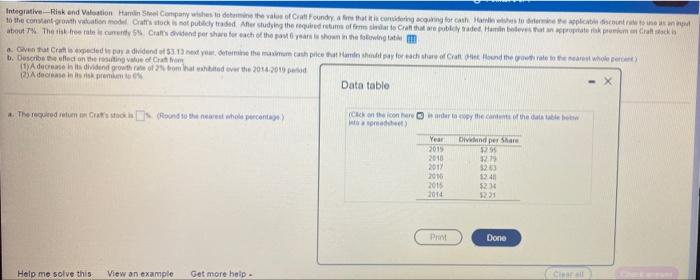

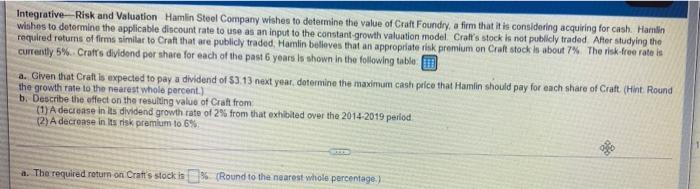

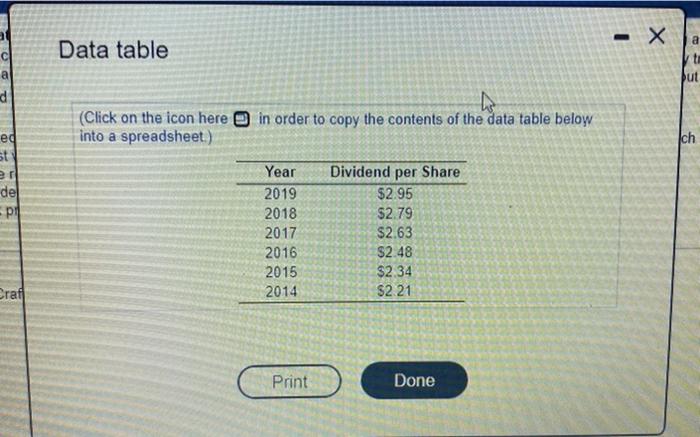

Integrative-Risk and lotion Hantin Steel Company wishes to determine the value of Cat Foundry for that it cering ring for the topics to the constant growth in Crock is played her studying the retums of Caltha puble det. Hun blevet propter Crash about the trees Crafts dividend per share for each of the years shown in the following ati Craftedet le doy adhibend $3.13 next you determine the main price and have for each show Cound the series where b. Described on the ring vahe of (1) docenten is dividend growth of omhat we over the 2014-2010 2)Adrens pro Data table The requod tum u Crnoon I (Reino to the newest what percentage) Ck on the content of the cable or Year Dvd per Share 2015 23 2010 2011 120 2013 12:41 2015 $234 2014 2221 Post Dore Help me solve this View an example Get more help Integrative Risk and Valuation Hamlin Steel Company wishes to determine the value of Craft Foundry, a firm that it is considering acquiring for cash. Hamiin wishes to determine the applicable discount rate to use as an input to the constant growth valuation model Cralt's stock is not publicly traded After studying the required returns of firms similar to Craft that are publicly traded, Hamlin believes that an appropriate risk premium on Craft stock is about 7% The risk free rate is Currently 5% Crafts dividend per share for each of the past 6 years is shown in the following table a. Given that Craft is expected to pay a dividend of 53.13 next year, determine the maximum cash price that Hamlin should pay for each share of Craft (Hint Round the growth rate to the nearest whole percent.) b. Describe the effect on the resulting value of Craft from (1) A decrease in its dividend growth rate of 2% from that exhibited over the 2014-2019 period (2) A decrease in its risk premium to 6% a. The required return on Crafts stock is % (Round to the nearest whole percentage.) - X Data table CL a to put d (Click on the icon here into a spreadsheet.) ho in order to copy the contents of the data table beloy ch ed st erl del pill Year 2019 2018 2017 2016 2015 2014 Dividend per Share $2.95 $2.79 $2.63 $2.48 $2.34 $2.21 Prat Print Done