Question

Interest expense (1400000*7%) 98,000 Answer 2 (a) Straight-line depreciation Cost of assets (1750000*1.13 = 1977500) (1977500-(1977500*2%)) 1,937,950 Salvage value 320,000 Depreciable cost 1,617,950 Divided: useful

-

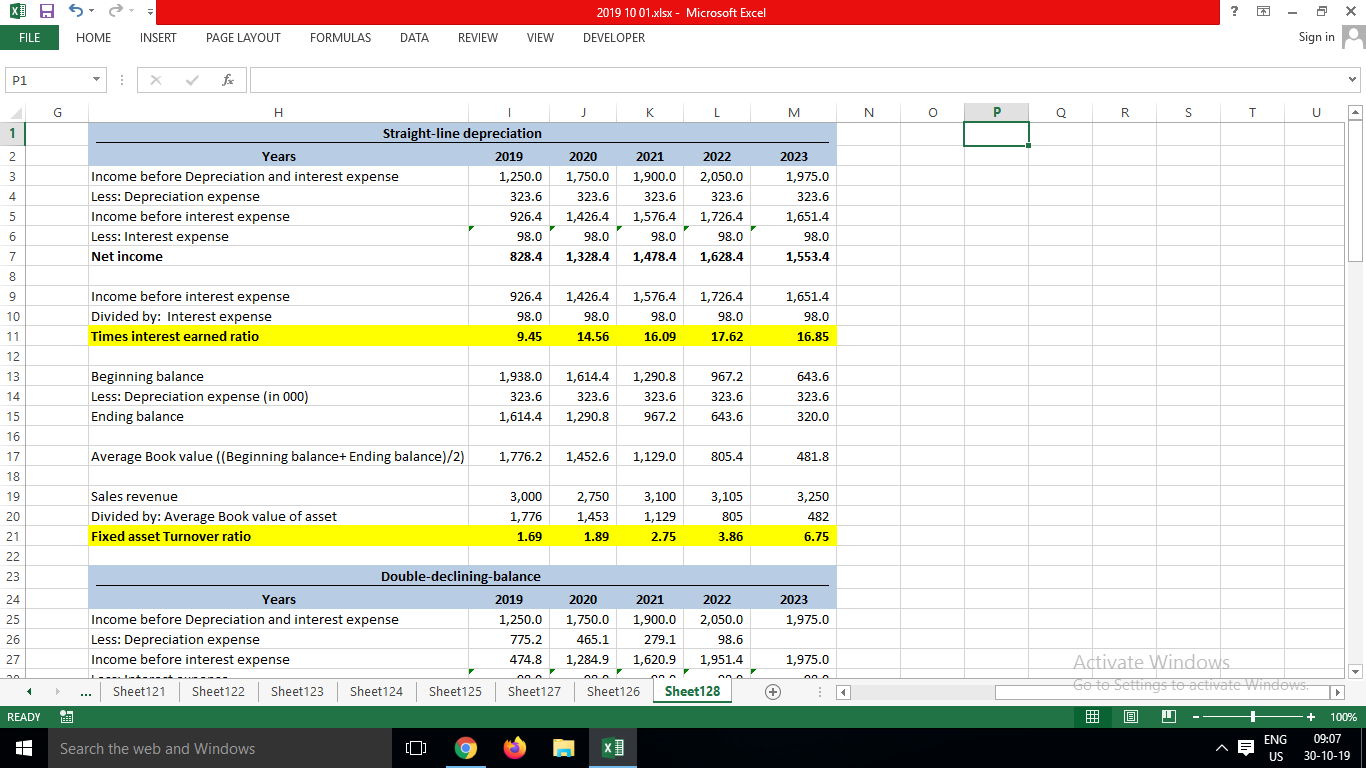

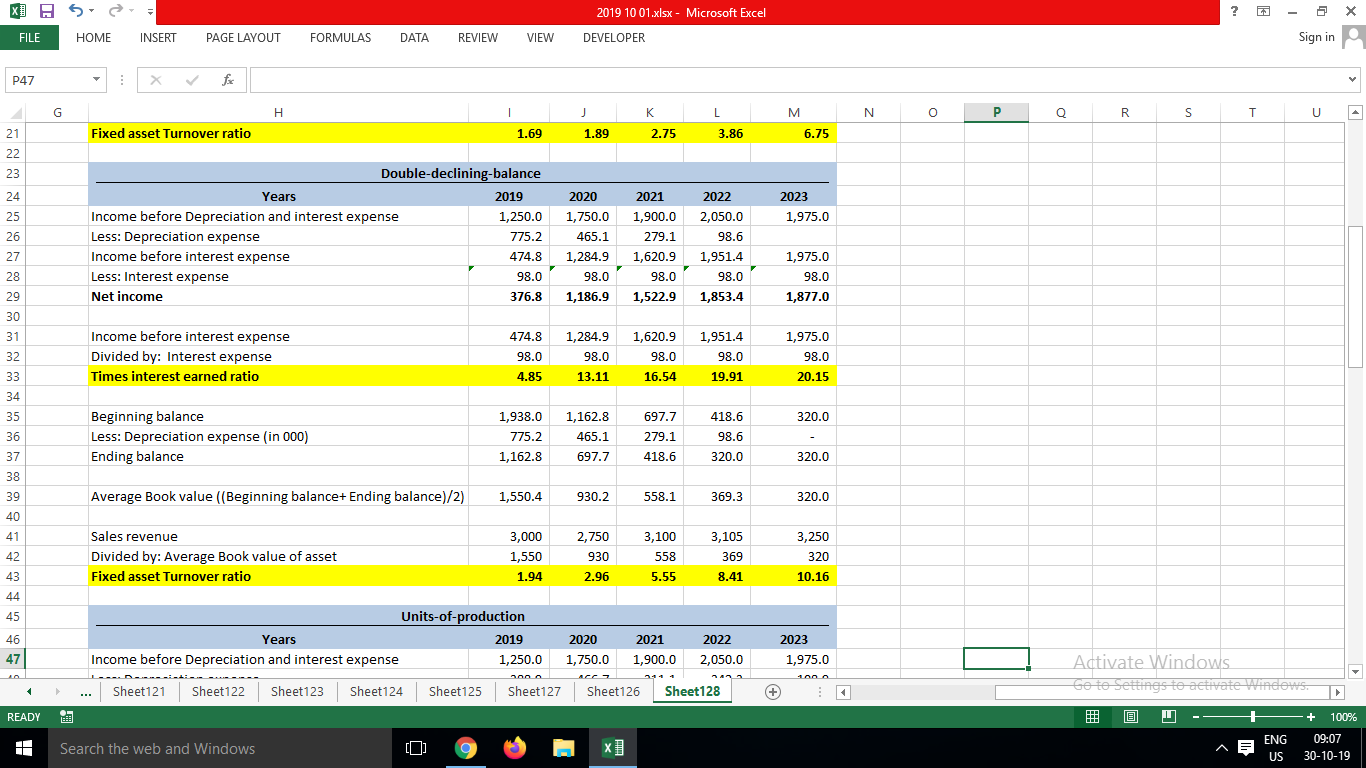

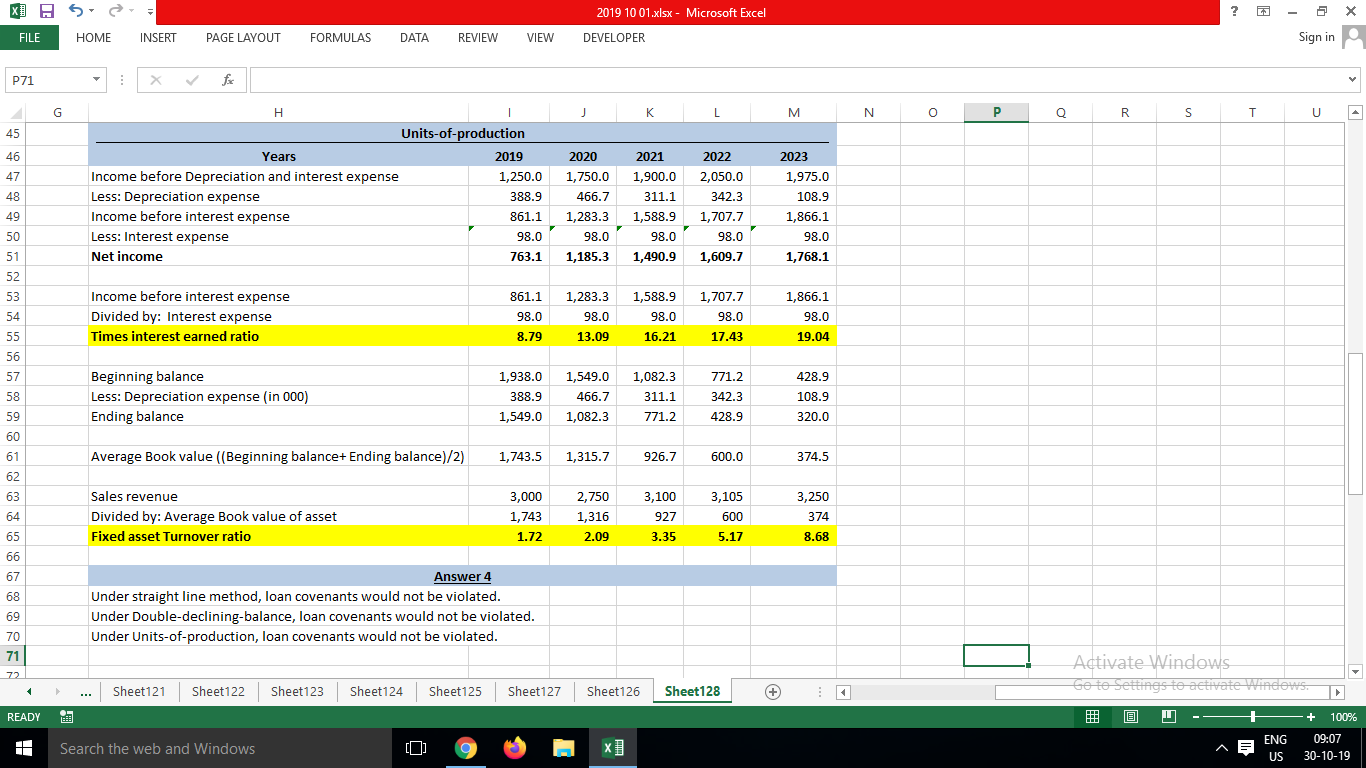

Interest expense (1400000*7%) 98,000 Answer 2 (a) Straight-line depreciation Cost of assets (1750000*1.13 = 1977500) (1977500-(1977500*2%)) 1,937,950 Salvage value 320,000 Depreciable cost 1,617,950 Divided: useful life in Years 5 Depreciation expense per year 323,590 Answer 2 (b) Double-declining-balance Depreciation rate under (1/5 year =20%) (20%*2=40%) 40% Book value of machine does not less than salvage value. For year 4 = 418597 - 320000 salvage value = 98597 Year Beginning balance Depreciation @ 40% ending balance 1 1,937,950 775,180 1,162,770 2 1,162,770 465,108 697,662 3 697,662 279,065 418,597 4 418,597 98,597 320,000 5 320,000 - 320,000 Answer 2 (C) Units-of-production Cost of assets (1750000*1.13 = 1977500) (1977500-(1977500*2%)) 1,937,950 Salvage value 320,000 Depreciable cost 1,617,950 Divided: useful life in miles Total of Miles (25000+30000+20000+22000+7000) 104,000 Depreciation expense per mile $ 15.557212 Year Miles Depreciation expense per mile Depreciation expense 1 25,000 $ 15.557212 388,930 2 30,000 $ 15.557212 466,716 3 20,000 $ 15.557212 311,144 4 22,000 $ 15.557212 342,259 5 7,000 $ 15.557212 108,900

QUESTION 2

Cocao Excavating Inc. decided to buy a new Excavator after they realized they needed another excavator for a new long-term project. The company will need to finance some of the purchase using their bank. The owner signed a one year note to the bank for $150,000 payable at an interest rate of six (6) percent. The note was issued February 1, 2019, interest is payable semi- annually, and the year end is April 30.

1. Prepare the journal entries required from the issuance of the note until its maturity on January 3, 2020 assuming no entries are made other than year-end , and when the interest is payable and when the note reaches maturity.

QUESTION 3 (C8-1)

In the second half of the year for Cocao Here are some transactions from October 1st, 2018 to April 30, 2019:

| October 1 | Billed City of Windsor for $200,000, the cost of the materials to Cocao is $120,000. |

| November 10 | Received full payment from the City of Windsor |

| December 9 | One Capital sold equipment to TRW Excavating on account for $30,000; the cost to Cocao was $14,000 |

| January 15 | Billed Town of Kingsville on account for $80,000, the cost to Cocao was $44,000 |

| March 1 | Billed Town of Tecumseh on account for $20,000; the cost to Cocao was $12,000 |

| April 17 | Received payment from Town of Kingsville of $65,000 |

REQUIRED:

- Complete the following aged listing of customers as of April 30, 2019.

|

| 0 to 30 days | 31 to 60 days | 61 to 90 days | Over 90 days | Total |

| Customer |

|

|

|

|

|

| City of Windsor |

|

|

|

|

|

| Town of Kingsville |

|

|

|

|

|

| Town of Tecumseh |

| $20,000 |

|

| $20,000 |

| TRW Excavating |

|

|

| $30,000 | $30,000 |

- Estimate the allowance for Doubtful Accounts required at April 30, 2019, assuming the following uncollectable rates: one month, 1 percent: two months, 5 percent; three months, 20 percent; more than three months, 40 percent.

- Show how Cocao would report the accounts receivable on its April 30 balance sheet. What amounts would be reported on an income statement prepared for the April 30, 2019 balance sheet?

QUESTION 4 (PB11-4)

Several years later at April 30, 2022, Cocao outstanding:

had

the following retained earnings and shares

Common Shares (490,000 outstanding)

$490,000

Preferred Shares (8%, 19,000 outstanding)

$190,000

Retained Earnings

$2,966,000

| Common Shares (490,000 outstanding) | $490,000 |

| Preferred Shares (8%, 19,000 outstanding) | $190,000 |

| Retained Earnings | $2,966,000 |

On April 30, 2021, the Board of Directors in considering distributing of a cash dividend to the common and preferred shareholders. No dividends were declared in 2019 or 2020. Look at the following scenarios:

Case # 1: The preferred shares are non-cumulative; the total amount of 2021 dividends would be $45,000.

Case # 2: The preferred shares are cumulative; the total amount of 2021 dividends would be

$27,000. Dividends were not in arears prior to 2019.

Case # 3: Same as Case B except the amount is 175,000.

REQUIRED:

Calculate the amount of dividends , in total and per share, payable to each class of shareholder for each case. Show calculations. Round per share amounts to two decimal points.

? X GS HOMEINSERT 2019 10 01.xlsx - Microsoft Excel DEVELOPER - 2 Sign in FILE PAGE LAYOUT FORMULAS DATA REVIEW VIEW P1 : fic J K L M N O P R I Straight-line depreciation Years 2019 Income before Depreciation and interest expense 1,250.0 Less: Depreciation expense 323.6 Income before interest expense 926.4 Less: Interest expense 98.0 Net income 828.4 2020 1,750.0 323.6 1,426.4 98.0 1.328.4 2021 1,900.0 323.6 1,576.4 98.0 1,478.4 2022 2,050.0 323.6 1,726.4 98.0 1,628.4 2023 1,975.0 323.6 1,651.4 98.0 1,553.4 Income before interest expense Divided by: Interest expense Times interest earned ratio 926.4 98.0 9.45 1,426.4 98.0 14.56 1,576.4 98.0 16.09 1,726.4 98.0 17.62 1,651.4 98.0 16.85 Beginning balance Less: Depreciation expense (in 000) Ending balance 1,938.0 323.6 1,614.4 1,614.4 323.6 1,290.8 1,290.8 323.6 967.2 967.2 323.6 643.6 643.6 323.6 320.0 Average Book value (Beginning balance+ Ending balance)/2) 1,776.2 1,452.6 1,129.0 805.4 481.8 Sales revenue Divided by: Average Book value of asset Fixed asset Turnover ratio 3,000 1,776 1.69 2,750 1,453 1.89 3,100 1,129 2.75 3,105 805 3.86 3,250 482 6.75 Double-declining-balance Years 2019 Income before Depreciation and interest expense 1,250.0 Less: Depreciation expense 775.2 Income before interest expense 474.8 2023 1,975.0 2020 1,750.0 465.1 1,284.9 2021 1,900.0 279.1 1,620.9 2022 2,050.0 98.6 1,951.4 1,975.0 ... Sheet121 Sheet122 Sheet123 Sheet124 Sheet125 Sheet127 Sheet126 Sheet128 + 7 READY Activate Windows Go to Settings to activate Windows. 60U- + 100% = ENG 09:07 US 30-10-19 Search the web and Windows ? X GS HOMEINSERT 2019 10 01.xlsx - Microsoft Excel DEVELOPER - 2 Sign in FILE PAGE LAYOUT FORMULAS DATA REVIEW VIEW P47 : for H M N O P Q I 1.69 R S T U J 1.89 K 2.75 L 3.86 Fixed asset Turnover ratio 6.75 2023 1,975.0 Double-declining-balance Years 2019 Income before Depreciation and interest expense 1,250.0 Less: Depreciation expense 775.2 Income before interest expense 474.8 Less: Interest expense 98.0 Net income 376.8 2020 1,750.0 465.1 1,284.9 98.0 1,186.9 2021 1,900.0 279.1 1,620.9 98.0 1,522.9 2022 2,050.0 98.6 1,951.4 98.0 1,853.4 1,975.0 98.0 1,877.0 Income before interest expense Divided by: Interest expense Times interest earned ratio 474.8 98.0 4.85 1,284.9 98.0 13.11 1,620.9 98.0 16.54 1,951.4 98.0 19.91 1,975.0 98.0 20.15 320.0 Beginning balance Less: Depreciation expense (in 000) Ending balance 1,938.0 775.2 1,162.8 1,162.8 465.1 697.7 697.7 279.1 418.6 418.6 98.6 320.0 320.0 Average Book value ((Beginning balance+ Ending balance)/2) 1,550.4 930.2 558.1 369.3 320.0 Sales revenue Divided by: Average Book value of asset Fixed asset Turnover ratio 3,000 1,550 1.94 2,750 930 2.96 3,100 558 5.55 3,105 369 8.41 3,250 320 10.16 Units-of-production Years 2019 Income before Depreciation and interest expense 1,250.0 ... Sheet121 Sheet122 Sheet123 Sheet124 Sheet125 Sheet127 2020 1,750.0 2021 1,900.0 2022 2,050.0 2023 1,975.0 Sheet126 Sheet128 + Activate Windows Go to Settings to activate Windows. D U - 100% = ENG 09:07 US 30-10-19 READY Search the web and Windows ? X GS HOMEINSERT 2019 10 01.xlsx - Microsoft Excel DEVELOPER - 2 Sign in FILE PAGE LAYOUT FORMULAS DATA REVIEW VIEW P71 x fic J K L M N O P Q R S T U A I Units-of-production Years 2019 Income before Depreciation and interest expense 1,250.0 Less: Depreciation expense 388.9 Income before interest expense 861.1 Less: Interest expense 98.0 Net income 763.1 2020 1,750.0 466.7 1,283.3 98.0 1,185.3 2021 1,900.0 311.1 1,588.9 98.0 1,490.9 2022 2,050.0 342.3 1,707.7 98.0 1,609.7 2023 1,975.0 108.9 1,866.1 98.0 1,768.1 Income before interest expense Divided by: Interest expense Times interest earned ratio 861.1 98.0 8.79 1,283.3 98.0 13.09 1,588.9 98.0 16.21 1,707.7 98.0 17.43 1,866.1 98.0 19.04 428.9 Beginning balance Less: Depreciation expense (in 000) Ending balance 1,938.0 388.9 1,549.0 1,549.0 466.7 1,082.3 1,082.3 311.1 771.2 771.2 342.3 428.9 108.9 320.0 Average Book value (Beginning balance+ Ending balance)/2) 1,743.5 1,315.7 926.7 600.0 374.5 3,105 Sales revenue Divided by: Average Book value of asset Fixed asset Turnover ratio 3,000 1,743 1.72 2,750 1,316 2.09 3,100 927 3.35 600 3,250 374 8.68 5.17 Answer 4 Under straight line method, loan covenants would not be violated. Under Double-declining-balance, loan covenants would not be violated. Under Units-of-production, loan covenants would not be violated. 72 ... Sheet121 Sheet122 Sheet123 Sheet124 Sheet125 Sheet127 Sheet126 Sheet128 + - READY Activate Windows Go to Settings to activate Windows. D U - 100% = ENG 09:07 US 30-10-19 Search the web and Windows x] ? X GS HOMEINSERT 2019 10 01.xlsx - Microsoft Excel DEVELOPER - 2 Sign in FILE PAGE LAYOUT FORMULAS DATA REVIEW VIEW P1 : fic J K L M N O P R I Straight-line depreciation Years 2019 Income before Depreciation and interest expense 1,250.0 Less: Depreciation expense 323.6 Income before interest expense 926.4 Less: Interest expense 98.0 Net income 828.4 2020 1,750.0 323.6 1,426.4 98.0 1.328.4 2021 1,900.0 323.6 1,576.4 98.0 1,478.4 2022 2,050.0 323.6 1,726.4 98.0 1,628.4 2023 1,975.0 323.6 1,651.4 98.0 1,553.4 Income before interest expense Divided by: Interest expense Times interest earned ratio 926.4 98.0 9.45 1,426.4 98.0 14.56 1,576.4 98.0 16.09 1,726.4 98.0 17.62 1,651.4 98.0 16.85 Beginning balance Less: Depreciation expense (in 000) Ending balance 1,938.0 323.6 1,614.4 1,614.4 323.6 1,290.8 1,290.8 323.6 967.2 967.2 323.6 643.6 643.6 323.6 320.0 Average Book value (Beginning balance+ Ending balance)/2) 1,776.2 1,452.6 1,129.0 805.4 481.8 Sales revenue Divided by: Average Book value of asset Fixed asset Turnover ratio 3,000 1,776 1.69 2,750 1,453 1.89 3,100 1,129 2.75 3,105 805 3.86 3,250 482 6.75 Double-declining-balance Years 2019 Income before Depreciation and interest expense 1,250.0 Less: Depreciation expense 775.2 Income before interest expense 474.8 2023 1,975.0 2020 1,750.0 465.1 1,284.9 2021 1,900.0 279.1 1,620.9 2022 2,050.0 98.6 1,951.4 1,975.0 ... Sheet121 Sheet122 Sheet123 Sheet124 Sheet125 Sheet127 Sheet126 Sheet128 + 7 READY Activate Windows Go to Settings to activate Windows. 60U- + 100% = ENG 09:07 US 30-10-19 Search the web and Windows ? X GS HOMEINSERT 2019 10 01.xlsx - Microsoft Excel DEVELOPER - 2 Sign in FILE PAGE LAYOUT FORMULAS DATA REVIEW VIEW P47 : for H M N O P Q I 1.69 R S T U J 1.89 K 2.75 L 3.86 Fixed asset Turnover ratio 6.75 2023 1,975.0 Double-declining-balance Years 2019 Income before Depreciation and interest expense 1,250.0 Less: Depreciation expense 775.2 Income before interest expense 474.8 Less: Interest expense 98.0 Net income 376.8 2020 1,750.0 465.1 1,284.9 98.0 1,186.9 2021 1,900.0 279.1 1,620.9 98.0 1,522.9 2022 2,050.0 98.6 1,951.4 98.0 1,853.4 1,975.0 98.0 1,877.0 Income before interest expense Divided by: Interest expense Times interest earned ratio 474.8 98.0 4.85 1,284.9 98.0 13.11 1,620.9 98.0 16.54 1,951.4 98.0 19.91 1,975.0 98.0 20.15 320.0 Beginning balance Less: Depreciation expense (in 000) Ending balance 1,938.0 775.2 1,162.8 1,162.8 465.1 697.7 697.7 279.1 418.6 418.6 98.6 320.0 320.0 Average Book value ((Beginning balance+ Ending balance)/2) 1,550.4 930.2 558.1 369.3 320.0 Sales revenue Divided by: Average Book value of asset Fixed asset Turnover ratio 3,000 1,550 1.94 2,750 930 2.96 3,100 558 5.55 3,105 369 8.41 3,250 320 10.16 Units-of-production Years 2019 Income before Depreciation and interest expense 1,250.0 ... Sheet121 Sheet122 Sheet123 Sheet124 Sheet125 Sheet127 2020 1,750.0 2021 1,900.0 2022 2,050.0 2023 1,975.0 Sheet126 Sheet128 + Activate Windows Go to Settings to activate Windows. D U - 100% = ENG 09:07 US 30-10-19 READY Search the web and Windows ? X GS HOMEINSERT 2019 10 01.xlsx - Microsoft Excel DEVELOPER - 2 Sign in FILE PAGE LAYOUT FORMULAS DATA REVIEW VIEW P71 x fic J K L M N O P Q R S T U A I Units-of-production Years 2019 Income before Depreciation and interest expense 1,250.0 Less: Depreciation expense 388.9 Income before interest expense 861.1 Less: Interest expense 98.0 Net income 763.1 2020 1,750.0 466.7 1,283.3 98.0 1,185.3 2021 1,900.0 311.1 1,588.9 98.0 1,490.9 2022 2,050.0 342.3 1,707.7 98.0 1,609.7 2023 1,975.0 108.9 1,866.1 98.0 1,768.1 Income before interest expense Divided by: Interest expense Times interest earned ratio 861.1 98.0 8.79 1,283.3 98.0 13.09 1,588.9 98.0 16.21 1,707.7 98.0 17.43 1,866.1 98.0 19.04 428.9 Beginning balance Less: Depreciation expense (in 000) Ending balance 1,938.0 388.9 1,549.0 1,549.0 466.7 1,082.3 1,082.3 311.1 771.2 771.2 342.3 428.9 108.9 320.0 Average Book value (Beginning balance+ Ending balance)/2) 1,743.5 1,315.7 926.7 600.0 374.5 3,105 Sales revenue Divided by: Average Book value of asset Fixed asset Turnover ratio 3,000 1,743 1.72 2,750 1,316 2.09 3,100 927 3.35 600 3,250 374 8.68 5.17 Answer 4 Under straight line method, loan covenants would not be violated. Under Double-declining-balance, loan covenants would not be violated. Under Units-of-production, loan covenants would not be violated. 72 ... Sheet121 Sheet122 Sheet123 Sheet124 Sheet125 Sheet127 Sheet126 Sheet128 + - READY Activate Windows Go to Settings to activate Windows. D U - 100% = ENG 09:07 US 30-10-19 Search the web and Windows x]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started