Question

Intercompany Transactions Assume a parent company acquired 100% of a subsidiary on 1/1/X1 at a purchase price that was $300,000 in excess of the subsidiarys

Intercompany Transactions

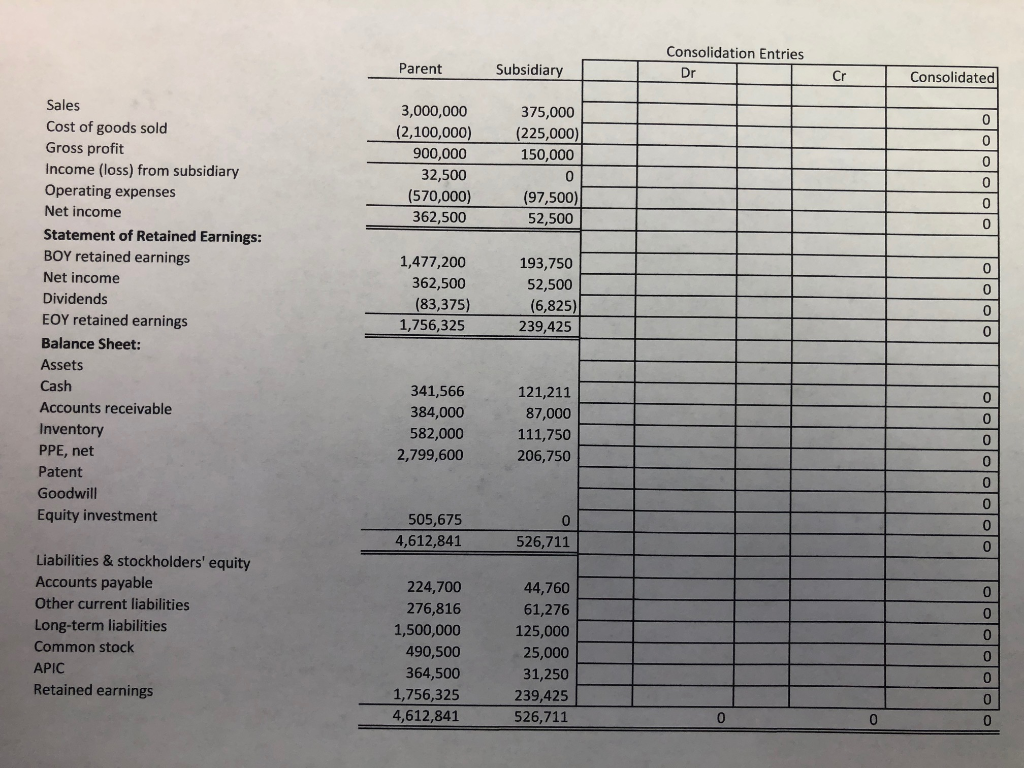

Assume a parent company acquired 100% of a subsidiary on 1/1/X1 at a purchase price that was $300,000 in excess of the subsidiarys book value. Of that excess, $200,000 was assigned to an unrecorded patent that is being amortized over 10 years. The remaining $100,000 was assigned to goodwill. In the year X2, the subsidiary sold land to the parent for $100,000. The land was reported on the balance sheet of the subsidiary for $70,000 at the date of sale. The financial statements for the parent and subsidiary for the year ended 12/31/X3 are attached in the Excel spreadsheet.

- Prepare the consolidated financial statements at 12/31/X3 by placing the appropriate entries in their respective debit/credit column cells.

- Indicate, in the blank column cell to the left of the debit and credit column cells if the entry is a [C], [E], [A], [D] or [I]entry.

- Show calculations on entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started