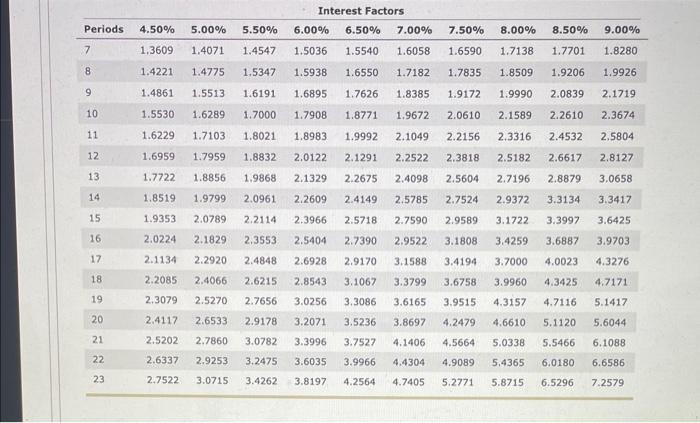

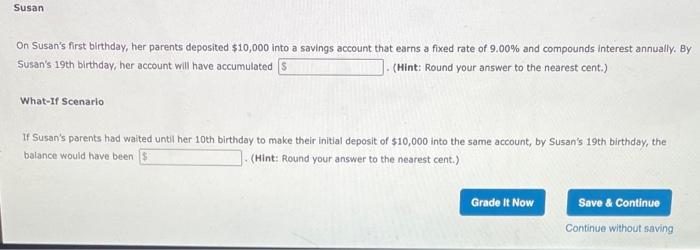

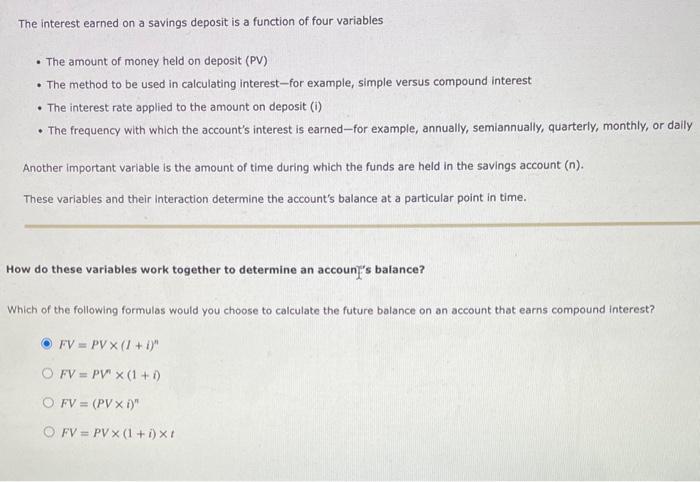

Interest Factors \begin{tabular}{llllllllllll} \hline Periods & 4.50% & 5.00% & 5.50% & 6.00% & 6.50% & 7.00% & 7.50% & 8.00% & 8.50% & 9.00% \\ \hline 7 & 1.3609 & 1.4071 & 1.4547 & 1.5036 & 1.5540 & 1.6058 & 1.6590 & 1.7138 & 1.7701 & 1.8280 \\ \hline 8 & 1.4221 & 1.4775 & 1.5347 & 1.5938 & 1.6550 & 1.7182 & 1.7835 & 1.8509 & 1.9206 & 1.9926 \\ \hline 9 & 1.4861 & 1.5513 & 1.6191 & 1.6895 & 1.7626 & 1.8385 & 1.9172 & 1.9990 & 2.0839 & 2.1719 \\ \hline 10 & 1.5530 & 1.6289 & 1.7000 & 1.7908 & 1.8771 & 1.9672 & 2.0610 & 2.1589 & 2.2610 & 2.3674 \\ \hline 11 & 1.6229 & 1.7103 & 1.8021 & 1.8983 & 1.9992 & 2.1049 & 2.2156 & 2.3316 & 2.4532 & 2.5804 \\ \hline 12 & 1.6959 & 1.7959 & 1.8832 & 2.0122 & 2.1291 & 2.2522 & 2.3818 & 2.5182 & 2.6617 & 2.8127 \\ \hline 13 & 1.7722 & 1.8856 & 1.9868 & 2.1329 & 2.2675 & 2.4098 & 2.5604 & 2.7196 & 2.8879 & 3.0658 \\ \hline 14 & 1.8519 & 1.9799 & 2.0961 & 2.2609 & 2.4149 & 2.5785 & 2.7524 & 2.9372 & 3.3134 & 3.3417 \\ \hline 15 & 1.9353 & 2.0789 & 2.2114 & 2.3966 & 2.5718 & 2.7590 & 2.9589 & 3.1722 & 3.3997 & 3.6425 \\ \hline 16 & 2.0224 & 2.1829 & 2.3553 & 2.5404 & 2.7390 & 2.9522 & 3.1808 & 3.4259 & 3.6887 & 3.9703 \\ \hline 17 & 2.1134 & 2.2920 & 2.4848 & 2.6928 & 2.9170 & 3.1588 & 3.4194 & 3.7000 & 4.0023 & 4.3276 \\ \hline 18 & 2.2085 & 2.4066 & 2.6215 & 2.8543 & 3.1067 & 3.3799 & 3.6758 & 3.9960 & 4.3425 & 4.7171 \\ \hline 19 & 2.3079 & 2.5270 & 2.7656 & 3.0256 & 3.3086 & 3.6165 & 3.9515 & 4.3157 & 4.7116 & 5.1417 \\ \hline 20 & 2.4117 & 2.6533 & 2.9178 & 3.2071 & 3.5236 & 3.8697 & 4.2479 & 4.6610 & 5.1120 & 5.6044 \\ \hline 21 & 2.5202 & 2.7860 & 3.0782 & 3.3996 & 3.7527 & 4.1406 & 4.5664 & 5.0338 & 5.5466 & 6.1088 \\ \hline 22 & 2.6337 & 2.9253 & 3.2475 & 3.6035 & 3.9966 & 4.4304 & 4.9089 & 5.4365 & 6.0180 & 6.6586 \\ \hline 23 & 2.7522 & 3.0715 & 3.4262 & 3.8197 & 4.2564 & 4.7405 & 5.2771 & 5.8715 & 6.5296 & 7.2579 \\ \hline \end{tabular} On Susan's first birthday, her parents deposited $10,000 into a savings account that earns a fixed rate of 9.00% and compounds interest annually. By Susan's 19 th birthday, her account will have accumulated (Hint: Round your answer to the nearest cent.) What-If Scenario If Susan's parents had waited until her 10 th birthday to make their initial deposit of $10,000 into the same account, by Susan's 19 th birthday, the baiance would have been (Hint: Round your answer to the nearest cent.) The interest earned on a savings deposit is a function of four variables - The amount of money held on deposit (PV) - The method to be used in calculating interest-for example, simple versus compound interest - The interest rate applied to the amount on deposit (i) - The frequency with which the account's interest is earned-for example, annually, semiannually, quarterly, monthly, or dails Another important variable is the amount of time during which the funds are held in the savings account ( n ). These variables and their interaction determine the account's balance at a particular point in time. How do these variables work together to determine an accounf's balance? Which of the following formulas would you choose to calculate the future balance on an account that earns compound interest? FV=PV(I+i)nFV=PV(1+i)FV=(PVi)nFV=PV(1+i)t