Question: A Ltd acquires 90% of the shares of B Ltd on 1 August 20x8. B Ltd reported Profit after tax of $120,000 in its

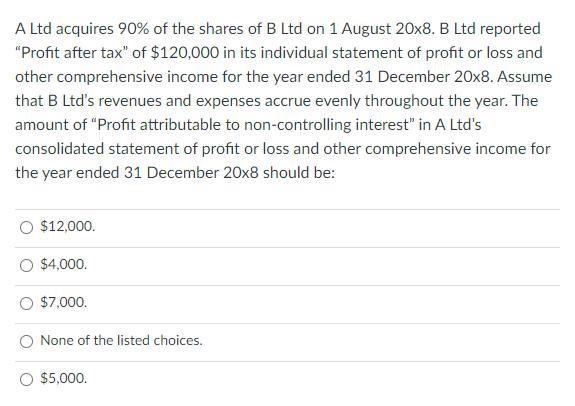

A Ltd acquires 90% of the shares of B Ltd on 1 August 20x8. B Ltd reported "Profit after tax" of $120,000 in its individual statement of profit or loss and other comprehensive income for the year ended 31 December 20x8. Assume that B Ltd's revenues and expenses accrue evenly throughout the year. The amount of "Profit attributable to non-controlling interest" in A Ltd's consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 20x8 should be: O $12,000. $4,000. $7,000. None of the listed choices. O $5,000.

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below The amount of Profit attributable to no... View full answer

Get step-by-step solutions from verified subject matter experts