Question

Interest and MARR Interest is expected to be 10% per year unless stated otherwise; and that will be the MARR unless otherwise stated Time 13

Interest and MARR Interest is expected to be 10% per year unless stated otherwise; and that will be the MARR unless otherwise stated

Time 13 weeks in a quarter, 52 weeks in a year, 4 quarters in a year, 3 months per quarter

Taxation Effective tax rate is 30%

Capital & Exchange

-

Capital can be borrowed at 12% per year but only for droids

-

Skywalker Towers has $300K in available funding

Q1- Consider that the AOC (not including salary of human engineers) and Revenue are the same per year between the HAL 9000 and 20 engineers. When viewed over an 8 year period, what is the rate of return for replacing 20 of Big Farma's engineers with a HAL 9000?

It is i* within:

a. -1.5M = -3M(A/P,I*,8)+23K(A/F,I*,8)

b.(P/A, i*, 8) = 1.5K

c. 1.5M(P/A, i*, 8) + 3M = 0

d.20*75K(P/A, i*, 8) -3M = 0

e.(P/A, i*, 8) = 3M 20*75K(P/A,I*,8)+23K(P/F,I*,8)

Q2- The rate of return in [%] for problem 1 is _________________________.

Q3. Disregard a comparison with engineers or anything else, what is the rate of return if you purchase the HAL 9000 from all given information by Odyssey Engineering?

It is i* within

a. 0 = -3M + (78K 49K)(P/A, i*, 8) + 1K(P/G, i*, 7) + 23K(P/F, i*, 8)

b. 0 = (78K 49K)(P/A, i*, 8) + 1K(P/G, i*, 8) + 23K(P/F, i*, 8) - 3M

c. 0 = -1.5M(P/A, i*, 8) + 3M + (78K 49K)(P/A, i*, 8) + 1K(P/G, i*, 8) + 23K(P/F, i*, 8)

d. 0 = -1M + (29K)(P/A, i*, 3) + 1K(P/G, i*, 3) + 23K(P/F, i*, 3)

e. 3M = (29K)(P/A, i*, 8) + 1K(P/G, i*, 8) + 23K(P/F, i*, 8)

Q4. The best robot to have is ________________

Q5. because the PW value of that robot is _______________ [units in $K]

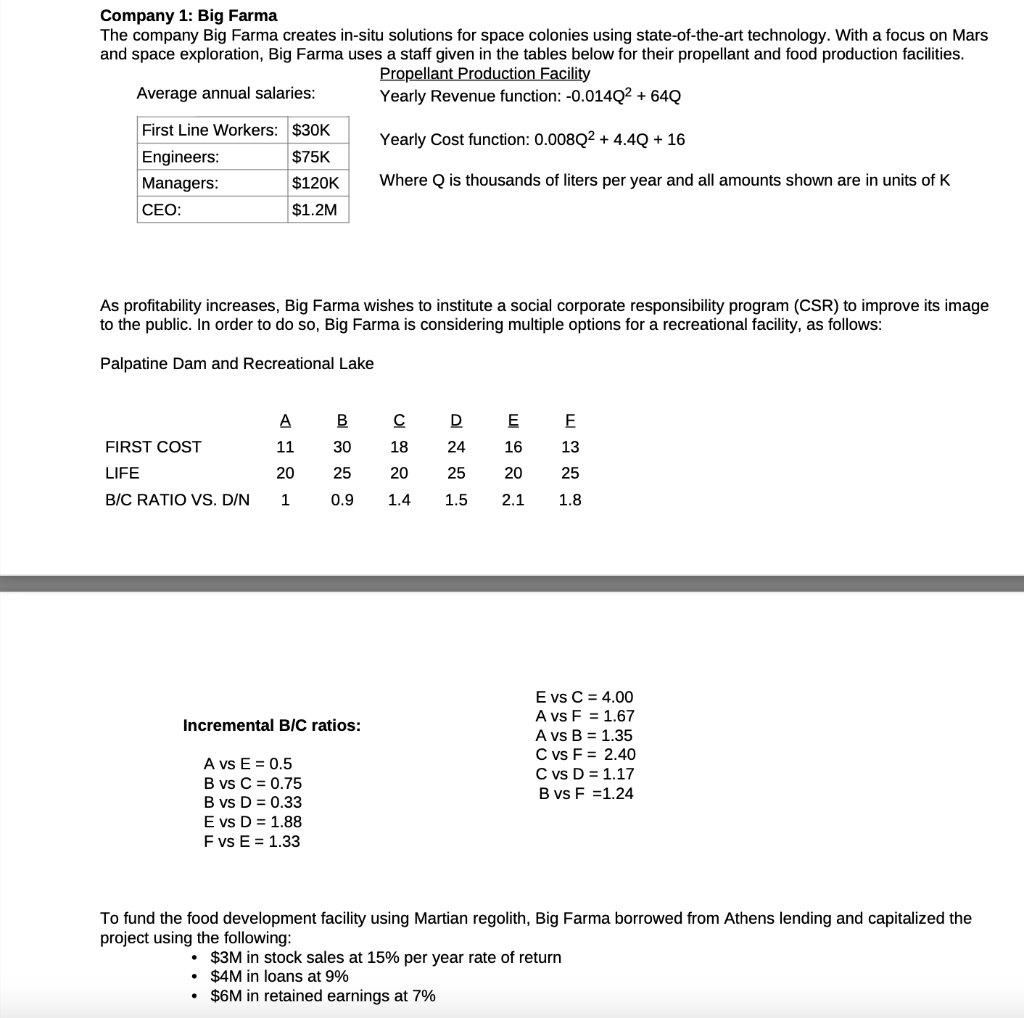

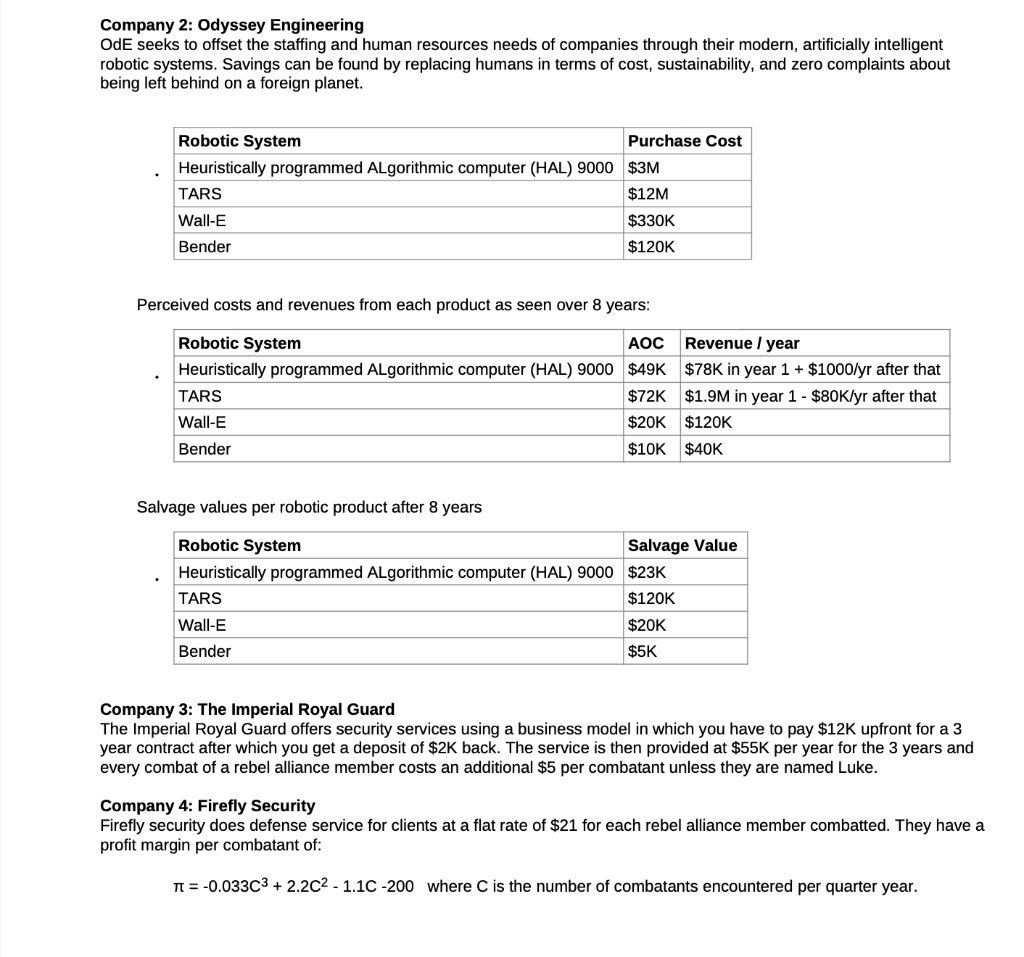

Company 1: Big Farma The company Big Farma creates in-situ solutions for space colonies using state-of-the-art technology. With a focus on Mars and space exploration, Big Farma uses a staff given in the tables below for their propellant and food production facilities. Propellant Production Facility Average annual salaries: Yearly Revenue function:-0.014Q2 + 64Q First Line Workers: $30K Yearly Cost function: 0.008Q2 + 4.4Q + 16 Engineers: $75K Managers: $120K Where Q is thousands of liters per year and all amounts shown are in units of K CEO: $1.2M As profitability increases, Big Farma wishes to institute a social corporate responsibility program (CSR) to improve its image to the public. In order to do so, Big Farma is considering multiple options for a recreational facility, as follows: Palpatine Dam and Recreational Lake B D E E 18 FIRST COST 11 30 24 16 13 LIFE 20 25 25 20 25 20 1.4 B/C RATIO VS. D/N 1 0.9 1.5 2.1 1.8 Incremental B/C ratios: E vs C = 4.00 A vs F = 1.67 A vs B = 1.35 C vs F = 2.40 C vs D = 1.17 Bvs F = 1.24 A vs E = 0.5 B vs C = 0.75 B vs D = 0.33 E vs D = 1.88 F vs E = 1.33 To fund the food development facility using Martian regolith, Big Farma borrowed from Athens lending and capitalized the project using the following: $3M in stock sales at 15% per year rate of return $4M in loans at 9% $6M in retained earnings at 7% Company 2: Odyssey Engineering OdE seeks to offset the staffing and human resources needs of companies through their modern, artificially intelligent robotic systems. Savings can be found by replacing humans in terms of cost, sustainability, and zero complaints about being left behind on a foreign planet. Robotic System Purchase Cost Heuristically programmed Algorithmic computer (HAL) 9000 $3M TARS $12M Wall-E $330K Bender $120K Perceived costs and revenues from each product as seen over 8 years: Robotic System AOC Revenue / year Heuristically programmed Algorithmic computer (HAL) 9000 $49K $78K in year 1 + $1000/yr after that TARS $72K $1.9M in year 1 - $80K/yr after that Wall-E $20K $120K Bender $10K $40K Salvage values per robotic product after 8 years Robotic System Salvage Value Heuristically programmed Algorithmic computer (HAL) 9000 $23K TARS $120K Wall-E $20K Bender $5K Company 3: The Imperial Royal Guard The Imperial Royal Guard offers security services using a business model in which you have to pay $12K upfront for a 3 year contract after which you get a deposit of $2K back. The service is then provided at $55K per year for the 3 years and every combat of a rebel alliance member costs an additional $5 per combatant unless they are named Luke. Company 4: Firefly Security Firefly security does defense service for clients at a flat rate of $21 for each rebel alliance member combatted. They have a profit margin per combatant of: T = -0.033C3 + 2.2C2 - 1.1C-200 where C is the number of combatants encountered per quarter year. Company 1: Big Farma The company Big Farma creates in-situ solutions for space colonies using state-of-the-art technology. With a focus on Mars and space exploration, Big Farma uses a staff given in the tables below for their propellant and food production facilities. Propellant Production Facility Average annual salaries: Yearly Revenue function:-0.014Q2 + 64Q First Line Workers: $30K Yearly Cost function: 0.008Q2 + 4.4Q + 16 Engineers: $75K Managers: $120K Where Q is thousands of liters per year and all amounts shown are in units of K CEO: $1.2M As profitability increases, Big Farma wishes to institute a social corporate responsibility program (CSR) to improve its image to the public. In order to do so, Big Farma is considering multiple options for a recreational facility, as follows: Palpatine Dam and Recreational Lake B D E E 18 FIRST COST 11 30 24 16 13 LIFE 20 25 25 20 25 20 1.4 B/C RATIO VS. D/N 1 0.9 1.5 2.1 1.8 Incremental B/C ratios: E vs C = 4.00 A vs F = 1.67 A vs B = 1.35 C vs F = 2.40 C vs D = 1.17 Bvs F = 1.24 A vs E = 0.5 B vs C = 0.75 B vs D = 0.33 E vs D = 1.88 F vs E = 1.33 To fund the food development facility using Martian regolith, Big Farma borrowed from Athens lending and capitalized the project using the following: $3M in stock sales at 15% per year rate of return $4M in loans at 9% $6M in retained earnings at 7% Company 2: Odyssey Engineering OdE seeks to offset the staffing and human resources needs of companies through their modern, artificially intelligent robotic systems. Savings can be found by replacing humans in terms of cost, sustainability, and zero complaints about being left behind on a foreign planet. Robotic System Purchase Cost Heuristically programmed Algorithmic computer (HAL) 9000 $3M TARS $12M Wall-E $330K Bender $120K Perceived costs and revenues from each product as seen over 8 years: Robotic System AOC Revenue / year Heuristically programmed Algorithmic computer (HAL) 9000 $49K $78K in year 1 + $1000/yr after that TARS $72K $1.9M in year 1 - $80K/yr after that Wall-E $20K $120K Bender $10K $40K Salvage values per robotic product after 8 years Robotic System Salvage Value Heuristically programmed Algorithmic computer (HAL) 9000 $23K TARS $120K Wall-E $20K Bender $5K Company 3: The Imperial Royal Guard The Imperial Royal Guard offers security services using a business model in which you have to pay $12K upfront for a 3 year contract after which you get a deposit of $2K back. The service is then provided at $55K per year for the 3 years and every combat of a rebel alliance member costs an additional $5 per combatant unless they are named Luke. Company 4: Firefly Security Firefly security does defense service for clients at a flat rate of $21 for each rebel alliance member combatted. They have a profit margin per combatant of: T = -0.033C3 + 2.2C2 - 1.1C-200 where C is the number of combatants encountered per quarter yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started