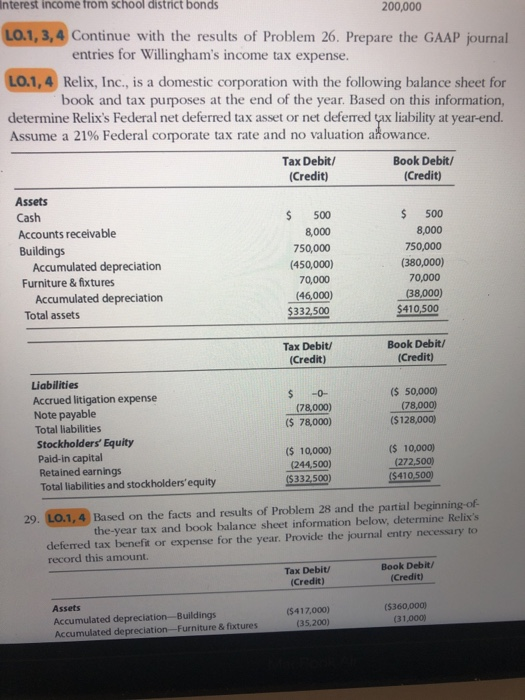

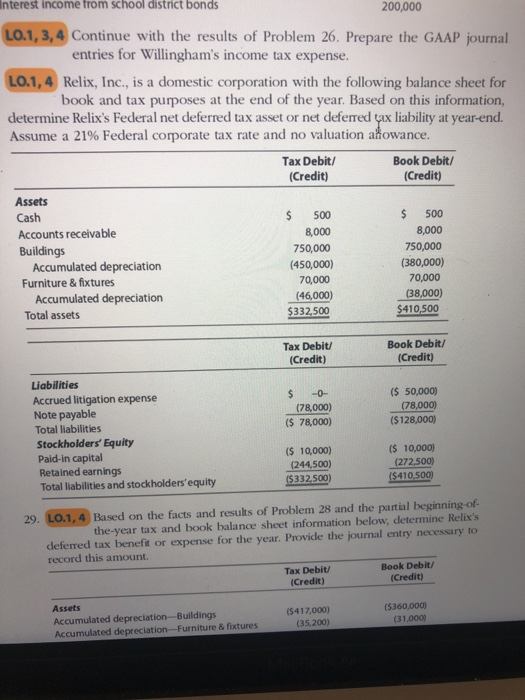

Interest income from school district bonds 200,000 LO.1, 3,4 Continue with the results of Problem 26. Prepare the GAAP journal entries for Willingham's income tax expense. LO.1, 4 Relix, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Based on this information, determine Relix's Federal net deferred tax asset or net deferred yax liability at year-end. Assume a 21% Federal corporate tax rate and no valuation allowance, Tax Debit/ Book Debit/ (Credit) (Credit) Assets Cash $ 500 Accounts receivable 8,000 Buildings 750,000 750,000 Accumulated depreciation (450,000) (380,000) Furniture & fixtures 70,000 Accumulated depreciation 500 $ 8,000 70,000 (46,000) $332,500 (38,000) $410,500 Total assets Tax Debit/ (Credit) Book Debit/ (Credit) $ -0- (78,000) ($ 78,000) ($ 50,000) (78,000) ($ 128,000) Liabilities Accrued litigation expense Note payable Total liabilities Stockholders' Equity Paid-in capital Retained earnings Total liabilities and stockholders'equity ($ 10,000) (244,500) ($332,500) ($ 10,000) (272,500) ($410.500 29. LO.1, 4 Based on the facts and results of Problem 28 and the partial beginning-of- the-year tax and book balance sheet information below, determine Relix's deferred tax benefit or expense for the year. Provide the journal entry necessary to record this amount. Tax Debit Book Debit/ (Credit) (Credit) Assets Accumulated depreciation Buildings ($417,000) (5360,000) Accumulated depreciation - Furniture & fixtures (35.200) (31,000 Interest income from school district bonds 200,000 LO.1, 3,4 Continue with the results of Problem 26. Prepare the GAAP journal entries for Willingham's income tax expense. LO.1, 4 Relix, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Based on this information, determine Relix's Federal net deferred tax asset or net deferred yax liability at year-end. Assume a 21% Federal corporate tax rate and no valuation allowance, Tax Debit/ Book Debit/ (Credit) (Credit) Assets Cash $ 500 Accounts receivable 8,000 Buildings 750,000 750,000 Accumulated depreciation (450,000) (380,000) Furniture & fixtures 70,000 Accumulated depreciation 500 $ 8,000 70,000 (46,000) $332,500 (38,000) $410,500 Total assets Tax Debit/ (Credit) Book Debit/ (Credit) $ -0- (78,000) ($ 78,000) ($ 50,000) (78,000) ($ 128,000) Liabilities Accrued litigation expense Note payable Total liabilities Stockholders' Equity Paid-in capital Retained earnings Total liabilities and stockholders'equity ($ 10,000) (244,500) ($332,500) ($ 10,000) (272,500) ($410.500 29. LO.1, 4 Based on the facts and results of Problem 28 and the partial beginning-of- the-year tax and book balance sheet information below, determine Relix's deferred tax benefit or expense for the year. Provide the journal entry necessary to record this amount. Tax Debit Book Debit/ (Credit) (Credit) Assets Accumulated depreciation Buildings ($417,000) (5360,000) Accumulated depreciation - Furniture & fixtures (35.200) (31,000 Interest income from school district bonds 200,000 LO.1, 3,4 Continue with the results of Problem 26. Prepare the GAAP journal entries for Willingham's income tax expense. LO.1, 4 Relix, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Based on this information, determine Relix's Federal net deferred tax asset or net deferred yax liability at year-end. Assume a 21% Federal corporate tax rate and no valuation allowance, Tax Debit/ Book Debit/ (Credit) (Credit) Assets Cash $ 500 Accounts receivable 8,000 Buildings 750,000 750,000 Accumulated depreciation (450,000) (380,000) Furniture & fixtures 70,000 Accumulated depreciation 500 $ 8,000 70,000 (46,000) $332,500 (38,000) $410,500 Total assets Tax Debit/ (Credit) Book Debit/ (Credit) $ -0- (78,000) ($ 78,000) ($ 50,000) (78,000) ($ 128,000) Liabilities Accrued litigation expense Note payable Total liabilities Stockholders' Equity Paid-in capital Retained earnings Total liabilities and stockholders'equity ($ 10,000) (244,500) ($332,500) ($ 10,000) (272,500) ($410.500 29. LO.1, 4 Based on the facts and results of Problem 28 and the partial beginning-of- the-year tax and book balance sheet information below, determine Relix's deferred tax benefit or expense for the year. Provide the journal entry necessary to record this amount. Tax Debit Book Debit/ (Credit) (Credit) Assets Accumulated depreciation Buildings ($417,000) (5360,000) Accumulated depreciation - Furniture & fixtures (35.200) (31,000 Interest income from school district bonds 200,000 LO.1, 3,4 Continue with the results of Problem 26. Prepare the GAAP journal entries for Willingham's income tax expense. LO.1, 4 Relix, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Based on this information, determine Relix's Federal net deferred tax asset or net deferred yax liability at year-end. Assume a 21% Federal corporate tax rate and no valuation allowance, Tax Debit/ Book Debit/ (Credit) (Credit) Assets Cash $ 500 Accounts receivable 8,000 Buildings 750,000 750,000 Accumulated depreciation (450,000) (380,000) Furniture & fixtures 70,000 Accumulated depreciation 500 $ 8,000 70,000 (46,000) $332,500 (38,000) $410,500 Total assets Tax Debit/ (Credit) Book Debit/ (Credit) $ -0- (78,000) ($ 78,000) ($ 50,000) (78,000) ($ 128,000) Liabilities Accrued litigation expense Note payable Total liabilities Stockholders' Equity Paid-in capital Retained earnings Total liabilities and stockholders'equity ($ 10,000) (244,500) ($332,500) ($ 10,000) (272,500) ($410.500 29. LO.1, 4 Based on the facts and results of Problem 28 and the partial beginning-of- the-year tax and book balance sheet information below, determine Relix's deferred tax benefit or expense for the year. Provide the journal entry necessary to record this amount. Tax Debit Book Debit/ (Credit) (Credit) Assets Accumulated depreciation Buildings ($417,000) (5360,000) Accumulated depreciation - Furniture & fixtures (35.200) (31,000