Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Intelligent Toys, Inc (ITI) is a well establish toys trading company which adopts the periodic system. ITI prepares its financial statements on a monthly basis.

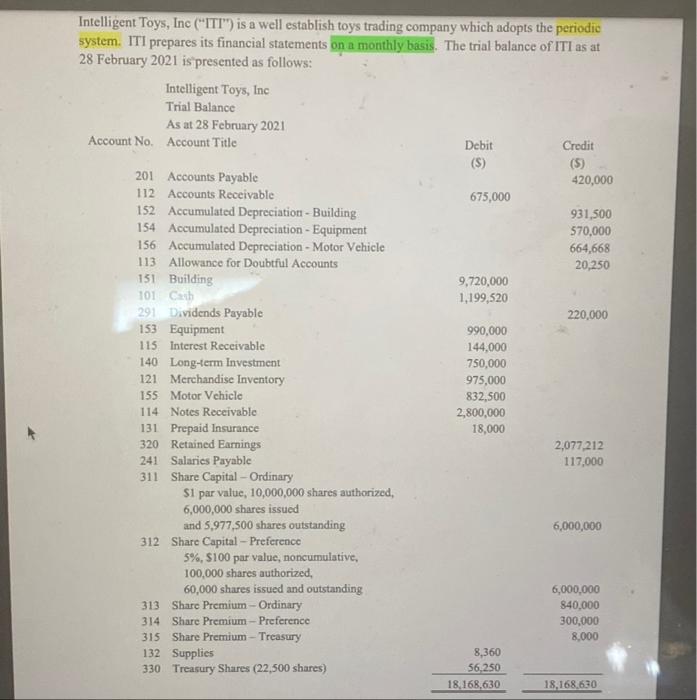

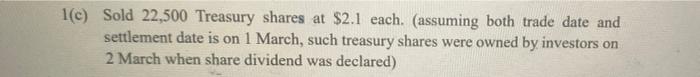

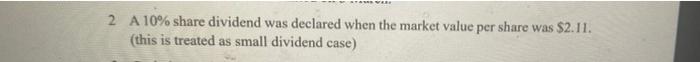

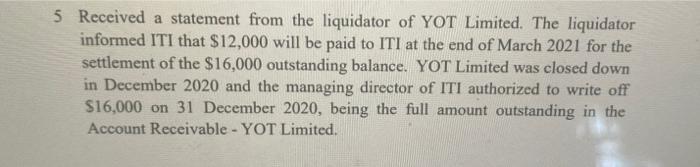

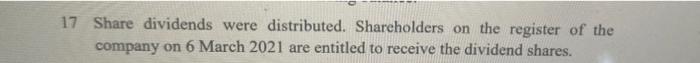

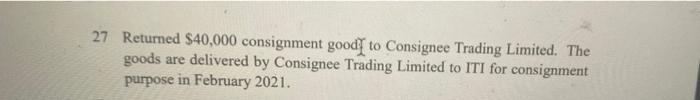

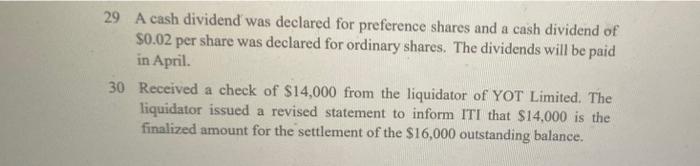

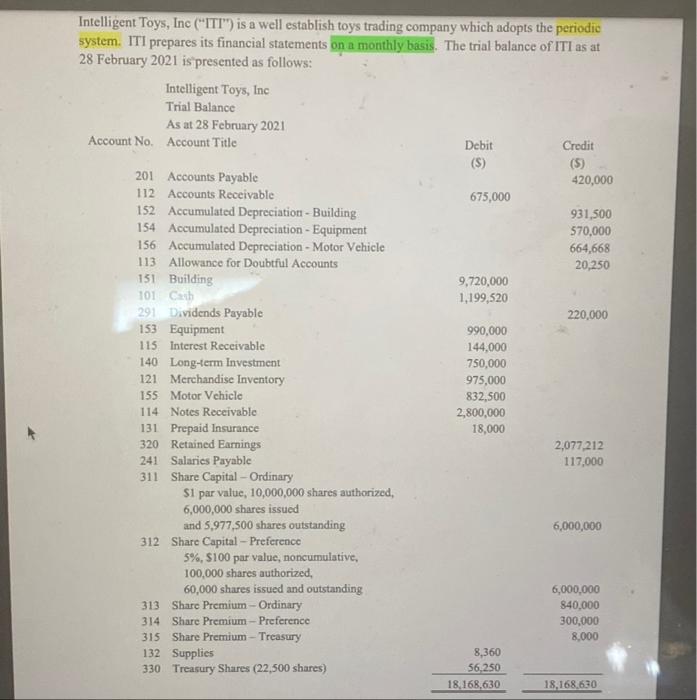

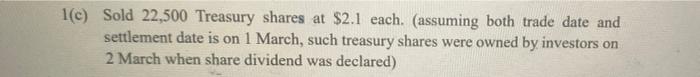

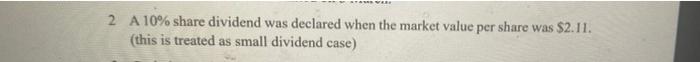

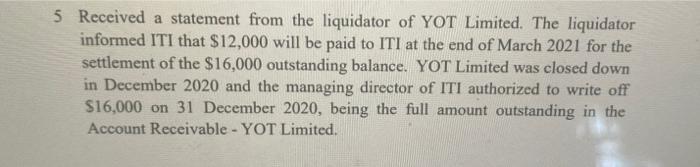

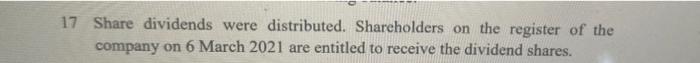

Intelligent Toys, Inc ("ITI") is a well establish toys trading company which adopts the periodic system. ITI prepares its financial statements on a monthly basis. The trial balance of ITI as at 28 February 2021 is presented as follows: Intelligent Toys, Inc Trial Balance As at 28 February 2021 Account No. Account Title Debit Credit (S) (5) 201 Accounts Payable 420,000 112 Accounts Receivable 675,000 152 Accumulated Depreciation - Building 931,500 154 Accumulated Depreciation - Equipment 570,000 156 Accumulated Depreciation - Motor Vehicle 664.668 113 Allowance for Doubtful Accounts 20,250 151 Building 9,720,000 101 C 1,199,520 291 Dividends Payable 220,000 153 Equipment 990,000 115 Interest Receivable 144,000 140 Long-term Investment 750,000 121 Merchandise Inventory 975,000 155 Motor Vehicle 832,500 114 Notes Receivable 2,800,000 131 Prepaid Insurance 18,000 320 Retained Earnings 2,077.212 241 Salaries Payable 117,000 311 Share Capital - Ordinary Si par value, 10,000,000 shares authorized, 6,000,000 shares issued and 5,977,500 shares outstanding 6,000,000 312 Share Capital - Preference 5%, $100 par value, noncumulative, 100,000 shares authorized, 60,000 shares issued and outstanding 6,000,000 313 Share Premium - Ordinary 840,000 314 Share Premium - Preference 300,000 315 Share Premium - Treasury 8,000 132 Supplies 8,360 330 Treasury Shares (22,500 shares) 56,250 18,168,630 18,168,630 1(c) Sold 22,500 Treasury shares at $2.1 each. (assuming both trade date and settlement date is on 1 March, such treasury shares were owned by investors on 2 March when share dividend was declared) 2 A 10% share dividend was declared when the market value per share was $2.11. (this is treated as small dividend case) 5 Received a statement from the liquidator of YOT Limited. The liquidator informed ITI that $12,000 will be paid to ITI at the end of March 2021 for the settlement of the $16,000 outstanding balance. YOT Limited was closed down in December 2020 and the managing director of ITI authorized to write off $16,000 on 31 December 2020, being the full amount outstanding in the Account Receivable - YOT Limited. 17 Share dividends were distributed. Shareholders on the register of the company on 6 March 2021 are entitled to receive the dividend shares. 27 Returned $40,000 consignment good to Consignee Trading Limited. The goods are delivered by Consignee Trading Limited to ITI for consignment purpose in February 2021. 29 A cash dividend was declared for preference shares and a cash dividend of $0.02 per share was declared for ordinary shares. The dividends will be paid in April. 30 Received a check of $14,000 from the liquidator of YOT Limited. The liquidator issued a revised statement to inform ITI that $14,000 is the finalized amount for the settlement of the $16,000 outstanding balance. Intelligent Toys, Inc ("ITI") is a well establish toys trading company which adopts the periodic system. ITI prepares its financial statements on a monthly basis. The trial balance of ITI as at 28 February 2021 is presented as follows: Intelligent Toys, Inc Trial Balance As at 28 February 2021 Account No. Account Title Debit Credit (S) (5) 201 Accounts Payable 420,000 112 Accounts Receivable 675,000 152 Accumulated Depreciation - Building 931,500 154 Accumulated Depreciation - Equipment 570,000 156 Accumulated Depreciation - Motor Vehicle 664.668 113 Allowance for Doubtful Accounts 20,250 151 Building 9,720,000 101 C 1,199,520 291 Dividends Payable 220,000 153 Equipment 990,000 115 Interest Receivable 144,000 140 Long-term Investment 750,000 121 Merchandise Inventory 975,000 155 Motor Vehicle 832,500 114 Notes Receivable 2,800,000 131 Prepaid Insurance 18,000 320 Retained Earnings 2,077.212 241 Salaries Payable 117,000 311 Share Capital - Ordinary Si par value, 10,000,000 shares authorized, 6,000,000 shares issued and 5,977,500 shares outstanding 6,000,000 312 Share Capital - Preference 5%, $100 par value, noncumulative, 100,000 shares authorized, 60,000 shares issued and outstanding 6,000,000 313 Share Premium - Ordinary 840,000 314 Share Premium - Preference 300,000 315 Share Premium - Treasury 8,000 132 Supplies 8,360 330 Treasury Shares (22,500 shares) 56,250 18,168,630 18,168,630 1(c) Sold 22,500 Treasury shares at $2.1 each. (assuming both trade date and settlement date is on 1 March, such treasury shares were owned by investors on 2 March when share dividend was declared) 2 A 10% share dividend was declared when the market value per share was $2.11. (this is treated as small dividend case) 5 Received a statement from the liquidator of YOT Limited. The liquidator informed ITI that $12,000 will be paid to ITI at the end of March 2021 for the settlement of the $16,000 outstanding balance. YOT Limited was closed down in December 2020 and the managing director of ITI authorized to write off $16,000 on 31 December 2020, being the full amount outstanding in the Account Receivable - YOT Limited. 17 Share dividends were distributed. Shareholders on the register of the company on 6 March 2021 are entitled to receive the dividend shares. 27 Returned $40,000 consignment good to Consignee Trading Limited. The goods are delivered by Consignee Trading Limited to ITI for consignment purpose in February 2021. 29 A cash dividend was declared for preference shares and a cash dividend of $0.02 per share was declared for ordinary shares. The dividends will be paid in April. 30 Received a check of $14,000 from the liquidator of YOT Limited. The liquidator issued a revised statement to inform ITI that $14,000 is the finalized amount for the settlement of the $16,000 outstanding balance

Intelligent Toys, Inc ("ITI") is a well establish toys trading company which adopts the periodic system. ITI prepares its financial statements on a monthly basis. The trial balance of ITI as at 28 February 2021 is presented as follows: Intelligent Toys, Inc Trial Balance As at 28 February 2021 Account No. Account Title Debit Credit (S) (5) 201 Accounts Payable 420,000 112 Accounts Receivable 675,000 152 Accumulated Depreciation - Building 931,500 154 Accumulated Depreciation - Equipment 570,000 156 Accumulated Depreciation - Motor Vehicle 664.668 113 Allowance for Doubtful Accounts 20,250 151 Building 9,720,000 101 C 1,199,520 291 Dividends Payable 220,000 153 Equipment 990,000 115 Interest Receivable 144,000 140 Long-term Investment 750,000 121 Merchandise Inventory 975,000 155 Motor Vehicle 832,500 114 Notes Receivable 2,800,000 131 Prepaid Insurance 18,000 320 Retained Earnings 2,077.212 241 Salaries Payable 117,000 311 Share Capital - Ordinary Si par value, 10,000,000 shares authorized, 6,000,000 shares issued and 5,977,500 shares outstanding 6,000,000 312 Share Capital - Preference 5%, $100 par value, noncumulative, 100,000 shares authorized, 60,000 shares issued and outstanding 6,000,000 313 Share Premium - Ordinary 840,000 314 Share Premium - Preference 300,000 315 Share Premium - Treasury 8,000 132 Supplies 8,360 330 Treasury Shares (22,500 shares) 56,250 18,168,630 18,168,630 1(c) Sold 22,500 Treasury shares at $2.1 each. (assuming both trade date and settlement date is on 1 March, such treasury shares were owned by investors on 2 March when share dividend was declared) 2 A 10% share dividend was declared when the market value per share was $2.11. (this is treated as small dividend case) 5 Received a statement from the liquidator of YOT Limited. The liquidator informed ITI that $12,000 will be paid to ITI at the end of March 2021 for the settlement of the $16,000 outstanding balance. YOT Limited was closed down in December 2020 and the managing director of ITI authorized to write off $16,000 on 31 December 2020, being the full amount outstanding in the Account Receivable - YOT Limited. 17 Share dividends were distributed. Shareholders on the register of the company on 6 March 2021 are entitled to receive the dividend shares. 27 Returned $40,000 consignment good to Consignee Trading Limited. The goods are delivered by Consignee Trading Limited to ITI for consignment purpose in February 2021. 29 A cash dividend was declared for preference shares and a cash dividend of $0.02 per share was declared for ordinary shares. The dividends will be paid in April. 30 Received a check of $14,000 from the liquidator of YOT Limited. The liquidator issued a revised statement to inform ITI that $14,000 is the finalized amount for the settlement of the $16,000 outstanding balance. Intelligent Toys, Inc ("ITI") is a well establish toys trading company which adopts the periodic system. ITI prepares its financial statements on a monthly basis. The trial balance of ITI as at 28 February 2021 is presented as follows: Intelligent Toys, Inc Trial Balance As at 28 February 2021 Account No. Account Title Debit Credit (S) (5) 201 Accounts Payable 420,000 112 Accounts Receivable 675,000 152 Accumulated Depreciation - Building 931,500 154 Accumulated Depreciation - Equipment 570,000 156 Accumulated Depreciation - Motor Vehicle 664.668 113 Allowance for Doubtful Accounts 20,250 151 Building 9,720,000 101 C 1,199,520 291 Dividends Payable 220,000 153 Equipment 990,000 115 Interest Receivable 144,000 140 Long-term Investment 750,000 121 Merchandise Inventory 975,000 155 Motor Vehicle 832,500 114 Notes Receivable 2,800,000 131 Prepaid Insurance 18,000 320 Retained Earnings 2,077.212 241 Salaries Payable 117,000 311 Share Capital - Ordinary Si par value, 10,000,000 shares authorized, 6,000,000 shares issued and 5,977,500 shares outstanding 6,000,000 312 Share Capital - Preference 5%, $100 par value, noncumulative, 100,000 shares authorized, 60,000 shares issued and outstanding 6,000,000 313 Share Premium - Ordinary 840,000 314 Share Premium - Preference 300,000 315 Share Premium - Treasury 8,000 132 Supplies 8,360 330 Treasury Shares (22,500 shares) 56,250 18,168,630 18,168,630 1(c) Sold 22,500 Treasury shares at $2.1 each. (assuming both trade date and settlement date is on 1 March, such treasury shares were owned by investors on 2 March when share dividend was declared) 2 A 10% share dividend was declared when the market value per share was $2.11. (this is treated as small dividend case) 5 Received a statement from the liquidator of YOT Limited. The liquidator informed ITI that $12,000 will be paid to ITI at the end of March 2021 for the settlement of the $16,000 outstanding balance. YOT Limited was closed down in December 2020 and the managing director of ITI authorized to write off $16,000 on 31 December 2020, being the full amount outstanding in the Account Receivable - YOT Limited. 17 Share dividends were distributed. Shareholders on the register of the company on 6 March 2021 are entitled to receive the dividend shares. 27 Returned $40,000 consignment good to Consignee Trading Limited. The goods are delivered by Consignee Trading Limited to ITI for consignment purpose in February 2021. 29 A cash dividend was declared for preference shares and a cash dividend of $0.02 per share was declared for ordinary shares. The dividends will be paid in April. 30 Received a check of $14,000 from the liquidator of YOT Limited. The liquidator issued a revised statement to inform ITI that $14,000 is the finalized amount for the settlement of the $16,000 outstanding balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started