Answered step by step

Verified Expert Solution

Question

1 Approved Answer

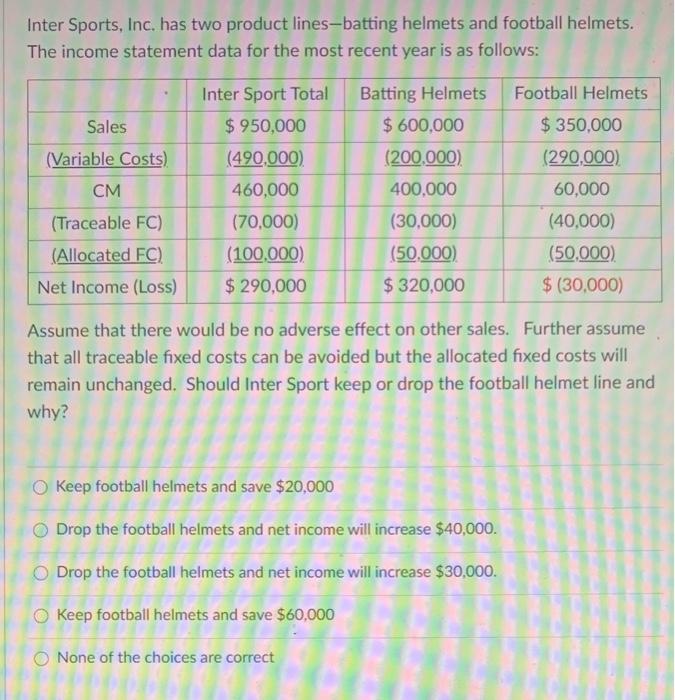

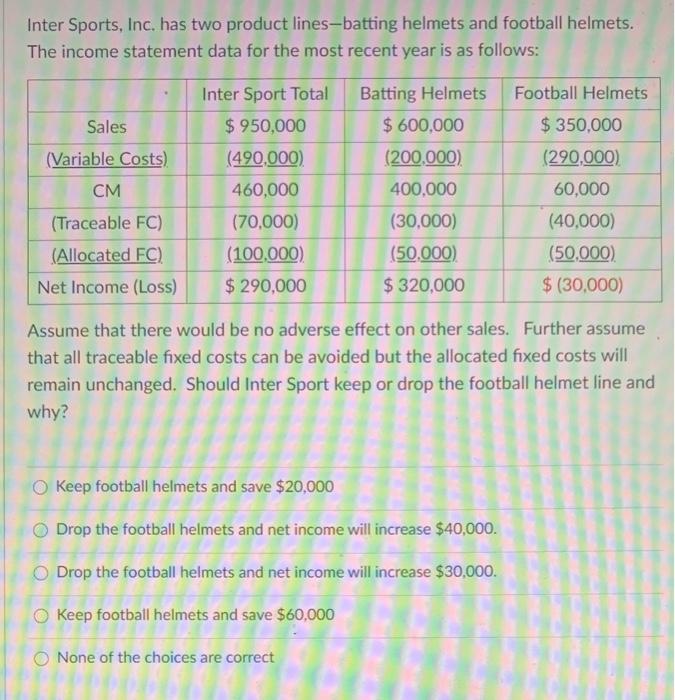

Inter Sports, Inc. has two product lines- batting helmets and football helmets. Inter Sports, Inc. has two product lines--batting helmets and football helmets. The income

Inter Sports, Inc. has two product lines- batting helmets and football helmets.

Inter Sports, Inc. has two product lines--batting helmets and football helmets. The income statement data for the most recent year is as follows: Sales (Variable Costs) CM Inter Sport Total $ 950,000 (490,000) 460,000 (70,000) (100,000) $ 290,000 Batting Helmets $ 600,000 (200,000) 400,000 (30,000) (50.000) $ 320,000 Football Helmets $ 350,000 (290,000) 60,000 (40,000) (50,000) $ (30,000) (Traceable FC) (Allocated FC) Net Income (Loss) Assume that there would be no adverse effect on other sales. Further assume that all traceable fixed costs can be avoided but the allocated fixed costs will remain unchanged. Should Inter Sport keep or drop the football helmet line and why? O Keep football helmets and save $20,000 Drop the football helmets and net income will increase $40,000. Drop the football helmets and net income will increase $30,000. Keep football helmets and save $60,000 None of the choices are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started