Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Intercompany transfers of non - depreciable noncurrent assets - Equity method Assume that a parent company owns a 1 0 0 % controlling interest in

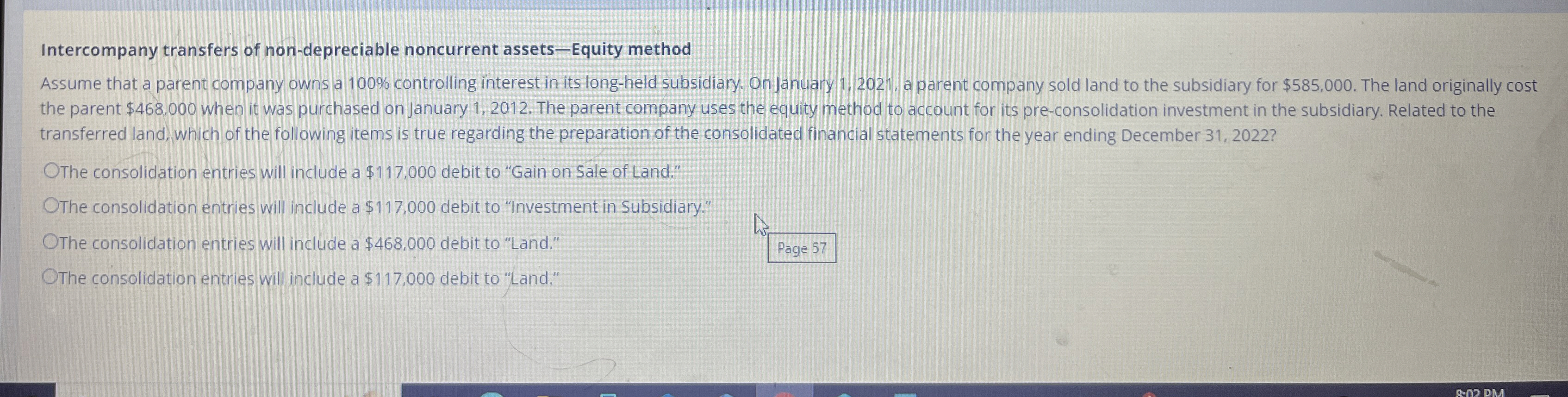

Intercompany transfers of nondepreciable noncurrent assetsEquity method

Assume that a parent company owns a controlling interest in its longheld subsidiary. On January a parent company sold land to the subsidiary for $ The land originally cost the parent $ when it was purchased on January The parent company uses the equity method to account for its preconsolidation investment in the subsidiary. Related to the transferred land, which of the following items is true regarding the preparation of the consolidated financial statements for the year ending December

The consolidation entries will include a $ debit to "Gain on Sale of Land."

The consolidation entries will include a $ debit to "Investment in Subsidiary."

The consolidation entries will include a $ debit to "Land."

The consolidation entries will include a $ debit to "Land."

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started