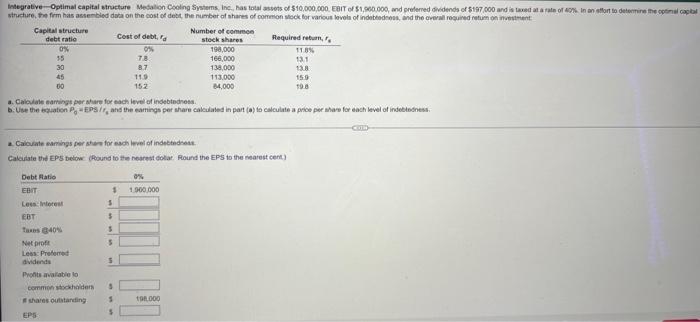

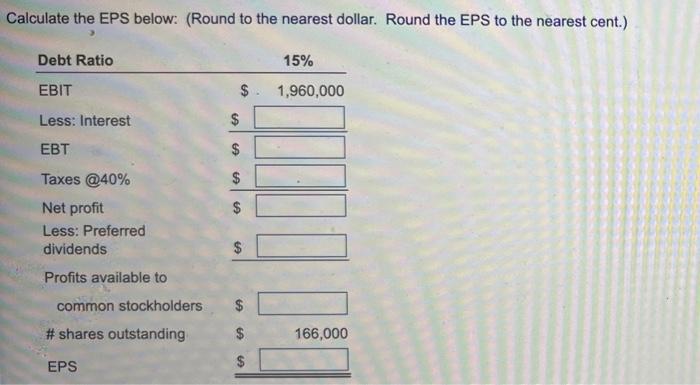

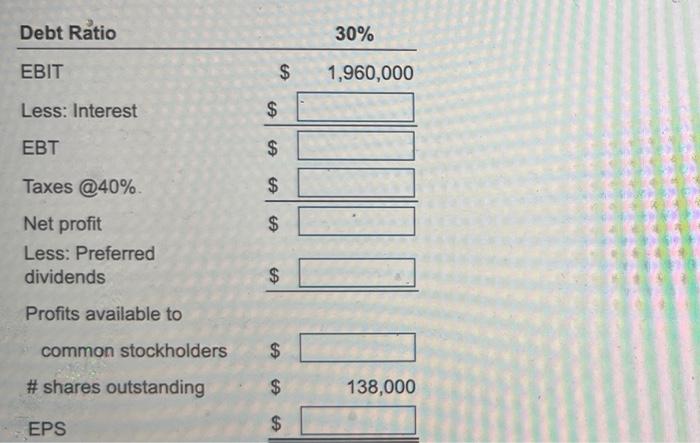

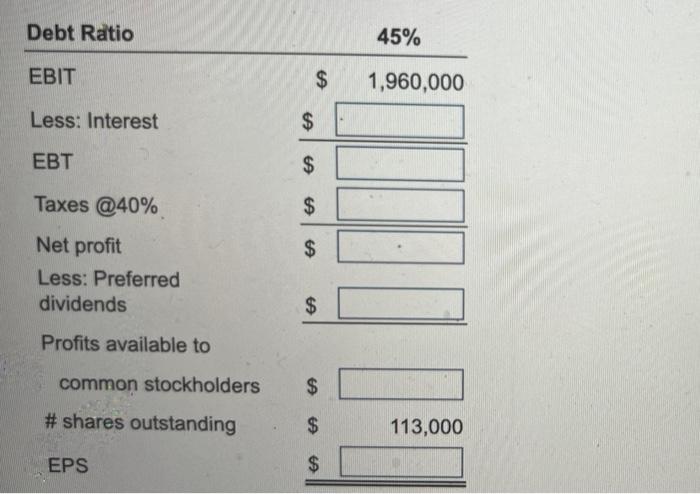

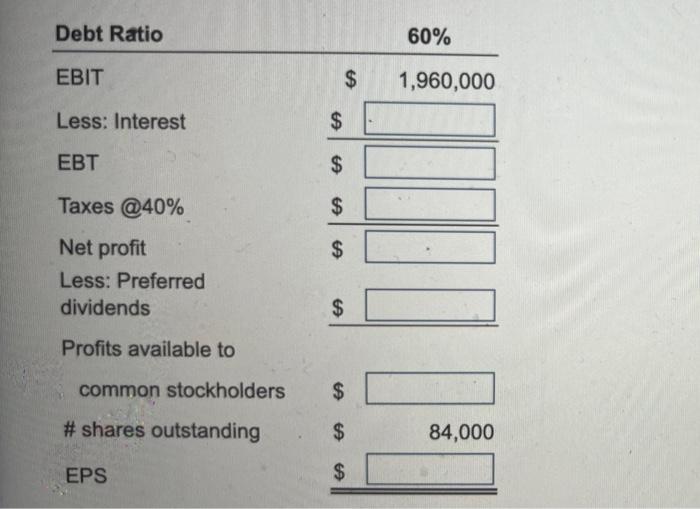

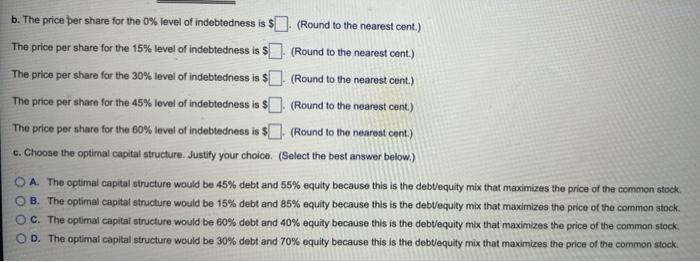

Integrative-Optimal capital structure Medalion Cooling Systems, Inc., has total assets of $10,000,000 EDIT $1,600.000, and preferred vidends of $197.000 and is taxed at a rate of 40%. In an effort to determine the optical structure, the firm has assembled data on the cost of debt, the number of shares of common stock for various levels of indebtedness, and the valued return on investment Capital structure Number of common debt ratio Cost of debt, stock shares Required retur, 0% 0% 199,000 11.8% 35 78 166,000 13.1 30 8.7 138,000 138 119 113.000 159 00 152 24,000 198 a. Calculate arrings per share for each level of indebtednos b. Use the equation PEPSIT, and the cominge per share calculated in part(s) to calculate a price per here for each level of indebtedness COD Calcate amings per tre for each level of indettdress Calculated EPS below found to the nearest colar Round the EPS to the nearest cent) Debt Ratio 0% EBIT 1 1 900.000 Lorses $ EBT $ Taxes 404 Netpro 5 Les Preferred dividende 5 Profits available 10 common stockholders 5 shares outstanding 5 000 $ EPS Calculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest cent.) Debt Ratio 15% EBIT $ 1,960,000 Less: Interest $ EBT $ $ Taxes @40% Net profit Less: Preferred dividends $ $ Profits available to 10 $ common stockholders # shares outstanding 166,000 EPS $ Debt Ratio 30% EBIT $ 1,960,000 Less: Interest . $ EBT $ Taxes @40% $ $ |e $ Net profit Less: Preferred dividends $ $ Profits available to common stockholders $ # shares outstanding $ 138,000 EPS $ Debt Ratio 45% EBIT $ 1,960,000 Less: Interest $ EBT $ Taxes @40% $ A A $ Net profit Less: Preferred dividends $ Profits available to common stockholders $ # shares outstanding $ 113,000 EPS $ Debt Ratio 60% EBIT $ 1,960,000 Less: Interest $ EBT $ $ $ Taxes @40% $ Net profit Less: Preferred dividends $ Profits available to common stockholders $ # shares outstanding $ 84,000 EPS $ (Round to the nearest cent.) b. The price per share for the 0% level of indebtedness is $. (Round to the nearest cent.) The price per share for the 15% level of indebtedness is $. (Round to the nearest cent.) The price per share for the 30% level of indebtedness is $ The price per share for the 45% level of indebtedness is $(Round to the nearest cent.) The price per share for the 60% level of indebtedness is $. (Round to the nearest cont.) c. Choose the optimal capital structure. Justify your choice. (Select the best answer below.) O A The optimal capital structure would be 45% debt and 55% equity because this is the debt/equity mix that maximizes the price of the common stock B. The optimal capital structure would be 15% debt and 85% equity because this is the debtequity mix that maximizes the price of the common stock C. The optimal capital structure would be 60% debt and 40% equity because this is the debt/equity mix that maximizes the price of the common stock OD. The optimal capital structure would be 30% debt and 70% equity because this is the debt/equity mix that maximizes the price of the common stock