Answered step by step

Verified Expert Solution

Question

1 Approved Answer

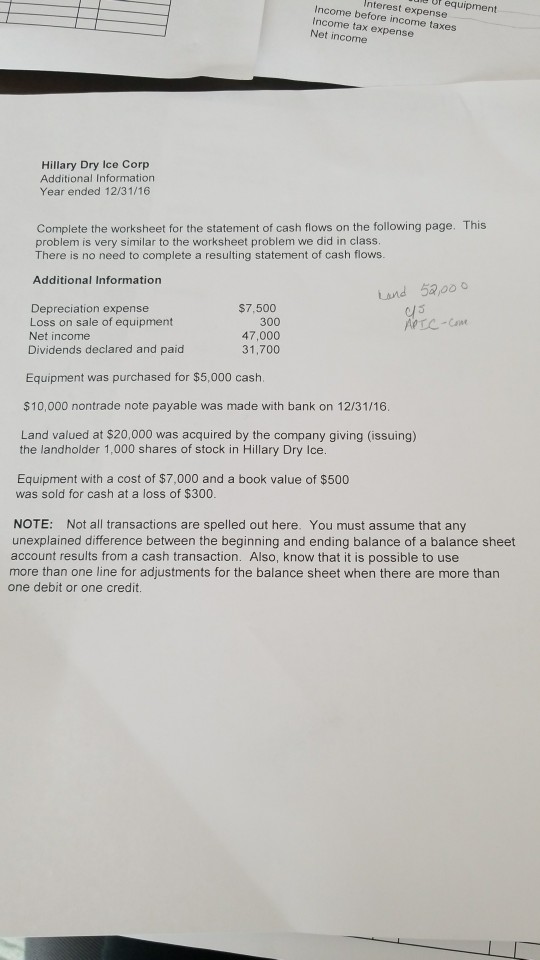

Interest expense Income before income taxes ncome tax expense Net income Hillary Dry Ice Corp Additional Information Year ended 12/31/16 Complete the worksheet for the

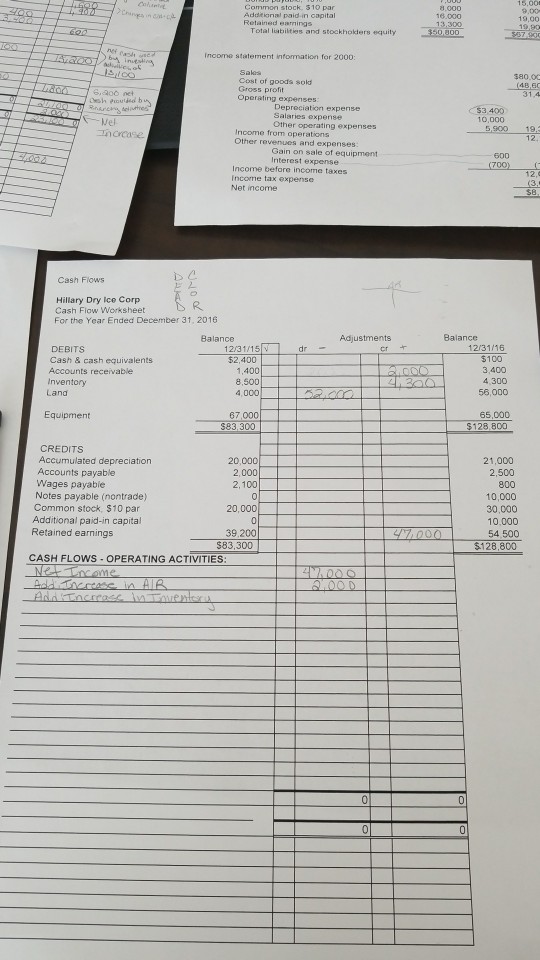

Interest expense Income before income taxes ncome tax expense Net income Hillary Dry Ice Corp Additional Information Year ended 12/31/16 Complete the worksheet for the statement of cash flows on the following page. This problem is very similar to the worksheet problem we did in class. There is no need to complete a resulting statement of cash flows Additional Information und 5a,00 Depreciation expense $7,500 300 47,000 31,700 Loss on sale of equipment Net income Dividends declared and paid Equipment was purchased for $5,000 cash $10,000 nontrade note payable was made with bank on 12/31/16 Land valued at $20,000 was acquired by the company giving (issuing) the landholder 1,000 shares of stock in Hillary Dry Ice. Equipment with a cost of $7,000 and a book value of $500 was sold for cash at a loss of $300. NOTE: Not all transactions are spelled out here. You must assume that any unexplained difference between the beginning and ending balance of a balance sheet account results from a cash transaction. Also, know that it is possible to use more than one line for adjustments for the balance sheet when there are more than one debit or one credit. Interest expense Income before income taxes ncome tax expense Net income Hillary Dry Ice Corp Additional Information Year ended 12/31/16 Complete the worksheet for the statement of cash flows on the following page. This problem is very similar to the worksheet problem we did in class. There is no need to complete a resulting statement of cash flows Additional Information und 5a,00 Depreciation expense $7,500 300 47,000 31,700 Loss on sale of equipment Net income Dividends declared and paid Equipment was purchased for $5,000 cash $10,000 nontrade note payable was made with bank on 12/31/16 Land valued at $20,000 was acquired by the company giving (issuing) the landholder 1,000 shares of stock in Hillary Dry Ice. Equipment with a cost of $7,000 and a book value of $500 was sold for cash at a loss of $300. NOTE: Not all transactions are spelled out here. You must assume that any unexplained difference between the beginning and ending balance of a balance sheet account results from a cash transaction. Also, know that it is possible to use more than one line for adjustments for the balance sheet when there are more than one debit or one credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started