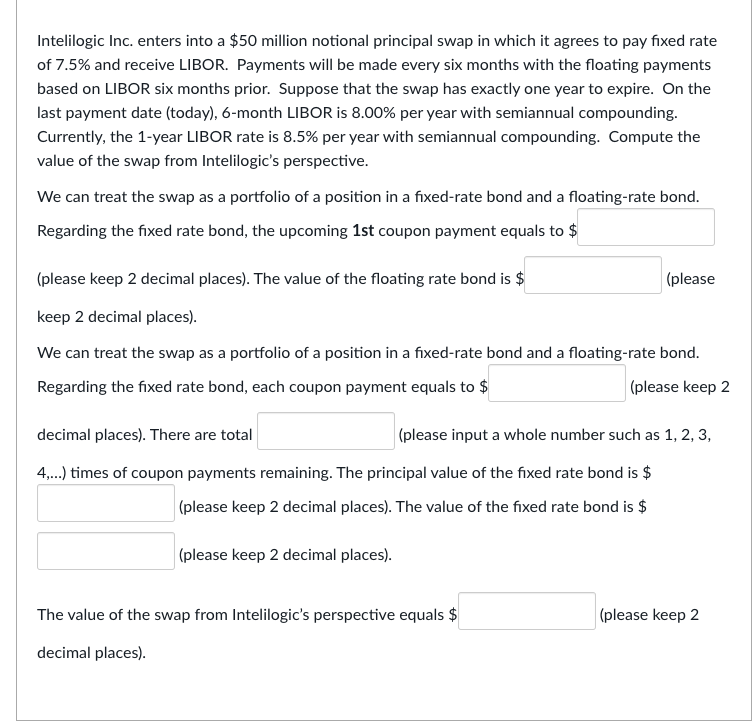

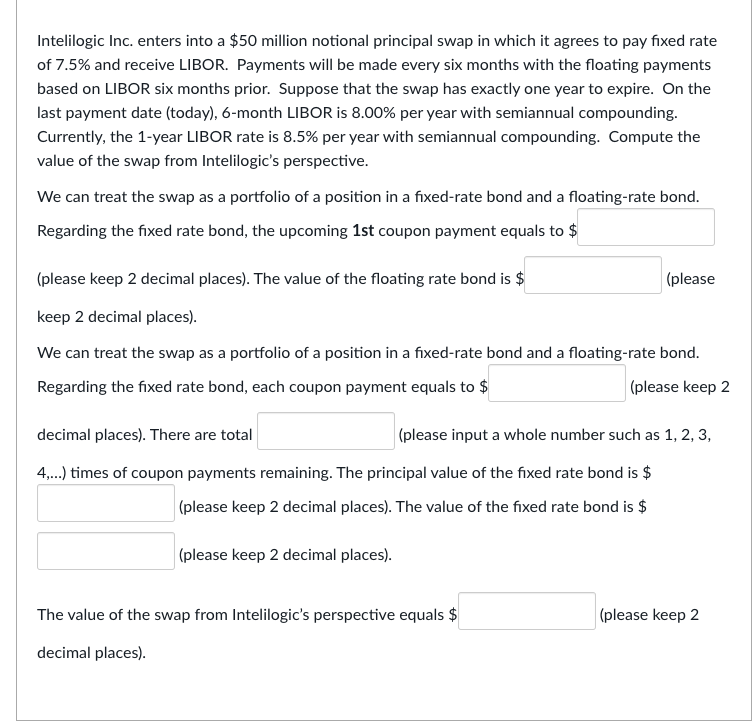

Intelilogic Inc. enters into a $50 million notional principal swap in which it agrees to pay fixed rate of 7.5% and receive LIBOR. Payments will be made every six months with the floating payments based on LIBOR six months prior. Suppose that the swap has exactly one year to expire. On the last payment date (today), 6-month LIBOR is 8.00% per year with semiannual compounding. Currently, the 1-year LIBOR rate is 8.5% per year with semiannual compounding. Compute the value of the swap from Intelilogic's perspective. We can treat the swap as a portfolio of a position in a fixed-rate bond and a floating-rate bond. Regarding the fixed rate bond, the upcoming 1st coupon payment uals to $ (please keep 2 decimal places). The value of the floating rate bond is $ (please keep 2 decimal places). We can treat the swap as a portfolio of a position in a fixed-rate bond and a floating-rate bond. Regarding the fixed rate bond, each coupon payment equals to $ (please keep 2 decimal places). There are total (please input a whole number such as 1, 2, 3, 4....) times of coupon payments remaining. The principal value of the fixed rate bond is $ (please keep 2 decimal places). The value of the fixed rate bond is $ (please keep 2 decimal places). The value of the swap from Intelilogic's perspective equals $ (please keep 2 decimal places). Intelilogic Inc. enters into a $50 million notional principal swap in which it agrees to pay fixed rate of 7.5% and receive LIBOR. Payments will be made every six months with the floating payments based on LIBOR six months prior. Suppose that the swap has exactly one year to expire. On the last payment date (today), 6-month LIBOR is 8.00% per year with semiannual compounding. Currently, the 1-year LIBOR rate is 8.5% per year with semiannual compounding. Compute the value of the swap from Intelilogic's perspective. We can treat the swap as a portfolio of a position in a fixed-rate bond and a floating-rate bond. Regarding the fixed rate bond, the upcoming 1st coupon payment uals to $ (please keep 2 decimal places). The value of the floating rate bond is $ (please keep 2 decimal places). We can treat the swap as a portfolio of a position in a fixed-rate bond and a floating-rate bond. Regarding the fixed rate bond, each coupon payment equals to $ (please keep 2 decimal places). There are total (please input a whole number such as 1, 2, 3, 4....) times of coupon payments remaining. The principal value of the fixed rate bond is $ (please keep 2 decimal places). The value of the fixed rate bond is $ (please keep 2 decimal places). The value of the swap from Intelilogic's perspective equals $ (please keep 2 decimal places)